Strategic Impact Analysis of Penghui Energy's H-share Listing: Valuation, Globalization, and Financing Capability Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current data and industry case studies, I will comprehensively analyze the far-reaching impact of Penghui Energy’s H-share issuance and listing in Hong Kong from multiple dimensions.

According to the latest data, Penghui Energy (300438.SZ) currently presents the following characteristics:

| Indicator | Value | Assessment |

|---|---|---|

| Market Capitalization | ~$27.09 billion [0] | Mid-sized lithium battery enterprise |

| Current Stock Price | $53.82 [0] | - |

| P/E Ratio (TTM) | -136.54x [0] | Profit Pressure |

| P/B Ratio (TTM) | 5.20x [0] | High Valuation |

| ROE | -3.90% [0] | Profitability Needs Improvement |

| Net Profit Margin | -2.01% [0] | In Loss Status |

- The company is currently in loss status; negative P/E indicates profit pressure

- 52-week stock price increase exceeds 100%, cumulative growth is significant, but volatility is as high as 80.64%[0]

- Current ratio is 0.99, short-term debt repayment pressure is relatively large

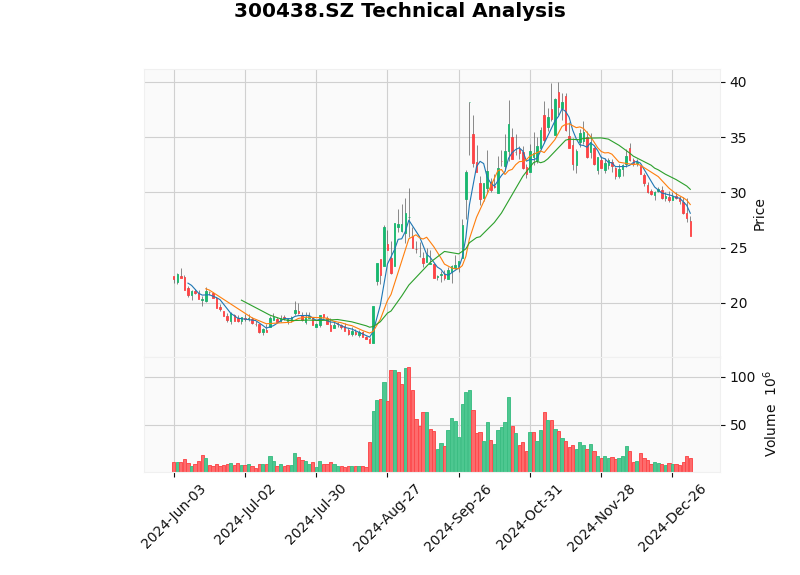

Technical analysis shows [0]:

- Trend Judgment:Sideways consolidation, no clear trend direction

- Key Support Level:$25.42 [0]

- Key Resistance Level:$30.27 [0]

- Technical Indicators:KDJ shows oversold opportunities; RSI is also in the oversold zone

Based on brokerage API data and web searches, the current AH premium index is approximately

| Company Type | AH Premium Performance | Typical Cases |

|---|---|---|

| New Energy Leaders | H-shares Premium |

CATL (H-shares premium 11-30% over A-shares) [2] |

| Lithium Battery Industry Chain | Partial Premium | BYD (H-shares premium 3.8%) [2] |

| Traditional Industries | H-shares Significant Discount | Banking, aviation, etc., discount over 30% [3] |

- CATL’s Hong Kong listing showed a rare premium phenomenon, with H-shares 11-30% more expensive than A-shares [2]

- This breaks the traditional perception that “H-shares must be discounted”

- Foreign Capital Pricing Powerhas significantly increased in the new energy sector

- Sentiment Boost:H-share listing plans are usually interpreted as positive by the market, which may drive A-share prices upward in the short term

- Valuation Reference:H-share pricing will provide an international valuation anchor for A-shares

- Liquidity Diversion:Some funds may shift to H-shares, causing short-term volatility in A-shares

| Impact Dimension | Expected Direction | Driving Factors |

|---|---|---|

| Valuation Convergence | H-shares may converge toward A-shares | If company performance improves, foreign capital recognition increases |

| Premium/Discount | Depends on Fundamentals | Similar to CATL, exceeding performance expectations may bring H-share premium |

| Pricing Power Transfer | Partial Internationalization | Increased participation of foreign institutional investors promotes alignment of valuation systems |

- If the company continues to lose money, H-shares may face significant discount

- Current P/B ratio has reached 5.20x; H-share investors may require higher risk compensation

Based on web search research [1], the core strategic motivations for lithium battery enterprises to list in Hong Kong include:

- Raised funds can be directly used for: Overseas production base construction, technical R&D center establishment, international marketing network expansion

- Case: Sunwoda clearly stated in its H-share announcement that it was to “further advance the company’s internationalization strategy and build an international capital operation platform” [1]

- Listing in Hong Kong, an international financial center, is itself a strong certification of corporate governance, transparency, and brand reputation

- Helps gain trust from international customers, partners, and investors, strengthening the position to win global orders [1]

- New energy vehicle competition is already global competition

- Chinese lithium battery enterprises are among the world’s leading in technical strength and production capacity scale

- The next key step is to deeply participate and lead the global market

| Strategic Direction | H-share Listing Support | Specific Manifestations |

|---|---|---|

| Overseas Production Capacity Layout | Provide international financing channels | Funding support for building factories in Europe, America, Southeast Asia |

| Internationalization of R&D | Attract international talents and technical cooperation | Establish overseas R&D centers |

| Customer Structure Optimization | Enhance international brand recognition | Enter the supply chain of international automobile enterprises |

