Impact Analysis of Cantor Fitzgerald Reaffirming Tesla's Overweight Rating

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and analyst reports, I will comprehensively analyze the impact of Cantor Fitzgerald reaffirming Tesla’s (TSLA) “Overweight” rating on the future stock price trend and valuation.

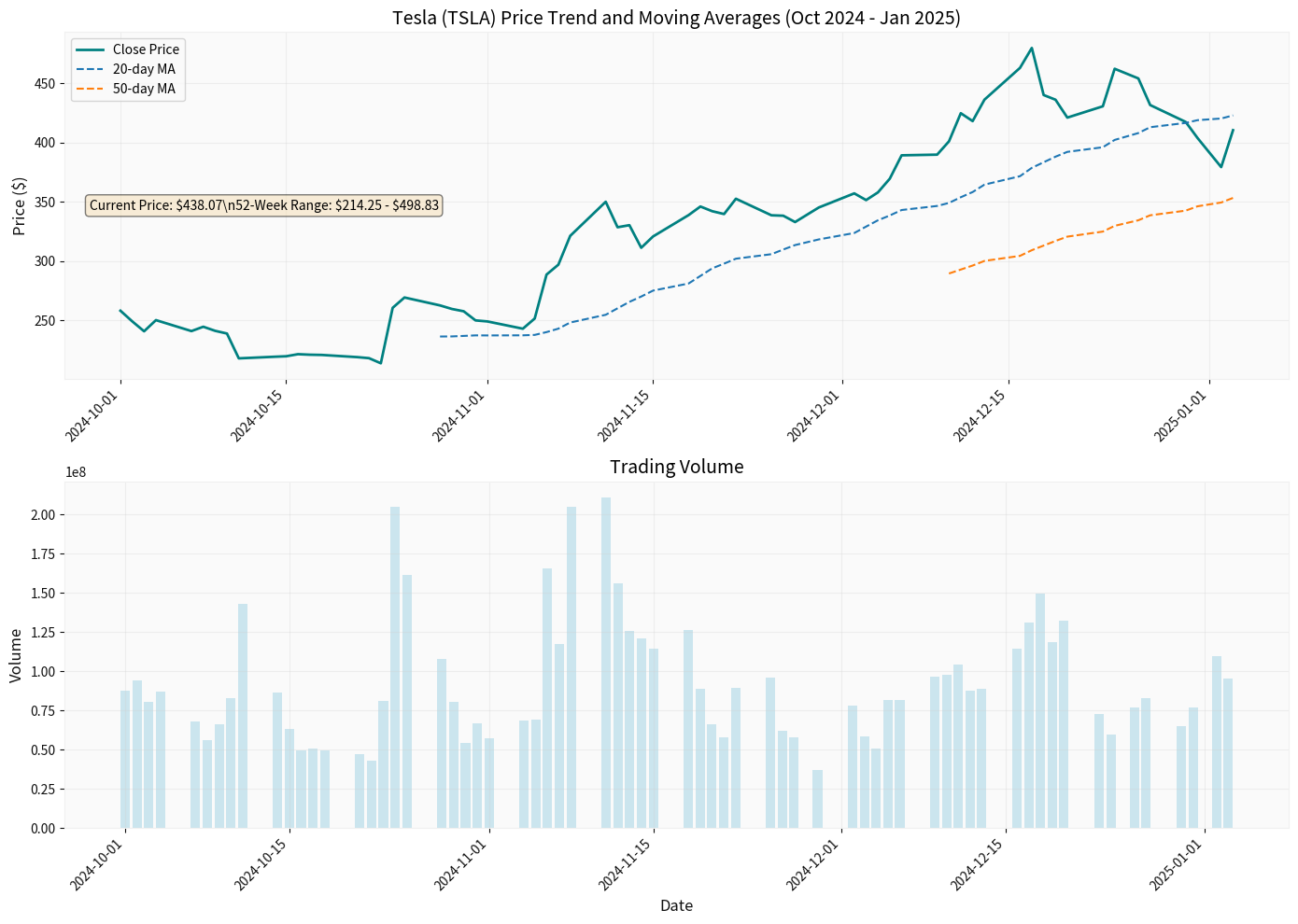

- Current Stock Price: $438.07 (down 2.59% today, -$11.65)

- 52-Week Price Range: $214.25 - $498.83

- Market Capitalization: $1.41 trillion

- P/E Ratio: 268.35x (extremely high valuation)

- EPS (TTM): $1.90

- 1 Day: -2.59%

- 5 Days: -3.95%

- 1 Month: -3.72%

- 3 Months: +1.92%

- 6 Months: +49.03%

- 1 Year: +6.57%

- 3 Years: +297.02%

The chart shows Tesla’s price trend from October 2024 to January 2025 and the 20-day/50-day moving averages. The current stock price fluctuates around $438 and is in a sideways consolidation state.

