Analysis of the In-depth Impact of Samsung's Expanded Galaxy AI Scale on the Smartphone Market Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Samsung Electronics announced a strategic initiative to

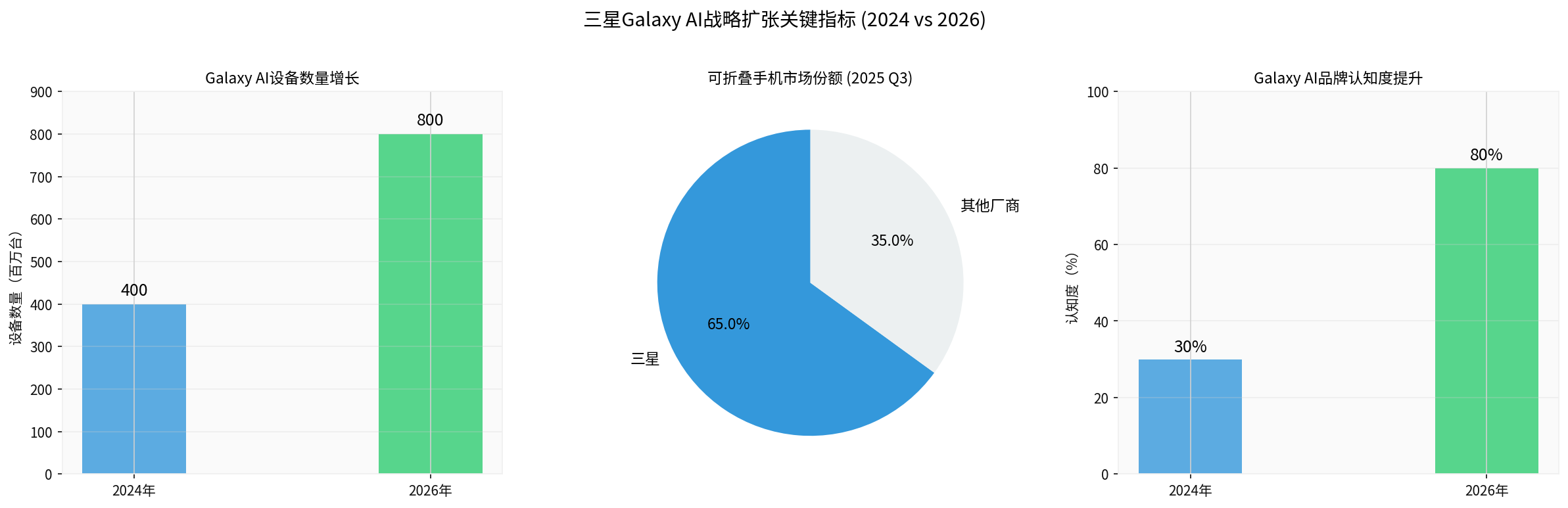

- Scale Doubling: From 400 million units in 2024 to 800 million devices by 2026[1][2]

- Technical Support: Core technical support provided by Google Gemini large model[2][3]

- Comprehensive Coverage: Includes multiple product forms such as smartphones, tablets, foldable devices, etc.[4]

- Function Integration: Covers various AI applications like real-time translation, image editing, intelligent assistant, etc.

Chart shows: Samsung plans to double the number of Galaxy AI devices from 400 million to 800 million units, while Galaxy AI brand awareness jumps from 30% to 80%[1][2][5]

The competition dimensions of the smartphone industry are shifting from

- Traditional Hardware Homogenization: Hardware parameters such as processors, cameras, screens have approached physical limits

- AI Becomes a New Differentiator: Intelligent translation, image generation, personalized recommendations become core competitiveness

- User Experience Revolution: From “tool-type” to “intelligent assistant-type” transformation

Through large-scale deployment of Galaxy AI, Samsung is

Deep cooperation between Samsung and Google will further consolidate

- Android Advantage Expansion: 800 million Galaxy AI devices will provide a huge user base and data feedback for Gemini

- iOS Faces Pressure: Although Apple is also advancing AI functions, it may lag behind in scale and speed

- HarmonyOS Opportunity: Huawei HarmonyOS needs to quickly catch up in AI capabilities to maintain competitiveness in the local market

According to the latest market data, Samsung’s

- Enhance High-end Premium Capability: AI functions become standard for foldable devices

- Establish Technical Barriers: The combination of hardware + AI is difficult to copy quickly

- Lock High-end Users: Increase user conversion costs

The下沉 of Galaxy AI to mid-range models will produce chain reactions:

