Analysis of the Impact of Tier 2 Capital Bond Issuance by European Banks on Bank Stock Valuation and Investors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

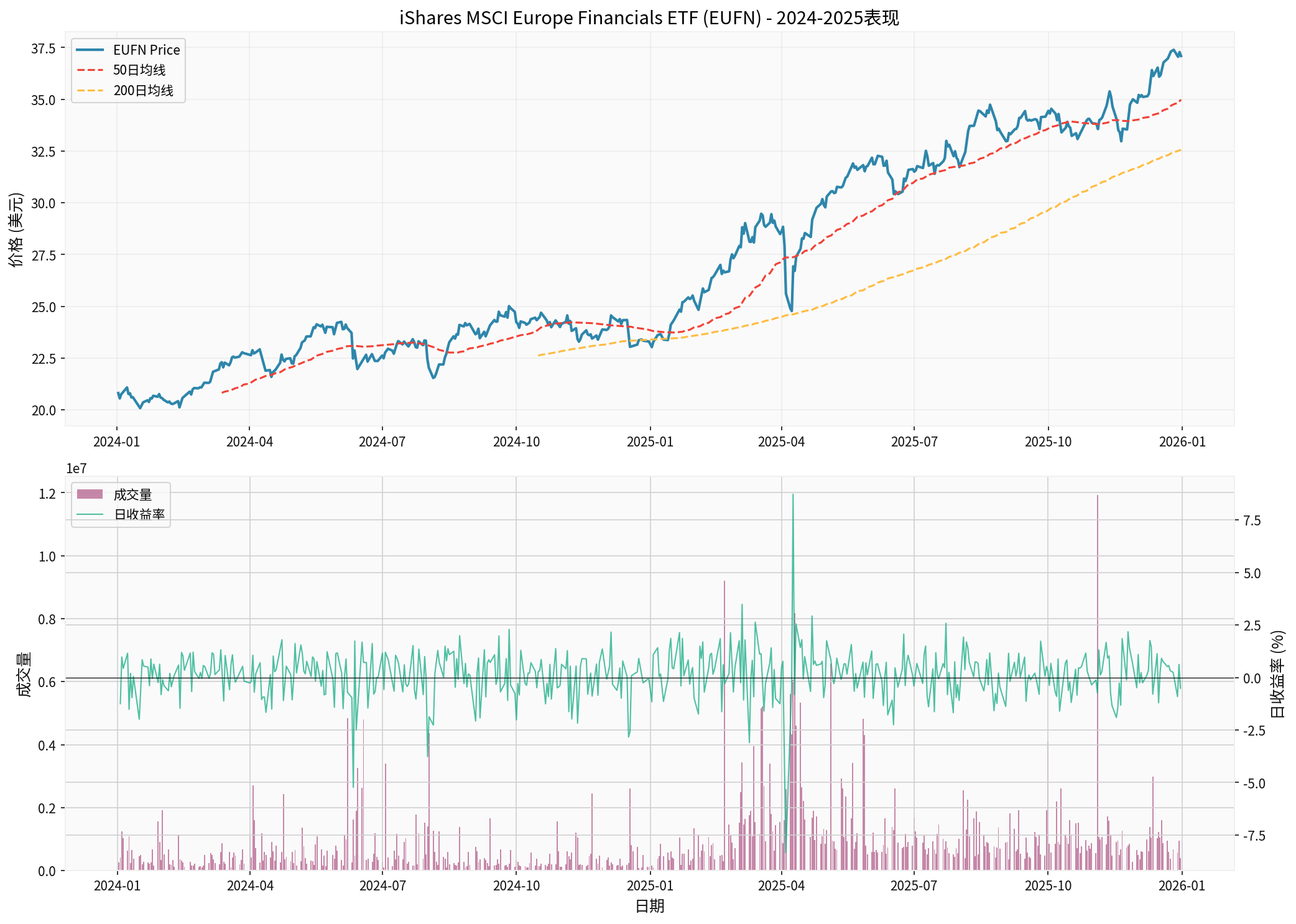

European bank stocks performed strongly between 2024 and 2025. The iShares MSCI Europe Financials ETF (EUFN) rose 78.23% throughout 2024, from $20.81 at the start of the year to $37.09 at the end [0]. As of January 5, 2026, EUFN traded at $37.53, up 1.19% from the previous day [0]. The ETF’s 52-week price range was $23.08-$37.56, indicating that the European banking sector is at a high level in recent years [0].

