NVIDIA Rubin Platform's Inference Computing Power Increases 5x: In-depth Analysis of AI Chip Competition Landscape and Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

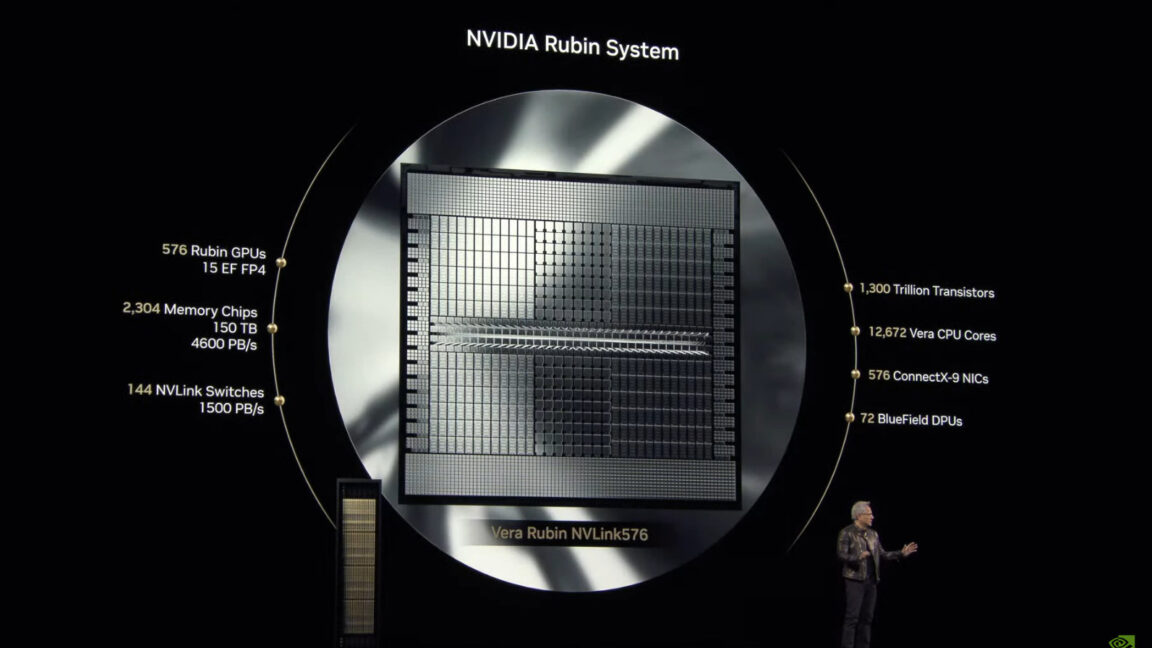

The Rubin platform launched by NVIDIA at CES 2025 represents a major breakthrough in AI chip technology [0]. According to currently disclosed information:

- 5x Increase in Inference Computing Power: The Rubin GPU is equipped with the 3rd-generation Transformer engine, achieving an NVFP4 inference computing power of 50 PFLOPS—5x the performance of the Blackwell platform

- Significant Cost Efficiency: It is revealed that the Rubin platform can reduce inference token costs by up to 10x [2]

- Product Launch Timeline: The platform has entered full production and is scheduled to be officially launched in the second half of 2026

- Product Portfolio: Includes 6 new chip models, forming a complete product matrix

The launch of the Rubin platform marks a key shift in AI chip competition from the training phase to the inference phase:

- Training Market Has Peaked: NVIDIA has established an absolute dominant position in the AI training infrastructure field

- Rise of the Inference Market: With large-scale deployment of AI applications, inference (running AI models in real time) has become a new growth engine

- Broad Market Space: The AI inference market is currently valued at approximately $103 billion and is expected to grow to $255 billion by 2032 [6]

