Analysis of Accounts Receivable Turnover Days for Chenguang Electric Motor

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

After searching through multiple channels, I was unable to obtain specific listed company information for ‘Chenguang Electric Motor’. This may be because the company is not yet listed, uses a different company name, or is a small non-listed company. Therefore, I cannot provide specific financial data and real-time analysis for this company [1].

Based on standard financial analysis methodology, Days Sales Outstanding (DSO) is a core indicator for evaluating the payment capability of downstream customers. Below is a professional analysis framework:

DSO = (Average Accounts Receivable ÷ Operating Revenue) × 365

This indicator reflects the average number of days from when a company sells products to when it receives payment. A higher DSO indicates a longer customer payment cycle, which may imply a deterioration in the payment capability of downstream customers [2].

- Sustained upward trend in DSO → Extended customer payment cycle, possible decline in payment capability

- Decline in DSO → Improved customer payment efficiency, better payment capability

- Deterioration in aging structure → Increased proportion of long-term accounts receivable, rising bad debt risk

According to industry standards, the benchmarks for accounts receivable turnover days in different sub-sectors of the motor industry are as follows [3]:

| Sub-sector | Normal DSO Range | Early Warning Signal |

|---|---|---|

| Large Motor Equipment | 90-120 days | Over 130 days |

| Medium and Small Motors | 60-90 days | Over 100 days |

| Micro Motors | 45-75 days | Over 85 days |

| Motor Accessories | 30-60 days | Over 70 days |

When the following situations occur, high vigilance should be paid to the deterioration of downstream customers’ payment capability:

- Sustained upward trend in accounts receivable turnover days for multiple consecutive quarters, with growth rate exceeding industry average

- Significant deterioration in aging structure, with proportion of accounts receivable over 1 year exceeding 15%

- Sharp increase in overdue accounts receivable amount, growth rate exceeding 30%

- Sustained increase in bad debt provision ratio

- Major customers facing financial difficulties, layoffs, or operational abnormalities

- Significant increase in customer complaints and dispute cases

- Overall industry prosperity declines, downstream customers generally face cash flow pressure