- Chinese Manufacturers Under Pressure: Xiaomi, OPPO, vivo, etc. face pressure to upgrade AI capabilities in the mid-range market

- Apple Ecosystem Pressure: iPhone is relatively conservative in AI experience, which may affect mid-to-high-end market share

- Industry Innovation Accelerated: All manufacturers are forced to increase AI R&D investment

According to Samsung’s internal research,

- Innovative Leader Image: Consolidate Samsung’s brand positioning as “AI phone leader”

- User Stickiness Enhanced: Deep use of AI functions improves user retention rate

- Premium Capability Improved: Support high-end product pricing strategy

From Samsung Electronics’ latest financial data, the company is at a

Financial Indicator |

Performance |

Significance |

|---|---|---|

Stock Price Performance |

+118.17% in 6 months, +147.05% in 1 year | Market highly recognizes AI strategy |

Market Value |

923.35 trillion KRW | Return to the first echelon of global technology giants |

Q4 Performance Forecast |

EPS estimated at 2270.19 KRW | AI starts to contribute substantial profits |

P/E Ratio |

28.40x | Valuation still has room for improvement |

- Hardware Synergy: Galaxy AI links across multiple devices such as phones, tablets, watches, headphones

- Service Integration: Deep integration with services like Samsung Health, Samsung Pay

- Data Advantage: Data generated by 800 million devices will form a strong AI training feedback loop

Facing Apple’s strong position in the high-end market, Samsung has achieved

- More Aggressive AI Functions: Compared with Apple’s conservative strategy, Samsung launches innovative AI functions more quickly

- Price Range Coverage: Comprehensive coverage from flagship to mid-range

- Localization Advantage: Stronger local AI service integration in Asian markets

Samsung’s 800 million Galaxy AI devices will become

- User Scale: 800 million users provide a huge user base for Gemini

- Data Feedback: Large-scale usage data will continuously improve model performance

- Application Scenarios: Cover multiple high-frequency usage scenarios such as search, translation, image processing

In the AI model competition landscape,

- OpenAI Challenge: ChatGPT lacks native hardware support on mobile

- Google Advantage: Gain “pre-installed” level distribution advantage through Samsung devices

- Market Impact: Analysts believe this may “force OpenAI to reduce capital expenditure in 2026”[9]

- Ecosystem Binding: Strengthen Samsung’s position as the largest supporter of Android

- Service Integration: Deep integration of Google services on Samsung devices

- Competitive Advantage: Compared with the closed nature of iOS ecosystem, the combination of Android + AI is more open

From Google’s financial structure, AI mobilization will provide a foundation for

Revenue Source |

Current Proportion |

AI Enhancement Potential |

|---|---|---|

Google Search |

56.0% | AI enhances search experience |

Google Cloud |

12.9% | Mobile AI computing demand |

YouTube Advertising |

10.1% | AI recommendation optimization |

Hardware Services |

12.1% | AI subscription services |

- AI Hallucination Risk: Generative AI still has factual accuracy issues

- User Acceptance: Actual usage rate of AI functions by consumers still needs to be verified

- Privacy Concerns: Deep use of user data by AI functions raises privacy concerns

- Apple Apple Intelligence: Apple is reconstructing Siri and plans to launch an LLM-driven version in 2026[14][15]

- Huawei HarmonyOS: Huawei quickly promotes AI capability integration in the local market

- Chinese Manufacturers: Xiaomi, OPPO, etc. are quickly catching up in AI photography, voice assistants, etc.

- Memory Shortage: AI functions have higher requirements for device memory and storage

- Cost Increase: Hardware upgrades for 800 million AI devices will significantly increase costs

- Pricing Pressure: Under the background of weak consumer electronics demand, cost pass-through is difficult

- Sino-US Tech Competition: AI becomes the core field of a new round of tech competition

- Regulatory Review: AI integration of large tech companies faces stricter regulatory review

- Data Sovereignty: Restrictions on cross-border data transmission in different regions

- Market Differentiation Accelerated: Manufacturers with strong AI capabilities will further expand market share

- Product Iteration Accelerated: AI functions will become core selling points of new phones

- User Education Completed: Consumers’ awareness and usage habits of AI functions gradually form

- AI Becomes Standard: Devices without AI functions will be difficult to sell

- Business Model Innovation: AI subscription services may become a new revenue source

- Ecosystem Competition Intensified: Competition between different AI ecosystems becomes more fierce

- Device Form Innovation: AI-driven new device forms may emerge

- Human-computer Interaction Revolution: Voice, gesture and other new interaction methods become mainstream

