Impact of Roborock's H-share IPO on Sci-Tech Innovation Board Valuation and Value Analysis of A+H Dual Listing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

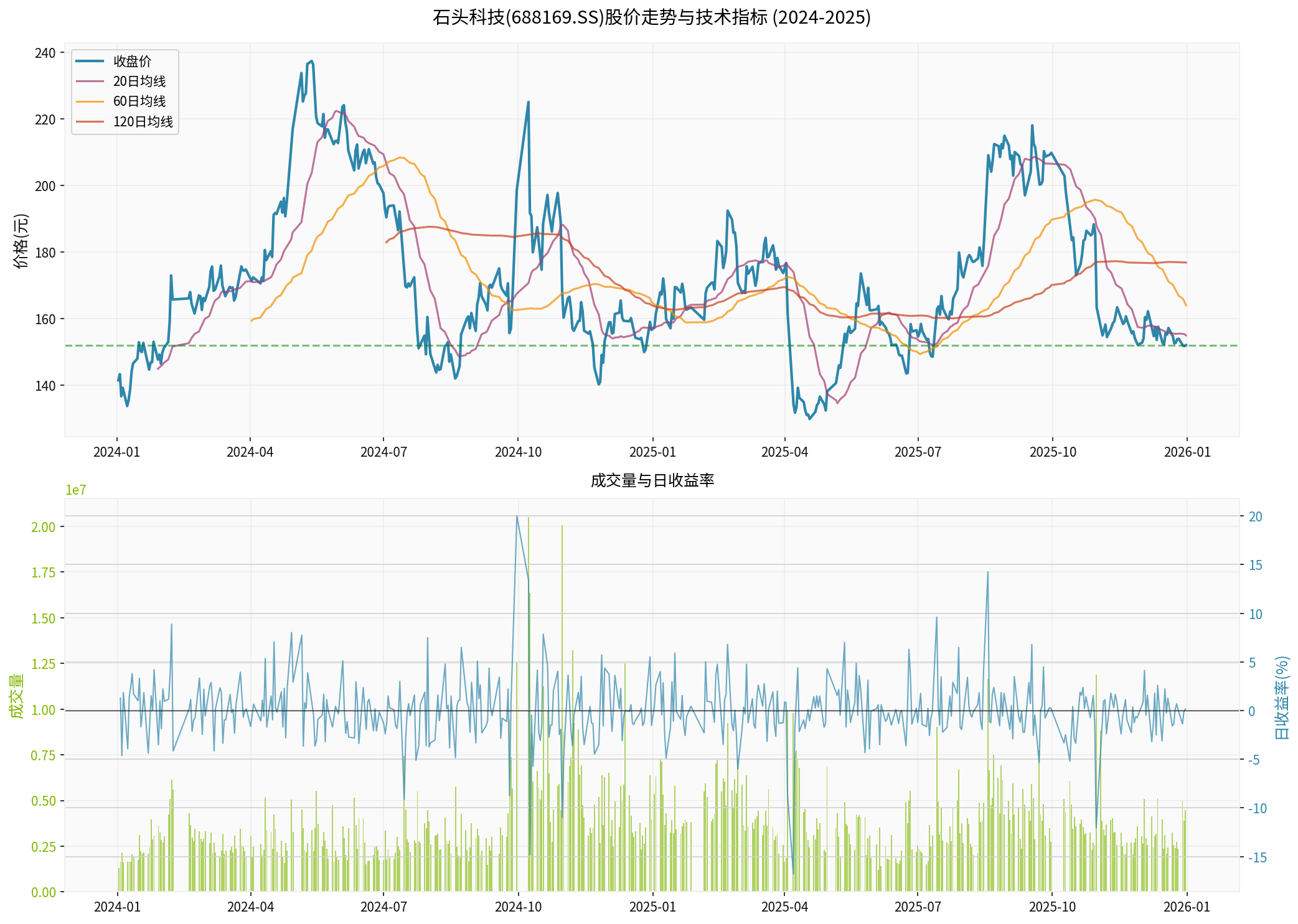

Roborock (688169.SS), an enterprise in the Xiaomi ecosystem, focuses on the R&D and sales of smart cleaning devices and is a global leader in the smart robot vacuum sector. According to the latest data, the company’s current market capitalization is

- P/E Ratio: 26.06x (TTM)

- ROE: 11.61%

- Net Profit Margin: 9.07%

- Operating Profit Margin: 8.95% [0]

- 2025 first three quarters revenue reached 12.066 billion CNY, up 72.22% YoY

- Net profit 1.038 billion CNY, but down 29.51% YoY

- Net cash flow was negative 1.06 billion CNY[1]