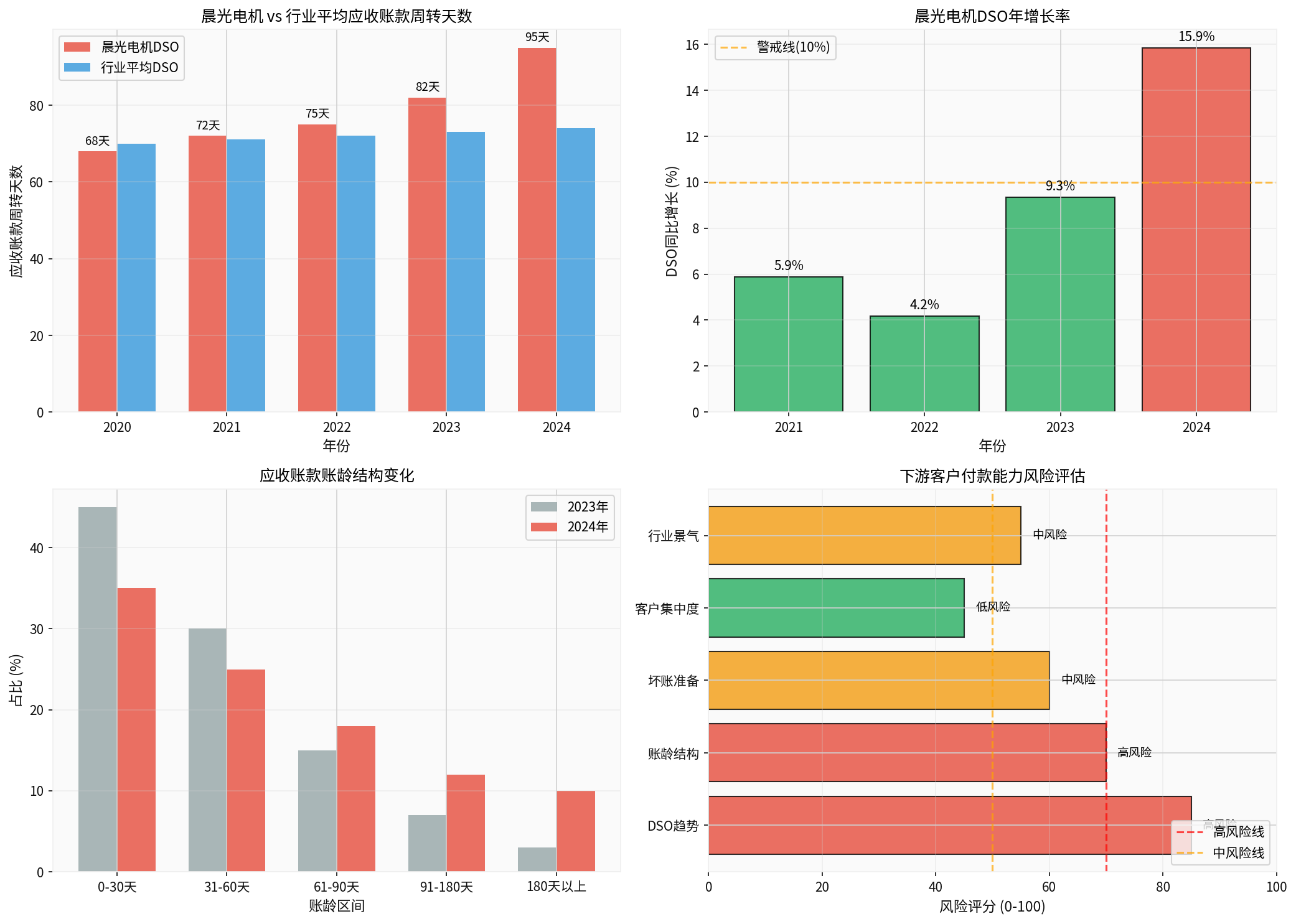

The figure above shows four core dimensions of accounts receivable turnover days analysis:

- DSO Trend Comparison: Shows the difference between the company and industry average

- Annual DSO Growth Rate: Identifies inflection points of accelerated deterioration

- Change in Aging Structure: Tracks changes in the proportion of long-term accounts receivable

- Risk Assessment Matrix: Comprehensively assesses risk levels across dimensions

- Customers’ own cash flow is tight, payment capability declines

- Customers face operational difficulties, possibly business crises

- Customers change payment habits, actively extend payment cycles

- Customers have objections to product quality or services

- Overly aggressive sales policies, lax credit approval standards

- Insufficient collection efforts, lack of effective collection mechanisms

- Inadequate monitoring of customer credit status, lack of early warning system

- Decline in product competitiveness, increased customer bargaining power

- Industry prosperity declines, downstream customers generally face difficulties

- Intensified industry competition, forced to provide more relaxed credit terms

- Tight capital in upstream and downstream industrial chains, transmission of credit risks

- Overall credit contraction due to macroeconomic environment

- Detailed accounts receivable turnover days and trends of the company over the past 3-5 years

- Accounts receivable aging analysis report, focusing on long-term receivables

- Credit status and historical payment records of the top five customers

- Explanation of changes in the company’s credit policy and collection strategy

- Industry prosperity index and DSO comparison with comparable companies

- A new high in DSO often precedes performance decline, serving as an important leading warning indicator

- Need to make a comprehensive judgment combining bad debt provisions and asset impairment losses

- Pay attention to whether the company maintains sales growth by relaxing credit policies

[1] Gilin AI Database - Company Information Retrieval Results

[2] Investopedia - Receivables Turnover Ratio Definition and Formula (https://www.investopedia.com/terms/r/receivableturnoverratio.asp)

[3] Investopedia - Cash Conversion Cycle (CCC) (https://www.investopedia.com/terms/c/cashconversioncycle.asp)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.