Valuation Risk Assessment Report for Shengtong Energy After Resumption of Trading

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

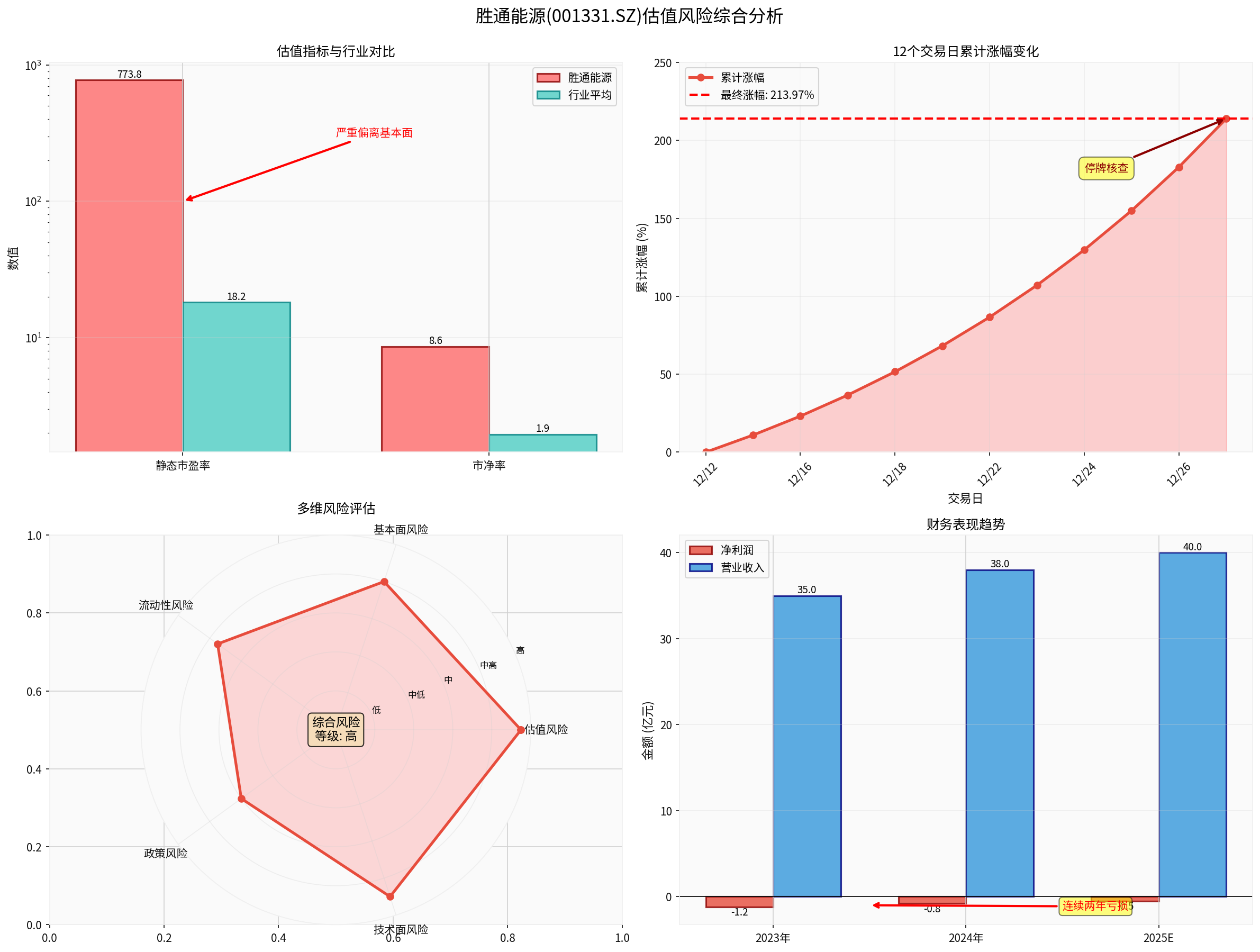

Based on company announcements and market data analysis, Shengtong Energy (001331.SZ) resumed trading after a 213.97% surge in its stock price between December 12 and 29, 2025, and investors face extremely high valuation risks. Below is a detailed analysis:

-

Shengtong Energy:

- Static P/E ratio: -773.81x (negative value means the company is in loss)

- PB ratio: 8.63x

- Stock price: 46.31 yuan/share

-

Gas Industry Average:

- Static P/E ratio: 18.20x

- PB ratio: 1.95x [1]

From the chart:

- 12 consecutive limit-up trading days, with a cumulative gain of 213.97%

- Showed a typical “one-word board” trend, indicating extremely exuberant market sentiment

