In-depth Analysis of Mobix Labs' Strategic Layout in Defense Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Mobix Labs (MOBX) has recently demonstrated clear strategic intent to transform into the defense sector through the appointment of a General Manager for Defense Business, plans to expand military-recognized facilities, and the initiation of an acquisition of Peraso [1]. However, despite certain progress in improving gross margin and narrowing operating losses [0], its

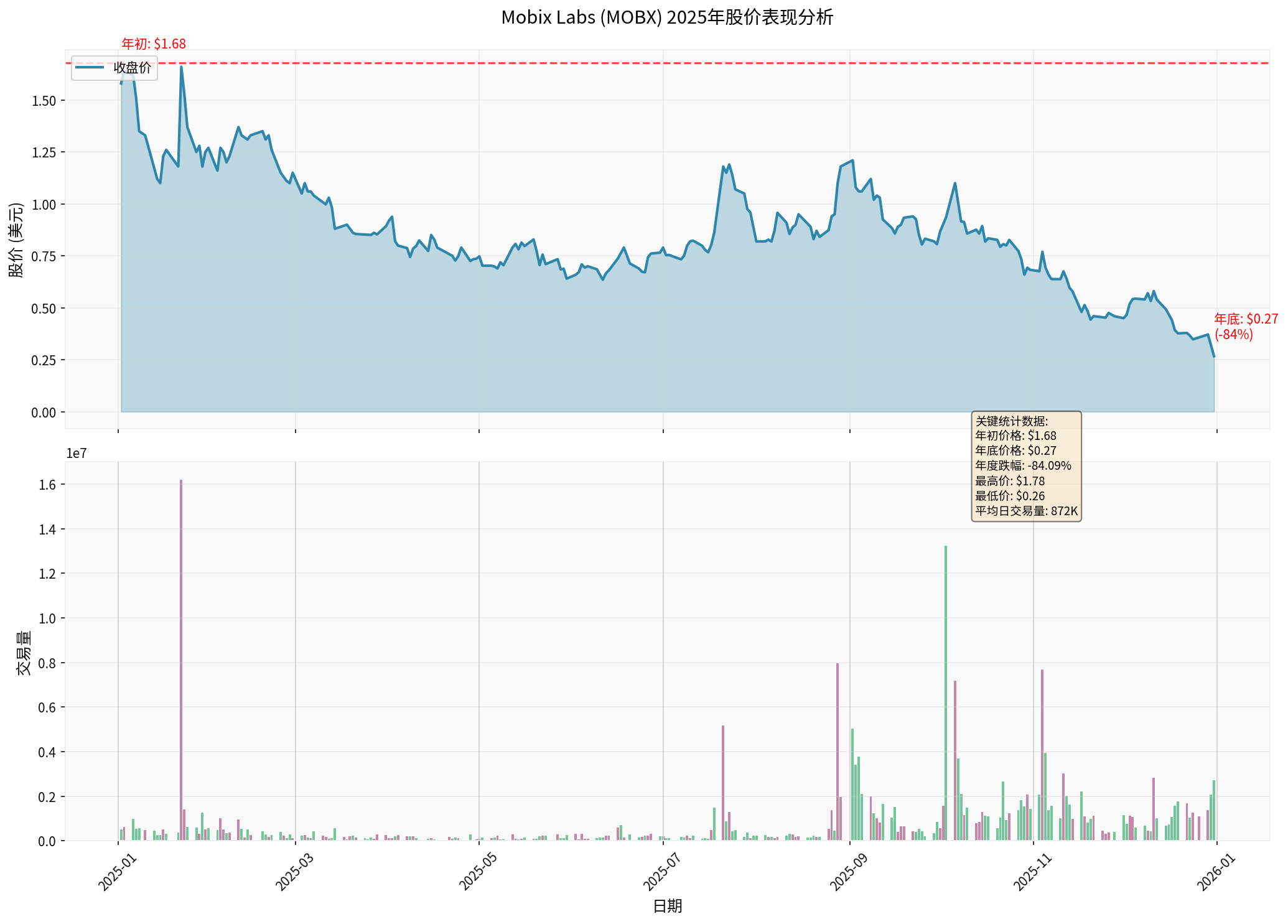

Figure 1: MOBX 2025 Stock Price Trend and Trading Volume Analysis, showing an annual decline of 84.09% [0]