The company faces an obvious dilemma of “revenue growth without profit growth”, mainly due to:

- Overseas market expansion leading to a significant increase in marketing expenses

- Continuous increase in R&D investment, especially in the embodied intelligence field

- Rising costs of global channel construction and localized operations

Roborock has received the “Overseas Issuance and Listing Filing Notice” from the China Securities Regulatory Commission (CSRC), officially launching its H-share IPO plan [1]. According to public information, the company intends to issue no more than

- Current net cash flow is negative 1.06 billion CNY

- H-share financing will inject key funds into embodied intelligence R&D and global channel expansion

- Alleviate financial pressure from “revenue growth without profit growth” [1]

- Overseas revenue accounted for over 60%

- Products entered more than 170 countries and regions

- Served over 20 million household users

- Global market share reached 21.7%, ranking first in the industry [1]

- Reduce reliance on a single market

- Attract international institutional investors

- Enhance global brand awareness

- Expected A-H Share Premium Rate: 30-50%: Referencing the average level of Sci-Tech Innovation Board tech stocks

- The H-share issue price may be discounted by 20-40%compared to A-shares to attract international investors

- A-shares may face 5-10%short-term adjustment pressure

- H-shares may experience significant volatility on the first day of listing

- A-H share price difference creates room for arbitrage transactions

- Capital flow between the two markets may exacerbate A-share volatility

- As H-share liquidity improves, the A-H price difference gradually converges

- Expected premium rate to converge from the initial 40% to 20-30%

- A-share valuation gradually returns to a rational level

- From the perspective of international investors, the company’s valuation will be benchmarked against global peers

- Valuation levels of international comparable companies such as iRobot and SharkNinja become references

- Expected P/E ratio to adjust from the current 26x to the 20-24xrange

- The company will reposition from a “Chinese tech stock” to a “global leader in smart cleaning devices”

- Valuation logic will shift from Sci-Tech Innovation Board premium to global pricing

- In the long term, increased international capital recognition may support valuation

- After dual listing, liquidity improves significantly

- Expected A-share average daily trading volume to increase by 20-40%

- Improved liquidity may bring a valuation premium of 5-10%

- A-share trading hours: 9:30-15:00 (Beijing Time)

- H-share trading hours: 9:30-16:00 (Beijing Time)

- Investors in different time zones can trade separately, enhancing overall liquidity

- A-share Market: Mainly domestic individual investors and domestic institutional investors

- H-share Market: Attracts international institutional investors, hedge funds, and long-term value investors

- Expected overseas institutional investor share to increase from the current 5%to20-30%