Based on web search research [1,3], the Hong Kong stock market has the following advantages over A-shares:

- Systems like lightning placementprovide fast financing channels

- Suitable for continuous and convenient capital replenishment of lithium battery enterprises in the rapid expansion stage

- Respond to huge investment needs for technological iteration and production capacity construction

- Attract global long-term funds, sovereign funds, and professional investment institutions

- Diversified shareholder structure improves stock liquidity

- Helps stabilize company market capitalization and reduce single-market volatility risks

| Financing Dimension | A-share Current Status | Post H-share Listing Expectations |

|---|---|---|

| Investor Base | Mainly mainland investors | Participation of global institutional investors |

| Financing Tools | Private placement, rights issue, etc. | More refinancing tools |

| Capital Cost | Depends on A-share market sentiment | May obtain lower-cost international capital |

| Financing Efficiency | Approval cycle is relatively long | Hong Kong stock refinancing mechanism is more flexible |

- 2025 Hong Kong IPO raised approximately HK$41 billion[2]

- Book cash exceeds RMB 300 billion, still chose to list in Hong Kong [2]

- Raised over RMB 100 billionthrough equity financing since listing [2]

- Regulatory Endorsement:Accept strict supervision from the Hong Kong Securities and Futures Commission and HKEX

- Information Disclosure:Conduct financial disclosure and corporate governance in accordance with international standards

- Investor Relations:Establish long-term relationships with top global institutional investors

Based on web search cases [1], the governance issues of Ganfeng Lithium show:

- Compliant operation becomes a lifeline; illegal acts like insider trading may lead to a significant downgrade of ESG ratings

- International capital has stricter requirements for ESG frameworks

- A+H dual-listed enterprises will directly undergo review by internationally accepted ESG frameworks

- H-share listing will force the company to accelerate alignment with international standards in environmental protection, social responsibility, and corporate governance

- This improvement in “soft power” is crucial for deep integration into the global system

| Risk Category | Specific Performance | Impact Level |

|---|---|---|

| Valuation Risk | H-shares may be issued at a discount, dragging down A-share valuation | High |

| Liquidity Risk | Hong Kong stock liquidity may be lower than A-shares | Medium |

| Regulatory Risk | Need to meet both mainland and Hong Kong regulatory requirements | Medium |

| Exchange Rate Risk | Fluctuations in HKD and RMB exchange rates | Medium |

| Fundamental Risk | Current loss status affects H-share subscription willingness | High |

- Improve Fundamentals:Increase R&D investment, enhance product competitiveness, and turn losses into profits as soon as possible

- Reasonable Pricing:H-share issue price needs to balance financing needs and investor acceptance

- Investor Communication:Strengthen communication with international investors

- Performance Delivery:Use sustained growth performance to prove the correctness of H-share investment

- Globalization Implementation:Truly use raised funds for overseas layout, not domestic expansion

- Corporate Governance Improvement:Fully align with international standards and improve ESG ratings

| Impact Dimension | Rating | Key Reasons |

|---|---|---|

| A-share Valuation | ⚠️ Neutral to Positive | Short-term volatility risk, long-term expected improvement |

| Globalization Strategy | ✅ Positive |

Establish international capital platform to support overseas layout |

| Financing Capability | ✅ Significantly Positive |

Hong Kong stock financing mechanism is flexible, capital cost may be lower |

| Brand Influence | ✅ Positive |

International certification effect, enhance global recognition |

-

Fundamental Improvement is Fundamental

- Current P/E is negative; must turn losses into profits as soon as possible

- Raise ROE and net profit margin to reasonable industry levels

-

Globalization Strategy Must Be Substantially Advanced

- Raised funds must be truly used for overseas layout

- Cannot just be a “financing supplement for the A-share market”

-

Corporate Governance Must Meet International Standards

- Avoid compliance issues similar to Ganfeng Lithium [1]

- ESG ratings need to be continuously improved

- Short-term:Pay attention to H-share issuance progress and pricing; there may be trading opportunities

- Long-term:Focus on observing company performance improvement and globalization progress

- Risk:Current valuation is high (P/B 5.20x); need to be alert to correction risks

- Pay attention to the company’s path and timeline to turn losses into profits

- Evaluate the specific use and return rate of raised funds

- Consider the margin of safety under the current AH premium level

[0] 金灵API数据 - 鹏辉能源(300438.SZ)公司概况、实时报价、财务分析、技术分析

[1] 低碳网 - “锂电企业’A+H’ 布局升温赴港上市助全球化扩张” (http://www.ditan.com/industry/energy/9675.html)

[2] 21财经 - “宁德时代港股较A股溢价30%!港股估值逻辑生变” (https://www.21jingji.com/article/20250709/herald/4d9c63f6ab1b168669721e2284b3a71b.html)

[3] 新浪财经 - “港股的战略地位与价值” (https://finance.sina.com.cn/roll/2026-01-05/doc-inhfezix2294109.shtml)

[4] 证券时报 - “手握3000亿现金,年躺赚40亿利息,宁德时代赴港上市!” (https://stcn.com/article/detail/1837928.html)

[5] 网通社 - “港股成新战场?锂电巨头为何集体’南下’” (https://www.news18a.com/news/storys_219713.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.