Analysis of the Strong Performance and Sustainability of Kaide Quartz (920179)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

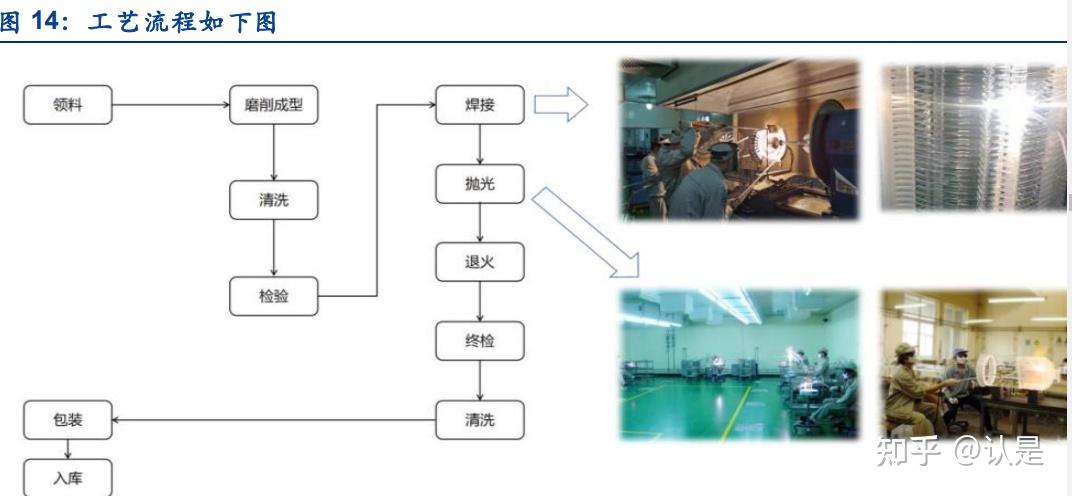

Kaide Quartz (Beijing Kaide Quartz Co., Ltd.) is the first “stock” of semiconductor quartz products listed on the Beijing Stock Exchange in March 2022. It focuses on the R&D, production and sales of quartz glass products (quartz instruments, quartz tubes, quartz boats, etc.) for semiconductor integrated circuit chips, photovoltaic solar energy and other fields. It is one of the few domestic enterprises with 8/12-inch semiconductor quartz product processing capabilities [0].

On January 5, 2026, Kaide Quartz (920179) closed at 47.28 yuan, with a daily increase of 22.36% and entered the Dragon and Tiger List. In terms of trading, the daily trading volume reached 10.8923 million shares, with a transaction amount of 477.42 million yuan; institutional investors bought a total of 11.1654 million yuan and net bought 6.5941 million yuan [0].

- Strong Business Growth: In the first half of 2025, the company’s semiconductor business revenue was about 150 million yuan, a year-on-year increase of 24.33%, which was the core growth driver [0].

- High-end Product Breakthrough: 12-inch semiconductor quartz products have obtained certification from key customers such as SMIC and Hua Hong Semiconductor, and orders are gradually increasing [0].

- Capacity Expansion: The subsidiary Kaide Xinbei focuses on high-end products such as 12-inch quartz bell jars and vertical boats, and is expected to release capacity in 2025; Kaimei Quartz (large-diameter high-quality quartz glass tubes, high-purity quartz sand), a joint venture with Tongmei Crystal, was officially put into production in March 2025 [0].

- Favorable Industry Environment: The global semiconductor quartz product market is expected to exceed 10 billion US dollars in 2025, and China contributes more than 40% of the capacity [0].

- Downstream Demand Driver: The expansion of the semiconductor industry leads to strong demand for quartz materials, and the company directly benefits as a leading domestic supplier [0].

- Independent and Controllable Opportunity: Under the trend of independent and controllable domestic semiconductor materials, the company has gained customer recognition by virtue of its technical advantages in 12-inch products [0].

- Institutional Capital Confidence: Significant institutional buying indicates professional investors’ confidence in the company’s fundamentals and industry status [0].

- The continuous growth of the semiconductor industry drives the expansion of demand for quartz materials [0];

- The release of 12-inch high-end product capacity and the increase in orders enhance performance flexibility [0];

- Policy support for independent and controllable domestic semiconductor materials [0].

- The global semiconductor quartz product market is highly competitive, and domestic enterprises face challenges from foreign brands [0];

- There are uncertainties in capacity expansion and new product promotion [0];

- Fluctuations in the price of raw materials such as quartz sand may affect cost control [0].

Kaide Quartz (920179)'s strong performance is jointly driven by industry demand, company fundamentals and institutional capital. In the short term, technical volume growth and institutional inflow provide momentum support; in the long term, it is necessary to closely monitor the rhythm of 12-inch product capacity release, downstream customer orders and the overall development trend of the semiconductor industry. Investors should evaluate its long-term investment value based on factors such as the company’s capacity expansion progress and industry competition pattern.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.