Comprehensive Investment Value Assessment Report on UISEE’s Hong Kong IPO

I. Investment Value Evaluation Framework for Hong Kong IPOs in the Autonomous Driving Sector

1.1 Industry Background and Policy Environment

2025 Marks a Critical Turning Point for the Autonomous Driving Industry

. In December 2025, the Ministry of Industry and Information Technology announced that China’s first batch of L3 conditional autonomous driving vehicles had obtained access permits, marking an important step for autonomous driving technology from the testing phase to commercial application [1]. This policy breakthrough has injected a shot in the arm for the entire industry.

Capital Market Enthusiasm Runs High

. 2025 was a “capital boom year” for the autonomous driving industry, with a total annual financing of approximately 60 billion yuan involving 35 enterprises. Among them, the Robotaxi track saw 5 enterprises raising a total of up to 28.8 billion yuan, becoming the veritable “cash king” [2].

Hong Kong Market Attractiveness Stands Out

. HKEX Chapter 18C (Listing Rules for Specialized Technology Companies) provides a listing channel for unprofitable tech enterprises. In 2025, several autonomous driving enterprises such as WeRide (

00800.HK),

Pony.ai (

02026.HK), and HeadSense Drive (

03881.HK) successfully listed [1].

1.2 Performance Analysis of Hong Kong Autonomous Driving Sector

Market Index Performance

. In 2025, the three major U.S. stock indices performed strongly: the S&P 500 Index rose by 15.96%, the Nasdaq Composite Index rose by 19.78%, and the Dow Jones Industrial Average rose by 12.67% [0]. The overall strength of tech stocks provided a favorable market environment for the autonomous driving sector.

Differentiated Performance of Listed Companies

.

Pony.ai and WeRide debuted on the Hong Kong Stock Exchange on the same day, November 6, 2025, but their share prices fell by 9.28% and 9.96% respectively on the first day of listing [3], reflecting the market’s divergent expectations for the “high investment, long return” characteristics of L4 autonomous driving enterprises.

Southbound Capital Attention

. Hong Kong Stock Connect funds significantly increased their positions in autonomous driving concept stocks in December 2025, including Joyson Electronics, Seres, and Caocao Chuxing, indicating mainland investors’ long-term optimism about this track [4].

1.3 Core Dimensions of Investment Value Evaluation

When evaluating Hong Kong IPO enterprises in the autonomous driving sector, the following dimensions should be focused on:

| Evaluation Dimension |

Key Indicators |

Description |

Commercialization Capability |

Revenue growth rate, gross margin, order backlog |

Whether a sustainable business model closed loop can be achieved |

Technology Moat |

R&D investment ratio, number of patents, difficulty of scenario implementation |

Technology leadership and barrier height |

Financial Health |

Cash reserves, loss narrowing speed, break-even expectation |

Survival ability and sustainable development potential |

Market Positioning |

Market share in segmented scenarios, quality of partners |

Differentiated competitive advantages |

Policy Adaptability |

Alignment between scenario selection and regulatory policies |

Speed of commercial implementation |

II. Analysis of UISEE’s Core Competitiveness and Business Model

2.1 Company Basic Overview

Business Positioning

: UISEE focuses on L4 autonomous driving solutions, mainly through the “full-scenario” strategy to layout multiple segmented tracks, including closed or semi-closed scenarios such as airports, factories, and logistics [5].

Listing Structure

:<br>- Plans to issue no more than 1,891,400 overseas listed ordinary shares<br>- 41 shareholders plan to convert a total of 11,226,425 domestic unlisted shares held into overseas listed shares (“full circulation”)<br>- CITIC Securities acts as the exclusive sponsor<br>- Lists via HKEX Chapter 18C specialized technology company rules [5]

Equity Structure

: Founder Wu Gansha holds 8,113,910 shares; other major shareholders include Beijing司马驹Technology Center and Beijing GrinShine DeepTech, with investment lineup including well-known institutions such as Innovation Works and CITIC Securities [5].

