Analysis of Jacobio Pharma's Pan-KRAS Inhibitor R&D Progress and Valuation Differences vs. Peer Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

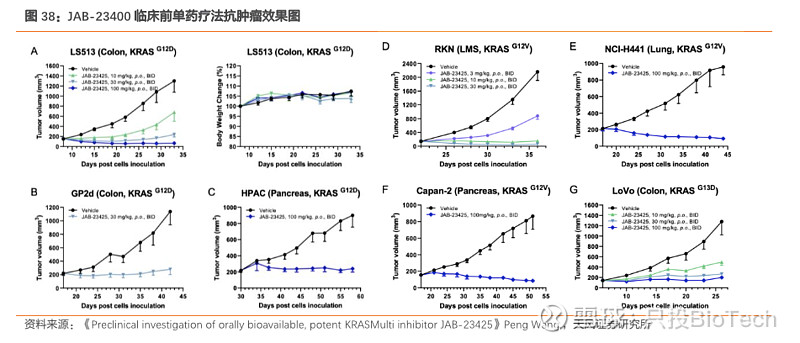

Jacobio Pharma’s pan-KRAS inhibitor

- Clinical progress: Phase I clinical trials ongoing simultaneously in China and the US

- Latest data: As of the end of 2025,early anti-tumor activity signalshave been observed [1]

- Global ranking: Rankssecond globallyin R&D progress among pan-KRAS inhibitors [1]

- Technical advantages: Adoptssmall molecule inhibitordevelopment route, which haslower riskcompared to macromolecular drugs [1]

Revolution Medicines is a

| Comparison Dimension | Jacobio (JAB-23E73) | Revolution Medicines (RMC-6236) |

|---|---|---|

| R&D Phase | Phase I Clinical | More Advanced Clinical Progress |

| Global Ranking | 2nd | 1st |

| Clinical Layout | China-US Simultaneous | Global Multi-center |

| Activity Signal | Early Anti-tumor Activity | More Mature Clinical Data |

The KRAS inhibitor market is in a period of rapid growth:

- 2023 Market Size: Approximately USD 500 million

- 2034 Projected Size: Will reach USD 7.847 billion

- Compound Annual Growth Rate (CAGR): Approximately 35% [4]

| Company | Market Capitalization Level | Valuation Multiple Difference |

|---|---|---|

| Revolution Medicines | Exceeds RMB 100 billion [1] |

Benchmark |

| Jacobio (1167.HK) | Less than HKD 10 billion [1] |

Over 10x |

- R&D progress gap: Revolution Medicines’ RMC-6236 has more mature clinical data and an earlier R&D phase

- Market awareness: As the world’s first pan-KRAS company to enter Phase III, Revolution Medicines enjoys a higher market premium

- Clinical data maturity: Revolution Medicines has released more complete clinical efficacy data, while Jacobio has only observed early activity signals so far

- Liquidity premium: The liquidity and investor structure of the US stock market give Revolution Medicines a higher valuation

Despite the valuation gap, the market believes Jacobio has the following

- Scarcity of second-place R&D progress: Only a few companies globally are engaged in pan-KRAS development

- Technical route advantage: Small molecule inhibitors have better druggability and lower development risk compared to macromolecular drugs

- KRAS G12C inhibitor Glecirasib: Approved for marketing by NMPA in May 2025, with expected peak sales exceeding RMB 1 billion [1]

- Cash flow support: The company has a stable capital balance, which can support approximately 4 years of R&D expenses in the future [3]

[1] 2025 Top 10 Innovative Drug Stocks in China Analysis - OFweek Medical Network (https://m.ofweek.com/medical/2026-01/ART-11102-8120-30678195.html)

[2] Jacobio Pharma 2024 Annual Performance Report (https://www.jacobiopharma.com/sites/default/files/pdfs/加科思2024年度业绩PPT_final_0321.pdf)

[3] Glecirasib’s Registrational Clinical Data Published in Nature Medicine - Jacobio Pharma Official Website (https://www.jacobiopharma.com/cn/news/glecirasib-data-nature-medicine)

[4] KRAS Inhibitors Market Report - DelveInsight (https://www.delveinsight.com/insights/kras-inhibitors-market-size)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.