Chart Description: The chart above shows EUFN’s price trend (including 50-day and 200-day moving averages) and volume changes during 2024-2025. The price shows an obvious upward trend, and the volume increased at key price points, indicating that market attention to the European banking sector continues to rise.

The European banking sector performed excellently overall in 2025. The Stoxx 600 Index rose 16% for the year, and European bank stocks were one of the important drivers for the index to hit a record high. Even in the face of global macroeconomic headwinds, European bank stocks still showed strong resilience. Analysts pointed out that the stable interest rate environment, inflation and unemployment rates, and the continuously improving economic outlook put European bank stocks in a favorable position at the beginning of 2026 [1].

Tier 2 capital bonds are important tools for banks to supplement capital and meet regulatory capital requirements. Their core feature is that in the event of bank bankruptcy, the loss absorption order is secondary to common shareholders but superior to depositors and general creditors. According to the European Central Bank’s proposal in December 2025, regulators are considering adjusting the design of subordinated bonds including AT1 (Additional Tier 1) and Tier 2 to ensure they can absorb losses more effectively during bank crises and improve transparency for investors and lending institutions [3].

-

Reduce Financial Risk Premium:Supplementing capital through Tier 2 capital bond issuance can improve banks’ capital adequacy ratio and risk resistance capacity, reduce investors’ expectations of bank risks, thereby lowering the equity risk premium and helping to increase valuation levels. Taking European banks as an example, in the context of stable interest rates and stricter regulation in 2025, strengthening capital buffers was regarded by the market as a key factor in reducing tail risks and improving long-term stability [3].

-

Meet Regulatory Requirements and Unlock Growth Space:Continuous capital supplementation can help banks meet regulatory requirements under the Basel III framework and provide capital space for future business expansion (such as credit lending and balance sheet expansion). UBS previously faced pressure from higher local capital requirements; then Swiss lawmakers proposed allowing UBS to use AT1 bonds to cover part of the capital needs of its overseas institutions, thereby reducing pressure on equity financing [2]. After the proposal was announced, UBS’s share price rose to its highest level since 2008 [2].

-

Optimize Capital Structure and Leverage Level:Through reasonable-scale subordinated bond issuance, banks can optimize their capital structure and enhance financial flexibility while maintaining a reasonable leverage level, providing support for valuation repair and expansion.

-

Dilution Effect and Impact on ROE:Tier 2 capital bonds will increase the scale of interest-bearing liabilities and interest expenses. If the new capital is not efficiently allocated and generates corresponding returns, it may lower the return on equity (ROE), thus exerting certain pressure on valuation.

-

Investor Sentiment and Repricing:If the market interprets it as a signal of “capital tension” for banks, or has concerns about the pricing and solvency of subordinated bonds, it may trigger short-term stock price fluctuations. For example, some institutions repriced the credit risk of AT1 and Tier 2 instruments of some European banks between 2023 and 2024, leading to an upward trend in yields.

The increase in Tier 2 capital bond issuance is usually interpreted as a positive signal that banks are “proactively supplementing capital and strengthening resilience”. Against the backdrop of current European interest rates stabilizing at a high level and the regulatory environment gradually becoming clearer, the market is more inclined to view this move as banks prudently supplementing capital and leaving room for future growth and dividends. If pricing is stable and underwriting and market-making capabilities are strong (such as UBS providing pricing support services to other banks), it will help enhance market confidence and further reduce risk premiums [3].

-

Rebalancing of Returns and Risks:Tier 2 capital bonds usually offer higher yields than ordinary bonds to compensate for their higher risks (prior loss absorption order in bankruptcy, potential triggering of some clauses). In the current interest rate environment, such instruments are attractive to institutions and high-net-worth clients seeking higher returns.

-

Pricing and Liquidity:Pricing stability support provided by strong investment banks (such as UBS providing price stability services for Bank of Ireland’s €500 million Tier 2 capital bond in this transaction) helps reduce the risk of sharp price fluctuations after issuance, providing bond investors with more predictable liquidity and smoother secondary market performance.

-

Terms and Trigger Conditions:Investors need to carefully read the prospectus, pay attention to the term structure (such as whether it is redeemable, whether it can be written down or converted into shares), trigger conditions and loss absorption order to evaluate the actual risk-return matching degree.

-

Reassessment of Risk and Return:The supplementation of Tier 2 capital bonds helps improve banks’ capital buffers and stability, which has a positive effect on reducing expectations of systemic risks and tail risks, and is conducive to the upward shift of banks’ valuation centers in the long run. At the same time, if the new capital can be used for business expansion or to improve profitability, it is expected to support future EPS growth.