- Suspension for verification: Suspended from December 30, expected to last no more than 3 trading days [3]

- 2023: Net profit loss of approximately 40 million yuan

- 2024: Net profit loss of 16.89 million yuan, operating revenue of 5.348 billion yuan

- 2025 First Three Quarters: Net profit turned positive to 44.39 million yuan, butnon-GAAP net profit was only 13.79 million yuan, down 20% YoY[5]

- The company’s main business is LNG procurement, transportation, and sales

- Affected by saturated LNG tank truck capacity and weak downstream demand

- IPO-funded projects “Comprehensive Logistics Park Construction Project” and “Logistics Informatization System Construction Project” have been delayed to the end of 2027 [6]

LNG trade business has the following characteristics:

- Low gross margin: Profit mainly relies on price differences

- High price volatility: Significantly affected by international natural gas market conditions

- Capital-intensive: Requires large capacity and storage investment

- Obvious cyclicality: Closely related to macroeconomics and energy demand

- Northeast Asia LNG spot price rose 28.4% YoY

- Domestic supply-demand fundamentals were sufficient in multiple periods, with prices supported by costs

- LNG consumption increased by only 6.1% YoY, with limited growth

- Agreement transfer: Acquire 29.99% of shares (84.64 million shares) at 13.28 yuan/share

- Partial tender offer: Acquire another 15% of shares (42.33 million shares) at the same price

- Total shareholding: 44.99%, becoming the controlling shareholder

- Transaction consideration: Approximately 1.686 billion yuan (calculated based on the agreement transfer part) [8]

- Transfer price of 13.28 yuan/share is far lower than the pre-suspension price of 46.31 yuan/share

- Market price is 248% higher than the transfer price, indicating speculation has seriously overdrawn future expectations

- The company clearly stated in the announcement: No involvement in robot business, no asset restructuring plan [9]

- Acquirer Qiteng Robot: No asset restructuring plan within the next 12 months

- No plan or arrangement for backdoor listing through the listed company within the next 36 months [10]

- Qiteng Robot’s acquisition funds are from “own funds and self-raised funds”

- Application for self-raised funds is still under approval, and success is uncertain [11]

- Original controller Wei Jisheng promised that existing businesses will remain profitable from 2026 to 2028

- However, the company has suffered consecutive losses, and the LNG business faces structural challenges

- Commitment compensation is only in cash, which does not affect the risk of stock price decline [12]

According to the radar chart analysis in the chart, Shengtong Energy faces the following five major risks:

- PB ratio is 4.4x the industry average

- Static P/E ratio is negative, and current stock price cannot be supported by traditional valuation methods

- Technical patterns show obvious bubble characteristics

- Consecutive losses for two years, main business under pressure

- Non-GAAP net profit continues to decline

- Delayed IPO-funded projects reflect difficulties in business expansion

- Resumption after suspension may face huge selling pressure

- Consecutive limit-ups have accumulated a large number of profit-taking positions

- Turnover rate soared to over 15% before suspension, with daily turnover approaching 1.1 billion yuan [13]

####4.4 Policy Risk (Risk Level:6.0/10,

- Shenzhen Stock Exchange has placed Shengtong Energy under key monitoring[14]

- Regulatory attention to possible “abnormal trading behaviors such as pulling/pressing prices and false declarations”

- Suspension for verification itself is a signal of regulatory intervention

####4.5 Technical Risk (Risk Level:9.0/10,

- 12 consecutive limit-up boards forming a “one-word board” trend

- Technical indicators are severely overbought

- Huge correction pressure after resumption

####5.1 For Investors Who Already Hold Shares

-

Valuation regression risk:

- Theoretical valuation range (based on industry average PB ratio of1.95x):

- Assuming net asset per share is approximately5.36 yuan (calculated from total share capital of282 million shares, market capitalization of13.071 billion yuan, PB ratio of8.63)

- Reasonable price range: 10-12 yuan/share(corresponding to PB ratio of1.9-2.2x)

- Current price of46.31 yuan has a 73%-82% downside space

- Theoretical valuation range (based on industry average PB ratio of1.95x):

-

Liquidity impact:

- Resumption day may see a limit-down

- Risk of consecutive limit-downs cannot be ignored

- Turnover rate soared to over15% before suspension, with daily turnover approaching1.1 billion yuan

-

Sentiment reversal:

- Market expectations shift from “change of control” to “fundamental reality”

- Exit of short-term speculative funds may lead to rapid price decline

####5.2 For观望 Investors

-

Wait for correction to reasonable range:

- Suggest waiting until the price falls to the 15-20 yuan range before considering

