Analysis of the Impact of Large-Scale Insider Stock Sales on Biotech Company Valuations: A Case Study of Adaptive Biotechnologies (ADPT)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Ticker Symbol: ADPT (NASDAQ)

- Current Stock Price: $16.17 (as of January 5, 2026)

- Market Capitalization: $2.47 billion

- Industry: Biotechnology/Healthcare

- Core Business: Developing clinical products using adaptive immune system genetics for disease diagnosis and treatment

- YTD Return: +129.36% [0]

- Annual Return: +162.36% (from $6.19 to $16.24) [0]

- 52-Week High: $20.76

- 52-Week Low: $5.97

- Beta Coefficient: 2.18 (high volatility) [0]

According to SEC filings, Adaptive Biotechnologies submitted Form 144 multiple times in December 2025, indicating that insiders planned to sell restricted stock [1]:

- LO FRANCIS (Chief People Officer):

- December 15: Sold 113,890 shares at $15.57, worth approximately $1.773 million

- December 22: Sold 4,394 shares at $17.50, worth approximately $76,895 [2]

- Remaining Shares Held: 315,978 shares

- Other Insiders:

- Multiple Form 144 filings in December [1]

Form 144 is a document required by the SEC for insiders to file when planning to sell restricted stock, and must be submitted before the intended sale date. This indicates:

- The shares sold are restricted stock (usually part of equity incentives)