2.2 Core Competitiveness Analysis

(1)

Full-Scenario Layout Strategy

UISEE adopts a “full-scenario” strategy, laying out multiple segmented tracks in different application scenarios to reduce the risk of commercial failure in a single scenario. According to public information, its business covers:

Airport Scenario

: Hong Kong International Airport is its benchmark case, having established safety and efficient operation standards [6]Factory Logistics

: Provides unmanned distribution solutions for manufacturing and industrial parksUrban Distribution

: Last-mile unmanned distribution

(2)

Cloud-End Collaborative Technology Architecture

The company has established a complete autonomous driving system architecture, including cloud platform, on-board computing platform, and operation management system, forming a closed-loop technical system [6]. This architecture can support functions such as remote monitoring, predictive maintenance, and OTA upgrades to improve operational efficiency.

(3)

Commercial Implementation Capability

Unlike some enterprises focusing on Robotaxi but still not realizing large-scale commercialization, UISEE has achieved commercial closed loop in specific closed scenarios, which is its important differentiated advantage.

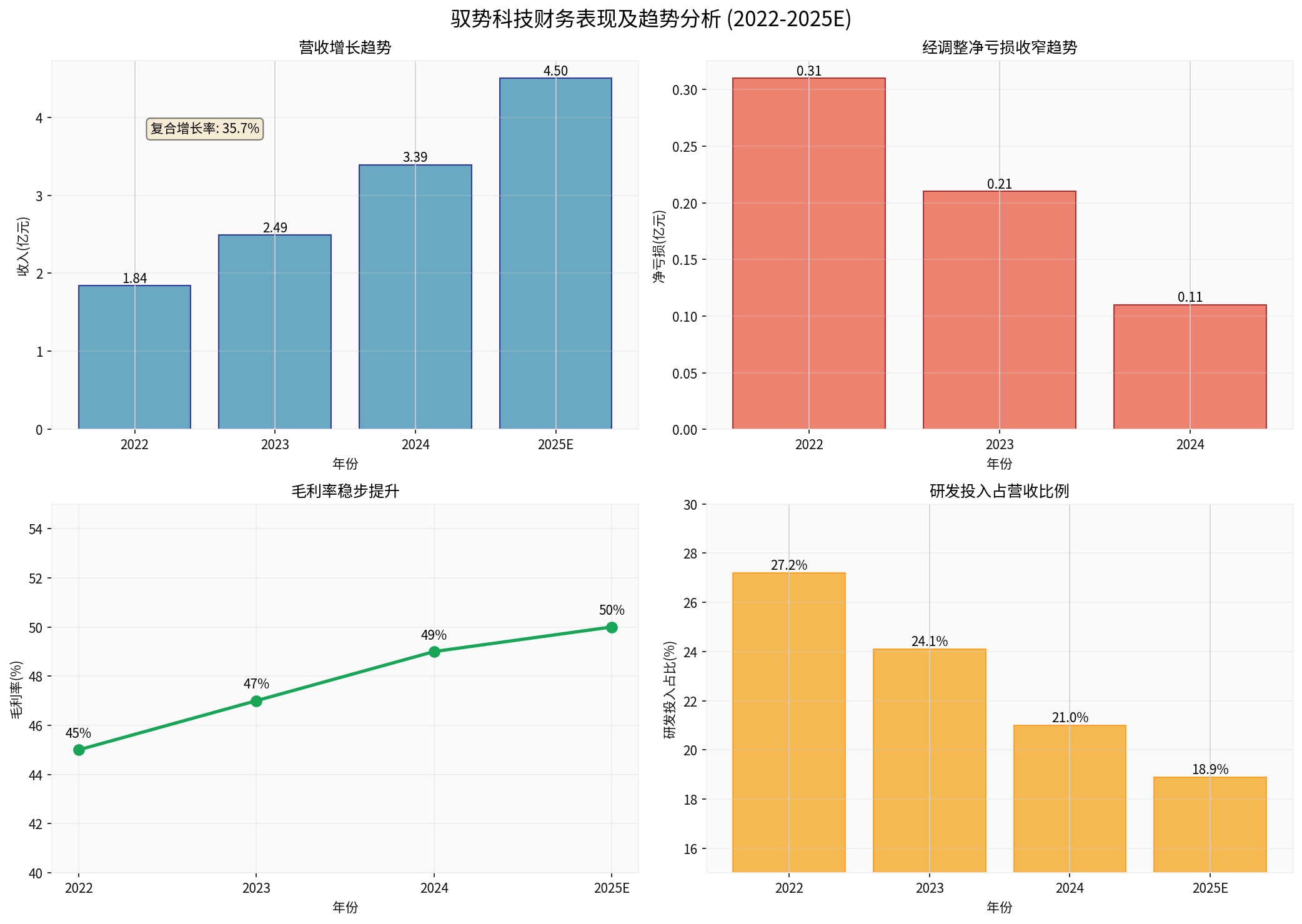

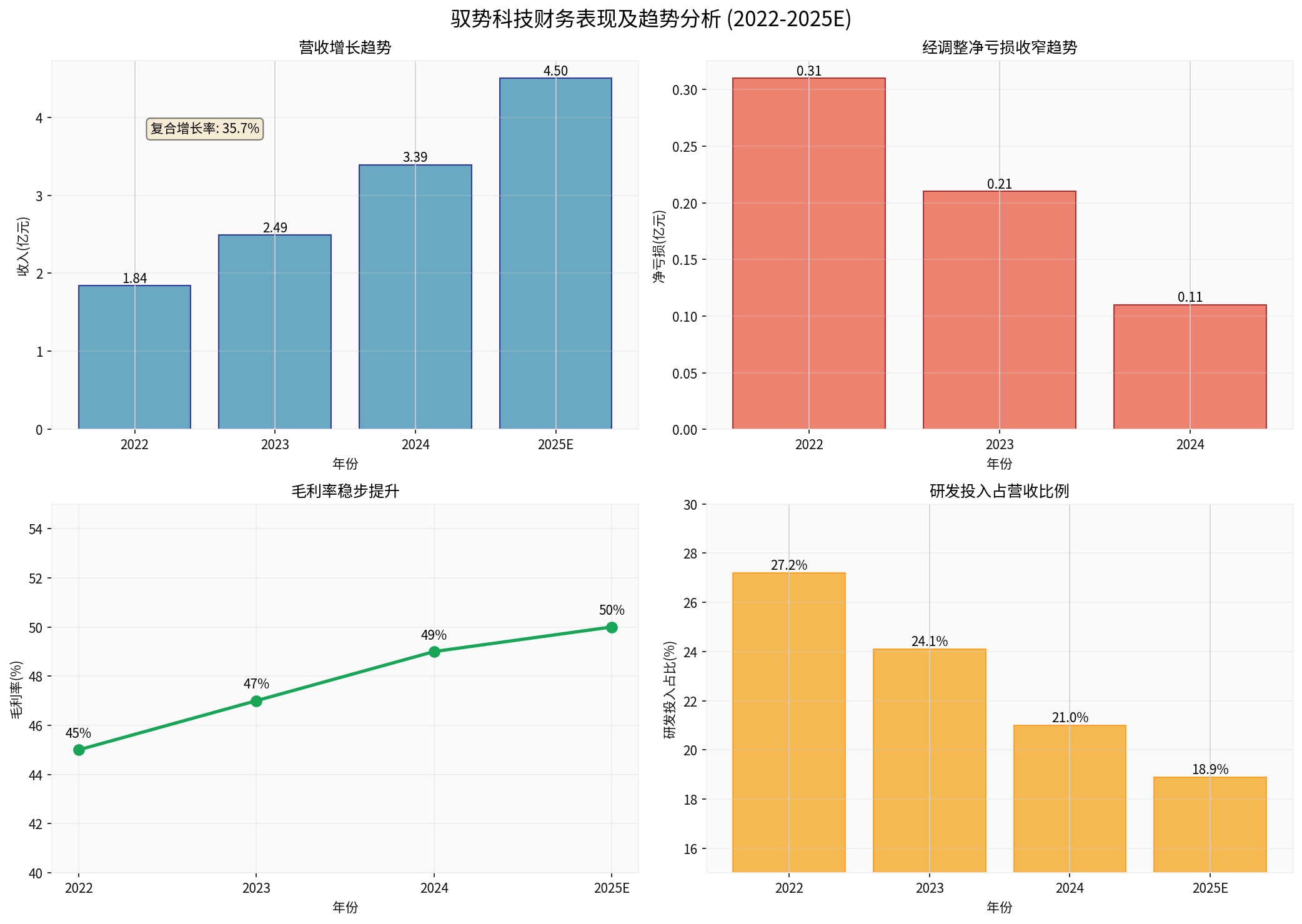

Chart Description

: The above chart shows the trend of key financial indicators of UISEE from 2022 to 2025 (forecast). From the chart, we can see:

Strong Revenue Growth

: From 184 million yuan in 2022 to 339 million yuan in 2024, with a compound growth rate of 35.7%Continuous Loss Narrowing

: Adjusted net loss decreased from 31 million yuan in 2022 to 11 million yuan in 2024, narrowing by 64.5%Steady Gross Margin Improvement

: From 45% in 2022 to 49% in 2024, showing improvement in product pricing power and cost controlOptimized R&D Investment Ratio

: Although the absolute value of R&D investment increased, the ratio to revenue decreased from 27.2% to 21.0%, reflecting economies of scale [7]

III. Commercial Prospects Analysis

3.1 Financial Performance and Profit Path

High-Quality Revenue Growth

:<br>- CAGR of 35.7% from 2022 to 2024, showing strong growth momentum [7]<br>- Gross margin stable in the range of 45%-49%, with strong product pricing power<br>- Increased business diversification, reducing the risk of dependence on a single customer

Rapid Loss Narrowing

:<br>- Adjusted net loss decreased from RMB 31 million in 2022 to RMB 11 million in 2024<br>- Expected to achieve break-even in 2025-2026 [7]

Capital Efficiency Improvement

:<br>- R&D investment ratio to revenue decreased from 27.2% to 21.0%, reflecting economies of scale<br>- With the expansion of revenue scale, the dilution effect of fixed costs is obvious

3.2 Market Space and Growth Drivers

Industry Policy Catalysis

:<br>- The first batch of L3 autonomous driving vehicles obtained access permits, clearing regulatory obstacles for industry development [1]<br>- Local governments actively promote the construction of autonomous driving demonstration zones<br>- Policies for unmanned operation in specific scenarios (such as airports and factories) are relatively loose

Technology Cost Reduction

:<br>- Referring to

Pony.ai’s seventh-generation model, the BOM cost of autonomous driving kits decreased by 70% compared to the previous generation [3]<br>- Continuous cost reduction of core hardware such as lidar and computing platforms<br>- Large-scale production further reduces unit costs

Rigid Market Demand

:<br>- Scenarios such as airports and factories face problems of rising labor costs and difficulty in recruiting workers<br>- The pandemic has accelerated the acceptance of unmanned operations<br>- Clear demand for safety and efficiency improvement

