Analysis of the Commercialization Prospects of Clover Biopharmaceuticals' RSV Vaccine Pipeline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Clover Biopharmaceuticals Limited (Hong Kong Stock Exchange: 02197) has laid out multiple candidate products in the RSV (Respiratory Syncytial Virus) vaccine field [0]:

- SCB-1019: Bivalent RSV vaccine (adjuvant-free recombinant protein vaccine) using Trimer-Tag technology platform

- SCB-1022: RSV+hMPV combination vaccine

- SCB-1033: RSV+hMPV+PIV3 triple vaccine

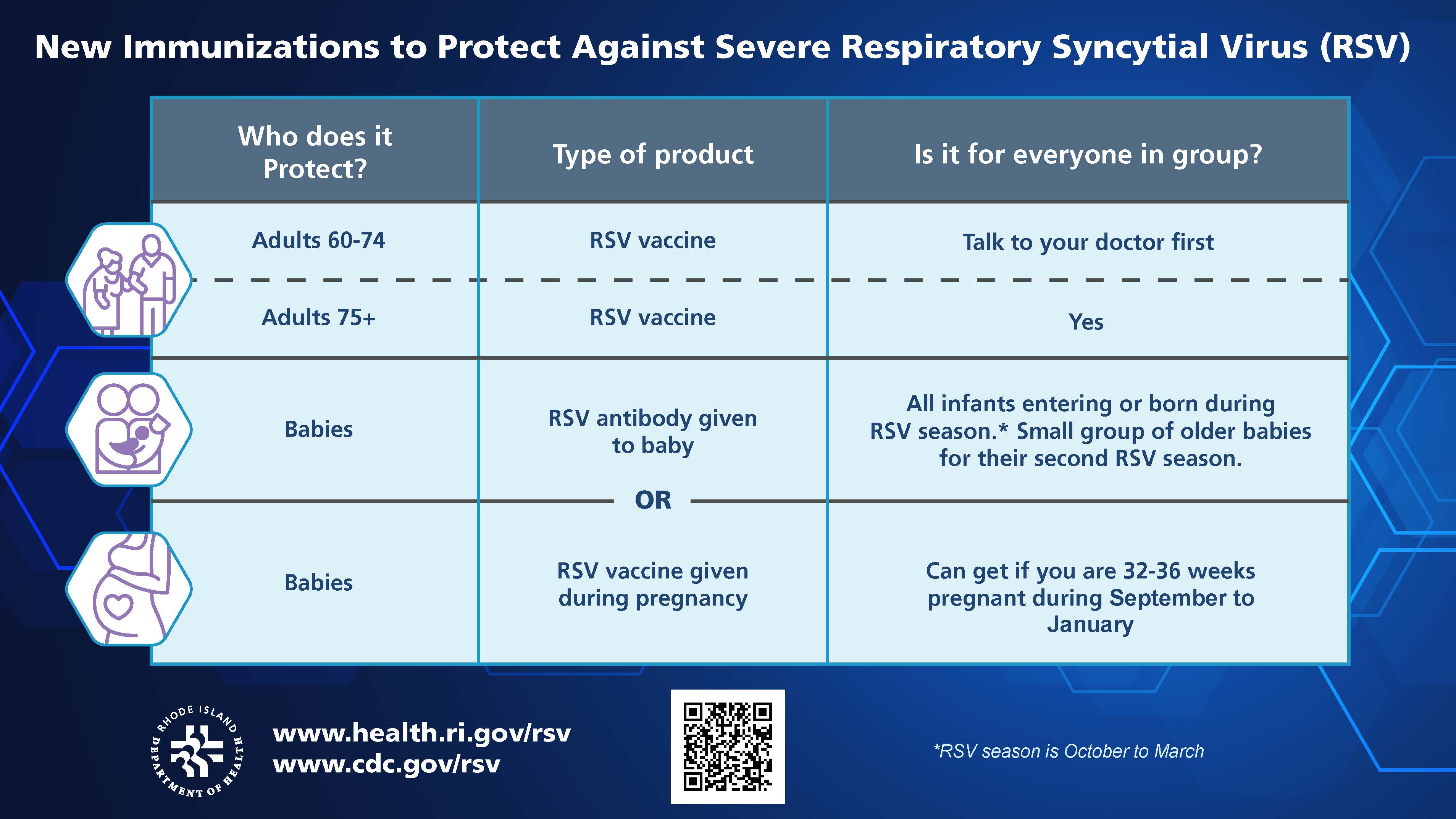

In June 2025, Clover Biopharmaceuticals initiated Phase I clinical trials for SCB-1022 and SCB-1033, with the first subjects enrolled, recruiting a total of 192 elderly subjects (60-85 years old) [1].

In October 2024, the company announced Phase I clinical trial results of SCB-1019 in 70 elderly subjects [1]:

- Head-to-head comparison with GSK’s Arexvy

- Data shows SCB-1019 has “best-in-class” comprehensive immunogenicity and tolerability data

- Adjuvant-free design is a differentiation advantage

- GSK’s Arexvy: Approved in 2023, with a 65% market share in 2025, and has expanded to the 50-59 age group [2]

- Pfizer’s Abrysvo: Approved simultaneously

- Moderna’s mResvia: mRNA vaccine

In January 2025, the FDA issued a safety warning requiring Pfizer, GSK and other approved RSV vaccines to add a risk warning for Guillain-Barré syndrome [0]. This safety issue cast a shadow over the entire track.

- Differentiated Technology Route: Adjuvant-free design may reduce side effect risks, which has competitive advantages against the background of safety concerns about GSK/Pfizer vaccines

- Combination Vaccine Strategy: RSV+hMPV±PIV3 combination vaccines target multiple respiratory diseases, which may simplify vaccination procedures

- Chinese Domestic Market: As a Chinese company, it may have geographical advantages in domestic approval and market competition