Cantor Fitzgerald maintaining the “Overweight” rating indicates that the institution believes Tesla’s stock has the following advantages[0]:

- Relative Industry Performance: Expected to outperform the average level of the automotive industry

- Long-term Growth Potential: Optimistic about its development prospects in electric vehicles, autonomous driving, and AI fields

- Innovation Leadership: Recognizes Tesla’s leading edge in technological innovation

- Consensus Rating: HOLD

- Average Target Price: $483.00 (10.3% upside from current price)

- Target Price Range: $300.00 - $600.00 (significant difference)

- Buy: 31 analysts (38.8%)

- Hold: 32 analysts (40.0%)

- Sell:17 analysts (21.2%)

- UBS: Maintains Sell rating, target price $247[1]

- Morgan Stanley: Downgraded to “Hold”, target price $425[2]

- Deutsche Bank: Maintains Buy rating, target price $500[1]

- Wedbush: Target price $600, optimistic about Robotaxi development[1]

- Canaccord Genuity: Maintains Buy rating, target price $551[1]

| Scenario | Intrinsic Value | Difference from Current Price |

|---|---|---|

| Conservative | $141.11 | -67.8% |

| Baseline | $147.25 | -66.4% |

| Optimistic | $188.20 | -57.0% |

- Revenue Growth Rate:32.7% (5-year average)

- EBITDA Margin:16.7%

- WACC:17.5% (high cost of capital)

- Beta Coefficient:1.88 (high volatility)

- P/E Ratio:268.35x (far higher than traditional automakers)

- P/B Ratio:17.68x

- EV/OCF:89.26x

- P/S Ratio:14.75x

- Return on Equity (ROE):6.91%

- Net Profit Margin:5.51%

- Operating Margin:4.74%

- Current Ratio:2.07 (good liquidity)

- Quick Ratio:1.67

###3. Discussion on Rationality of High Valuation

Although DCF model shows overvaluation, the reasons for market giving Tesla high valuation may include:

- Growth Expectations: Market expects Robotaxi and FSD to bring huge revenue

- AI Premium: Tesla is regarded as a leader in AI/autonomous driving field

- Network Effect: Autonomous driving data accumulation forms a moat

- Ecosystem Value: Synergy between energy storage, charging network and other businesses

- Trend State: Sideways consolidation

- Support Level:$398.29

- Resistance Level:$422.92

- MACD: No clear crossover, bearish bias

- KDJ: Bearish signal

- Beta Coefficient:1.88 (high volatility, significantly higher than market)

- Stock price oscillates in $398-$423 range

- Lack of clear directional trend

- Today’s 2.59% drop indicates short-term selling pressure

- Volume:85.54M, higher than average of 80.86M

###1. Short-term Impact (1-3 Months)

- Confidence Support: Well-known institution maintaining Overweight rating helps stabilize investor sentiment

- Counter Bearish Pressure: Provides fundamental support during stock price decline

- Attract Long-term Capital: Institutional investors may see this as a long-term holding signal

- Technical Weakness: MACD and KDJ indicators both show bearish signals[0]

- Valuation Pressure: Extremely high P/E ratio limits short-term upside

- Increased Competition: Fierce competition in Chinese and European EV markets

- Macroeconomy: High interest rate environment is unfavorable for high-valuation stocks

###2. Mid-term Impact (3-12 Months)

- Robotaxi Deployment: Commercialization progress of fully autonomous driving services

- FSD Technical Breakthrough: Technological advancement of autonomous driving system

- New Model Launch: Introduction of Model 2 or lower-priced models

- Energy Business Growth: Expansion of energy storage and solar businesses

- Chinese Market Performance: Changes in sales and market share in China

- Slowdown in Delivery Growth: Analysts worry about weak quarterly delivery growth

- Margin Pressure: Price wars and incentives affect profitability

- Regulatory Risk: Safety regulatory review faced by autonomous driving[1]

- Valuation Regression: Valuation may correct if growth is lower than expected

###3. Long-term Impact (1-3 Years)

If Tesla successfully achieves the following goals, valuation may be supported or even increased:

-

Robotaxi Business Model Validation

- FSD technology reaches L4/L5 level

- Large-scale operation of Robotaxi services

- Increased proportion of high-margin service revenue

-

AI and Autonomous Driving Ecosystem

- Data advantage transformed into technical barrier

- Software and service revenue becomes main growth engine

- Synergy with other AI applications

-

Energy Business Scaling

- Sustained growth in demand for Megapack and Powerwall

- Become global leader in energy storage market

- Synergy with electric vehicle business

###1. Response Strategies for Different Investors

- Cautiously Optimistic: Cantor Fitzgerald’s Overweight rating supports long-term holding logic

