Procore Technologies (PCOR): Stock Performance Drivers & Construction Industry Cycle Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

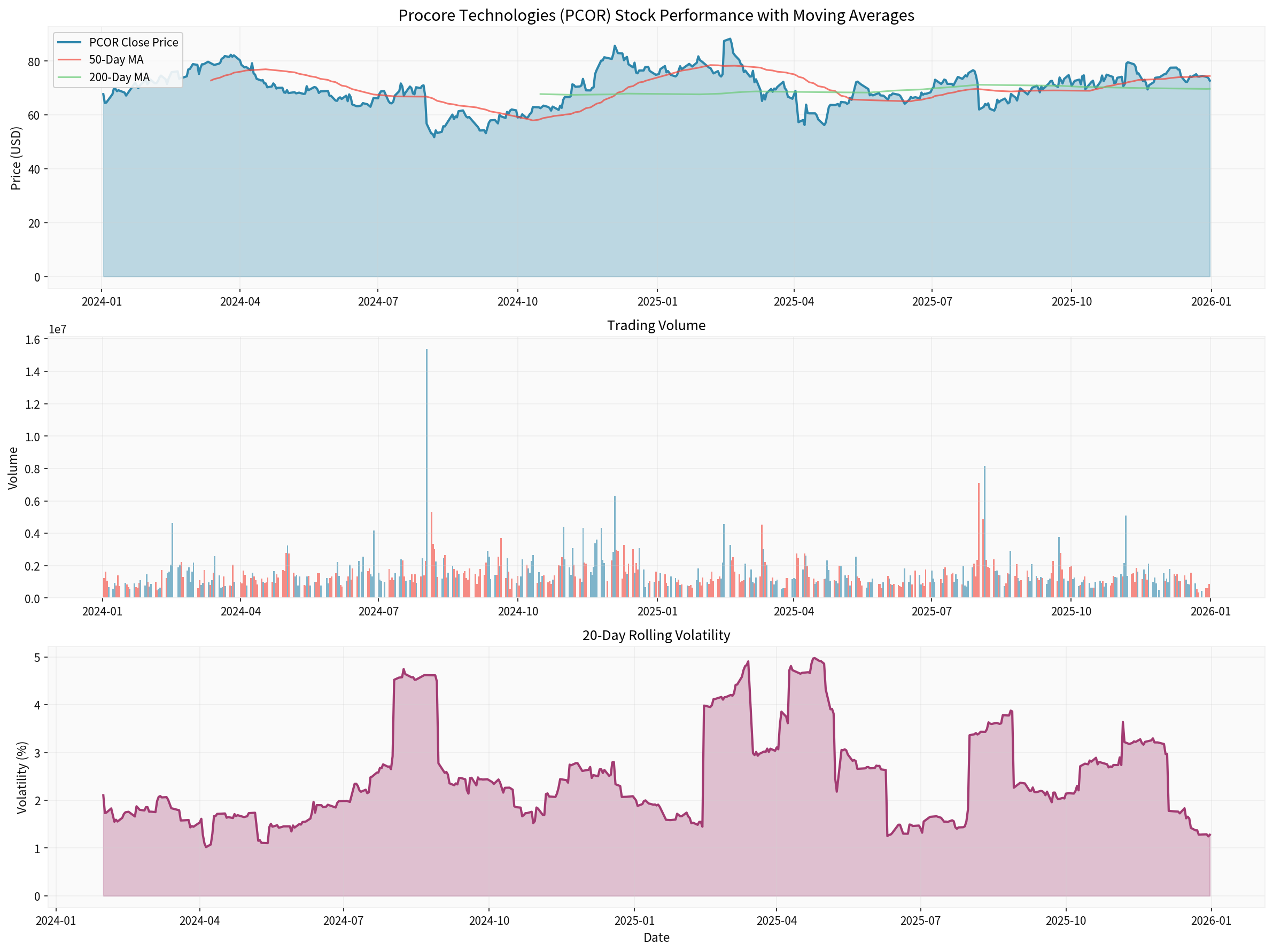

Chart: Procore’s stock performance over the past year shows volatility with a 7.40% return, trading between $51.74 and $88.33, with the stock currently below its 50-day moving average[0].

Barclays analyst Saket Kalia outlined three primary reasons for the upgrade[1]:

-

US Non-Residential Construction Recovery: Confidence in US non-residential construction performance for 2026, with rate cuts beginning in late 2024. Historical rate cut cycles show construction spending turning approximately2 years after rate cuts begin, then compounding for multiple years thereafter[1].