- Follow the actual progress of Qiteng Robot’s asset injection

-

Key signals to watch:

- Whether the company issues a major asset restructuring announcement

- Whether Qiteng Robot’s funds are in place

- Whether the 2025 annual report shows continuous improvement

-

Risk-reward ratio analysis:

- Upside: Successful restructuring (low probability)

- Downside: Valuation regression (73%-82%)

- Risk-reward ratio is severely imbalanced

####5.3 For Long-Term Value Investors

-

Tracking points:

- Whether the profitability of the LNG business improves

- Whether Qiteng Robot injects robot assets

- Whether the company successfully transforms

-

Investment logic:

- Current stock price is completely detached from fundamentals

- Obvious short-term speculative nature

- Does not conform to the value investment philosophy

- Robot company took over via share transfer

- Triggered consecutive limit-ups

- Existence of restructuring expectations

- Most cases saw significant price declines before restructuring was completed

- Only a few successfully transformed

- Retail investors generally suffered losses

####7.1 Core Conclusions

-

Severe valuation bubble: Current stock price seriously deviates from fundamentals, with a 73%-82% correction risk

-

No fundamental improvement: Consecutive losses, main business under pressure, major restructuring uncertainty

-

Obvious speculation: Price rise is completely based on control change expectations, not fundamental improvement

-

Increasing regulatory risk: Shenzhen Stock Exchange has placed it under key monitoring, which may trigger further regulatory measures

####7.2 Investment Recommendations

- Investors with low risk tolerance: Resolutely avoid, do not participate

- Existing investors: Reduce or clear positions after resumption

- Aggressive speculators: Even if participating, use minimal position size and strict stop-loss

“Currently, the company’s stock price has seriously deviated from the fundamentals of the listed company, and there is a risk of rapid decline in the future” — Shengtong Energy Announcement [15]

- Do not ignore fundamentals due to short-term gains

- Do not blindly chase concepts and expectations

- Strictly abide by risk management and stop-loss disciplines

[0] Gilin API Data

[1] Shengtong Energy Co., Ltd. Stock Trading Abnormal Fluctuation Announcement - Sina Finance (https://finance.sina.com.cn/roll/2025-12-22/doc-inhcrcmu9610236.shtml)

[2] Stock Price Surges Over 200% and Suspended for Verification! Shengtong Energy’s “Takeover by Robot Company” Triggers Hype - Daily Economic News (https://finance.sina.com.cn/roll/2025-12-30/doc-inhenvwe9994699.shtml?vt=4&pos=108)

[3] 12 Consecutive Limit-Ups for Shengtong Energy: Stock Suspended for Verification From Tomorrow - Securities Star (https://finance.stockstar.com/IG2025122900035674.shtml)

[4] Shandong Stock Observation | Seven Consecutive Limit-Ups Catalyzed by Takeover Expectations, Shengtong Energy’s Stock Price Seriously Deviates From Fundamentals - Jiemian News (https://finance.sina.com.cn/jjxw/2025-12-23/doc-inhctxhn8512988.shtml)

[5] Shengtong Energy Reissues Abnormal Fluctuation Announcement: No Involvement in Robot-Related Business - Securities Times (https://www.stcn.com/article/detail/3561365.html)

[6] Stock Price Surges Over 200% and Suspended for Verification! Shengtong Energy’s “Takeover by Robot Company” Triggers Hype - Daily Economic News (https://finance.sina.com.cn/roll/2025-12-30/doc-inhenvwe9994699.shtml?vt=4&pos=108)

[7] Shengtong Energy Co., Ltd. 2025 Semi-Annual Report Full Text - Shenzhen Stock Exchange (http://static.cninfo.com.cn/finalpage/2025-08-27/1224577470.PDF)

[8] Shengtong Energy: Stock Trading Risk Prompt and Suspension for Verification Announcement - Sina Finance (http://vip.stock.finance.sina.com.cn/corp/view/vCB_AllBulletinDetail.php?stockid=001331&id=11884900)

[9] Same as above

[10] Same as above

[11] Same as above

[12] Shengtong Energy’s 11 Consecutive Limit-Ups Push Price to 42 Yuan! Qiteng Robot’s 4 Billion Gamble on Backdoor Listing - Oriental Fortune (https://caifuhao.eastmoney.com/news/20251227184900031139450)

[13] Same as above

[14] Same as above

[15] Shengtong Energy Co., Ltd. Stock Trading Abnormal Fluctuation Announcement - Sina Finance (https://finance.sina.com.cn/roll/2025-12-22/doc-inhcrcmu9610236.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.