3.3 Competitive Landscape and Differentiated Advantages

Comparison of Hong Kong Autonomous Driving Segmented Tracks

:<br>

| Company |

Stock Code |

Main Scenarios |

2024 Revenue |

Core Advantages |

Listing Status |

| Pony.ai |

02026.HK |

Robotaxi, Robotruck |

- |

Leading Robotaxi technology, obtaining all permits in first-tier cities |

Listed |

| WeRide |

00800.HK |

Robotaxi, Robotruck |

- |

Cooperation with Bosch, ADAS mass production experience |

Listed |

| HeadSense Drive |

03881.HK |

Mining trucks, commercial vehicles |

410 million yuan |

Leading market share in mining truck scenarios |

Listed |

| Trunk Tech |

- |

Logistics hubs, highways |

254 million yuan |

31.8% market share in logistics hub scenarios |

Filed |

UISEE |

- |

Airports, factories |

339 million yuan |

Full-scenario layout, airport benchmark case |

Filed |

Data Sources: [1][2][7][8]

UISEE’s Differentiated Advantages

:<br>

-

Pragmatic Scenario Selection

: Avoids highly competitive tracks with unclear commercial paths such as Robotaxi, focusing on closed scenarios like airports and factories with higher commercial certainty

-

Benchmark Case Effect

: The Hong Kong International Airport project has established industry operation standards, providing strong endorsement for expanding other airport scenarios [6]

-

Full-Stack Self-Research Capability

: Full-stack capabilities from algorithms, systems to operation platforms, reducing dependence on external supply chains

-

International Layout

: Has entered the Hong Kong market and has international operation experience

3.4 Potential Risks and Challenges

Industry Level

:<br>-

Early Commercial Verification

: Currently, all autonomous driving enterprises listed in Hong Kong have not yet made profits, and their business models are still being verified [3]<br>-

Technology Iteration Risk

: Autonomous driving technology evolves rapidly, and there is a risk of wrong technical route selection

Intensified Competition

: At least 5 L4 autonomous driving truck companies will sprint for Hong Kong IPO in 2025, and competition in segmented tracks is becoming increasingly fierce [8]

Company Level

:<br>-

Relatively Small Scale

: Compared with leading enterprises like

Pony.ai, UISEE has gaps in capital strength and brand influence

Scenario Dispersion Risk

: Full-scenario layout may lead to resource dispersion, making it difficult to form absolute advantages in a single scenarioValuation Pressure

: The Hong Kong market is becoming more rational about the valuation of unprofitable tech enterprises, which may affect IPO pricing

IV. Investment Value Evaluation

4.1 Valuation Methods and Benchmarks

Valuation Comparison of Hong Kong Autonomous Driving Listed Companies

:<br>

| Company |

Market Cap (HKD) |

PS Multiple (2024E) |

Commercial Stage |

| Pony.ai |

~70 billion |

~20x |

Eve of Robotaxi scale-up |

| WeRide |

~20 billion |

~15x |

Multi-scenario layout |

| HeadSense Drive |

~11.2 billion |

~8x |

Commercialization in specific scenarios |

| Trunk Tech |

- |

- |

Filed |

UISEE |

TBD |

Expected 8-12x |

Commercialization in specific scenarios |

Valuation Logic

:<br>- UISEE’s commercialization level and revenue scale (339 million yuan in 2024) are between HeadSense Drive and Trunk Tech<br>- Due to scenario dispersion, market share in a single scenario may not be as high as HeadSense Drive (mining trucks) and Trunk Tech (logistics hubs)<br>- However, full-scenario layout provides higher growth potential and risk resistance<br>- Referring to comparable companies, the reasonable PS valuation range is 8-12x

4.2 Investment Highlights

-

High Commercialization Level

: Compared with Robotaxi enterprises that still need large-scale investment, UISEE focuses on closed scenarios like airports and factories, with higher commercialization certainty

-

Good Financial Health

: Obvious improvement in financial indicators and clear profit path

-

Beneficiary of Policy Dividends

: Specific scenario commercialization is more aligned with regulatory policies, with faster implementation speed

-

Certain Growth

: 35.7% revenue CAGR, and the profit inflection point is clear with stable gross margin

