Lucid Group: In-depth Analysis of the 'Tesla Killer' Journey Amid Production Bottlenecks and Intense Competition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

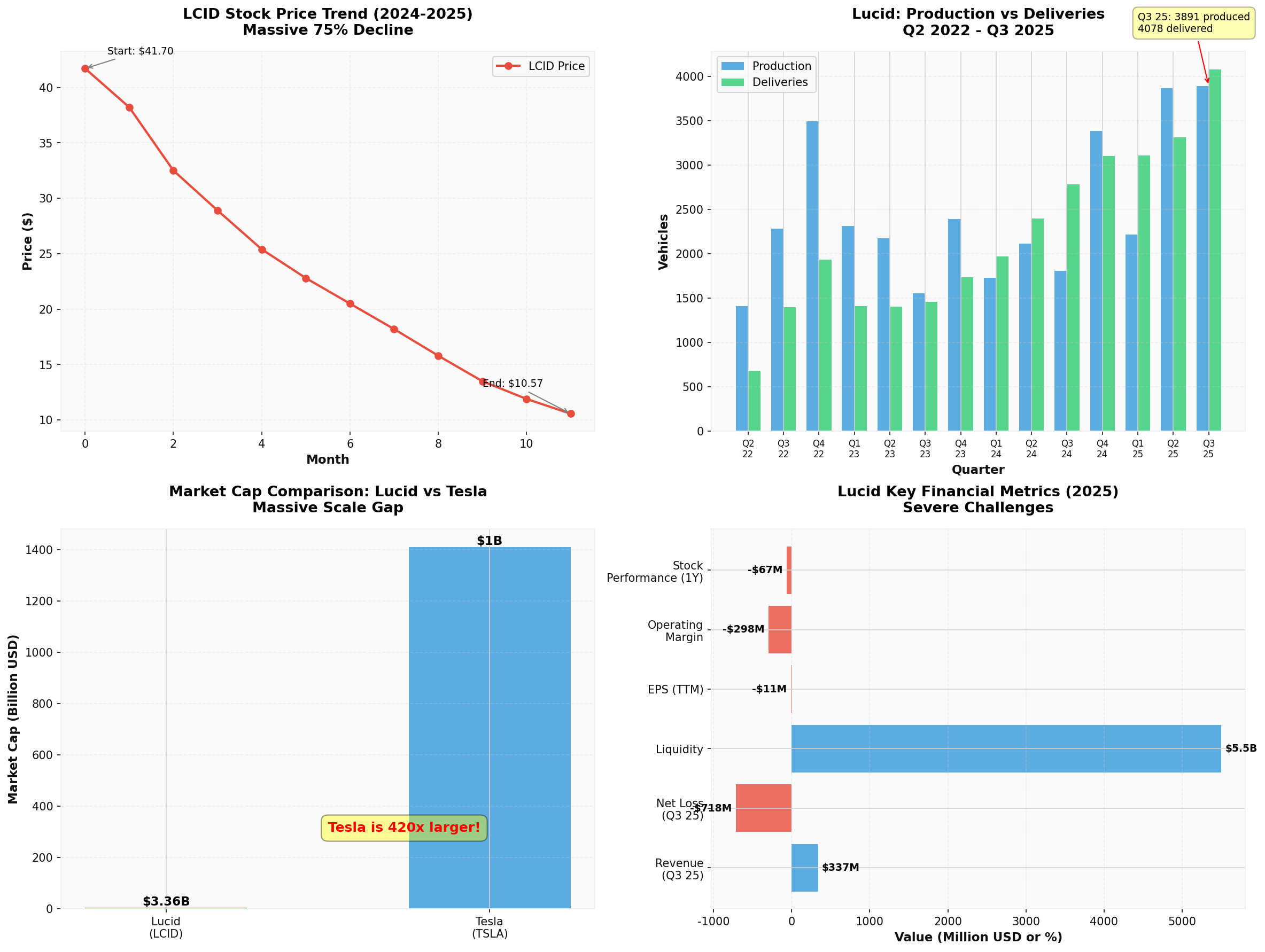

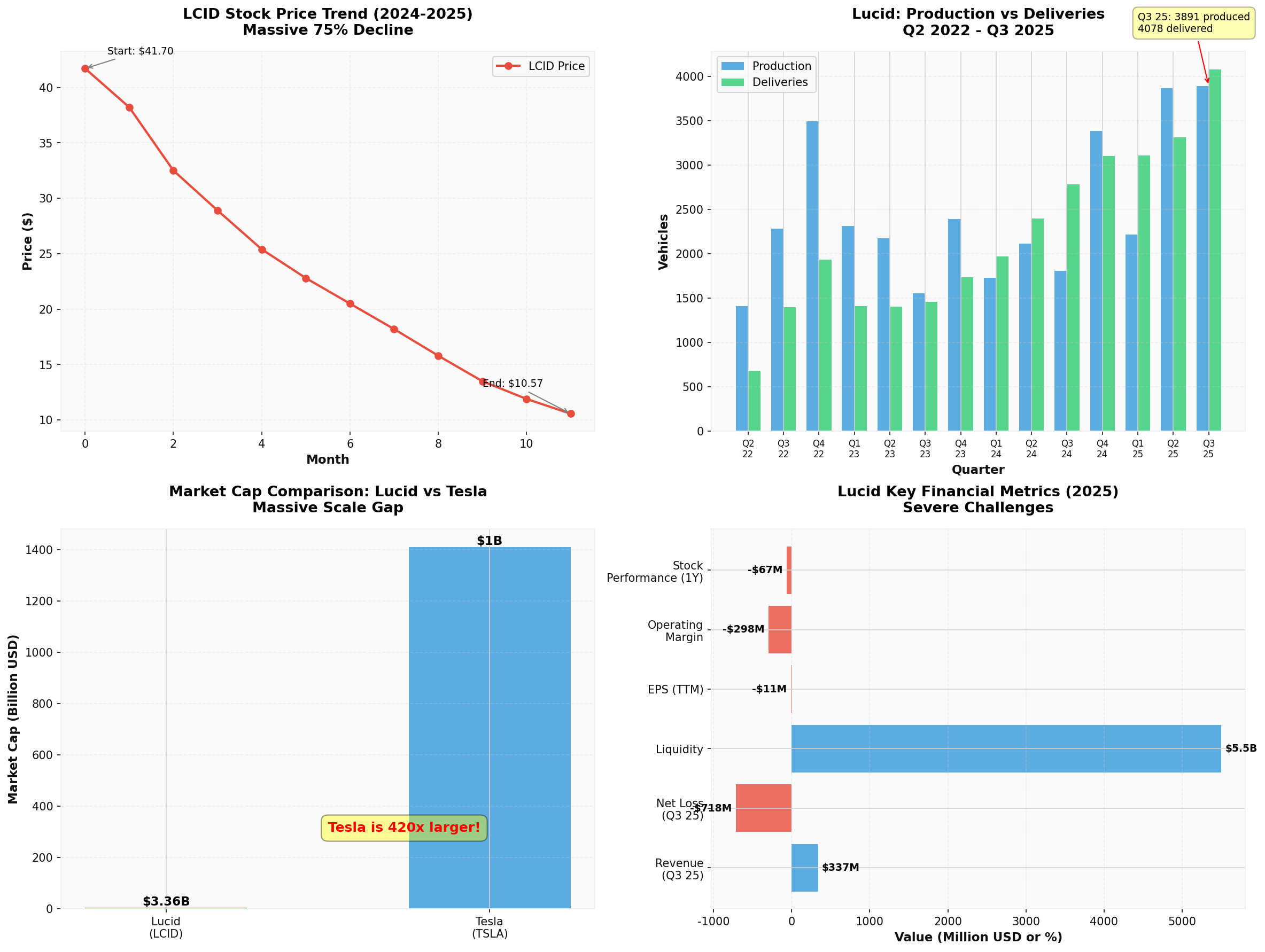

Based on a comprehensive analysis of Lucid Group (LCID), I will systematically dissect the challenges the company faces, its response strategies, and the validity of its ‘Tesla Killer’ title.

| Indicator | Value | Status |

|---|---|---|

| Revenue | $336.58M | Below expected $473.08M (-28.85%) |

| Net Loss | ~$717.7M | Loss of $240,000 per vehicle sold |

| EPS (TTM) | -$10.51 | Continuous loss |

| Operating Margin | -297.5% | Severely deteriorated |

| Gross Margin | -97.91% | Negative gross margin operation |

| Cash Burn | ~$950M/quarter | Extremely high burn rate |

- Negligible production scale: Only 3,891 vehicles produced in Q3 2025, while Tesla produced 447,000 vehicles in the same period—over 100x difference