- Industry Pattern Reshaped: AI capability becomes the core competitiveness determining manufacturers’ survival

- Accelerate AI Innovation: Continuously launch differentiated AI functions to maintain technical leadership

- Optimize Cost Structure: Control cost increases through supply chain optimization and scale effects

- Strengthen Ecosystem Construction: Deeply integrate Galaxy AI with Samsung ecosystem

- Focus on Localization: Launch localized AI functions and services in different markets

- Deepen Cooperation: Establish a closer strategic partnership with Samsung

- Optimize Model: Optimize Gemini model performance for mobile scenarios

- Open Ecosystem: Attract more developers to join the Galaxy AI ecosystem

- Protect Privacy: Establish a credible AI usage privacy framework

- Focus on AI Industry Chain: Investment opportunities across the entire chain from chips, models, applications to services

- Evaluate Long-term Value: AI capability will become the core indicator of long-term value of tech companies

- Be Alert to Technical Risks: Investment risks brought by uncertainty of AI technology

- Seize Opportunities: Look for buying opportunities of high-quality targets when the market overreacts

Samsung’s initiative to expand Galaxy AI device scale to 800 million units is an

This strategy will have far-reaching impacts on the market landscape:

- Accelerate industry AI transformation, pushing all manufacturers to increase AI investment

- Consolidate Samsung’s leading position in the Android ecosystem, narrowing the gap with Apple

- Provide a huge mobile distribution channel for Google Gemini, enhancing the ability to compete against OpenAI

- Reshape consumers’ expectations for smartphones, AI capability becomes a key factor in purchase decisions

However, the success of this strategy still faces multiple challenges such as

From an investment perspective, this strategy further strengthens the

[0] Gilin API Data - Samsung Electronics and Alphabet Financial Data

[1] Reuters - “Samsung to double mobile devices powered by Google’s Gemini to 800 mln units this year” (2026-01-05) [https://www.reuters.com/world/china/samsung-double-mobile-devices-powered-by-googles-gemini-800-mln-units-this-year-2026-01-05/]

[2] Yahoo Finance - “Exclusive-Samsung to double AI mobile devices to 800 million units this year” [https://finance.yahoo.com/news/exclusive-samsung-double-mobile-devices-030312758.html]

[3] CNET - “Samsung to Supercharge 800 Million Devices With AI This Year” [https://www.cnet.com/tech/services-and-software/samsung-supercharges-800-million-devices-with-ai-2026/]

[4] Forbes - “Galaxy S26 Ultra Release Date: Samsung’s Free Offer Now Makes Sense” (2025-12-30) [https://www.forbes.com/sites/jaymcgregor/2025/12/30/samsung-galaxy-phone-bixby-perplexity-integration-galaxy-s26/]

[5] Reuters - Samsung Galaxy AI brand awareness data (same as [1])

[7] Counterpoint Research - Foldable phone market share data (cited via Reuters)

[9] CNBC - “Gemini success to drive Alphabet shares to $400, cause OpenAI to cut capex” (2025-12-07) [https://www.cnbc.com/2025/12/07/gemini-success-to-drive-alphabet-shares-to-400-cause-openai-to-cut-capex-says-pivotal/]

[10] Investing.com - “Google plans to introduce ads to Gemini AI chatbot in 2026” [https://www.investing.com/news/stock-market-news/google-plans-to-introduce-ads-to-gemini-ai-chatbot-in-2026--adweek-93CH-4396732]

[11] GSMArena - “Google Translate is now powered by Gemini” (2025-12-13) [https://www.gsmarena.com/google_translate_is_now_powered_by_gemini-news-70701.php]

[12] 9to5Google - “Google Translate rolling out live translation using Gemini” (2025-12-12) [https://9to5google.com/2025/12/12/google-translate-gemini-headphones/]

[14] AppleInsider - “Apple’s AI team is bigger than reported” (2025-12-23) [https://appleinsider.com/articles/25/12/23/apples-ai-team-is-bigger-than-reported-strategy-reinforced-with-latest-restructure]

[15] ts2.tech - “Apple Inc. Stock News: Siri 2.0, iPhone 17 Momentum” (2025-12-21) [https://ts2.tech/en/apple-inc-stock-aapl-news-forecasts-and-analyst-targets-siri-2-0-iphone-17-momentum-and-app-store-risks-updated-dec-21-2025/]

[16] CNBC - “Apple needs to deliver an AI-charged Siri” (2025-12-30) [https://www.cnbc.com/2025/12/30/apple-intelligence-ai-siri-iphone.html]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.