Deep Analysis Report on Shaanxi International Trust A (000563)’s Participation in Chang’an Bank’s Capital Increase Transaction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on professional data obtained from Jinling AI, this report conducts a systematic analysis of this related party transaction.

- Investment Amount: No more than 800 million yuan

- Shares Obtained: No more than 209 million shares

- Subscription Price per Share: Approximately 3.83 yuan/share

- Transaction Nature: Related party transaction (due to Director Zhao Zhongqi holding positions in both companies)

- Compliance: Has avoided voting as required, no need to submit to shareholders’ meeting for review, does not constitute a major asset restructuring

| Indicator | Value | Evaluation |

|---|---|---|

| Current Stock Price | 3.50 yuan | - |

| Total Market Capitalization | 17.9 billion yuan | - |

| PE Ratio (TTM) | 12.58x | At the industry median level |

| PB Ratio (TTM) | 0.96x | Below 1x, indicating undervalued stock price |

| Return on Equity (ROE) | 7.79% | Lower than the banking industry average |

| Net Profit Margin | 40.88% | Strong profitability |

| Beta Coefficient | 0.69 | Low volatility, strong defensive nature |

- Subscription Price per Share: 3.83 yuan/share

- Estimated Shares Obtained: Up to 209 million shares

- Total Investment Amount: No more than 800 million yuan

- Typical PB Ratio for City Commercial Banks: 0.5-0.8x

- Typical PE Ratio for City Commercial Banks: 4-6x

- Typical ROE for City Commercial Banks: 10-13%

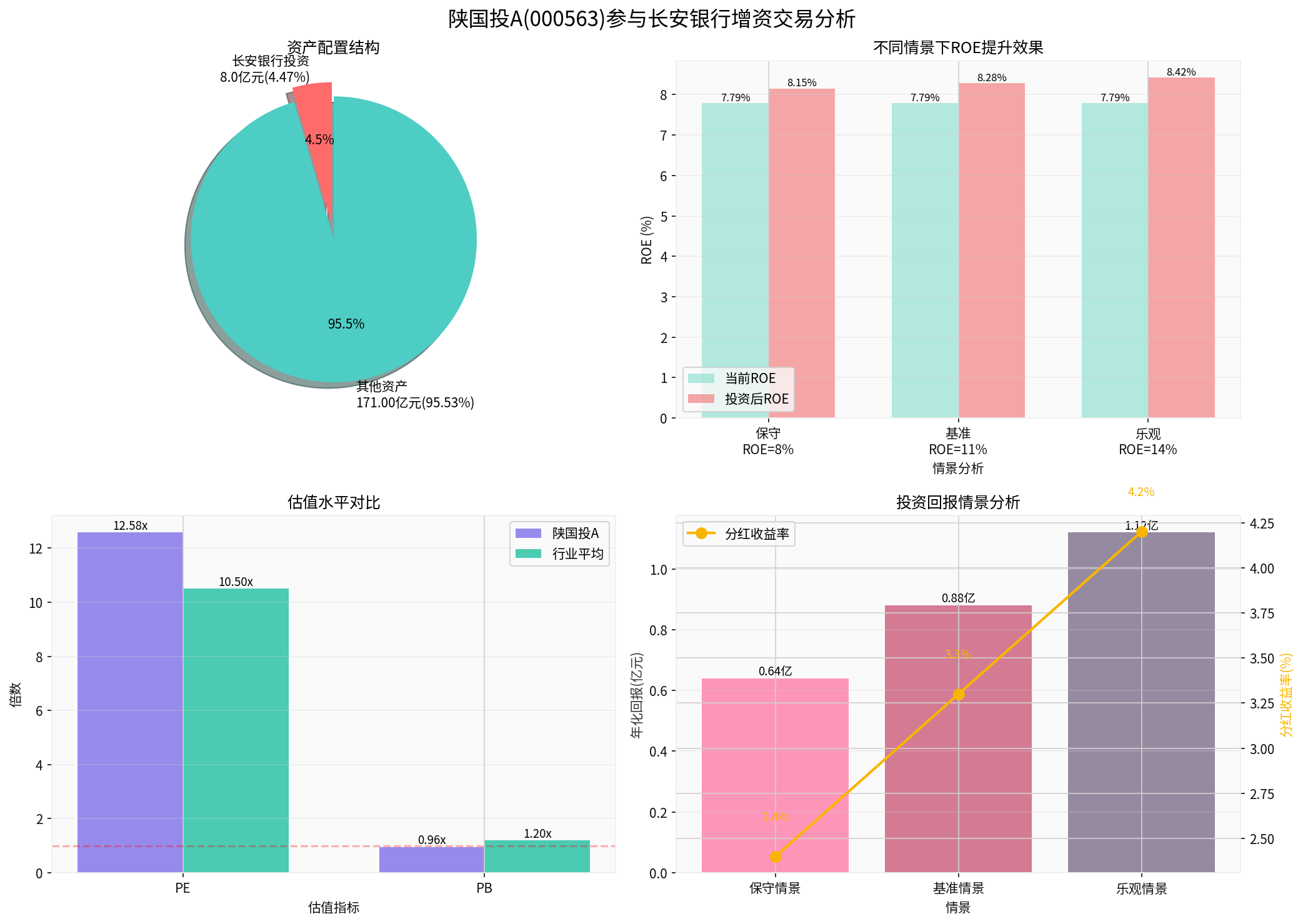

- Left Upper Chart: The 800 million yuan investment accounts for 4.47% of the company’s total assets, which will not significantly affect liquidity.

- Right Upper Chart: The impact of different ROE assumptions on the overall ROE of Shaanxi International Trust.

- Left Lower Chart: PB ratio of 0.96x is significantly lower than the industry average of 1.2x, indicating undervaluation.

- Right Lower Chart: Annualized returns and dividend yields under three scenarios.

| Scenario | Assumed ROE | Annualized Investment Return | ROE Improvement for Shaanxi International Trust | New ROE Level |

|---|---|---|---|---|

| Conservative | 8% | 64 million yuan | +0.36 percentage points | 8.15% |

| Baseline | 11% | 88 million yuan | +0.49 percentage points | 8.28% |

| Optimistic | 14% | 112 million yuan | +0.63 percentage points | 8.42% |