- Severe inventory backlog: Unsold inventory reached 3,856 vehicles in Q3 2025, accounting for 99% of total production

- Repeatedly lowered annual targets: From the initial target of 500,000 vehicles to 18,000-20,000 vehicles (2025), and finally only about 9,000 vehicles completed (first 9 months of 2025)

| Dimension | Lucid | Tesla | Gap |

|---|---|---|---|

| Market Cap | $3.36B | $1,410B | 420x difference |

| 2025 Production | ~9,000 units | 1,800,000+ units | 200x difference |

| Average Selling Price | $145,000 | $55,000 (EV average) | Too high-end |

| Number of Models | 2 (Air, Gravity) | 4+ (Model S/3/X/Y/Cybertruck) | Weak product line |

- Limited market size: The luxury sedan market itself is limited in size; Model S sold only 4,500 units in the first three quarters of 2025[0]

- Price misalignment: Lucid Air starts at $72,400, while the average price of EVs in the main market is $59,000, and Model 3 starts at only $37,000[0]

- Loss of tax credits: The U.S. federal EV tax credit ($7,500) has expired, further weakening competitiveness[0]

In addition to Tesla, Lucid also faces:

- Traditional luxury brands: Mercedes EQS, BMW i5/iX, Porsche Taycan, etc.

- New EV players: Rivian R1T/R1S, Fisker Ocean (bankrupt), Canoo

- Mid-market competition: Ford Mustang Mach-E, Volkswagen ID.4, Hyundai Ioniq 5

- Starting price $79,900-$96,400

- Three rows of seats, targeting family market

- Will become the main production focus starting from Q4 2025

- But delivery data remains sluggish (only three-digit registrations in the first half of 2025)[0]

- Key strategic model: Starting price $50,000, directly competing with Tesla Model Y

- This is Lucid’s real opportunityto prove its ‘Tesla Killer’ title

- But faces huge risks: Entering the most competitive and price-sensitive market

- Cooperate with Uber and Nuro to develop robotaxis

- Cooperate with Nvidia to develop AI chips

- Invest in autonomous driving technology, but far from commercialization

- Equity structure: PIF holds about 60% of shares, with absolute control

- Credit line: Expanded the delayed draw term loan from $750M to $2B

- Liquidity buffer: Total liquidity reaches $5.5B, expected to support until the first half of 2027

- Risk: Over-reliance on a single investor, PIF’s strategy may change

- Issued $975M convertible senior notes in 2025 (maturity 2031)

- Used $750M to repurchase convertible notes maturing in 2026 to ease short-term pressure

- Multiple price cuts to maintain competitiveness, but at the cost of gross margin

- After price cuts, performance advantages shrink, and the gap with Tesla narrows

- Hired actor Timothée Chalamet as the first global brand ambassador

- Trying to increase brand awareness, but the effect remains to be seen

- Middle East market (especially Saudi Arabia) has become an important growth point

- Q3 2025: Saudi market revenue $38M, accounting for 5.9% of total revenue

- Benefiting from PIF’s political and economic influence

- Range: Air has a maximum EPA range of 512 miles, exceeding Model S Plaid’s 396 miles

- Charging speed: Supports 350kW DC fast charging, adding 200 miles in 12 minutes

- Efficiency: Currently the most efficient electric vehicle on the market

- Interior luxury: 34-inch curved display, leather seats, rear legroom exceeds Model S by two inches

- Excessively high pricing limits market penetration

- Severe lack of large-scale production capacity

- Software ecosystem is far behind Tesla

| Indicator | Tesla (2012) | Lucid (2025) | Gap Analysis |

|---|---|---|---|

| Production | ~2,600 units (Model S) | ~9,000 units | Lucid’s production is slightly higher, but the era background is completely different |

| Market Environment | Few competitors | Intense competition | Lucid faces far more competition than Tesla did then |

| Funding Support | Difficult financing after IPO | Continuous funding from PIF ($8B+) | Lucid has more abundant funds |

| Brand Awareness | Emerging brand | ‘Tesla Killer’ label | High expectations instead create pressure |

- Strong technical strength: Leading in range, efficiency, and charging speed

- Strong PIF support: Political and economic commitments from Saudi sovereign fund provide financial security