- Focus on Key Indicators: Progress of Robotaxi, FSD technical breakthroughs, growth of energy business

- Dollar-Cost Averaging: Buy in batches during corrections to reduce average cost

- Risk Reminder: Current valuation still needs strong performance support

- Technical Dominance: Focus on support level $398 and resistance level $423[0]

- Volatility Trading: Use high Beta of 1.88 for swing trading

- Event-driven: Next Q4 earnings report (February 4,2026) may bring volatility opportunities

- Stop-loss Setting: Strictly control below key support levels

- Allocation Weight: Consider moderate allocation given high valuation

- Hedging Strategy: Use options to hedge downside risk

- Long-term Perspective: Focus on the company’s strategic value in AI and autonomous driving fields

###2. Key Monitoring Indicators

| Indicator Category | Specific Indicator | Importance |

|---|---|---|

Operational Data |

Quarterly Deliveries | ★★★★★ |

Financial Data |

Automotive Gross Margin | ★★★★☆ |

Technical Progress |

FSD Mileage Data | ★★★★★ |

Regulatory Dynamics |

NHTSA Investigation Progress | ★★★★☆ |

Market Competition |

Chinese Market Share | ★★★★☆ |

Macroeconomic Environment |

Interest Rate Changes | ★★★☆☆ |

###3. Valuation Scenario Analysis

- Successful Robotaxi deployment, rapid growth of FSD subscription revenue

- 2025 delivery growth exceeds 20%

- Automotive gross margin recovers to over 20%

- Energy business revenue doubles

- Steady growth, deliveries maintain 10-15% growth

- FSD continues to invest but has limited short-term revenue

- Competitive pressure leads to margin compression

- Valuation gradually returns to rationality

- Delivery growth stagnates or declines

- Robotaxi commercialization falls short of expectations

- Price wars continue to worsen profitability

- Macroeconomic recession impacts demand

-

Short-term Sentiment Support: Provides confidence support during stock price corrections but is unlikely to fully reverse the technical weakness trend

-

Long-term Value Recognition: Indicates institutions still optimistic about Tesla’s long-term potential in AI and autonomous driving fields

-

Huge Valuation Disagreements: Wall Street has huge disagreements over Tesla’s valuation, with target prices ranging from $19 to $600, reflecting high uncertainty

-

Execution is Key: The rating itself will not change the stock price trend; the key is whether the company can deliver on Robotaxi and FSD expectations

- Valuation Risk: Current P/E ratio of 268x, huge correction pressure if growth is lower than expected

- Technical Risk: Robotaxi commercialization may face technical and regulatory obstacles

- Competition Risk: Traditional automakers and emerging competitors continue to increase investment

- Macroeconomic Risk: High interest rate environment is unfavorable for high-valuation stocks

- Current stock price already reflects a lot of optimistic expectations

- Short-term trend is more likely to be affected by technical factors and market sentiment

- Long-term investment value depends on actual progress of Robotaxi and FSD

- High volatility is suitable for investors with strong risk tolerance

- Existing holders can continue to hold but set stop-loss

- New investors wait for better entry opportunities (correction below $400)

- Focus on Q4 earnings report on February 4,2026 as an important verification point

- Long-term investors focus on Robotaxi commercialization progress rather than short-term fluctuations

[0] Jinling API Data (real-time stock price, financial indicators, technical analysis, DCF valuation)

[1] ts2.tech - “Tesla Stock News Today (Dec.24,2025)” (https://ts2.tech/en/tesla-stock-news-today-dec-24-2025-tsla-hovers-near-500-as-robotaxi-hype-meets-fresh-nhtsa-safety-probe/)

[2] ts2.tech - “Tesla Stock News and Forecasts for Dec.14,2025” (https://ts2.tech/en/tesla-stock-news-and-forecasts-for-dec-14-2025-robotaxi-countdown-sales-signals-and-wall-streets-targets-for-tsla/)

[3] Yahoo Finance - “Cantor Fitzgerald Maintains An Overweight Rating On…” (https://finance.yahoo.com/news/cantor-fitzgerald-maintains-overweight-rating-164742511.html)

[4] ts2.tech - “Tesla Stock (TSLA) News and Forecasts for Dec.20,2025” (https://ts2.tech/en/tesla-stock-tsla-news-and-forecasts-for-dec-20-2025-musks-pay-deal-reinstated-robotaxi-momentum-and-wall-streets-split-outlook/)

[5] Yahoo Finance - “Tesla stock drops as new Morgan Stanley analyst downgrades shares” (https://finance.yahoo.com/news/tesla-stock-drops-as-new-morgan-stanley-analyst-downgrades-shares-citing-valuation-164741776.html)

Note: This article’s data is based on market data as of January 5,2025. Stock prices and financial data may change with market fluctuations. Investors should make decisions based on their own risk tolerance and investment objectives.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.