Analysis of Reasons for Gross Margin Decline and Improvement Measures for Tianyue Advanced's Silicon Carbide Substrate Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

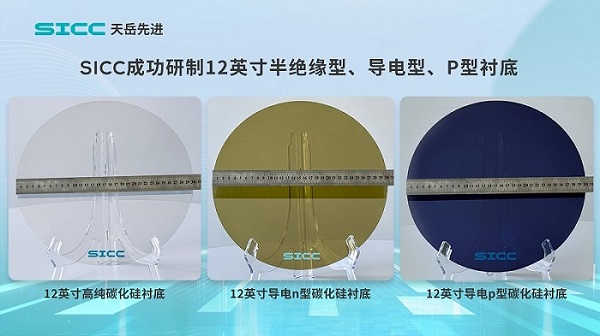

Tianyue Advanced (stock code: 688234.SS), known as China’s ‘first stock of silicon carbide substrates’, occupies an important position in the global silicon carbide substrate market. According to Frost & Sullivan data, Tianyue Advanced held a 22.8% global market share in silicon carbide substrates in 2024, ranking second globally, just behind the US-based Wolfspeed (23.5% market share) [1]. The company has formed commercialization capabilities for silicon carbide substrates from 2-inch to 8-inch, and in November 2024, it launched the world’s first 12-inch N-type silicon carbide substrate, becoming the first enterprise globally to achieve mass production of 12-inch silicon carbide substrates [1].

From the secondary market performance, Tianyue Advanced’s stock price has risen by 78.85% in the past year and 59.94% in the past six months, reflecting the capital market’s recognition of its long-term development prospects [0]. However, the company faces significant pressure on profitability: the latest financial report shows its operating profit margin is -2.06% and net profit margin is only 2.32% [0].

Tianyue Advanced’s silicon carbide substrate business has experienced a significant gross margin decline cycle. From its peak, the gross margin dropped sharply from 32.93% in Q3 2024 to 12.64% in Q2 2025, a decrease of more than 20 percentage points [1]. This change directly impacted the company’s profitability: although it turned profitable in 2024 with a net profit of 179 million yuan, its net profit in Q3 2025 was only 1.1199 million yuan, a year-on-year decline of 99.22% [1].

In terms of product prices, the average selling price of Tianyue Advanced’s silicon carbide substrates has continued to decline: 5,110.4 yuan per piece in 2022, 4,798.0 yuan in 2023, and further down to 4,080.1 yuan in 2024 [2]. In contrast, sales volume increased from 63,800 pieces in 2022 to 361,200 pieces in 2024, showing a ‘volume-for-price’ business strategy [2].

The primary reason for Tianyue Advanced’s gross margin decline is its proactive pricing strategy to expand market share. The company clearly stated that the decline in revenue and profit is mainly due to active price cuts for silicon carbide substrates to expand market share [1]. This strategy led to a more than 18% drop in the average product price from 2022 to the first three quarters of 2024, while the median industry price fell by 31.5% over the same period [1].

From the market competition pattern, the silicon carbide substrate industry is facing fierce ‘price wars’. With the gradual release of global silicon carbide substrate production capacity, the supply-demand relationship has changed, and downward price pressure continues to increase. Tianyue Advanced chose to quickly seize market share through price advantages during the industry reshuffle period; although it sacrificed short-term gross margin, it helps build long-term competitive barriers.

On the cost side, Tianyue Advanced faces enormous pressure from continuously rising raw material prices. Key raw materials such as graphite parts and graphite felt, which account for more than 85% of procurement costs, increased by 78% and 87.2% respectively from 2020 to 2024 [1]. More seriously, industry forecasts indicate these raw materials are expected to rise by another 21% and 41.1% by 2030 [1].

The reasons for rising raw material costs are multifaceted: first, silicon carbide substrate production relies heavily on high-purity graphite materials, which are scarce resources; second, the rapid development of the new energy industry has led to a significant increase in graphite demand; third, domestic graphite processing capacity is relatively concentrated, giving upstream suppliers strong bargaining power. This ‘price drop + cost rise’ double squeeze directly compresses the company’s gross profit margin.

Tianyue Advanced’s R&D expenses have maintained rapid growth, putting pressure on short-term profitability. In the first three quarters of 2025, the company’s R&D investment reached 123 million yuan, a year-on-year increase of 29.75%, and the R&D expense ratio rose to 11.09% [1]. Although continuous R&D investment is crucial for maintaining technological leadership, it does directly affect gross margin in the short term.

In terms of R&D direction, the company is focusing on the development of large-size substrate products, process optimization for mass production of 12-inch substrates, and cutting-edge fields such as new crystal growth technologies. These R&D activities require substantial capital investment and a long industrialization cycle, making it difficult to contribute significant returns in the short term.

Tianyue Advanced’s capital recovery efficiency has declined significantly: the accounts receivable turnover days rose from less than 15 days in 2018 to 117.82 days in Q2 2025, a record high [1]. This indicator reflects weakened payment capabilities of downstream customers and highlights the transmission effect of the silicon carbide industry chain. Tianyue Advanced’s downstream customers are mainly epitaxial wafer or device manufacturers, where competition is more intense than in the substrate industry; increased operating pressure on customers directly affects the company’s cash flow [1].