- Product line expansion: Gravity SUV and mid-size SUV provide more market entry points

- Valuation has pulled back significantly: Down 88+% from the high, some negative expectations have been priced in

- Continuous huge losses: The business model of losing $240,000 per vehicle sold is unsustainable

- Scale failure: Cumulative deliveries in 5 years are only 31,232 units, far below expectations

- Fierce competition: Encirclement by Tesla Model Y, traditional luxury EVs, and Chinese EV manufacturers

- Cash flow risk: Need continuous financing, which may dilute existing shareholders

- Management turmoil: CEO resigned, interim CEO took over, strategic direction is unclear

- Production/delivery data for Q4 2025 and Q1 2026

- Launch and pre-order status of mid-size SUV

- Whether cash burn rate improves

- Whether gross margin turns positive

- Whether annual production can reach 50,000-100,000 units

- Whether gross margin can turn positive (predicted in 2028)

- Whether PIF continues to support

- Whether autonomous driving/robotaxis can generate revenue

- Production capacity issue: Annual production of less than 20,000 units vs Tesla’s 1.8 million units

- Financial sustainability: Huge losses, negative gross margin, high cash burn

- Market positioning: Too high price, narrow target market

- Unfavorable timing: EV market is already mature, competition is far more intense than Tesla’s era

- The 2026 mid-size SUVis a key turning point—starting price $50,000, directly competing with Model Y

- If it can successfully enter the mid-end market (sales of 100,000+ units), it will truly have the potential to challenge Tesla

- But this requires perfect execution: Capacity ramp-up, cost control, brand building, channel expansion—none can be missing

- Market acceptance of the mid-size SUV

- Long-term commitment from PIF

- Achieving economies of scale before funds run out

- Saudi PIF will support indefinitely

- Lucid can achieve economies of scale before 2028

- The mid-size SUV can successfully open the market

should consider entering. Otherwise, it is recommended to wait and see or wait for a clear profit path signal.

[0] Jinling API Data - Lucid Group (LCID) Market Data, Financial Analysis, Technical Analysis, Production and Delivery Data

[1] Motley Fool - “Lucid Group: When Will the Dust Settle?” (https://www.fool.com/investing/2026/01/04/lucid-group-when-will-the-dust-settle/)

[2] 24/7 Wall St. - “Lucid (NASDAQ: LCID) Stock Price Prediction and Forecast 2026-2030” (https://247wallst.com/forecasts/2026/01/02/lucid-group-stock-lcid-price-prediction-and-forecast-2025-2030/)

[3] Electrek - “Lucid (LCID) took ‘quite a few’ Rivian trade-ins in 2025, but most were still Tesla” (https://electrek.co/2026/01/02/lucid-took-quite-a-few-rivian-trade-ins-but-most-were-still-tesla/)

[4] Electrek - “Lucid-EVs-show-up-in-record-numbers-amid-year-end-push” (https://electrek.co/2025/12/29/lucid-lcid-evs-record-numbers-amid-year-end-push/)

[5] CNBC - “Lucid’s big SUV arrives with high expectations, and big risks” (https://www.cnbc.com/2025/12/20/lucids-gravity-suv-arrives-with-high-expectations-and-big-risks.html)

[6] StockTwits - “Lucid’s Moment Of Truth: Luxury EV Hype Meets A Brutal Market” (https://stocktwits.com/news-articles/markets/equity/lucid-s-luxury-ev-hype-meets-brutal-truth-low-priced-pivot-enough/cLeUeTkREwZ)

[7] The Electric Car Scheme - “Best Tesla Model S Alternatives For 2025” (https://www.electriccarscheme.com/blog/tesla-model-s-alternatives)

[8] Yahoo! Autos - “I’m a Car Expert: These EVs Beat Tesla Every Time” (https://autos.yahoo.com/ev-and-future-tech/articles/m-car-expert-evs-beat-181605982.html)

[9] Yahoo Finance - “Is Lucid a Millionaire-Maker Stock?” (https://finance.yahoo.com/news/lucid-millionaire-maker-stock-213500254.html)

[10] AInvest - “Lucid’s Gravity Woes: A Critical Inflection Point for EV Growth or Death Knell” (https://www.ainvest.com/news/lucid-gravity-woes-critical-inflection-point-ev-growth-death-knell-2512/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.