Comparative Analysis of Jacobio's JAB-23E73 and Revolution Medicines' Pan-KRAS Inhibitors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest public data and market information, I conducted a comprehensive comparative analysis of the pan-KRAS inhibitors from the two companies [0][1][2].

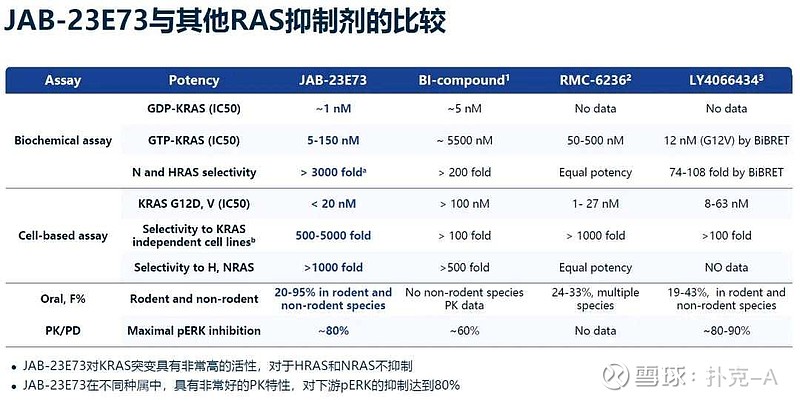

JAB-23E73 is a highly potent pan-KRAS (ON/OFF) inhibitor, distinguished by its ability to simultaneously inhibit GDP-bound KRAS (OFF state) and GTP-bound KRAS (ON state) [2]. This dual-state inhibition mechanism endows it with broad-spectrum anti-tumor activity, showing strong inhibitory effects against various KRAS mutants, including common mutation types such as G12D, V, A, R, G13D, and Q61H [3].

JAB-23E73 exhibits excellent selectivity over HRAS and NRAS, with a selectivity ratio exceeding 1000-fold [3]. This feature is crucial because inhibition of HRAS and NRAS may lead to severe off-target toxicity, while high selectivity ensures a wider therapeutic window and better safety.

The drug is currently in Phase I/II clinical trials (NCT06973564), with dose escalation ongoing simultaneously in China and the US [0]. According to Jacobio’s 2025 interim results announcement, multiple partial responses (PR) have been observed so far, with favorable safety profiles—low incidence of skin toxicity (rash ~10%, all Grade 1), and no Grade 3 or higher liver toxicity reported to date [1].

Daraxonrasib is an oral RAS (ON) multi-selective inhibitor that suppresses RAS signaling by blocking the interaction between RAS (ON) and its downstream effectors [4]. It primarily targets KRAS G12X, G13X, and Q61X mutations, which are common drivers of major cancers such as pancreatic ductal adenocarcinoma (PDAC), non-small cell lung cancer (NSCLC), and colorectal cancer.

Daraxonrasib is currently in Phase III clinical development, with four global Phase III clinical trials initiated, including three for PDAC and one for locally advanced or metastatic RAS-mutated NSCLC [4]. In June 2025, the drug received FDA Breakthrough Therapy Designation for the treatment of previously treated metastatic PDAC patients with KRAS G12 mutations [4].

Based on data公布 in September 2025, among 28 evaluable patients in the RASolute 303 trial, daraxonrasib monotherapy achieved a 47% objective response rate (ORR) and an 89% disease control rate (DCR) [5]. The median follow-up time was 9.3 months, and most patients remained on treatment, indicating a trend of sustained benefit.

At the recommended Phase II dose (RP2D) of 300 mg once daily in second-line treatment, the median progression-free survival (PFS) for patients with KRAS G12X mutations was 8.5 months (95% CI: 5.9-NE), with an overall response rate of 36%; for RAS-mutated patients, the median PFS was 8.5 months and ORR was 27% [5].

When daraxonrasib was combined with gemcitabine + nab-paclitaxel (GnP), the ORR for first-line PDAC patients reached 55% and DCR was 90%, showing potential for synergistic effects [6]. However, the incidence of Grade 3 or higher treatment-related adverse events (TRAEs) was 58%, higher than the 35% in monotherapy, indicating that combination therapy has better efficacy but also increased toxicity.

According to preclinical data presented at the 2025 AACR-NCI-EORTC International Conference, JAB-23E73 showed significant anti-tumor activity in various KRAS-driven tumor models, capable of inducing tumor regression [2]. In KRAS-driven mouse tumor models, JAB-23E73 induced tumor regression without causing significant weight loss, indicating excellent tolerance and a wide therapeutic window.

JAB-23E73 exhibits favorable pharmacokinetic properties, suitable for oral administration. Plasma drug concentrations showed a dose-dependent relationship with intratumoral p-ERK inhibition, with a maximum p-ERK inhibition rate of approximately 80%, comparable to daraxonrasib [3].

JAB-23E73 can simultaneously inhibit both RAS (ON) and RAS (OFF) states. This unique mechanism may lead to stronger anti-tumor effects and more durable responses [2]. Since KRAS dynamically switches between GDP and GTP states, single-state inhibition may face drug resistance issues, while dual-state inhibition can block the RAS signaling pathway more comprehensively.

Over 1000-fold selectivity over HRAS and NRAS significantly reduces the risk of off-target toxicity, which is an important safety advantage [3]. In clinical development, this high selectivity may translate into better tolerance and higher maximum tolerated doses.

Inducing tumor regression in various KRAS-mutated tumor models without affecting weight shows strong preclinical efficacy and favorable safety profiles [2].