The decline in accounts receivable turnover efficiency not only increases the company’s capital costs but may also lead to increased bad debt provisions, further eroding profits.

To address rising raw material costs, Tianyue Advanced should accelerate the domestic substitution of key raw materials. Currently, the company relies heavily on imports for raw materials such as graphite parts and graphite felt, with limited domestic procurement channels. By establishing strategic cooperation with domestic graphite processing enterprises or achieving vertical integration of the industrial chain through investment and shareholding, it can effectively reduce raw material procurement costs and improve supply chain stability.

In addition, the company should continue to optimize production processes, improve material utilization, reduce unit product energy consumption, and explore cost reduction potential from the production process level.

Large-size silicon carbide substrates are the mainstream trend in the industry; products of 8-inch and above can significantly reduce unit costs. Tianyue Advanced has taken the lead in achieving mass production of 12-inch silicon carbide substrates and should accelerate the industrialization progress of large-size products to increase their share in revenue. Through economies of scale, it can reduce the cost per piece and offset the gross profit loss caused by price declines.

From the technical route perspective, the company should continue to maintain R&D investment in core technical fields such as crystal growth and substrate processing to ensure intergenerational technological leadership. In August 2025, the company successfully listed on the Hong Kong Stock Exchange, raising HK$2.04 billion, which provides sufficient funds for technical R&D and capacity expansion [1].

Beyond the traditional automotive power semiconductor field, Tianyue Advanced should actively expand into emerging application fields such as AI data centers, photovoltaic energy storage, and household appliances. The company expects that from 2024 to 2030, the xEV field will continue to lead the growth of the global silicon carbide power semiconductor device market, while emerging fields such as data centers, household appliances, and low-altitude flight will show the fastest growth rates [2].

The rapid development of the AI market brings new growth opportunities for silicon carbide power devices. Data centers have a rapidly growing demand for electricity; traditional silicon-based power supply systems have an efficiency of about 85% to 88%, with 12% to 15% of electrical energy wasted as heat, while silicon carbide power devices can significantly improve energy efficiency [2]. The company should seize this market opportunity and strengthen cooperation with data center operators and server manufacturers.

In terms of customer structure, Tianyue Advanced should continue to deepen cooperation with international leading customers such as Bosch and Infineon, with hand orders exceeding 2 billion yuan [1]. By binding high-quality customer resources, it can improve order stability and reduce customer concentration risks. At the same time, it should strengthen customer credit management, shorten accounts receivable turnover days, and improve cash flow conditions.

In terms of capacity utilization, the company should fully leverage its current advantage of around 90% capacity utilization (slightly reduced to 79.8% in Q1 2025 due to capacity ramping of 12-inch products) and further dilute fixed costs through capacity expansion [1].

Despite short-term pressure from gross margin decline, the industry Tianyue Advanced is in still has broad development prospects. The global silicon carbide market is in a period of rapid growth; demand for silicon carbide power devices continues to increase in fields such as electric vehicles, photovoltaic power generation, rail transit, and smart grids. In 2024, the company’s overseas revenue reached 840 million yuan, a year-on-year increase of 104.43%, accounting for 47.53% of total revenue [1], reflecting strong demand in the international market.

Notably, in June 2025, Wolfspeed, the global leader in silicon carbide substrates, filed for bankruptcy with debts of up to $6.5 billion [1]. Wolfspeed’s core problem lies in a serious mismatch between production capacity and market demand; its newly built 200mm wafer fab has a capacity utilization rate of only 20% [1]. In contrast, Tianyue Advanced maintains a high capacity utilization rate and has formed stable supply-demand relationships with domestic electric vehicle enterprises such as BYD, Li Auto, and NIO. Wolfspeed’s bankruptcy may bring global market opportunities for Tianyue Advanced.

The gross margin decline of Tianyue Advanced’s silicon carbide substrate business is the result of multiple factors, including active price reduction to seize market share, continuous rise in raw material costs, increased R&D investment, and decreased accounts receivable turnover efficiency. To address these challenges, the company should take measures from multiple dimensions such as cost control, technological innovation, market expansion, and operational optimization to balance short-term profit pressure and long-term development strategy.

From a long-term perspective, Tianyue Advanced’s technological leadership and scale advantages in the global silicon carbide substrate market remain solid. With the gradual optimization of the industry pattern and the improvement of its own cost control capabilities, the gross margin is expected to stabilize and recover. The company should fully utilize the financing advantages of the A+H dual platform, continue to increase R&D investment, accelerate the industrialization of large-size products, actively expand into emerging application fields, and seize the historic opportunity brought by the rapid development of the silicon carbide industry.

[0] Jinling API Data - Tianyue Advanced Company Overview and Financial Indicators

[1] Financial Account - “Important Shareholders of Tianyue Advanced’s Industry Insider Securities Reduce Holdings, Can AI New Scenarios Break the Deadlock?” (http://mp.cnfol.com/52698/article/1767574952-142196736.html)

[2] 21st Century Business Herald - “‘First Stock of Silicon Carbide Substrates’ Tianyue Advanced Lands in Hong Kong Stock Exchange, Plans to Expand Large-Size Substrate Capacity” (https://www.21jingji.com/article/20250820/herald/0ff3d5bbaa7d0ff2c21bd217ebeb96ce.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.