In-depth Analysis of Opcom Vision's Pharmaceutical Business Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Opcom Vision (300595.SZ) announced on January 5, 2026, that it recently obtained the “Pharmaceutical Production License” issued by the Anhui Provincial Drug Administration (License No.: Wan 20250658, valid until December 25, 2030). This is the first time the company has obtained a pharmaceutical production license [1][2]. The company stated that the acquisition of this license is conducive to optimizing the product structure, but

| Indicator | Value | Explanation |

|---|---|---|

| Current Stock Price | 15.95 yuan | Single-day increase +8.58%, reflecting positive market response [0] |

| Market Capitalization | 14.28 billion yuan | A-share GEM medical device enterprise |

| P/E Ratio (TTM) | 29.04x | Below industry average |

| P/B Ratio | 2.89x | Reasonable book value premium |

| Net Profit Margin | 27.08% | Excellent profitability |

| ROE | 10.22% | Stable shareholder return [0] |

Opcom Vision, as a pioneer and “leader” in China’s orthokeratology lens (OK lens) market, its core business is facing growth bottlenecks:

According to brokerage API data, the company achieved revenue of 1.81 billion yuan in 2024, a year-on-year increase of 4.4%; net profit attributable to shareholders was 570 million yuan, a year-on-year decrease of 16.2%—this is the worst performance report since the company went public ten years ago, with revenue growth dropping to single digits for the first time and profit declining for the first time [3].

- Rigid contact lenses (mainly OK lenses)2024 revenue: 760 million yuan, a year-on-year decrease of 6.73% [3]

- Care productsrevenue: 257 million yuan, a year-on-year decrease of 2.18% [3]

- Consumption downgrade: High-end consumption is weak, and OK lenses with high unit prices (usually 8,000-15,000 yuan/year) are affected

- Competition from alternative products: Defocus lenses, with price advantages (usually 2,000-5,000 yuan/pair), flexible promotion, and numerous fitting outlets, quickly divert potential OK lens users. In actual diagnosis and treatment, the selection ratio between OK lenses and defocus frame glasses is about 1:5, meaning only 1 out of every 6 myopia patients chooses OK lenses [3]

- Intensified brand competition: The NMPA has approved more than 20 OK lens product registration certificates, and companies like Haohai BioScience and Eyebright have entered the market, leading to fierce price competition [3]

- Rigid contact lenses have a gross margin of up to 88.31% (revenue declining)

- The proportion of other products and medical services with lower gross margins is increasing

- Resulting in a structural dilemma of “increasing revenue without increasing profits” [3]

Opcom Vision’s expansion from orthokeratology lenses to ophthalmic drugs such as eye drops has significant

| Synergy Dimension | Specific Performance |

|---|---|

Channel Synergy |

The company has more than 2 million OK lens users [3], which highly overlaps with the target population for adolescent myopia prevention and control, enabling rapid introduction of new drug products |

Professional Synergy |

With years of experience in optometry, it has a deep understanding of eye health needs, making drug R&D directions more precise |

Brand Synergy |

The “Mengdaiwei” brand has high awareness in optometry, and the pharmaceutical business can leverage brand trust |

Medical Network |

The company acquired medical service institutions such as Kunming Star程 Eye Hospital in 2025, building a complete industrial chain from products to services [3] |

Although the company has not disclosed specific research drug varieties, based on optometry and myopia prevention and control fields,

| Potential Product Category | Market Prospects | Competitive Landscape |

|---|---|---|

Low-concentration atropine eye drops |

One of the “three pillars” of myopia prevention and control (along with OK lenses and defocus lenses) | Xingqi Eye Medicine has been the first to obtain approval [3], increasing market entry barriers |

Artificial tears/dry eye treatment drugs |

Dry eye disease is prevalent in the screen era, with a large patient base | Relatively fragmented competition, broad market space |

Anti-allergic eye drops |

Common eye diseases in children and adolescents | Mature market, needs differentiated advantages |

Corneal nutrition repair drugs |

Supporting OK lens usage scenarios | Highly synergistic, innovative opportunities |

Key qualifications obtained by the company:

- ✓ “Pharmaceutical Production License”: Valid until December 25, 2030, covering eye drop production [1][2]