- The sale plan has been disclosed in advance, increasing transparency

- This is a normal diversified portfolio management practice

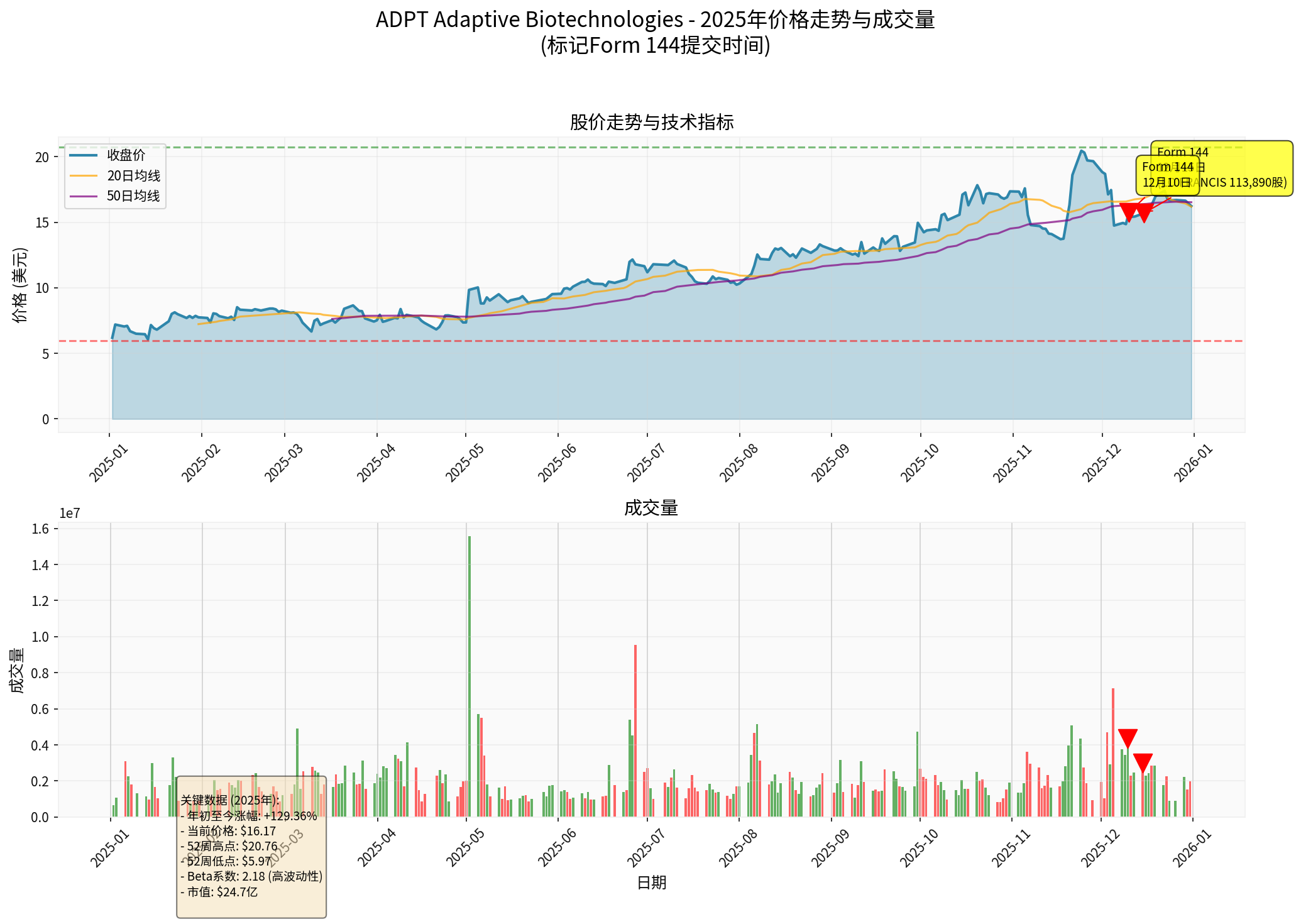

Chart shows: ADPT experienced significant growth in 2025; around the time of insider sales in mid-December, the stock price fell from a high of $20.76 to around $16.

- Investors may interpret insider sales as a signal that management lacks confidence in the company’s prospects

- Increases market uncertainty, especially when stock prices are at high levels

- May trigger short-term selling pressure, leading to stock price volatility

- After LO FRANCIS’s large-scale sale (113,890 shares) on December 15, the stock price fell from a high of $20.76

- The stock price fell by 5.69% in late December [3]

- However, the overall decline was limited, indicating that the market’s reaction was relatively mild

- Increases the supply of tradable shares in the market

- Has a greater impact on small and mid-cap biotech stocks with low liquidity

- May create short-term downward pressure on stock prices

- Public Float: 147 million shares

- Short Interest as % of Float: 6.64% [3]

- Average Daily Volume: 2.2 million shares (moderate liquidity)

- The scale of insider sales relative to total float is small, and no significant liquidity impact occurred

| Impact Factor | Negative Impact | Neutral/Positive Factors |

|---|---|---|

| Sale Motivation | May indicate insiders believe the stock is overvalued | Restricted stock maturation, normal redemption |

| Sale Scale | Large-scale sales may trigger panic | ADPT’s sale scale is relatively small |

| Company Fundamentals | - | Reached important collaboration agreement with Pfizer [4] |

| Industry Outlook | - | Biotech sector overall performance is strong |

- Q3 2025 earnings exceeded expectations: Revenue $93.97M (expected $59.28M), beating expectations by 58.51% [0]

- EPS continued to improve: From -$0.23 in Q4 2024 to -$0.15 in Q3 2025 [0]

- Key Catalyst: On December 15, announced two immune receptor licensing agreements with Pfizer, with potential milestone payments up to $890 million [4]

- Analyst Ratings: 11 Buy, 4 Hold, 2 Sell [0]

- Median Target Price: $20.00 (23.7% upside from current price) [0]

- Recent Rating Actions:

- Morgan Stanley: Maintain “Neutral” rating, target price $21

- BTIG: Maintain “Buy” rating

- JPMorgan: Maintain “Overweight” rating [0]

- P/E Ratio: -30.96x (company is still in loss phase) [0]

- P/B Ratio: 12.06x

- P/S Ratio: 9.76x [0]

- The high P/S ratio reflects market expectations for its long-term growth

Insider sales in biotech companies need to be analyzed in combination with industry characteristics:

- Equity Incentive Structure: Biotech companies generally use a large number of equity incentives; insider sales are often pre-set cash-out plans

- Long R&D Cycle: Management needs to diversify personal wealth risks

- Regulatory Compliance: Form 144 filing itself is a sign of compliance and transparency

- High Volatility: ADPT’s Beta coefficient is 2.18, with large stock price fluctuations [0]

- Dependence on a Single Product: Market acceptance of the clonoSEQ testing product

- Profitability: Net profit margin is -31.50%, has not yet achieved profitability [0]

- LO FRANCIS sold when the stock price was near its 52-week high ($15.57-$17.50)

- This may reflect tactical reduction by insiders rather than bearish views on the company’s long-term prospects

- After a 162% surge in stock price, partial profit-taking is a rational investment management behavior

- December 15: LO FRANCIS’s large-scale sale (113,890 shares)

- Same Day: Company announced an important collaboration agreement with Pfizer [4]

- This indicates that insider sales may coincide with major positive company announcements, not based on negative information

| Evaluation Dimension | ADPT Situation | Interpretation |

|---|---|---|

| Sale Scale | Relatively small proportion of float | Limited impact |

| Sale Frequency | Concentrated sales in December | Need to monitor if there are more sales later |

| Remaining Shares Held | LO FRANCIS still holds 316,000 shares | Retains a significant stake |

| Company Fundamentals | Q3 earnings exceeded expectations, collaboration with Pfizer | Strong fundamentals |

| Industry Trend | Biotech sector overall rising | Favorable industry environment |