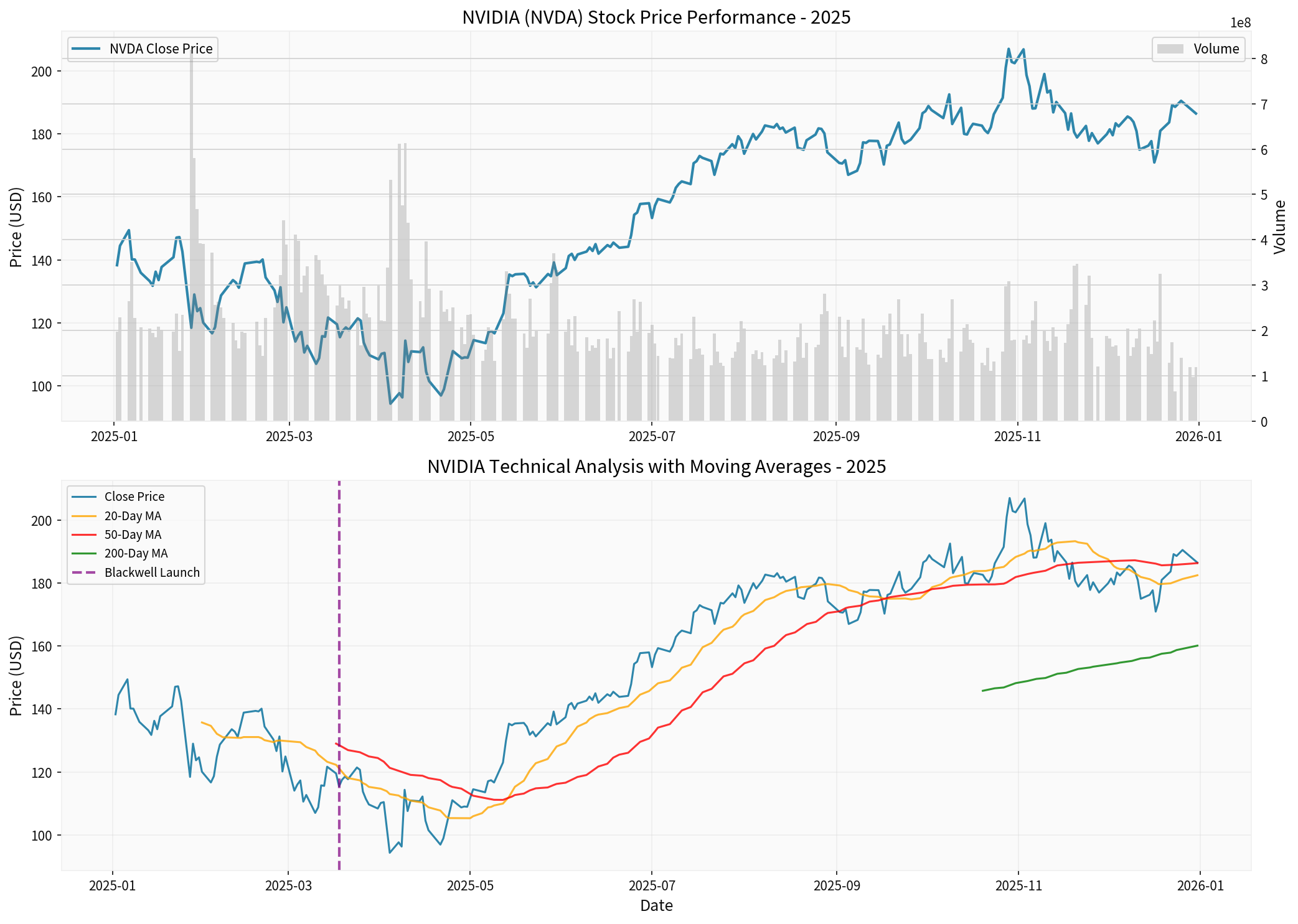

- Annual Increase: +37.13%

- Period High: $212.19

- Period Low: $86.62

- Year-end Close: $186.50

- Average Daily Trading Volume: 221 million shares

- Volatility (Daily Standard Deviation): 3.12%

- Market Capitalization: $4.58 trillion

- Price-to-Earnings Ratio (P/E): 46.13x

- Net Profit Margin: 53.01%

- Operating Profit Margin:58.84%

- Current Ratio: 4.47

- Quick Ratio:3.71

- Data Center: $41.1 billion (87.9%)

- Gaming: $4.29 billion (9.2%)

