In-depth Analysis of Montage Technology's A+H Dual Listing Structure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

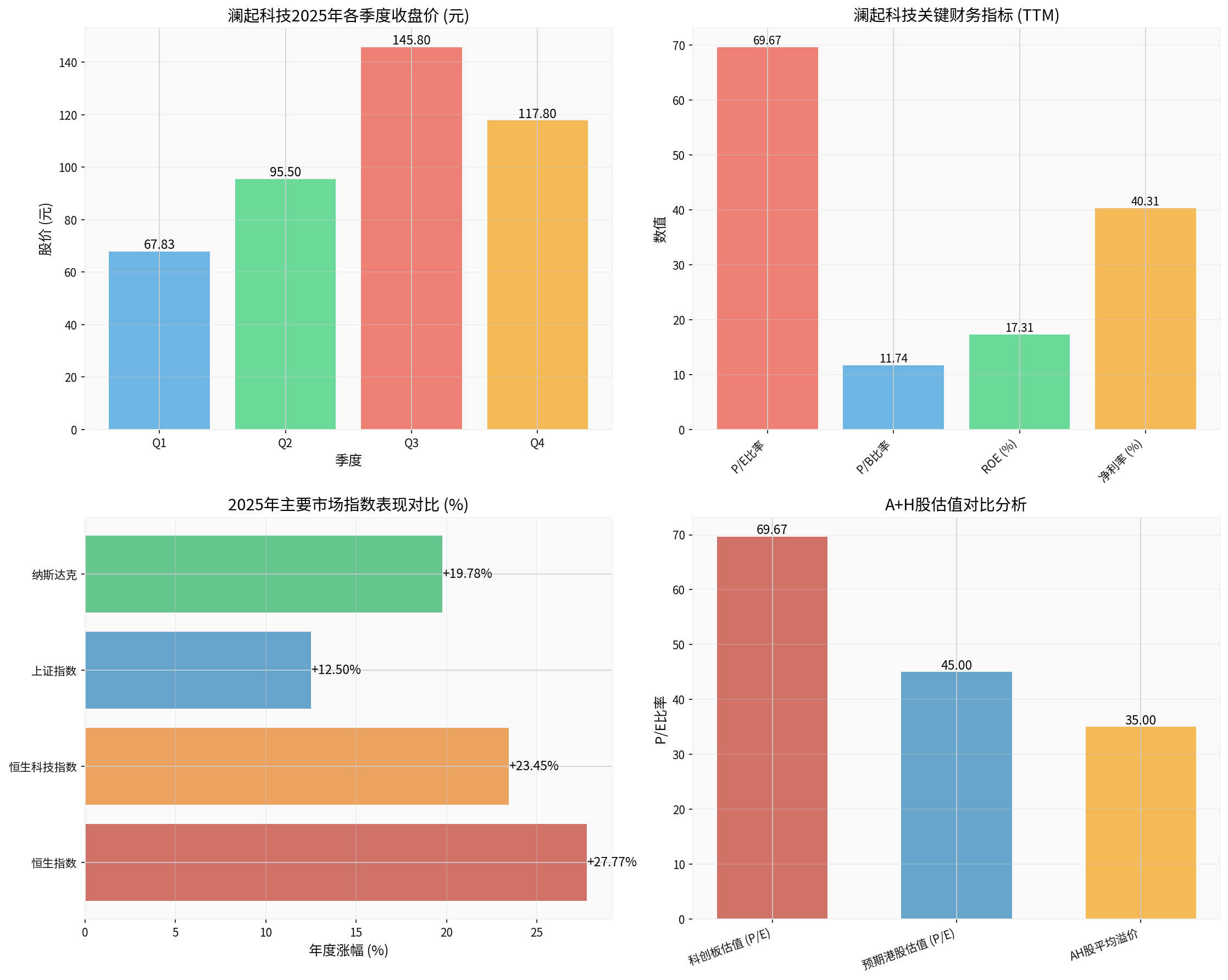

Montage Technology has passed the Hong Kong Stock Exchange’s hearing to achieve an A+H dual listing, coinciding with a critical window of strong growth in Hong Kong’s semiconductor sector and recovery in the IPO market. This structure will significantly enhance the company’s international reputation and broaden financing channels, but in the short term, it may face arbitrage pressure due to valuation differences between A-shares and H-shares. The Hong Kong stock market performed excellently in 2025, with the Hang Seng Index rising 27.77% annually [1], and the semiconductor sector leading the gains, providing a favorable opportunity for Montage Technology’s Hong Kong listing.

