Analysis of Popular Performance and Catalysts for Black Sesame Intelligence (02533.HK)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Stock Overview: Black Sesame Intelligence (02533.HK) mainly operates in the AI chip and intelligent driving fields. On January 5, 2026, its intraday price was HKD 20.92, and its Hong Kong market capitalization reached HKD 13.4 billion [1].

- Market Catalysts:

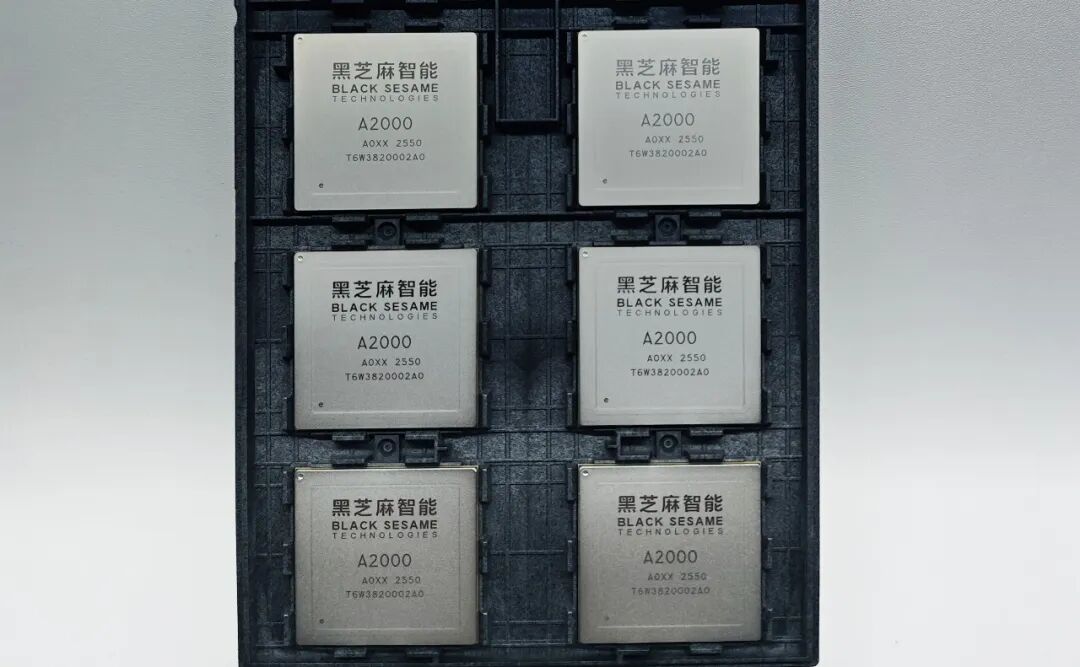

- Global sales approval for chips: On January 4, 2026, the company announced that its Huashan A2000 chip passed U.S. regulatory review and was approved for global sales, becoming the only domestic intelligent driving chip enterprise to obtain this qualification [2], breaking the sales restrictions in overseas markets.

- Acquisition of AI chip enterprise: Recently, it acquired a 60% stake in Zhuhai E-Zhi Electronic Technology for RMB 478 million. The latter focuses on the development and sales of cost-effective, low-power AI system-on-chips (SoCs), strengthening the company’s industrial chain layout [3].

- Price and Trading Volume Performance: On January 5, 2026, the stock price opened 5.58% higher, with an intraday high of HKD 21.08 and low of HKD 20.30. As of press time, the increase was 7.12%; the trading volume was 7.36 million shares, and the turnover was HKD 152.09 million, a significant increase compared to usual [1].

- Market Sentiment: Positive sentiment dominates. The chip approval event is regarded as a major positive for the international recognition of its technology. The acquisition further consolidates the company’s position, and related option varieties have risen by more than 40%, indicating strong bullish expectations [1].

- The Huashan A2000 chip passing U.S. regulatory review is a rare breakthrough for domestic intelligent driving chip enterprises in global market access, laying the foundation for the company to expand its overseas intelligent driving customer base.

- After acquiring Zhuhai E-Zhi Electronics, the company’s AI SoC product matrix will be more complete, covering high, medium, and low-power scenarios, which is expected to enhance market competitiveness and revenue growth points.

- The stock price rise accompanied by a significant increase in trading volume reflects the market’s confidence in the company’s technical strength and future development, with strong short-term momentum.

- Opportunities: Global sales approval opens up overseas market space, and the acquisition strengthens product layout; the AI chip and intelligent driving industry are in a high-growth stage, and the company is expected to benefit from industry dividends.

- Risks: There are uncertainties in the international technical regulatory environment, and subsequent policy changes need to be watched; the AI chip field is highly competitive, and there are challenges in product market share performance; the effect of acquisition integration and financial impact remain to be seen.

Black Sesame Intelligence (02533.HK) saw a significant stock price rise and increased trading volume on January 5, 2026, driven by two catalysts: global sales approval for chips and the acquisition of an AI chip enterprise, with positive market sentiment. The company’s breakthrough in global intelligent driving chip market access and strengthened product layout are core driving factors, but attention should be paid to regulatory, competitive, and integration risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.