Mobix Labs has recently taken a series of key initiatives to transform into the defense sector:

- Appointment of Defense Business General Manager: The company has newly appointed an executive with rich experience in the defense and aerospace markets to specifically oversee defense business expansion [1]

- Facility Expansion Plan: Plans to relocate to a larger military-recognized facility, integrate West Coast operations, simplify production processes, and improve operational efficiency to meet the growing needs of defense and aerospace customers [1]

- Business Focus Shift: From previous civilian communication technologies to military communication and the application of 5G millimeter-wave RF technology in the defense sector

- Acquisition of military-recognized facilities will enable the company to undertake more sensitive defense contracts

- Improve production efficiency and reduce operating costs through specialized facility integration

- Leverage the application potential of RF and millimeter-wave technologies in military communication

Mobix Labs has made an all-cash offer of $1.30 per share for Peraso Inc. (PRSO), representing a 53% premium over Peraso’s 20-day volume-weighted average price [2]. This acquisition has significant strategic implications:

- Technical Capabilities: Millimeter-wave integrated circuits and antenna module technologies [2]

- Application Areas: Military communication, 60GHz fixed wireless access, 5G multi-gigabit connectivity

- Market Position: Technical advantages in point-to-point wireless links within a 25-kilometer range

- Technical Synergy: Complement Mobix Labs’ technical capabilities in millimeter-wave RF

- Market Expansion: Expand coverage in the military communication market through Peraso’s product portfolio

- Scale Effect: Possess a more complete product line and larger customer base after the merger

- The acquisition requires regulatory approval and Peraso board consent, with uncertainties

- All-cash acquisition will consume the company’s valuable cash resources

- Post-acquisition integration risks, including cultural fusion and operational integration

The company plans to relocate to a large military-recognized facility, which has multiple implications:

- Integrate West Coast operations into a single location to reduce the complexity of multi-site operations

- Optimize production processes and improve manufacturing efficiency

- Reduce leasing and operating costs

- Military-recognized facilities are a necessary condition for undertaking sensitive defense contracts

