Analysis of 2026 MarketWatch Report on Trump Doctrine's Geopolitical and Market Dividends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

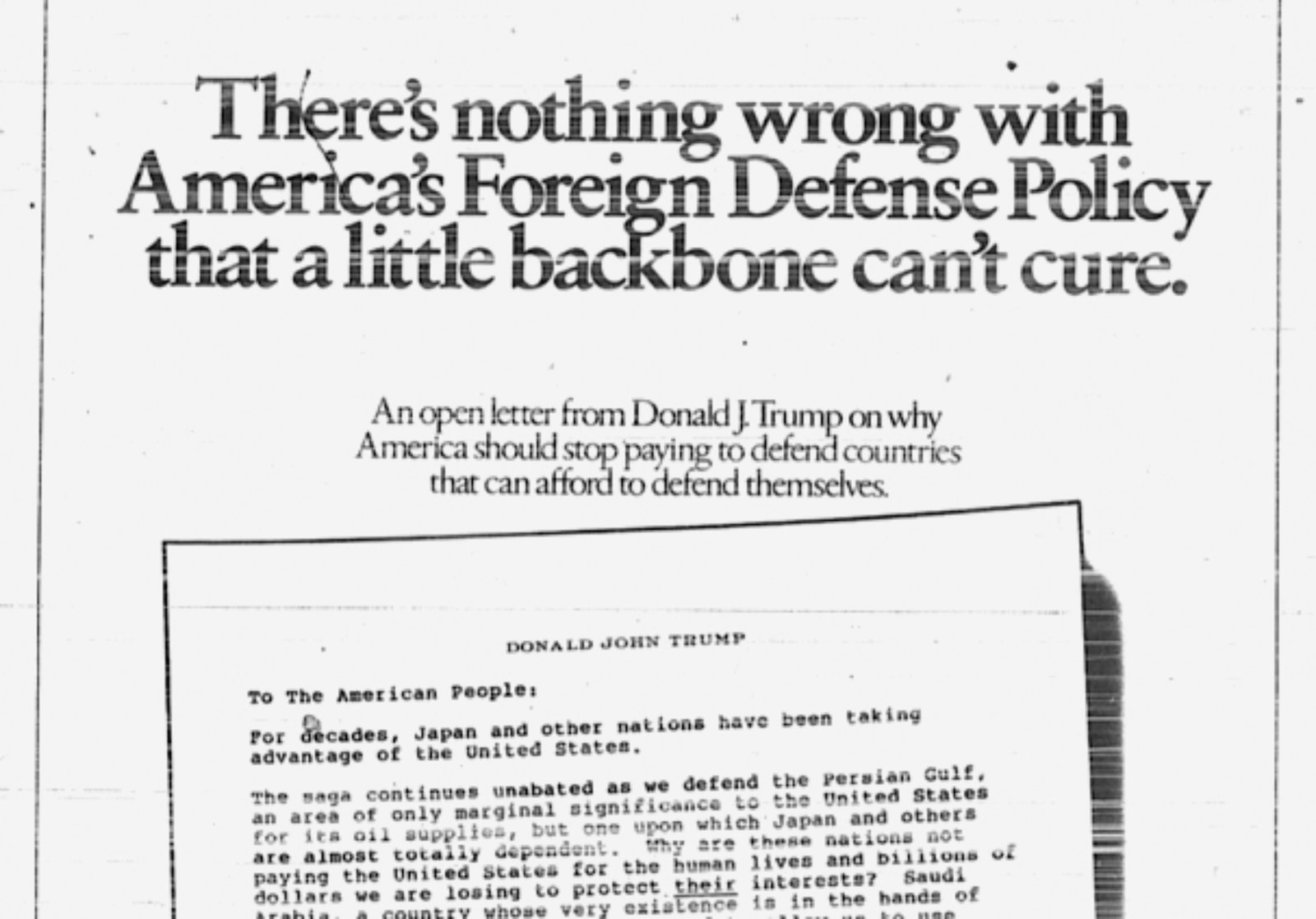

The event centers on the publication of a MarketWatch article [1] (distributed via Morningstar) on January 5, 2026, timed two days after the U.S. secured access to Venezuela’s 303 billion barrels of oil reserves [1]—17% of global proven reserves, optimized for U.S. refineries. The article frames the Trump doctrine as an evolution of a 1987 full-page ad in major U.S. newspapers, where Trump demanded Japan and Saudi Arabia pay for U.S. military protection [1]. This evolved into the 2025 White House National Security Strategy’s core principle: “The United States will insist on being treated fairly by other countries” [1]. Cited achievements include: crippled Iran’s nuclear program, China’s concessions on rare earths (strategic for tech/defense), soybeans (major U.S. export), and fentanyl (opioid crisis driver), as well as European rearmament (notably NATO members increasing defense spending) [2]. The doctrine’s transactional nature, emphasizing leverage over traditional statecraft, is credited for these fast results [2].

- Temporal Consistency: The doctrine’s core demand (transactional fairness) has remained unchanged from 1987 to 2026, showing long-term strategic continuity [1].

- Cross-Market Linkages: Venezuela’s oil access (energy) [1], China’s soybean concessions (agriculture) [2], and European rearmament (defense) [2] create interconnected market impacts, highlighting how geopolitical doctrine directly shapes economic sectors.

- Trigger Event Alignment: The article’s publication is clearly linked to the January 3 Venezuela oil access announcement, framing it as a high-profile example of the doctrine’s success [1].

- Opportunities:

- Energy Markets: Stabilized global oil prices and reduced U.S. Middle East oil reliance [1].

- Agricultural Markets: Increased soybean export volumes and prices benefiting U.S. farmers [2].

- Defense Sector: Higher U.S. defense exports to rearming European countries [2].

- Risks:

- Alliance Durability: The doctrine’s transactional approach raises questions about long-term alignment with Saudi Arabia and Japan, with uncertainty about post-administration renegotiations [2].

- Information Gaps: Missing details on mechanisms for achievements (e.g., Iran’s nuclear program) [2], U.S. concessions to Venezuela [1], and counterarguments (e.g., erosion of U.S. soft power) [2].

- Author Credibility: Limited publicly available information on article author Charlie Garcia’s expertise or biases [1].

The report covers a January 5, 2026, MarketWatch article [1] advocating for the Trump doctrine’s success, with ties to a recent Venezuela oil access agreement. MarketWatch is owned by Dow Jones & Company (News Corp), distributed via Morningstar [1]. The analysis identifies gaps in the article’s evidence [0], including unspecified policy mechanisms and lack of counterperspectives, while noting clear market and geopolitical implications linked to the doctrine’s transactional diplomacy.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.