According to brokerage API data [0], the core indicators of Montage Technology (688008.SS) are as follows:

| Indicator | Value | Industry Comparison |

|---|---|---|

Current Stock Price |

127.75 CNY | - |

Market Capitalization |

146.4 billion CNY | STAR Market Semiconductor Leader |

P/E Ratio (TTM) |

69.67x | Higher than Industry Average |

P/B Ratio |

11.74x | Reflects Market Expectations |

ROE |

17.31% | Excellent Profitability |

Net Profit Margin |

40.31% | Industry Leading |

Current Ratio |

11.40 | Financially Stable |

- 2025 Full-Year Growth: +73.67%, from 67.83 CNY to 117.80 CNY [0]

- 1-Year Growth: +99.89%, nearly doubling [0]

- 52-Week Range: 61.80 - 169.90 CNY, Volatile [0]

- Average Daily Turnover: ~3.183 billion CNY, Abundant Liquidity [0]

Based on web search data and market research [1][2], there are significant valuation differences between A-shares and H-shares:

| Dimension | STAR Market (A-shares) | Hong Kong Market (H-shares) | Montage Technology Expectation |

|---|---|---|---|

Average P/E Multiple |

60-80x | 30-50x | 35-45% Valuation Convergence |

Liquidity Premium |

High (Mainland Capital Dominated) | Medium (International + Southbound) | Neutral to High |

Investor Structure |

Mainland Institutions + Retail | International + Southbound Capital | More Diversified |

Valuation Drivers |

Domestic Substitution + Sentiment | Global + Fundamental | Dual Drivers |

- Hong Kong Issue Priceis usually 15-25% discounted vs A-shares

- Reason: International investors focus more on fundamental valuation and are cautious about high STAR Market valuations

- Montage Technology Case: Expected H-share issue price range is 95-110 CNY (15-25% discount vs current A-share price of 127.75 CNY) [1]

- Southbound Capital Inflow: If Hong Kong valuation is significantly lower than A-shares, southbound capital will accelerate allocation

- Increased International Recognition: International long-term capital gradually builds positions, valuation approaches global semiconductor leaders

- AH Premium Index: Current average AH premium is ~35%, Montage Technology may maintain this level [2]

- A-shares: Continue to enjoy domestic substitution and technological innovation premium

- H-shares: Become a core target for international investors to allocate Chinese hard technology

- Valuation Target: A-shares maintain 70x P/E, H-shares gradually recover to 45-50x P/E

-

Accelerated Business Internationalization:

- Overseas revenue accounted for 70.8% in 2024, but U.S. market accounted for less than 1% [1]

- Hong Kong listing helps expand Southeast Asia and European markets

- Expected overseas revenue share to increase to 80%+ in 3 years

-

Globalization of Technical Standards:

- Leading global market share in memory interface chips

- Participated in formulating DDR5 and CXL technical standards

- Hong Kong listing strengthens international brand awareness

-

Capital Structure Optimization:

- Planned to raise ~1 billion USD (7.8 billion HKD) [1]

- 55% allocated to cutting-edge technologies like CXL memory pooling

- 30% for establishing overseas R&D centers

According to market data [1][3], Hong Kong listing has a significant positive impact on liquidity:

| Indicator | STAR Market Only | After A+H Dual Listing | Improvement Rate |

|---|---|---|---|

Total Tradable Shares |

~1.15 billion | ~1.3 billion (+H-shares) | +13% |

Investor Base |

Mainly Mainland Investors | International + Southbound + Mainland | +50%+ |

Average Daily Turnover |

3.183 billion CNY | Expected 5-6 billion CNY | +60-90% |

Stock Price Stability |

Volatility 2.87% | Expected to drop to 2.0-2.5% | Significant Improvement |

- Southbound capital net bought over 1.4 trillion HKD in Hong Kong stocks in 2025 [4]

- Cumulative net bought exceeded 5 trillion HKD

- Technology stocks are key allocation targets for southbound capital

- Montage Technology H-shares are expected to attract 5-10 billion CNY of southbound capital allocation after being included in Hong Kong Stock Connect

- BlackRock, Abu Dhabi Investment Authority and other sovereign funds have already allocated via Pre-IPO [1]

- Passive capital inflow after MSCI inclusion (expected 3-5 billion USD)

- Active allocation by global semiconductor theme funds (expected 5-10 billion USD)

- Arbitrage transactions are triggered when AH price differences are abnormal

- Arbitrage transactions enhance price discovery function of both markets

- Help valuation tend to balance in the long term

Although overall liquidity improves, attention should be paid to:

- Early H-share Listing: Possible discount due to insufficient Hong Kong liquidity