- Professional Visualization: $601 million (1.3%)

- Automotive: $586 million (1.3%)

Company |

2025 Increase |

Current Market Cap |

Strategic Focus |

|---|---|---|---|

NVIDIA (NVDA) |

+37.13% | $4.58T | Full-stack AI training + inference |

AMD |

+75.12% | Significantly behind NVDA | MI300/MI400 data center GPUs |

Intel (INTC) |

+82.40% | Far below NVDA | Gaudi3 AI accelerator |

- Cumulative increase of75.12% in 2025, showing strong performance

- Stock Price Range: $76.48 - $267.08

- Average Daily Trading Volume:48.16 million shares

- Volatility:3.82%, higher than NVIDIA

- Cumulative increase of82.40% in2025, showing potential in AI chip transformation

- Stock Price Range: $17.67 - $44.02

- Average Daily Trading Volume:99.77 million shares

- Volatility:4.03%, the highest among the three

- The5x increase in inference computing power will further widen the gap with competitors

- The3rd-generation Transformer engine is optimized for generative AI

- The10x reduction in inference costs will significantly increase enterprise adoption rate [2]

- CUDA ecosystem advantages continue to expand

- Strategic licensing and talent cooperation with Groq (reportedly valued at $20 billion) [1][8]

- Advantages in hardware-software co-design

- AMD: The MI400 series faces greater competitive pressure and needs to seek breakthroughs in cost performance or specific application scenarios

- Intel: Market promotion of Gaudi3 will be more difficult, requiring reliance on x86 ecosystem integration advantages

- Specialized ASIC Vendors: Specialized chips like Google TPU and AWS Inferentia face the challenge of widening performance gaps

- If the Rubin platform is mass-produced in the second half of2026 as scheduled, NVIDIA will repeat its monopoly in the training market in the inference market

- Competitors may shift to differentiated routes such as edge AI and specific vertical markets

- Stock Price: $188.12 (closing on January5,2026)

- Analyst Target Price: $257.50 (36.9% upside potential)

- Target Price Range: $140.00 - $352.00

- Rating Distribution: Buy73.4%, Hold20.3%, Sell3.8%

- Q3 FY2026 Revenue: $57.01 billion (YoY growth of3.81%)

- Q2 FY2026 Revenue: $46.74 billion

- Q1 FY2026 Revenue: $44.06 billion

- Q4 FY2025 Revenue: $39.33 billion

- Blackwell Ultra: Expected to double shipments in 2026, equipped with288GB HBM3e memory, providing1.5x AI performance [5]

- Rubin Platform: Launched in the second half of 2026, leading a new round of AI inference upgrade cycle

- Accelerated Enterprise AI Adoption: Agentic AI and enterprise AI application deployment will drive an explosion in inference demand [1]

- Process Technology Challenges: Rubin uses more advanced processes, so mass production risks exist

- Competitors’ Countermeasures: AMD and Intel may achieve breakthroughs in specific scenarios

- Rise of Specialized Chips: ASICs may pose a threat in terms of cost and efficiency

- AI Investment Cycle Fluctuations: If AI commercialization falls short of expectations, capital expenditure may slow down

- Geopolitical Risks: Export restrictions in China affect sales of products like H200 [4]

- Valuation Risk: Current P/E ratio has reached 46x, requiring sustained high growth to support

- 2026 is considered likely to be a “more difficult year” for semiconductor stocks [1]

- New entrants try to take a share of NVIDIA’s economic profits

- Delays in mass production of the Rubin platform may affect growth expectations

###4.3 Key Observation Indicators (2026)

- Q1-Q2: Whether Blackwell Ultra shipments meet expectations

- Q3-Q4: Mass production progress of the Rubin platform and early customer feedback

- HBM4 Memory Supply: Whether it can support large-scale mass production of Rubin [4]

- Whether data center revenue growth rate continues to exceed50%

- Ability to maintain gross margin above60%

- Changes in market share in the AI inference market

- Market acceptance of AMD MI400

- Customer adoption of Intel Gaudi3

- Progress of cloud service providers’ self-developed chips

###5.1 Short-term View (0-12 Months)