-

Revenue Growth Projections: Barclays assumes11% revenue growth in both FY26 and FY27, with an 8x EV/Sales multiple, justifying the $90 price target (approximately 22% upside from current levels)[1].

-

Construction Spending Multiplier Effect: Historical patterns demonstrate that construction spending compounds for multiple years following initial recoveries, creating sustained growth opportunities for construction software vendors[1].

- Consensus Rating: BUY (83.67 out of 100)

- Price Target: $86.00 (22.8% upside potential)[0]

- Rating Distribution: 14 Buy ratings (63.6%), 8 Hold ratings (36.4%), 0 Sell ratings[0]

Procore is the

- 7.4% market sharein the global construction applications market, ranking #1 among vendors[7]

- 1 trillion+ in annual construction volumecontracted across all global stakeholders on its platform[3]

- 17,501 organic customersas of Q2 2025, with 2,517 customers generating over $100,000 in ARR[3]

- 95% gross revenue retention rate, indicating strong customer loyalty[3]

- The global construction software market is valued at $10.64 billion in 2025and projected to reach$16.62 billion by 2030(9.33% CAGR)[5]

- Construction applications market expected to grow from $14.7 billion (2024) to $19.7 billion (2029)(6.1% CAGR)[7]

- Top 10 vendors control 46.5% of the total market, indicating consolidation opportunities[7]

Barclays’ analysis emphasizes a

Rate Cut Cycle Timeline:

Year 0 (2024): Rate cuts begin

Year 2 (2026): Construction spending inflection point

Year 3-5+: Multi-year compounding growth phase

According to industry forecasts for 2026[6]:

- Non-residential constructionexpected to grow 3% in 2026 (moderate but steady)

- Total non-residential constructionprojected to expand 4% in 2025 and 3% in 2026

- Key growth sectors: Data centers, manufacturing, education, healthcare, and public safety projects

- Challenges: Tariff uncertainty, labor shortages, and elevated material costs continue to pressure margins

- Gradual interest rate cuts in 2026 expected to improve financing conditions[6]

- Public infrastructure investments and megaproject funding increasing[6]

- Construction complexity driving technology adoption needs[5]

- High financing costs persist in multifamily segment despite GDP recovery[5]

- Smaller trade contractors find large-scale implementations risky[5]

- IT spending in AEC industry averages only 1-2% of revenue(vs. 3-5% industry average)[9]

Procore delivered strong Q3 2025 results[0]:

- EPS: $0.42 actual vs. $0.32 estimate (+30.07% surprise)

- Revenue: $338.85M actual vs. $328.28M estimate (+3.22% surprise)

- Revenue Growth: Consistent year-over-year expansion with Q3 2025 showing robust top-line growth[0]

| Period | EPS | Revenue | Growth Trajectory |

|---|---|---|---|

| Q3 FY2025 | $0.42 | $338.85M | Accelerating |

| Q2 FY2025 | $0.35 | $323.92M | Steady growth |

| Q1 FY2025 | $0.23 | $310.63M | Seasonal improvement |

| Q4 FY2024 | $0.01 | $302.05M | Baseline |

- Revenue Range: $1.312 - $1.314 billion (+14% YoY growth)

- Non-GAAP Operating Margin: Expected 14%

- United States: $288.74M (85.2% of revenue)

- International: $50.12M (14.8% of revenue)

The heavy US concentration provides leverage from domestic construction spending but also increases vulnerability to US economic cycles.

The construction industry is undergoing a significant digital transformation, with companies increasingly adopting software to address:

- Labor shortagesrequiring productivity improvements

- Project complexitydemanding sophisticated coordination tools

- Remote workpersistence necessitating real-time collaboration platforms[5]

Procore’s 2025 vision emphasizes AI-driven capabilities[4]:

- Predictive analyticsfor risk identification and mitigation

- Automated workflowsreducing manual processes

- Data-driven decision-makingbased on historical project insights

- Integration with BIM (Building Information Modeling)through acquisitions like Novorender and Flypaper Technologies[3]

- Cross-selling leverageimproving expansion booking contribution[3]

- International growthwith non-US market representing only 14.8% of revenue[0]

- Mid-market penetrationshowing strong growth momentum[3]

- Specialty contractor segmentoutperforming expectations[3]