Existing clinical data shows a rash incidence of only 10%, all Grade 1, with no Grade 3 or higher liver toxicity. This safety profile is superior to many similar drugs [1].

Currently only in Phase I/II clinical trials, there is still a long way to go before marketing approval. In contrast, daraxonrasib has entered Phase III clinical development and received FDA Breakthrough Therapy Designation [4].

Currently available clinical data are mainly preclinical data and early dose escalation safety data, lacking large-scale clinical efficacy data support.

The KRAS inhibitor market is highly competitive. Amgen’s sotorasib and BMS’s adagrasib have been approved for KRAS G12C-mutated NSCLC, and Jacobio’s Glecirasib (JAB-21822) was also approved in China in May 2025 [1]. Jacobio needs to accelerate clinical development progress to seize market opportunities.

It has entered four Phase III clinical trials, with the most extensive Phase III clinical development program for pan-KRAS inhibitors [4]. On December 18, 2025, the first patient was randomized in the RASolute 302 Phase III clinical trial [5].

It has shown excellent efficacy in first-line and second-line PDAC treatment, with a first-line ORR of 47% and second-line PFS of 8.5 months [5]. These data provide a solid foundation for subsequent approval.

Receiving FDA Breakthrough Therapy Designation can accelerate drug development and obtain closer regulatory guidance [4]. This is crucial for gaining a first-mover advantage in the highly competitive KRAS inhibitor market.

In addition to monotherapy, it is also exploring combination with standard chemotherapy regimens (GnP), with a 55% ORR showing good synergistic potential [6].

As an RAS (ON) inhibitor, its selectivity over HRAS and NRAS may not be as good as JAB-23E73, which may limit its therapeutic window or lead to more off-target toxicity.

Although overall tolerance is good (35% incidence of Grade 3 or higher TRAEs), rash and gastrointestinal events are the most common treatment-related adverse events [5]. Toxicity increased significantly in combination therapy (58% Grade 3 or higher TRAEs), which may limit its application in some patients.

Although daraxonrasib covers KRAS G12X, G13X, and Q61X mutations, it may not cover all mutation types covered by JAB-23E73 (such as G13D, Q61H, etc.).

According to DelveInsight’s analysis, the KRAS inhibitor market is expected to grow significantly from 2020 to 2034, mainly driven by the increase in KRAS-mutated cancer incidence, improved treatment awareness and accessibility, and strong pipeline activities [7]. The pancreatic cancer market is also expanding continuously, and new treatment methods are expected to reshape the treatment landscape [8].

- Adopts a diversified KRAS inhibitor strategy, developing both KRAS G12C inhibitor (Glecirasib, already approved in China) and pan-KRAS inhibitor (JAB-23E73) [1]

- The successful commercialization of Glecirasib provides financial support for subsequent R&D

- Reduces R&D investment pressure through collaboration with partners

- Strengthened pipeline strength and balance sheet through the acquisition of EQRx [9]

- Focuses on in-depth development of RAS (ON) multi-selective inhibitors

- Establishes a leading position in the field of pancreatic cancer, which has high unmet medical needs

Based on the above analysis, the pan-KRAS inhibitors of the two companies have their own advantages and disadvantages:

From an investment perspective, Revolution Medicines has a clearer short-term commercial prospect due to its clinical progress advantages and leading position in pancreatic cancer; while Jacobio provides an opportunity to participate in the long-term growth of pan-KRAS inhibitors through JAB-23E73, especially considering that its KRAS G12C inhibitor Glecirasib has been approved in China, reducing the risk of single pipeline failure.

[0] Yahoo Finance - Jacobio Pharma Announces 2025 Interim Results (https://finance.yahoo.com/news/jacobio-pharma-announces-2025-interim-162500712.html)

[1] PR Newswire - Jacobio Pharma Announces 2025 Interim Results (https://www.prnewswire.com/news-releases/jacobio-pharma-announces-2025-interim-results-302542189.html)

[2] PR Newswire - Jacobio Presents Pre-Clinical Data of Pan-KRAS Inhibitor JAB-23E73 (https://www.prnewswire.com/news-releases/jacobio-presents-pre-clinical-data-of-pan-kras-inhibitor-jab-23e73-at-aacr-nci-eortc-international-conference-302592811.html)

[3] Jacobio Pharma Pipeline & Corporate Presentation (https://www.jacobiopharma.com/en/pipeline)

[4] Globe Newswire - Revolution Medicines Announces FDA Breakthrough Therapy Designation (https://ir.revmed.com/news-releases/news-release-details/revolution-medicines-announces-fda-breakthrough-therapy)

[5] OncoDaily - RASolute 303 Trial Evaluates Daraxonrasib in First-Line Metastatic PDAC (https://oncodaily.com/oncolibrary/rasolute-303-daraxonrasib-in-1l-mts-pdac)

[6] Oncology Pipeline - Revolution could have a first-line pancreatic balancing act (https://www.oncologypipeline.com/apexonco/revolution-could-have-first-line-pancreatic-balancing-act)

[7] Yahoo Finance - KRAS Inhibitors Market: New Treatments Are Set to Change Cancer Care (https://finance.yahoo.com/news/kras-inhibitors-market-treatments-set-170000691.html)

[8] Yahoo Finance - Pancreatic Cancer Market Set to Expand (https://finance.yahoo.com/news/pancreatic-cancer-market-set-expand-223100240.html)

[9] Yahoo Finance - Revolution Medicines Completes Acquisition of EQRx (https://finance.yahoo.com/news/revolution-medicines-completes-acquisition-eqrx-141000106.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.