- Focus on Fundamentals: Q3 revenue exceeded expectations by 58.51%, collaboration with Pfizer brings long-term value [0][4]

- Rationally View Insider Sales: Normal redemption behavior after restricted stock maturation

- Monitor Catalysts: clonoSEQ presented 90 abstracts at the ASH Annual Meeting, clinical recognition improved [3]

- Note Volatility: Beta is 2.18, large stock price fluctuations; need to set stop-loss levels [0]

- Focus on Technicals: Currently in sideways consolidation; support level at $15.81; be cautious if it breaks below

- Track Volume: Whether volume abnormally increases after insider sales

- Multiple executives selling large-scale simultaneously

- Insiders selling before the company releases major negative news

- Shareholding ratio drops to a very low level after selling

- Company fundamentals deteriorate at the same time

- ✅ Sale scale is controllable

- ✅ Clear trend of fundamental improvement

- ✅ Major strategic collaboration provides support

- ⚠️ Has not yet profitable, relies on financing capacity

- ⚠️ High valuation, need to monitor growth sustainability

The impact of large-scale insider sales on biotech company valuations depends on multiple factors:

-

Short-Term Impact (1-3 months):

- May cause short-term stock price fluctuations and downward pressure

- Market sentiment may be affected

- ADPT’s stock price corrected by about 5-6% after insider sales in December, but the decline was relatively mild

-

Long-Term Impact (6-12 months):

- If fundamentals are strong, the impact will gradually dissipate

- ADPT’s collaboration agreement with Pfizer ($890 million potential milestones) provides a strong catalyst [4]

- Analyst target price of $20 implies a 23.7% upside [0]

-

Valuation Impact Judgment:

- Insider sales do not necessarily mean a valuation downgrade

- Need to make a comprehensive judgment based on sale motivation, company fundamentals, and industry outlook

- ADPT’s case shows that with strong fundamental support, the negative impact of insider sales is limited and controllable

For investors considering investing in ADPT:

- 2025 stock price increase of 162%, strong technicals [0]

- Q3 earnings exceeded expectations, strong revenue growth [0]

- Collaboration with Pfizer opens new commercial opportunities [4]

- Clinical recognition of clonoSEQ product improved [3]

- Insider sales may continue

- Company has not yet profitable, negative cash flow

- High valuation, P/S ratio of 9.76x [0]

- High Beta value means high volatility [0]

- Long-term investors: May consider buying on dips during corrections, monitor Q4 earnings on February 10, 2026 [0]

- Short-term investors: Closely monitor technical support level at $15.81; be cautious if it breaks below

- All investors: Continuously monitor subsequent Form 144 filings and insider trading activities

- Q4 earnings on February 10, 2026 (expected EPS -$0.19) [0]

- Subsequent Form 144 filing status

- Progress of collaboration with Pfizer

- Commercialization progress of clonoSEQ

- Cash flow improvement status

Insider sales are an important reference indicator for evaluating the investment value of biotech companies, but should not be the only basis for judgment. In the case of Adaptive Biotechnologies, despite insider sales in December, strong fundamentals, important strategic collaborations, and favorable industry prospects mean that the company’s long-term investment value is still recognized by most analysts.

[0] Gilin API Data - Adaptive Biotechnologies (ADPT) Stock Price, Financial Data, Technical Analysis, Analyst Ratings

[1] SEC EDGAR - Adaptive Biotechnologies Form 144 Filings (Multiple Submissions in December 2025) https://www.sec.gov/Archives/edgar/data/1478320/

[2] NewsHeater - “Adaptive Biotechnologies Corp (ADPT) Stock: A Guide to the Market Trend” https://newsheater.com/2025/12/31/adaptive-biotechnologies-corp-adpt-stock-a-guide-to-the-market-trend/

[3] Seeking Alpha - “Adaptive Biotechnologies is the top performing life sciences tools and services stock YTD” https://seekingalpha.com/news/4534522-adaptive-biotechnologies-is-the-top-performing-life-sciences-tools-and-services-stock-ytd

[4] Globe Newswire - “Adaptive Biotechnologies Announces Two Immune Receptor Licensing Agreements with Pfizer” (December 15, 2025) https://www.globenewswire.com/en/news-release/2025/12/15/3205383/0/en/Adaptive-Biotechnologies-Announces-Two-Immune-Receptor-Licensing-Agreements-with-Pfizer.html

[5] MarketChameleon - “Adaptive Biotechnologies and Pfizer Forge Major Partnerships Targeting Rheumatoid Arthritis and Immunology Data Applications” https://marketchameleon.com/Blog/post/2025/12/15/adaptive-biotechnologies-pfizer-immune-receptor-licensing-ra-ai-data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.