- Meet strict safety and compliance requirements for defense contractors

- Enhance the company’s credibility among defense customers

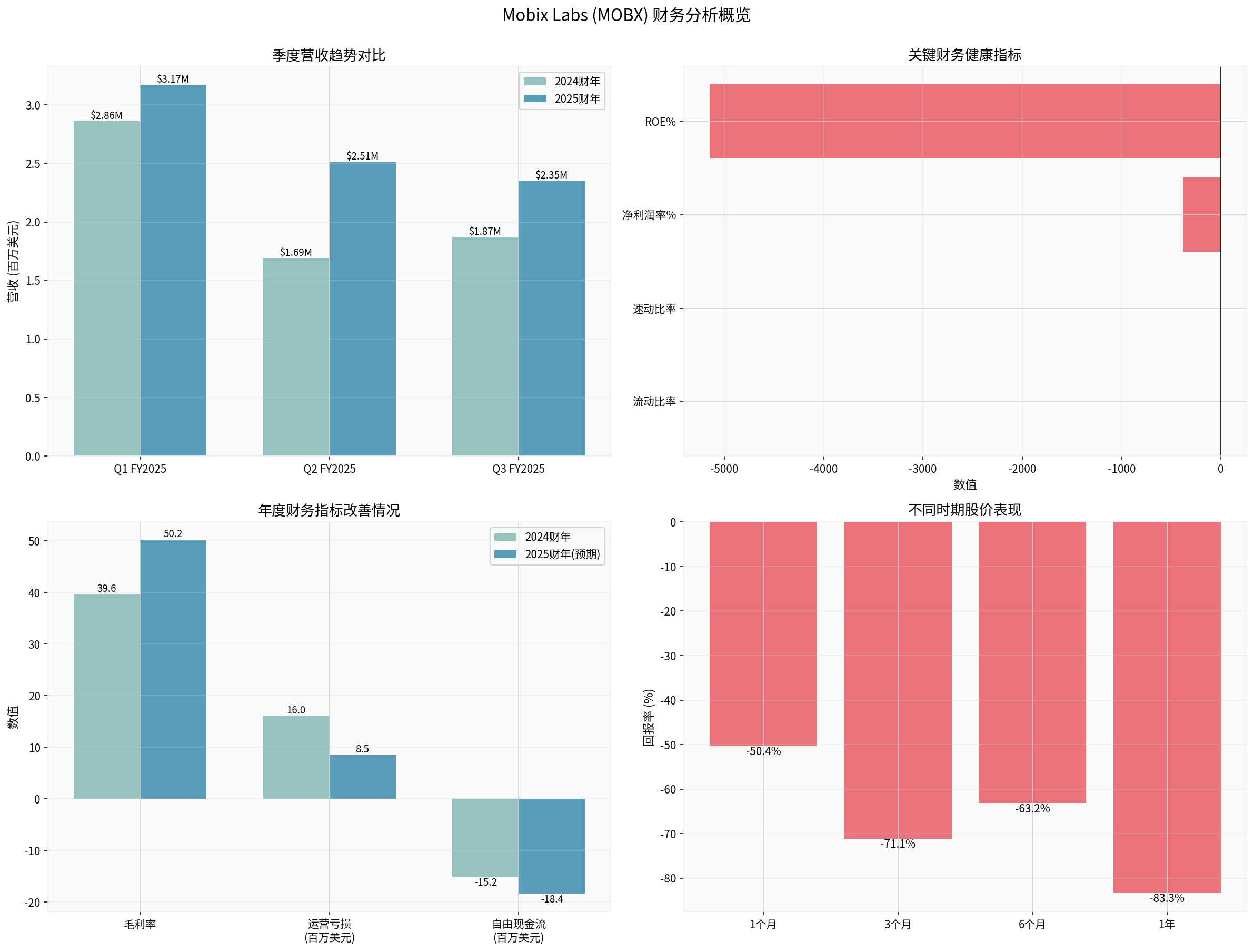

- Revenue Forecast: $9.7M - $9.9M

- YoY Growth: Approximately 54% (compared to $6.4M in FY2024)

- Gross Margin: Improved from 39.6% to 50.2%-50.5%, an increase of 10.6 percentage points

- Q1 FY2025: $3.17M

- Q2 FY2025: $2.51M (↓20.8%)

- Q3 FY2025: $2.35M (↓6.4%)

Although the full-year forecast shows 54% growth, quarterly revenue exhibits a

- Large initial orders in the early year drove the full-year growth forecast

- Insufficient sustained business momentum

- High customer concentration, relying on a few major clients

-

Defense Market Opportunities

- Global defense spending continues to grow, especially in communication and electronic warfare fields

- The U.S. Department of Defense has strong demand for advanced communication technologies

- Broad application prospects of 5G millimeter-wave technology in military communication

-

Technical Positioning

- RF and millimeter-wave technologies are strategically important in military communication

- The company’s EMI filtering solutions are suitable for complex electromagnetic environments

- The Peraso acquisition will enhance technical capabilities in the military communication sector

-

Gross Margin Improvement

- Gross margin increased from 39.6% to 50.2%-50.5%, indicating improved product pricing power or cost control

- High gross margin is a positive signal for a sustainable business model

-

Severe Financial Constraints

- Current Ratio: Only 0.14, Quick Ratio: 0.09, extremely high liquidity risk [0]