4.3 Investment Recommendations

Recommend Participating in IPO Subscription, but Need to Control Positions

Reasons

:<br>

Supporting Factors

:<br>- Friendly industry policy environment, accelerating commercialization process<br>- Obvious improvement in company financial indicators, clear profit path<br>- Higher commercial certainty in specific scenarios than Robotaxi track<br>- Relatively reasonable valuation, lower than leading Robotaxi enterprises

Prudent Factors

:<br>- The overall commercialization of the autonomous driving industry is still in the early stage, with uncertainties<br>- Relatively small company scale, limited risk resistance<br>- Scenario dispersion may lead to difficulty in concentrating resources<br>- The Hong Kong market is becoming more cautious about the valuation of unprofitable enterprises

Investment Strategy

:<br>-

Short-Term Investors

: Pay attention to the first-day listing performance; if the breakage rate exceeds 15-20%, consider short-term intervention<br>-

Long-Term Investors

: Can build positions gradually, track commercial progress and break-even implementation<br>-

Position Allocation

: It is recommended not to exceed 3-5% of the Hong Kong stock portfolio, which is a high-risk and high-growth allocation

Key Tracking Indicators

:<br>1. Quarterly revenue growth rate and gross margin changes<br>2. Order acquisition and delivery progress in various scenarios<br>3. R&D investment output ratio<br>4. Cash consumption speed and financing rhythm<br>5. Industry policy changes

V. Summary

The investment value of UISEE’s Hong Kong IPO lies in its

pragmatic scenario selection

and

clear profit path

. Compared with tracks like Robotaxi that still need large-scale investment, UISEE focuses on closed scenarios like airports and factories, with higher commercialization level and better financial health.

Core Advantages

: Full-scenario layout reduces single-scenario risk, obvious improvement in financial indicators, high commercial certainty

Main Risks

: Relatively small scale, resource dispersion due to scenario dispersion, overall industry commercialization still needs verification

Investment Rating

: Cautious recommendation, suitable for growth investors with high risk tolerance; it is recommended to control positions and track commercial progress for a long time.

References

[1] CNBRadio - 2025 Autonomous Driving Industry Observation: Commercialization Path Gradually Clear, Moving Towards a New Stage of Practical Application<br>https://finance.eastmoney.com/a/202512313607114219.html

[2] Sina Finance - 60 Billion! Autonomous Driving Explodes in 2025, 35 Enterprises Raise Funds, Mass Production Becomes Key Word<br>https://finance.sina.com.cn/stock/t/2026-01-05/doc-inhfhavn6780177.shtml

[3] Sina Finance - Unmanned Driving Track “Turbulent”, Can Pony.ai Safely Cross the Profit River?<br>https://finance.sina.com.cn/tech/roll/2025-12-29/doc-inheneyk7782321.shtml

[4] Securities Times - Sudden Policy Benefits, Funds Pour into This Track, Stock Picking List Released<br>https://www.stcn.com/article/detail/3549916.html

[5] Sina Finance - UISEE Obtains CSRC Filing Notice, Plans to List on Hong Kong Stock Exchange<br>https://finance.sina.com.cn/stock/aigc/ggxg/zjhba/2026-01-05/doc-inhfhicp6472171.shtml

[6] Bay Area Financial Experts Talk - Exclusive Interview with UISEE CEO Wu Gansha: Going Overseas is Not for Quick Money but Win-Win Cooperation<br>https://www.facebook.com/GlocalNews/videos/

[7] EET China - Hong Kong Stock Chapter 18C Listing Tide Explodes! 10 Specialized Technology Companies Rush to the Capital Market<br>https://www.eet-china.com/mp/a408910.html

[8] Smart Car Reference - Tsinghua Smart Car Team Leader Sprints for IPO! L4 Unmanned Truck, Annual Revenue 250 Million Yuan<br>https://www.eet-china.com/mp/a460093.html

[9] Jinling API Data - Market Index Data

[10] UISEE Prospectus and Related Financial Data

— tags (codes, translate to display labels) —