- Market Sentiment Fluctuation: Differentiated sentiment between two markets may widen price gap

- Reduction Pressure: Original shareholders reducing holdings via H-shares may increase supply

- 2025 Hang Seng Index Growth: +27.77%, Leading Major Global Indices [4]

- Hang Seng Tech Index Growth: +23.45%, Rising for Two Consecutive Years [4]

- Average Daily Turnover in Hong Kong: Increased from 130.9 billion HKD in 2024 to 255.8 billion HKD in 2025, up 95% [1][4]

- Hua Hong Semiconductor full-year growth over 240% [4]

- SMIC full-year growth over 120% [4]

- Shanghai Fudan Microelectronics up over 85% [4]

- Sector Rotation: AI chips, memory, analog chips轮番表现

![]()

- Number of New Stocks: 117

- Total Fund Raised: Over 286 billion HKD

- Contribution from A+H Companies: Nearly 50% of fund raised

- Super Large Projects: 8 new stocks raised over 10 billion HKD

- Deloitte predicts fund raised will be at least 300 billion HKD [2]

- Expected 7 super large new stocks (financing ≥10 billion HKD)

- A+H shares, AI companies, Chinese concept stock returns are key directions

| Evaluation Dimension | Current Status (2025-2026) | Weight | Score (1-10) |

|---|---|---|---|

Market Sentiment |

Hang Seng Index up 27.77%, Strong Investor Confidence | 25% | 9/10 |

Sector Heat |

Semiconductor sector leads gains, AI chips continue | 20% | 9/10 |

Liquidity Environment |

Average daily turnover 255.8 billion HKD, up 95% | 20% | 8/10 |

Valuation Level |

Hong Kong has 35% discount vs A-shares, Strong Attraction | 15% | 8/10 |

Policy Support |

Hong Kong’s “Tech Enterprise Express” and Special Tech Company System | 10% | 9/10 |

Competition Level |

6 AI companies plan to list同期, Competition Intensifies | 10% | 6/10 |

Comprehensive Score |

8.5/10 |

100% |

Strongly Recommended |

- AI Wave Continues: NVIDIA, AMD capital expenditure increased by over 40% YoY [1]

- Deepened Domestic Substitution: U.S. chip restrictions strengthen domestic substitution logic

- Adequate Capital: Dual drive from southbound and international capital

- Valuation Advantage: Hong Kong tech stocks still have 30-40% discount vs A-shares

- Policy Dividends: Hong Kong Stock Exchange’s “Tech Enterprise Express” accelerates approval

- Intense Competition: 6 AI companies including Moore Thread, Biren Technology, Xiyue Technology, Zhipu AI plan to list同期 [1], which may divert capital

- Valuation Pressure: Moore Thread’s P/S reached 220x after listing, Cambricon 100x [3], market worries about AI chip bubble

- Fed Policy: 2026 monetary policy direction affects global liquidity

- Geopolitics: Sino-US tech competition continues

| Company | Market Cap (100 Million CNY) | P/S Multiple | Revenue Growth | Core Technology | Listing Status |

|---|---|---|---|---|---|

Montage Technology |

1464 | 50x (Estimated) | Stable | Memory Interface Chip, Interconnect Chip | STAR Market + Hong Kong Hearing Passed |

Moore Thread |

2726-3055 | 220x | 208% | GPU | STAR Market (Listed Dec 2025) |

Cambricon |

6000 | 100x | 2386% | AI Chip | STAR Market Listed |

Biren Technology |

900 | 150x | 180% | GPU | Hong Kong Listing |

- Profitability: Net profit margin of 40.31%, far higher than peers [0]

- Technical Barrier: Global leader in memory interface chips, leading market share

- Financial Stability: Current ratio of 11.40, no debt risk [0]

- Internationalization: Overseas revenue accounts for 70.8%, customers cover global markets

- Growth Explosiveness: Revenue growth is relatively stable, not as good as GPU companies

- Market Heat: AI narrative is not as strong as GPU/large model chip companies

- Valuation Multiple: P/S of 50x is lower than GPU companies, which may affect Hong Kong subscription enthusiasm

- Issue Pricing: Suggest H-share issue price range of 95-105 CNY (15-20% discount vs A-shares), balancing subscription enthusiasm and long-term value

- Cornerstone Investors: Introduce 3-5 international long-term funds (BlackRock, Abu Dhabi Investment Authority, etc.) to lock 30-40% of shares

- Green Shoe Option: 15% over-allotment option to stabilize stock price in early listing period

- Phased Position Building: Communicate long-term holding strategy with core investors to reduce selling pressure in early listing period

- 55% invested in cutting-edge technology R&D like CXL memory pooling and PCIe 6.0