- Early R&D Stage: SCB-1019 is still in Phase I/II clinical stages, and there is still a long time before commercialization [1]

- Huge Cash Flow Pressure: The company previously encountered the GAVI (Global Alliance for Vaccines and Immunization) huge refund storm. In March 2025, GAVI unilaterally terminated the COVID-19 vaccine pre-purchase agreement and requested a refund of 224 million USD in advance payments [0]

- Tight Financial Situation: As of the 2024 annual report, the company’s cash and cash equivalents were only about 381 million RMB, far from enough to cover GAVI’s refund requirements [0]

- Fierce Market Competition: Giants like GSK and Moderna have already occupied the first-mover advantage in the market

In 2025, the company’s stock price rose by as much as 870%, but this increase is mainly due to the “extremely low starting point”—its market value was less than 300 million HKD at the beginning of 2025, which was more than 90% lower than the 15.496 billion HKD at the time of issuance [0]. The surge is more due to short-term capital speculation rather than substantial improvement in fundamentals.

- Facing GAVI arbitration lawsuit, which may result in huge compensation

- Extremely tight cash flow, continuously in a value-consuming state

- No substantial commercial value has been formed yet

The commercialization prospects of Clover Biopharmaceuticals’ RSV vaccine pipeline are

[0] 36氪 - “2025中国创新药十大牛股,真相有点意外” (https://m.36kr.com/p/3625053547693060)

[1] Pharmcube - “三叶草生物启动呼吸道合胞病毒(RSV)+ 人偏肺病毒(hMPV)± 副流感病毒3型(PIV3)联合疫苗临床试验” (https://bydrug.pharmcube.com/news/detail/ef31eec6ff8a049966e5844470ec3dc1)

[2] Porter’s Five Force - “What is Customer Demographics and Target Market of GSK” (https://portersfiveforce.com/blogs/target-market/gsk)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.