Mid-Session Market Analysis: Growth-Value Rotation Drives Divergent Performance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This midday market analysis reveals a significant divergence in US equity performance, driven by a pronounced rotation from growth to value sectors. The market dynamics reflect investor concerns about technology valuations and a shift toward defensive positioning ahead of potential economic uncertainties [0].

The Dow Jones Industrial Average demonstrates remarkable resilience with a +0.50% gain at 48,254.13, trading in a range between 48,015.79 and 48,431.57 [0]. In stark contrast, the technology-heavy Nasdaq Composite has declined -1.06% to 23,312.95, experiencing significant volatility with a range of 23,278.30 to 23,563.84 [0]. The S&P 500 sits between these extremes at -0.45% (6,837.20), while the Russell 2000 shows small-cap weakness at -0.28% (2,456.55) [0].

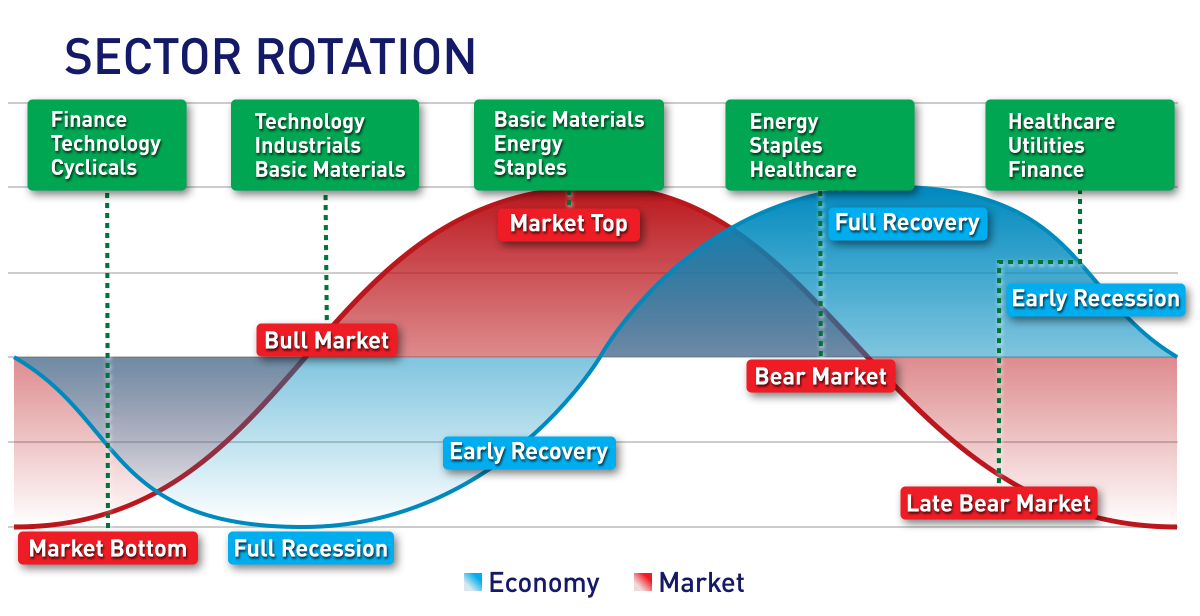

The performance divergence is clearly reflected in sector leadership. Healthcare (+0.60%) and Real Estate (+0.45%) emerge as the strongest performers, indicating defensive positioning [0]. Industrials show modest gains (+0.10%), while Technology (-1.35%), Consumer Cyclical (-1.41%), Energy (-1.26%), and Utilities (-1.11%) all face significant selling pressure [0]. This pattern suggests investors are rotating away from growth-oriented sectors toward more stable, dividend-paying alternatives.

Trading activity shows elevated participation in the technology sell-off, with Nasdaq volume reaching 3.51 billion shares [0]. S&P 500 volume stands at 1.08 billion shares, while Dow Jones volume remains relatively light at 199 million shares, consistent with typical blue-chip trading patterns [0].

Alphabet’s Waymo announcement regarding highway expansion of driverless taxi services in Los Angeles, Phoenix, and San Francisco represents a significant technological milestone [1]. This expansion to include San Jose International Airport marks a competitive development in the ride-hailing market that could have broader implications for transportation and technology sectors.

New York Fed President John Williams’ participation in the 2025 U.S. Treasury Market Conference adds potential market-moving catalyst [2]. While specific remarks aren’t yet available, Fed communications typically influence market sentiment, particularly regarding monetary policy outlook and Treasury market functioning.

The market continues to show robust merger and acquisition activity, with EBARA Corporation acquiring Mitsubishi Electric’s three-phase motor business [3]. Raymond James reported 125 defense and government M&A deals in Q3 2025, representing a 30% year-over-year increase [4], indicating continued corporate confidence despite market volatility.

Circle Internet Group’s exceptional Q3 2025 performance, with USDC circulation growing 108% year-over-year to $73.7 billion and revenue increasing 66% to $740 million, highlights the growing institutional adoption of digital assets [5]. The 202% increase in net income to $214 million suggests strong profitability in the crypto infrastructure space.

- Technology sector momentum may continue to weigh on broader market performance, with the Nasdaq’s significant decline suggesting persistent valuation concerns [0]

- Inflation concerns remain elevated, with investors showing sensitivity to price pressures through defensive sector rotation

- Geopolitical developments and Fed policy uncertainty could drive increased volatility, particularly as markets digest Williams’ Treasury conference remarks [2]

- Defensive sectors (healthcare, real estate) are demonstrating relative strength and may continue to attract capital [0]

- Quality large-cap stocks in the Dow are showing resilience during market stress [0]

- Crypto-related infrastructure companies may benefit from Circle’s strong results and broader digital asset adoption [5]

- Autonomous vehicle technology companies could see increased interest following Waymo’s expansion announcement [1]

Significant options positioning reveals mixed sentiment across sectors. Bearish activity in Lucid Motors (4,000 put contracts at $16 strike) contrasts with bullish bets on Seagate Technology (200 call contracts at $350 strike) and Canadian Solar (3,000 call contracts at $20 strike) [6]. Large positioning in TeraWulf (3,878 call contracts at $25 strike) suggests continued interest in cryptocurrency mining opportunities.

The midday session reflects a clear preference for value over growth, with investors rotating away from high-multiple technology stocks toward more defensive sectors. This rotation appears driven by concerns about technology valuations and uncertainty regarding upcoming economic data and Fed communications.

- S&P 500: Support at 6,829 (session low), resistance at 6,870 (session high) [0]

- Nasdaq: Critical support at 23,278, with 23,564 as near-term resistance [0]

- Dow Jones: Support at 48,015, resistance at 48,432 [0]

Market participants should monitor reactions to Williams’ Treasury conference remarks, potential breaks of key technical levels (particularly Nasdaq support), and continued sector rotation patterns [0][2]. Friday’s options expiration could also contribute to increased volatility as traders adjust positions.

Current market sentiment reflects cautious risk-off behavior, with the divergence between Dow strength and Nasdaq weakness suggesting investors are seeking quality and stability over growth potential. The elevated volume in technology stocks indicates significant repositioning, while defensive sector leadership suggests a preference for capital preservation during uncertain market conditions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.