-

Sustainability of Dividends and Buybacks:Capital supplementation creates conditions for banks to maintain or increase dividends and buybacks, improving shareholder returns. However, over-reliance on subordinated bonds may increase leverage costs and refinancing pressure, so it is necessary to comprehensively balance capital costs and equity returns.

-

Focus on ROIC and Capital Efficiency:Investors should pay attention to where banks allocate new capital (asset allocation), whether they can achieve an attractive return on invested capital (ROIC), and the impact on overall ROE and profit quality.

-

Stable Pricing Attracts Investors:If Tier 2 capital bond pricing is stable and has low volatility, it will enhance the participation willingness of investors (especially insurance companies, pension funds, and high-net-worth clients), helping banks complete issuance at a lower yield level, thereby reducing overall financing costs.

-

Improve Issuance Success Rate and Rhythm:Stable pricing helps the market form expectations of the issuance “window period”, allowing banks to more calmly grasp favorable issuance timing and smooth the capital supplementation rhythm.

-

Diversify Capital Instruments:A stable Tier 2 capital bond market provides banks with supplementary capital instruments other than equity, helping to optimize the capital structure and balance the costs of equity and debt capital.

-

Enhance Refinancing Flexibility:Historical issuance records and pricing stability can provide market references for subsequent refinancing, reducing refinancing premiums. If the market recognizes the bank’s credit and Tier 2 capital instrument terms, the bank can conduct rolling financing at a lower cost.

-

More Forward-Looking Capital Planning:A stable Tier 2 capital bond pricing environment provides banks with clearer information on financing costs and term structures, helping them formulate longer-term capital planning and stress testing plans.

-

Meet Regulatory and Rating Requirements:In the evolution of Basel III and subsequent regulations, a stable subordinated bond market provides banks with an effective tool to meet regulatory and external rating requirements for capital adequacy ratio in the short term.

-

For Bank Stock Investors:Pay attention to the capital adequacy ratio, Tier 2/AT1 issuance scale and terms, and evaluate their comprehensive impact on ROE and valuation center; prioritize banks with sufficient capital, strong capital allocation capabilities, and stable or steadily improving shareholder returns.

-

For Tier 2 Capital Bond Investors:Focus on analyzing the issuer’s credit quality, term structure (trigger conditions, write-down/conversion mechanism), issuance scale and market depth, and refer to pricing stability and market-making capabilities (such as UBS’s role in this transaction) [2,3].

-

Comprehensive Risk-Return Balance:The increase in Tier 2 capital bond issuance is an important part of the European banking sector’s “supplementing capital, optimizing structure, and stabilizing expectations”. For banks, it can both strengthen capital buffers and bring cost and dilution pressures; for investors, it is a tool for risk-return rebalancing and asset allocation diversification.

[0] Gilin API Data - EUFN Price, Volume and Time Series Analysis

[1] Yahoo Finance/Bloomberg - “European Banks Drive Stoxx 600 to Record Year, Outpacing US Markets” (2025 European banking sector drove the Stoxx 600 Index to a record high, outperforming U.S. markets)

https://finance.yahoo.com/news/european-banks-drive-stoxx-600-164524483.html

[2] Reuters/Wall Street Journal - “UBS shares hit 17 year-high as Swiss lawmakers pitch capital compromise”

https://www.reuters.com/sustainability/boards-policy-regulation/swiss-lawmakers-pitch-compromise-capital-rules-ubs-2025-12-12/;

https://www.wsj.com/finance/ubs-shares-hit-multiyear-high-on-proposed-capital-rules-in-switzerland-c885e55d

[3] Bloomberg - “ECB Floats Tweaking AT1 Bank Capital to Better Absorb Losses”

https://www.bloomberg.com/news/articles/2025-12-11/ecb-floats-tweaking-banks-at1-capital-to-better-absorb-losses

[4] Bloomberg Professional - “EU Lawmakers to Weigh Easing Capital Rules on Safest Bank Bonds”

https://www.bloomberg.com/news/articles/2025-12-12/eu-lawmakers-to-weigh-easing-capital-rules-on-safest-bank-bonds

[5] Yahoo Finance - “US Loses Financing Edge as Asia Borrows in Euros”

https://finance.yahoo.com/news/us-loses-financing-edge-asia-182528928.html

[6] Yahoo Finance - “Coop Pank AS raises subordinated capital from the European Energy Efficiency Fund”

https://finance.yahoo.com/news/coop-pank-raises-subordinated-capital-160000821.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.