Cantor Fitzgerald's Neutral Rating and 15 USD Target on Rivian (RIVN): Underlying Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data, I now provide a comprehensive analysis of the investor concerns reflected behind Cantor Fitzgerald’s decision to maintain a Neutral rating and a $15 price target on Rivian.

According to the latest data, Cantor Fitzgerald analyst Andres Sheppard maintained a

- Market Share Monopoly: Tesla currently holds approximately50% of the U.S. electric vehicle market share, especially in the mid-range market priced below $50,000 [3]

- Pricing Pressure: Tesla continues to exert pressure through aggressive price-cutting strategies for Model 3 and Model Y, forcing competitors to follow suit with price reductions

- Brand Awareness Advantage: Tesla has built a significant moat in charging networks, brand loyalty, and autonomous driving technology

- General Motors: Launched two electric pickup models, the Chevrolet Silverado EV and GMC Sierra EV [3]

- Ford Motor: The F-150 Lightning electric pickup has already established a foothold in the market

- Product Homogenization: Rivian’s core products (electric pickups and SUVs) face direct competition from traditional giants

- International Market Pressure: Chinese electric vehicle manufacturers are expanding globally, offering more price-competitive products [4]

- Technological Catch-Up: Chinese manufacturers are rapidly narrowing the gap in battery technology and manufacturing scale

The main reason Cantor Fitzgerald maintains a Neutral rating is concerns about the

- Technical Complexity: The R2 model is equipped with Rivian’s self-developed Rivian Autonomy Processor (RAP1) and LiDAR system, which have extremely high technical barriers [2]

- Production Capacity Ramp-Up: The Illinois factory needs to complete validation construction, and the Georgia factory will not start production until 2028 [2]

- Historical Experience: New model launches are often accompanied by production delays and quality issues

According to Morgan Stanley’s forecast [2]:

- 2026 Adjusted EBIT Loss: Expected to reach as high as$2.9 billion

- Free Cash Flow Consumption: Expected to reach$4.2 billion

- Financing Needs: In a high-interest rate environment, Rivian may need additional capital injections to maintain operations

- Slowdown in Growth: Rivian’s expected sales in 2025 willdrop by 17%compared to 2024 [1]

- Reduction in Incentive Policies: The gradual elimination of federal EV tax credits will directly hit consumer purchasing intentions [1][3]

- Insufficient Charging Infrastructure: Limits the adoption of EVs in suburban and rural markets

According to brokerage API data [0], Rivian’s financial indicators show significant pressure:

Financial Indicator |

Value |

Interpretation |

|---|---|---|

| Net Profit Margin | -61.32% | Loses 61 cents per dollar of sales |

| ROE (Return on Equity) | -59.85% | Shareholders’ equity is being eroded rapidly |

| EPS (Earnings Per Share) | -$3.10 | Sustained losses with no profit timeline |

| Price-to-Sales Ratio (P/S) | 4.06x | Valuation remains high relative to revenue |

- Free Cash Flow: -$2.857 billion (latest fiscal year) [0]

- Current Ratio: 2.71 (short-term solvency is acceptable)

- Quick Ratio: 2.23 (liquidity is good after excluding inventory)

Although liquidity indicators are healthy, sustained huge cash consumption is unsustainable.

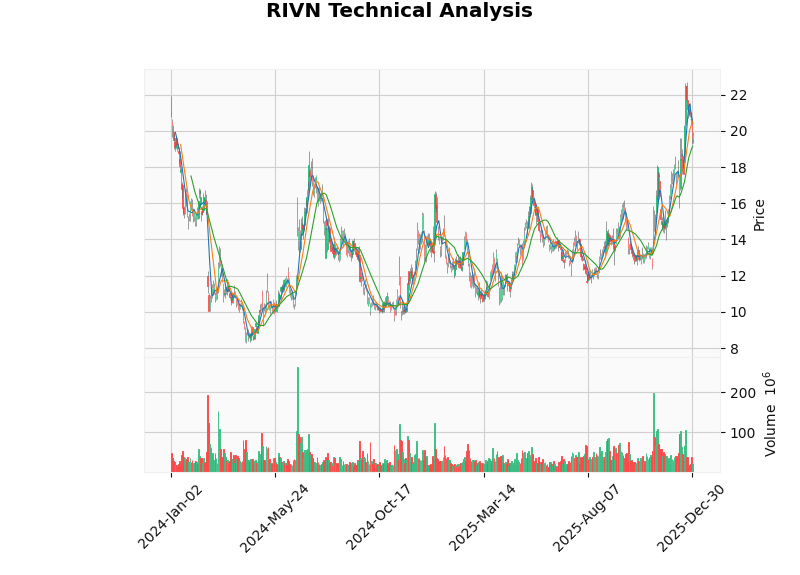

- Current Stock Price: $19.41 (closing price on January 5, 2026) [0]

- Cantor Fitzgerald Target Price: $15.00

- Downside Potential: Approximately-22.7%

This target price implies Cantor Fitzgerald believes:

- Current stock price has fully or even over-reflected future optimistic scenarios

- The success of the R2 model has already been reflected in the stock price in advance

- Execution risks have not yet been fully priced in by the market

In contrast, the Wall Street consensus target price is $20.50, which is only 5.6% higher than the current price [0], indicating that institutional investors overall are cautious.

Despite many concerns, Cantor Fitzgerald still maintains a Neutral rating, mainly based on the following positive factors [1][3]:

- Differentiated Product Portfolio: R1 (luxury pickup/SUV), EDV (commercial van), and R2 (mid-range SUV) form a complete product matrix

- Strategic Partnerships:

- EDV supply agreement with Amazon (100,000 unit order)

- Joint venture with Volkswagen (gaining technical and financial support)

- Autonomous Driving Potential: The Rivian Assistant AI voice interface is scheduled to launch in early 2026, which may improve user experience [4]

- 2026 Catalysts: R2 mass production, Illinois factory commissioning, early delivery data verification [1]

- Risks: Q4 2025 financial report may be weak; “gap period” before R2 launch [1]

- Opportunities: A pullback in the stock price to the $15-$16 range may offer a better risk/reward ratio

- Q4 2025: Completion of factory validation construction

- H1 2026: R2 starts production and delivery

- Second Half of 2026: Reach meaningful delivery volume (50,000-100,000 units/year)

- 2028: Georgia factory commissioning, achieving economies of scale

- Changes in R2 pre-order volume

- Production ramp-up speed and quality issues

- Cash burn rate and financing needs

- Competitors’ pricing strategies

- Overall demand recovery in the EV market

[0] Gilin API Data - RIVN Real-Time Quotes, Company Profile, Financial Analysis, Technical Analysis

[1] MarketWatch - “Meet the best non-Tesla EV stocks of 2025” (https://www.morningstar.com/news/marketwatch/20251231201/meet-the-best-non-tesla-ev-stocks-of-2025)

[2] AInvest - “Rivian’s 2026 Scalability Inflection: Assessing the R2 Launch” (https://www.ainvest.com/news/rivian-2026-scalability-inflection-assessing-r2-launch-market-penetration-2601/)

[3] Forbes - “From Ford To Tesla, Big Electric Pickups Are A Tough Sell” (https://www.forbes.com/sites/current-climate/2025/12/22/from-ford-to-tesla-big-electric-pickups-are-a-tough-sell/)

[4] Eletric Vehicles - “Cantor ‘Very Encouraged’ After Rivian Autonomous Test Ride” (https://eletric-vehicles.com/rivian/cantor-very-encouraged-after-rivian-autonomous-test-ride-with-zero-interventions/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.