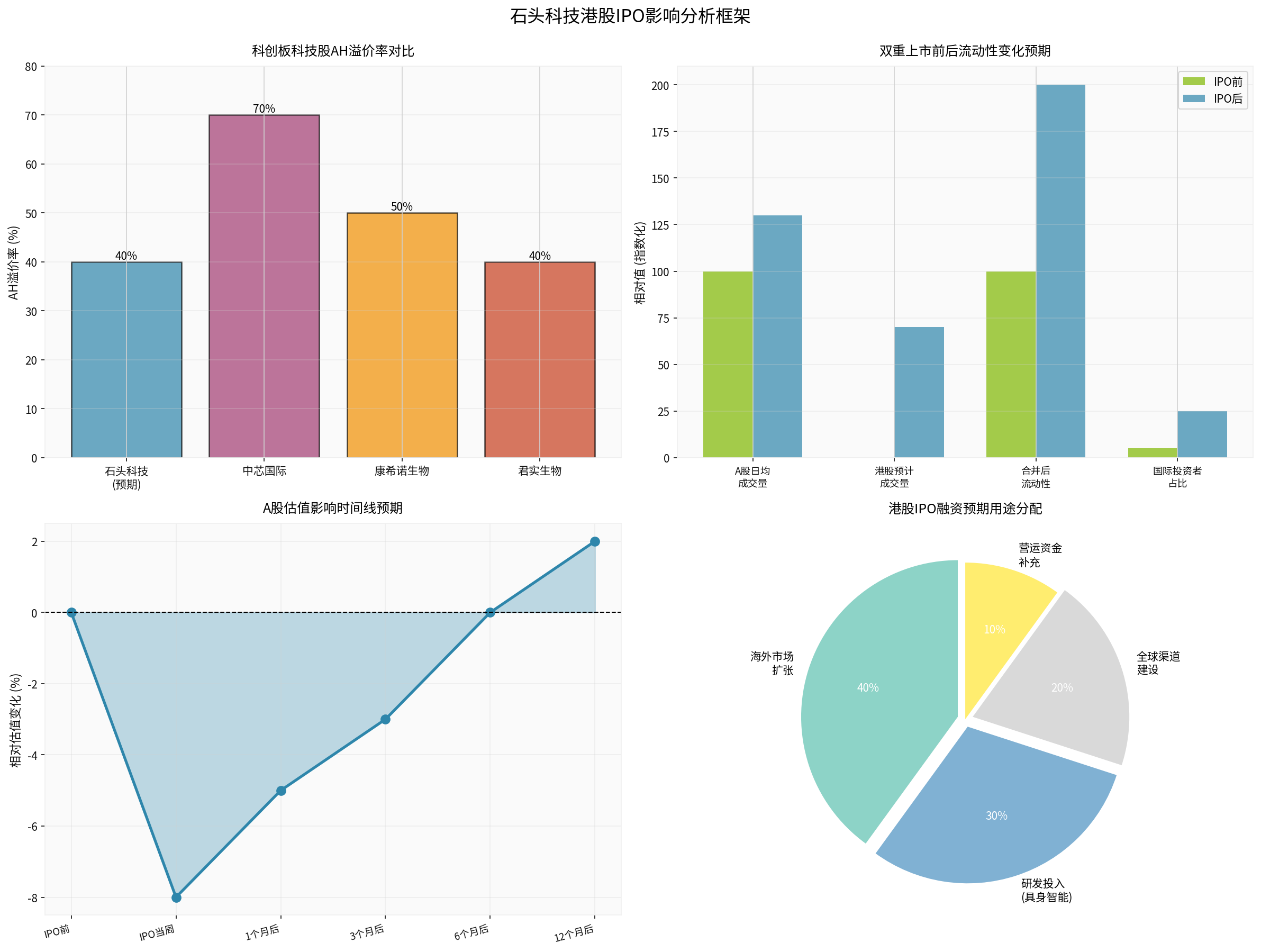

- Top Left: Comparison of A-H premium rates for Sci-Tech Innovation Board tech stocks; Roborock’s expected premium rate is about 40%, which is at the mid-level of the industry

- Top Right: Expected liquidity changes before and after dual listing; combined liquidity is expected to increase by 100%

- Bottom Left: Timeline of impact on A-share valuation; gradual recovery after short-term pressure

- Bottom Right: Allocation of H-share IPO proceeds; 40% for overseas market expansion, 30% for R&D investment

- A-share average daily trading volume: from current 3.88 million shares to 4.7-5.4 million shares

- Expected H-share average daily trading volume: 2.7-4.6 million shares(based on issuance size)

- Combined liquidity: expected to increase by 100-150%

- Bid-ask spread narrowing: expected from current 0.5-1.0%to0.3-0.5%

Referencing Sci-Tech Innovation Board tech companies that have achieved A+H dual listing:

| Company Name | A-share Code | H-share Code | A-H Premium Rate | Liquidity Change |

|---|---|---|---|---|

| SMIC | 688981.SH | 0981.HK | 60-80% | H-share average daily trading volume accounts for ~30-40% |

| CanSino Biologics | 688185.SH | 06185.HK | 40-60% | H-share average daily trading volume accounts for ~25-35% |

| Junshi Biosciences | 688180.SH | 1877.HK | 30-50% | H-share average daily trading volume accounts for ~20-30% |

As an intelligent hardware enterprise, Roborock’s expected A-H premium rate is about

Roborock already has a strong international foundation:

- Overseas revenue accounts for over 60%

- Global market share of 21.7%, with3.788 million unitsshipped (2025 first three quarters)

- Products entered 170+ countries and regions[1]

- H-shares are an important channel for international investors to allocate Chinese assets

- Mainland investors can also participate via Stock Connect southbound funds

- European and American institutional investors are more familiar with H-share market systems and rules

- Expected to be included in the Hang Seng Composite Index and Hang Seng Tech Index

- May enter the Chinese component stocks of international indices such as MSCI and FTSE Russell

- Passive capital inflow is expected to be 200-300 million USD

- International investment banks and research institutions will start coverage

- Expected to add 10-15overseas institutional analysts

- Research reports will expand from Chinese to English, covering global investors