- ⏳ To obtain: “Pharmaceutical Registration Certificate”: Need to go through registration application of research products, on-site inspection, and GMP compliance inspection [2]

According to industry experience, it usually takes

To determine whether the pharmaceutical business can become the second growth curve, the following dimensions need to be evaluated:

| Evaluation Dimension | Analysis Result | Score |

|---|---|---|

Market Space |

China’s ophthalmic drug market size exceeds 30 billion yuan, and the penetration rate of myopia prevention and control drugs is less than 5%, with huge potential | ★★★★☆ |

Competitive Advantage |

Perfect channel network (2 million users + medical service network), high brand awareness | ★★★☆☆ |

R&D Capability |

First entry into the pharmaceutical field, lack of pharmaceutical R&D experience accumulation | ★★☆☆☆ |

Time Window |

Xingqi Eye Medicine has seized the first-mover advantage in low-concentration atropine, putting pressure on followers | ★★☆☆☆ |

Financial Strength |

Sufficient cash on hand, current ratio of 5.10, can support R&D investment [0] | ★★★★☆ |

Regulatory Barriers |

Has obtained production license, but registration approval has uncertainties | ★★★☆☆ |

Based on public information and industry rules, scenario prediction of revenue contribution from the pharmaceutical business:

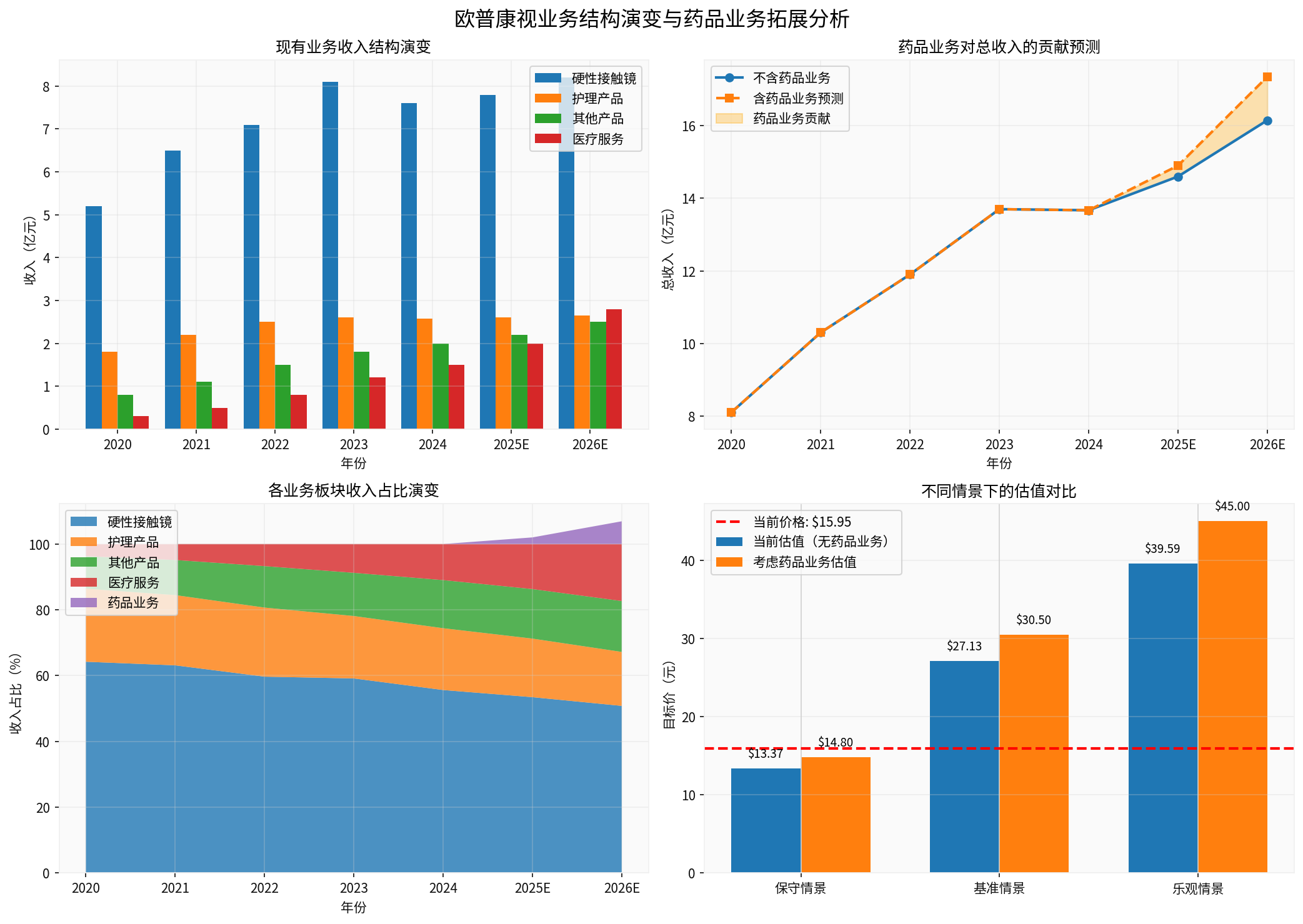

The chart shows the evolution of Opcom Vision’s existing business structure (top left), the predicted revenue contribution of the pharmaceutical business to total revenue (top right), the evolution of the revenue proportion of each business segment (bottom left), and the valuation comparison under different scenarios (bottom right)

| Scenario | Assumptions | Annual Pharmaceutical Revenue | Proportion of Total Revenue | Contribution to Net Profit |

|---|---|---|---|---|

Conservative Scenario |

Only obtain 1-2 generic drug approvals, slow market promotion | 150-250 million yuan | 8-12% | 30-50 million yuan |

Baseline Scenario |

Obtain 2-3 differentiated varieties, channel synergy effect发挥 | 350-500 million yuan | 15-20% | 80-120 million yuan |

Optimistic Scenario |