- 2026 will be a key validation year; need to pay attention to the mass production progress of the Rubin platform

- Current valuation has already reflected part of the growth expectations; short-term catalysts are limited

- Shipment performance of Blackwell Ultra will be a key catalyst in the first half of the year

- Risks lie in cyclical fluctuations in AI capital expenditure and intensified competition

###5.2 Mid-to-Long-term View (1-3 Years)

- High certainty of growth in the AI inference market (CAGR expected to be28.25%) [9]

- The5x performance improvement of the Rubin platform is expected to consolidate NVIDIA’s leading position in the inference market

- Software ecosystem moat continues to deepen

- Agentic AI and enterprise AI application deployment will bring sustained incremental demand

###5.3 Investment Strategy Recommendations

- Long-term Value Investors: Believe in the long-term transformation trend of AI and can withstand short-term fluctuations

- Growth Investors: Pursue high growth potential of leading companies in the AI industry chain

- Investors with Strong Risk Tolerance: Can cope with high valuations and fluctuations in the technology industry

- Conservative Investors: Current valuation is high and volatility is large

- Short-term Speculators: AI investment cycle may last for several years, and short-term fluctuations are difficult to predict

- Investors Seeking Stable Dividends: NVIDIA does not pay dividends; capital appreciation is the main source of return

- Dollar-Cost Averaging: Considering stock price volatility, it is recommended to buy in batches to average costs

- Long-term Holding: The AI revolution is still in its early stage; it is recommended to hold for3-5 years

- Dynamic Adjustment: Closely monitor the mass production progress of the Rubin platform and growth of the AI inference market

- Portfolio Allocation: As a core AI asset allocation, it is recommended to control the weight between5-15%

###5.4 Final Evaluation

The5x increase in inference computing power of the Rubin platform is a key step for NVIDIA to consolidate its dominant position in AI. Although it faces challenges of intensified competition and growth validation in2026, NVIDIA’s comprehensive advantages in technical strength, ecosystem, and market share are still significant. For investors who believe in the long-term transformation of AI, NVIDIA remains an indispensable core asset, but one needs to be wary of valuation risks and short-term fluctuations.

[0] 金灵API数据 - NVDA、AMD、INTC股票数据及公司概况

[1] Yahoo Finance - “Where Does Nvidia and the Semiconductor Stocks Stand…” (https://finance.yahoo.com/news/where-does-nvidia-semiconductor-stocks-150456906.html)

[2] Yahoo Finance - “NVIDIA Kicks Off the Next Generation of AI With Rubin” (https://finance.yahoo.com/news/nvidia-kicks-off-next-generation-222000815.html)

[3] ts2.tech - “NVIDIA (NVDA) Stock News Today: Groq Inference Deal, China H200 Export Path, HBM4 ‘Rubin’ Supply Signals” (https://ts2.tech/en/nvidia-nvda-stock-news-today-groq-inference-dec-26-2025/)

[4] Forbes - “What To Expect From Nvidia In 2026” (https://www.forbes.com/sites/greatspeculations/2025/12/30/what-to-expect-from-nvidia-in-2026/)

[5] The Motley Fool - “Nvidia, in the Last Days of 2025, Just Made a Game-Changing Move” (https://www.fool.com/investing/2025/12/29/nvidia-in-the-last-days-of-2025-just-made-a-game-ch/)

[6] The Motley Fool - AI inferencing market forecast (https://www.fool.com/investing/2025/12/29/nvidia-in-the-last-days-of-2025-just-made-a-game-ch/)

[7] ts2.tech - “AI Stocks Today: Nvidia’s Groq Inference Bet, Broadcom’s Margin Debate” (https://ts2.tech/en/ai-stocks-today-nvidias-groq-inference-bet-broadcoms-margin-debate/)

[8] ts2.tech - “AI Stocks Today: Nvidia, Micron and Meta Drive a Christmas Eve Record Rally” (https://ts2.tech/en/ai-stocks-today-dec-24-2025-nvidia-micron-and-meta-drive-a-christmas-eve-record-rally/)

[9] Verified Market Research - Global Inference AI Chip Market Report (inference AI chip market forecast)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.