- Board Independence

- Transparency of Information Disclosure

- ESG (Environmental, Social, Governance) Performance

- Overseas Market Expansion Strategy

- R&D Investment and Output Efficiency

- Commercialization Progress of New Businesses such as Embodied Intelligence

- Valuation Comparison with International Peers like iRobot and SharkNinja

- Growth Potential and Risk Matching Degree

- Shareholder Return Policy

- A-H share arbitrage transactions may lead to short-term price volatility

- H-shares may experience large gains or losses on the first day

- Capital flow between the two markets may exacerbate A-share volatility

- A-share Sci-Tech Innovation Board premium may partially disappear

- Valuation logic moves closer to international peers, P/E may be adjusted downward

- 2025 first three quarters revenue grew by 72.22%, but net profit declined by29.51%

- Need to improve profitability through economies of scale and operational efficiency

- New businesses like embodied intelligence have long investment cycles and are difficult to contribute profits in the short term

- Global robot vacuum market is highly competitive

- International brands like iRobot and SharkNinja are strong

- Domestic competitors (Ecovacs, Dreame, etc.) are also actively expanding overseas

- Overseas market expansion faces geopolitical uncertainties

- Risks such as trade frictions and technology blockades

- Regulatory policy differences across markets

- Embodied intelligence track is highly competitive

- Uncertainty in technology route selection

- R&D investment-output ratio remains to be verified

- Pay attention to H-share issue pricing; if the discount is too large, A-shares may come under pressure

- Short-term volatility intensifies; it is recommended to wait and see or reduce positions moderately at high prices

- Pay attention to A-H share arbitrage opportunities (need to consider transaction costs and exchange rate risks)

- Large volatility on the first day of listing; it is recommended to observe before making decisions

- Pay attention to the buying interest of international institutional investors

- Long-term investors may consider building positions in batches at reasonable prices

- Continuous growth of the global smart cleaning device market: Benefiting from aging population, consumption upgrade, and AI technology development

- Roborock’s global competitiveness: A21.7%market share proves its product strength and brand power

- Potential of embodied intelligence business: If successfully commercialized, it will open up new growth space

- Liquidity improvement from dual listing: Reduce transaction costs and enhance shareholder returns

- Short-term (3-6 months): P/E may pull back from current 26xto22-24x

- Mid-term (6-12 months): If “revenue growth without profit growth” improves, P/E can stabilize at 24-26x

- Long-term (1-3 years): If embodied intelligence business is successfully implemented, P/E can rebound to 26-30x

- Matching degree between revenue growth rate and profit growth rate

- Whether operating cash flow turns positive

- Improvement in profitability of overseas markets

- Changes in global market share

- Commercialization progress of embodied intelligence business

- Market acceptance of new products (e.g., G30 robot)

- Changes in A-H share premium rate

- Shareholding ratio of international institutional investors

- Changes in analyst coverage and target prices

Roborock’s H-share IPO is an important milestone in the company’s internationalization strategy, and will have

- Short-term (1-3 months): A-shares may face 5-10%adjustment pressure

- Mid-term (3-12 months): A-H share premium converges, A-share valuation tends to stabilize, with an expected P/E of 22-24x

- Long-term (1-3 years): Increased internationalization, improved liquidity and international capital recognition may support valuation rebound to 26-30x

- Combined liquidity is expected to increase by 100-150%

- A-share average daily trading volume is expected to increase by 20-40%

- Bid-ask spread narrows, reducing transaction costs

- Expected overseas institutional investor share to increase from 5%to20-30%

- Expected to be included in international indices, bringing passive capital inflows

- Increased analyst coverage, improved information dissemination efficiency

- Supports overseas market expansion (already accounting for over 60%of revenue)

- Provides capital support for new businesses like embodied intelligence

- Enhances global brand awareness and influence

Roborock’s H-share IPO is a strategic move with

For investors, it is necessary to

[0] Jinling API Data - Roborock (688169.SS) Company Overview, Financial Data, Stock Price Data

[1] Yahoo Finance - “Market Cap 39.3 Billion CNY! Roborock Wins Overseas Benchmark Honor, H-share IPO Starts New Global Journey”

https://hk.finance.yahoo.com/news/市值393億人民幣-石頭科技斬獲出海標竿榮譽-港股ipo開啟-全球化新旅程-055006257.html

[2] Investopedia - “Understanding Dual Listing: Benefits, Challenges, and How It…”

https://www.investopedia.com/terms/d/duallisting.asp

[3] CICC Report - “A-share to H-share Listing Wave: Nearly 50 A-shares Plan to Go to Hong Kong Next”

https://hk.finance.yahoo.com/news/大行-中金-a股往h股上市掀起浪潮-後續近50家a股擬赴港-料潛在流動性需求最高千八億-082756949.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.