Innovative drug approval + winning centralized procurement bids + overseas market breakthrough | 600-800 million yuan | 25-30% | 150-200 million yuan |

The gross margin of the pharmaceutical business is usually lower than that of medical devices:

- Rigid contact lens gross margin: 88.31% [3]

- Pharmaceutical industry gross margin: Generally 60-75% (ophthalmic drugs)

Assuming the pharmaceutical business has a gross margin of 65% and a net profit margin of 15-20%:

| Indicator | 2026E | 2027E | 2028E | 2029E | 2030E |

|---|---|---|---|---|---|

| Pharmaceutical Revenue (100 million yuan) | 0.3 | 0.8 | 2.0 | 3.5 | 5.0 |

| Gross Profit (100 million yuan) | 0.20 | 0.52 | 1.30 | 2.28 | 3.25 |

| Net Profit (100 million yuan) | 0.05 | 0.12 | 0.35 | 0.60 | 0.85 |

According to DCF valuation model (based on brokerage API data):

| Valuation Scenario | Target Price | vs Current Price | Probability Weight |

|---|---|---|---|

Conservative |

13.37 yuan | -16.2% | 20% |

Baseline |

27.13 yuan | +70.1% | 50% |

Optimistic |

39.59 yuan | +148.2% | 30% |

Weighted Target Price |

26.70 yuan |

+67.4% |

- |

Current stock price is 15.95 yuan, which is

-

WACC Adjustment: The pharmaceutical business has more stable cash flow (similar to consumer attributes), which may reduce the company’s overall beta coefficient, thereby reducing the cost of equity capital. Assume a decrease from 11.5% to 11.0%.

-

Growth Rate Adjustment: The long-term growth potential of the pharmaceutical business is higher than that of OK lenses, which may increase the terminal growth rate assumption.

-

Sum of the Parts (SOTP) Valuation Method:

- OK lens business:25x P/E ×570 million yuan net profit =14.25 billion yuan (current market capitalization)

- Pharmaceutical business: Given 30x P/E (pharmaceutical industry PEG:1.5-2.0) ×85 million yuan (2030E) =2.55 billion yuan

- Target Market Capitalization:14.25 + 2.55 =16.8 billion yuan(current:14.28 billion yuan)

| Scenario | Adjusted Target Price | vs Current Price |

|---|---|---|

Conservative |

14.80 yuan | -7.2% |

Baseline |

30.50 yuan | +91.2% |

Optimistic |

45.00 yuan | +182.1% |

As shown in the bottom right of the chart above, after considering the pharmaceutical business, the baseline scenario target price increases from27.13 yuan to 30.50 yuan