- Typical Dividend Payout Ratio for Bank Stocks: 30%

- Expected Annual Dividend Income: 26 million yuan

- Dividend Yield: 3.30%

- Limited Direct Impact: The 800 million yuan investment accounts for 4.47% of the market capitalization, which will not significantly change valuation multiples.

- Market Sentiment: May attract short-term attention due to related party transactions, but overall impact is neutral.

- Liquidity Impact: The 800 million yuan capital occupation has little impact on the company’s overall liquidity.

- If Chang’an Bank’s ROE >10%: Will improve the overall ROE of Shaanxi International Trust and enhance profitability.

- Synergistic Effects: Regional financial cooperation may generate additional value (fund custody, asset management, customer sharing).

- Asset Structure Optimization: Increase high-quality financial equity assets and improve asset quality.

- Current PB ratio is 0.96x; if the investment successfully drives ROE to 8.5%+

- PB ratio is expected to rise to the range of 1.0-1.1x

- Potential upside space for stock price: 4-15%

- Valuation Safety Margin: PB <1, stock price is below net asset value per share [0], providing downside protection for investment.

- ROE Improvement Potential: Current ROE of Shaanxi International Trust is 7.79%, expected ROE of Chang’an Bank is 10-14% [0], which is expected to improve overall ROE by 0.4-0.6 percentage points.

- Stable Dividend Income: Expected annual dividend yield of 3.3% (baseline scenario), providing continuous cash flow.

- Strategic Synergy Value: Regional financial resource integration and business synergy (custody, asset management, customer sharing).

- Low Volatility Characteristics: Beta coefficient of 0.69, strong defensive nature [0], suitable for stable investors.

- Industry Cycle Risk: The banking industry faces pressure from narrowing interest spreads and asset quality risks during economic downturns.

- Related Transaction Governance Risk: May trigger corporate governance concerns; need to pay attention to information disclosure transparency.

- Capital Opportunity Cost Risk: 800 million yuan used for bank equity investment may affect the main business or investment in other high-return projects.

- Regional Economic Risk: Chang’an Bank’s main business is in Shaanxi; regional economic fluctuations directly affect its performance.