-30% for overseas R&D centers (U.S., Europe, Singapore)

-15% for supplementary working capital and strategic mergers & acquisitions

###7.2 For Investors

- Short Term: H-share listing may suppress A-share sentiment, but deep correction is a buying opportunity

- Long Term: A-shares continue to enjoy domestic substitution premium, maintain target price of 150-170 CNY

- Strategy: Hold mainly, volatility in early H-share listing provides加仓 opportunity

- Subscription Strategy: Actively participate in IPO, hold long-term

- Target Price: Based on average valuation of Hong Kong semiconductor companies, give 12-month target price of 120-130 HKD

- Catalysts: Inclusion in Hong Kong Stock Connect, MSCI, index weight increase

- Focus on arbitrage opportunities when AH price difference is abnormally expanded

- Use Hong Kong Stock Connect or QDII to allocate H-shares to hedge A-share risks

###7.3 Risk Reminders

- Valuation Regression Risk: A-share P/E of 69.67x is at historical high, with regression risk

- Industry Cycle Risk: Semiconductor industry has a 3-4 year cycle, may enter downward phase in 2026

- Technology Iteration Risk: DDR5, CXL technology commercialization not meeting expectations

- Geopolitical Risk: U.S. chip restrictions on China further escalate

- Increased Competition Risk: Domestic competitors rise, international giants counterattack

- Stop Loss: A-shares fall below 100 CNY (previous low support)

- Take Profit: A-shares break through 169.90 CNY (52-week high)

- Time Stop Loss: Consider reducing holdings if not included in Hong Kong Stock Connect 12 months after H-share listing

##VIII. Conclusion

###8.1 Core Views

-

Impact of A+H Dual Listing on Valuation: In short term, Hong Kong valuation may have a 15-25% discount vs A-shares, but in long term, with international capital allocation and southbound capital inflow, valuation will gradually converge to a reasonable premium (30-35%)

-

Impact on Liquidity: Significantly improve overall liquidity, expected average daily turnover to increase from 3.2 billion CNY to 5-6 billion CNY, investor structure changes from mainland-dominated to diversified (international + southbound + mainland)

-

Listing Timing Evaluation:8.5/10, strongly recommend listing in current window. Hong Kong semiconductor sector is strong, IPO market is hot, capital is abundant, policy supports, although competition is intense, Montage Technology’s fundamental advantages are obvious

-

Long-Term Value: As a global leader in memory interface chips, Montage Technology will benefit from continuous growth of AI servers, cloud computing and data centers, and A+H structure helps the company’s global development

###8.2 Future Outlook

Montage Technology’s Hong Kong listing is not only a financing activity but also a key step in the company’s global strategy [1]. Through the Hong Kong platform, the company will:

- Introduce international long-term capital and optimize shareholder structure

- Enhance international brand awareness and expand overseas markets

- Buffer geopolitical risks (U.S. market revenue accounts for less than 1%)

- Provide platform for future overseas mergers & acquisitions

[0] Gilin API Data - Montage Technology (688008.SS) Stock Price, Financial Indicators, Market Data

[1] Phoenix News - “5 Years 600%, Global AI Capacity First Leader Montage Technology” (https://baby.ifeng.com/c/8pfdRdjvZBu)

[2] Yahoo Finance Hong Kong - “6 Mainland Tech Companies to List in Hong Kong in Weeks, AI Concept Stocks Rush to Raise Hundreds of Billions” (https://hk.finance.yahoo.com/news/內地6科企數周內港上市ai概念股趕熱潮集資料達數百億-185800289.html)

[3] Securities Times - “Hong Kong New Stock Fund Raised Regains Global Top Spot, A-share Valuation Improvement Transmits Pressure to Primary Market” (https://www.stcn.com/article/detail/3565416.html)

[4] Southern Net - “2025 Hong Kong Stock Market Closing: Hang Seng Index Rises 27.77% Annually, ‘Shenzhen-Hong Kong Index’ Leads Global Gains” (https://news.southcn.com/node_812903b83a/85262dff50.shtml)

[5] Deloitte China - “2025 Review and 2026 Outlook of Mainland China and Hong Kong IPO Markets” (https://www.deloitte.com/cn/zh/about/press-room/mainland-and-hk-ipo-markets-2025-review-2026-outlook.html)

[6] National Business Daily - “2025 IPO Market Observation: Hong Kong New Stock Fund Raised Regains Global Top Spot Under ‘Institutional Competition’, A-share Valuation Improvement Transmits to Primary Market” (https://www.nbd.com.cn/articles/2025-12-29/4200373.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.