- Free Cash Flow: Negative (-$18.4M) [0]

- Sustained large operating losses limit reinvestment capacity

-

Too Small Market Capitalization

- Current market cap: Only $16.08M, a micro-cap company [0]

- Limited financing capacity, difficult to support large-scale expansion

- Stock price plummeted 84.09% in 2025, showing severe lack of investor confidence [0]

-

High Customer Concentration Risk

- 89.7% of revenue comes from the U.S. market, extremely high geographical concentration [0]

- Dependence on a few major clients may lead to revenue fluctuations

- Cyclical nature and uncertainty of defense contracts

Figure 2: Comprehensive Analysis of MOBX Quarterly Revenue Trend, Financial Health Indicators, Annual Indicator Comparison, and Stock Price Performance [0]

- The global military communication market is expected to reach tens of billions of dollars by 2030

- Rapid penetration of 5G technology in military applications

- Expanding applications of millimeter-wave technology in tactical communication, electronic warfare, and radar systems

- Major competitors include large defense contractors (Lockheed Martin, Raytheon, etc.)

- Professional communication technology companies provide more direct competition

- Emerging technology companies enter the market through innovative solutions

- As a small company, it is at a disadvantage in price competition

- Technical specialization may be a differentiating advantage

- However, financial and technical resources are far less than large competitors

- RF Technology: Focus on wireless and wired connectivity, RF technology, and EMI filtering solutions [0]

- Millimeter-wave Technology: Application of 5G millimeter-wave RF technology in the defense sector

- Electromagnetic Interference (EMI) Solutions: Application value in complex electromagnetic environments

- ✅ Technical fields align with defense modernization needs

- ✅ EMI filtering solutions have strategic value in military communication

- ⚠️ Technical uniqueness is insufficient to establish strong barriers

- ⚠️ R&D investment is limited by financial constraints

- Communication equipment in the defense and aerospace sectors

- Application of 5G millimeter-wave RF technology in military communication

- Electromagnetic interference solutions for special communication systems

- ✅ Focus on niche markets to avoid direct competition with giants

- ✅ Military-recognized facilities provide compliance advantages

- ✅ Specialized positioning may attract specific customer groups

- ❌ Limited market size, low growth ceiling

- ❌ High entry barriers requiring long-term investment and certification

- ❌ High customer switching costs, but difficult to acquire new customers

- U.S. market accounts for 89.7%, showing dependence on local defense customers [0]

- Only 10.3% from other regions, low internationalization level

- ✅ Military clients usually have long-term cooperative relationships

- ✅ Long product certification cycles lead to high customer stickiness

- ❌ High customer concentration risk

- ❌ Losing key clients may cause significant revenue impact

| Indicator | Value | Assessment |

|---|---|---|

| Current Ratio | 0.14 | Extremely Dangerous |

| Quick Ratio | 0.09 | Extremely Dangerous |

| Net Profit Margin | -381.82% | Severe Loss |

| ROE | -5149.05% | Extremely Low Efficiency |

| Negative Equity | Yes | Bankruptcy Risk |

| Free Cash Flow | -$18.4M | Severe Cash Burn |

- Liquidity Crisis: Current ratio of 0.14 means extremely weak short-term debt repayment ability,随时可能面临 cash flow断裂

- Sustained Losses: High operating losses (expected to still lose $8.5M-$8.6M in FY2025) indicate unvalidated business model

- Financing Difficulties: Market cap of only $16M and plummeting stock price make financing channels extremely limited

- Debt Risk: Negative equity status means the company is insolvent, with real bankruptcy risk

- Management Team Capability: Defense business is highly complex, requiring professional knowledge and experience

- Cultural Transformation: Transition from civilian to military requires profound organizational changes

- Operational Integration: Facility relocation and business integration face execution complexity

- Uncertainty of Peraso Acquisition: Requires regulatory approval and shareholder consent