- Valuation Repair Risk: If market sentiment remains depressed, PB <1 may persist for a long time.

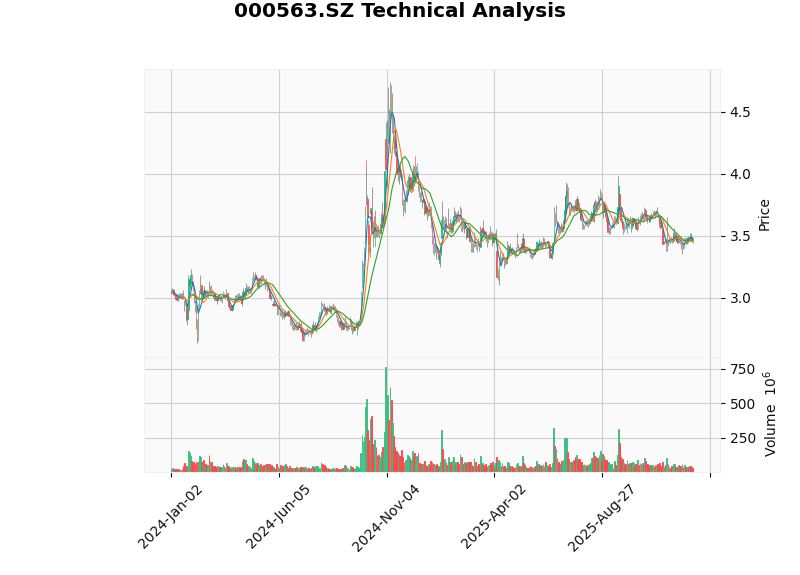

- Trend: Sideways consolidation, no clear direction.

- MACD: No crossover, slightly bullish.

- KDJ: Slightly bearish.

- RSI: Normal range.

- Support Level: 3.42 yuan.

- Resistance Level:3.48 yuan.

- Beta:0.69 (low volatility).

- Short-term: High-low trading in the range of 3.42-3.48 yuan.

- Mid-to-long-term: Pay attention to breakthrough signals and wait for a clear trend.

This transaction has a

- Limited Financial Impact: The 800 million yuan investment accounts for 4.47% of the market capitalization, which will not significantly change the company’s financial structure [0].

- Outstanding Strategic Value: Enhances regional financial layout and generates potential synergistic effects.

- Obvious Valuation Advantage: PB ratio of 0.96x indicates undervalued stock price and existence of safety margin [0].

- Improved Profitability: If Chang’an Bank’s ROE reaches 11%, it can increase Shaanxi International Trust’s ROE by about 0.5 percentage points [0].

- Stable Dividend Income: Expected annual dividend yield of 3.3% provides continuous cash flow [0].

- ✓ Stable value investors

- ✓ Long-term investors focusing on dividend income

- ✓ Investors optimistic about regional financial development

- ✗ Aggressive investors pursuing high growth

- ✗ Short-term traders

- ✗ Investors sensitive to related party transactions

-

Existing Shareholders:Continue to Hold

- Current valuation has safety margin

- Pay attention to subsequent financial disclosure of Chang’an Bank

- Hold for mid-to-long term to wait for value regression

-

Potential Investors:Build Positions in Batches

- Recommended price range:3.42-3.48 yuan

- Buy in batches to reduce average cost

- Set stop-loss level:3.35 yuan

-

Key Focus Indicators:

- Chang’an Bank’s ROE level and dividend policy

- Trend of overall ROE change of Shaanxi International Trust

- PB valuation repair situation

- Regional economic development status

- The banking industry faces pressure from narrowing interest spreads and asset quality risks.

- Related party transactions require attention to governance transparency.

- Short-term stock price may fluctuate due to market sentiment.

- Investment decisions should be made cautiously based on individual risk tolerance.

[0] Jinling AI Data - Company Overview, Financial Data, Technical Analysis, Market Data of Shaanxi International Trust A (000563.SZ)

[1] Technical Analysis Chart - K-line Chart and Technical Indicators of Shaanxi International Trust A

[2] Comprehensive Analysis Chart - Multi-dimensional Analysis of Shaanxi International Trust A’s Investment in Chang’an Bank

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.