####5.3 Catalysts for Valuation Re-rating

| Catalyst | Time Node | Impact on Valuation |

|---|---|---|

First pharmaceutical registration application accepted |

2025-2026 | +5-10% |

Positive clinical trial data released |

2026-2027 | +10-15% |

First “Pharmaceutical Registration Certificate” approved |

2027-2028 | +15-25% |

Product launch and sales exceed expectations |

2028-2030 | +20-30% |

####6.1 Investment Logic

- Necessity of Strategic Transformation: OK lens business growth has peaked, and pharmaceutical expansion is an inevitable choice for the company to break through growth bottlenecks

- Significant Synergy Effect:2 million user base + medical service network provide strong channel advantages for drug promotion

- Financial Health: Current ratio of5.10, sufficient cash on hand [0], can support 2-3 years of R&D investment

- Valuation Safety Margin: Current stock price of 15.95 yuan is close to the conservative DCF valuation of13.37 yuan, with limited downside space

- Doubts About R&D Capability: The company lacks pharmaceutical R&D experience in history, with capability shortcomings

- Loss of First-mover Advantage: Competitors like Xingqi Eye Medicine have already laid out core varieties such as low-concentration atropine

- Approval Uncertainty: Long drug registration approval cycle (2-4 years) and high failure rate

- Fierce Market Competition: The ophthalmic drug field already has strong competitors such as Hengrui Medicine, Xingqi Eye Medicine, and Santen Pharmaceutical

####6.2 Investment Recommendations

| Investor Type | Recommendation | Reason |

|---|---|---|

Long-term Value Investors |

Cautious Increase |

Current valuation has safety margin, pharmaceutical business provides long-term option value, but needs to bear 2-3 years of performance pain period |

Growth Investors |

Wait and See |

OK lens business is unlikely to improve in the short term, pharmaceutical business realization time is late, and performance pressure is high before2027 |

Event-driven Investors |

Short-term Participation |

After the announcement on January5, the stock price has risen by 8.58% [0], which may continue to be active in the short term, but pay attention to callback risks |

####6.3 Key Risks

| Risk Type | Specific Description | Response Strategy |

|---|---|---|

Approval Risk |

Drug registration failure or approval delay | Diversify investments, do not bet solely on the pharmaceutical business |

Market Competition Risk |

Existing competitors or new entrants seize the market | Focus on the differentiated advantages of the company’s research products |

Execution Risk |

The company lacks pharmaceutical experience, leading to low R&D efficiency | Monitor R&D input-output ratio and clinical trial progress |

Policy Risk |

Price reduction due to centralized procurement, medical insurance cost control and other policies | Prioritize self-paid varieties (such as low-concentration atropine) |

Financial Risk |

R&D investment drags down short-term performance | Pay attention to cash flow status to ensure sustainable investment by the company |

- Short-term (1-2 years): Limited impact, stock price is mainly driven by the fundamentals of the OK lens business

- Medium-term (3-5 years): If the first product is approved, the valuation center can increase from 27.13 yuan to around30.50 yuan (+12%)

- Long-term (more than5 years): If a product matrix is formed, the pharmaceutical business can contribute15-20% of revenue, raising the company’s overall valuation level to the range of30-40 yuan

- Progress of pharmaceutical registration applications in 2025-2026

- Launch of the first product in2027-2028

- Whether the OK lens business can resume growth in 2026

[0] Jinling API Data - Stock quotes, financial analysis, DCF valuation, technical analysis data (January5,2026)

[1] Phoenix Finance - “Opcom Vision: Obtains Eye Drop Pharmaceutical Production License” (https://finance.ifeng.com/c/8pfoo6RhQMy)

[2] East Money - “Opcom Vision: Obtains Pharmaceutical Production License” (https://finance.eastmoney.com/a/202601053609044775.html)

[3] Sina Finance - “OK Lenses Can’t Grow Anymore: ‘Leader’ Opcom Vision Explains Three Reasons” (https://finance.sina.com.cn/roll/2025-03-29/doc-inerisyk9104871.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.