- Integration Risks: Technical, personnel, and cultural integration challenges

- Payment Risks: All-cash acquisition will further consume limited cash resources

- Giant Advantages: Large defense contractors have stronger technology, financial, and customer resources

- Technology Iteration Risks: Rapidly changing technical environment may make existing technologies obsolete quickly

- Policy Risks: Changes in defense budgets and procurement policies may affect business

- Contract Concentration: Dependence on a few defense clients may lead to revenue fluctuations

- Long Procurement Cycles: Long approval cycles for defense contracts lead to time lags in revenue realization

- Political Sensitivity: Defense business is affected by international political situations

- Long-term stable growth in defense market demand

- Technical specialization aligns with market trends

- Gross margin improvement shows operational efficiency enhancement

- Continuous decline in quarterly revenue, insufficient growth momentum

- Extremely fragile financial situation, difficult to support sustained expansion

- High customer concentration, poor revenue stability

- Plummeting market cap and stock price, severe lack of market confidence

- Military-recognized facilities provide entry barriers

- Professional technical capabilities have value in specific fields

- Peraso acquisition may enhance technical strength

- Insufficient technical uniqueness, difficult to establish strong barriers

- Financial constraintslimit R&D investment and technical innovation

- Scale Disadvantagesput it at a disadvantage in competition with large competitors

- Weak Talent Attraction: Difficult to attract and retain top talent

- Unvalidated Business Model: Sustained losses for many years, no proven profitability

- Continuous Negative Cash Flow: Rely on external financing to maintain operations

- Negative Equity Status: Insolvent, with bankruptcy risk

- Exhausted Financing Channels: Plummeting stock price makes equity financing almost impossible

- Large-scale equity financing (but extremely unrealistic in the current environment)

- Strategic sale or merger

- Bankruptcy reorganization

-

Extremely High Risk

- Liquidity crisis may occur at any time

- Real bankruptcy risk

- Stock price may drop to zero

-

Extremely High Uncertainty

- Doubts about the success of defense business transformation

- Doubts about the completion of Peraso acquisition

- Doubts about obtaining sufficient financing

-

Poor Risk-Reward Ratio

- Even if transformation succeeds, upside potential is limited (market cap only $16M)

- Huge downside risk (may drop to zero)

-

Positive Signals:

- Successful completion of Peraso acquisition and realization of synergies

- Obtaining large defense contracts

- Successful financing to improve liquidity

- Reversal of quarterly revenue decline trend

-

Negative Signals (May Accelerate Deterioration):

- Liquidity crisis (inability to pay maturing debts)

- Loss of key clients

- Failure of Peraso acquisition

- Further revenue decline

- Small company size leads to limited public information

- Insufficient disclosure of defense business details

- Significant uncertainty about the outcome of the Peraso acquisition

- Financial data based on pre-audit estimates

- Closely monitor the company’s liquidity status

- Pay attention to the progress of the Peraso acquisition

- Watch whether the quarterly revenue trend reverses

- Consider downside risks in extreme cases

Mobix Labs’ strategic transformation into the defense business

- Sustainable Revenue Growth: Low possibility in the short term; survival issues need to be resolved first

- Competitive Advantages: Limited and fragile, difficult to maintain leading position in fierce market competition

- Investment Recommendation:Avoid, risks far outweigh potential benefits

Unless the company can quickly obtain large-scale financing and successfully execute its strategic transformation, the current defense business expansion initiatives

[0] Gilin API Data - Stock Price, Financial Data, Technical Analysis, Company Profile

[1] Investing.com Chinese - “Mobix Labs Stock Surges, Appoints Defense General Manager and Plans Facility Expansion” (https://cn.investing.com/news/stock-market-news/article-93CH-3150374)

[2] StockTitan - “Mobix Labs Moves Decisively with All-Cash $1.30 Per Share Offer for Peraso” (https://www.stocktitan.net/news/MOBX/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.