- Interest rate movements and financing conditions

- Government infrastructure spending policies

- Commercial real estate market dynamics

- Tariff and trade policies affecting material costs[6]

- Intense competitionfrom Autodesk Construction Cloud, Oracle Construction & Engineering, and Bentley Systems[7]

- Market fragmentationwith 318 competitors in the project collaboration category[7]

- Technology adoption barriersin an industry traditionally slow to embrace digital transformation[9]

- Profitability managementwhile maintaining growth investments

- Customer acquisition costsin competitive bidding environments

- Retention challengesduring construction downturns

- Trend: SIDEWAYS (no clear directional signal)

- Support Level: $75.79

- Resistance Level: $78.41

- Beta: 0.9 (correlates closely with S&P 500)

- 50-Day MA: $74.65

- 200-Day MA: $69.74

| Metric | Value | Interpretation |

|---|---|---|

| P/E Ratio | -83.72x | Not profitable (GAAP) |

| P/S Ratio | 8.23x | Premium vs. software peers |

| P/B Ratio | 8.58x | High book value multiple |

| EV/OCF | 47.60x | Expensive on cash flow basis |

- Market leadership position

- High growth expectations (14%+ revenue growth)

- Path to profitability narrative (non-GAAP margins expanding to 14%)

- Long-term TAM expansion opportunity

- US non-residential construction accelerates in 2026 following rate cuts

- 11% revenue growth in FY26 and FY27 achieved[1]

- EV/S multiple sustained at 8x reflecting premium growth profile

- Gross retention remains above 95% while net new ARR growth outpaces revenue growth[3]

- Moderate construction spending growth (3-4% annually)

- 10-12% revenue growth trajectory

- Steady margin expansion toward profitability

- Market share gains in fragmented construction software market

- Construction spending recession deeper than anticipated

- Slower rate cuts or prolonged high-rate environment

- Competitive margin pressure impacting pricing power

- Economic slowdown delaying software purchasing decisions[5]

Procore Technologies represents a

- Timing Alignment: The 2-year lag from rate cuts to construction spending suggests2026 as the pivotal yearfor Procore’s growth acceleration[1]

- Structural Tailwinds: Construction software market growing at 6-9% CAGR with Procore outpacing through market share gains[5][7]

- Execution Capability: Strong Q3 earnings beat and raised guidance demonstrate operational momentum[0]

- Monthly construction spending data for inflection confirmation

- Customer acquisition and retention metrics

- Competitive dynamics in core markets

- Interest rate trajectory and impact on construction financing

For investors, Procore offers exposure to a

[0] 金灵API数据 - Procore Technologies (PCOR) company overview, financial metrics, technical analysis, and price data

[1] StreetInsider - “Barclays Upgrades Procore Technologies, Inc (PCOR) to Overweight” (https://www.streetinsider.com/Analyst+Comments/Barclays+Upgrades+Procore+Technologies%2C+Inc+(PCOR)+to+Overweight/25800114.html)

[2] Procore Technologies - “Procore Announces Third Quarter 2025 Financial Results” (https://investors.procore.com/news/news-details/2025/Procore-Announces-Third-Quarter-2025-Financial-Results/default.aspx)

[3] Investing.com - “Earnings call transcript: Procore Technologies Q3 2025” (https://www.investing.com/news/transcripts/earnings-call-transcript-procore-technologies-q3-2025-beats-eps-forecasts-93CH-4335922)

[4] Procore Blog - “Procore Leadership’s Vision for Construction in 2025” (https://www.procore.com/blog/driving-innovation-procore-leaderships-vision-for-construction-in-2025)

[5] Mordor Intelligence - “Construction Management Software Market Size, Growth” (https://www.mordorintelligence.com/industry-reports/construction-management-software-market)

[6] Window & Door Magazine - “2026 Construction Industry Forecast” (https://www.windowanddoor.com/article/2026-construction-industry-forecast)

[7] LinkedIn - Apps Run The World - “Construction Software Market to Reach $19.7B by 2029” (https://www.linkedin.com/posts/apps-run-the-world_construction-activity-7379496637389246464-kqPq)

[8] 6sense - “Procore - Market Share, Competitor Insights in Project Collaboration” (https://www.6sense.com/tech/project-collaboration/procore-market-share)

[9] McKinsey - “Accelerating growth in construction technology” (https://www.mckinsey.com/industries/private-capital/our-insights/from-start-up-to-scale-up-accelerating-growth-in-construction-technology)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.