Analysis of the Systematic Impact of Dual Drivers on the Asian Foreign Exchange Market and Allocation Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and macro background, this analysis systematically解析 the joint effect of Venezuela-related actions and the Bank of Japan’s interest rate hike expectations on the Asian foreign exchange market, and provides actionable currency allocation recommendations accordingly.

According to market data and web searches, the continuous pressure from the U.S. on Venezuela’s oil industry (sanctioning related companies and tankers) is an existing risk premium factor, but its direct impact on the Asian foreign exchange market is mainly reflected through emotional transmission to energy and commodity prices.

- Data Support: From October to December 2025, WTI crude oil price (CLUSD) fell from $62.46/bbl to $57.42/bbl, a drop of 8.07% with a daily volatility of 1.49%, indicating the market is more focused on the fundamental of oversupply [0]. Web searches also point out that geopolitical risks have not effectively pushed up oil prices, and supply is still seen as sufficient by the market [1].

- Transmission Mechanism: Asian net energy importers (e.g., India, Japan, South Korea) theoretically face pressure from imported inflation and deteriorating trade terms, but under the backdrop of falling oil prices from October to December 2025, the direct upward impact of this channel on exchange rates is limited.

- Indirect Impact: Geopolitical risks may affect emerging market currencies through risk appetite and capital flow channels; for example, when risk aversion rises, capital may flow out阶段性 from Asian emerging market currencies (KRW, INR).

The Bank of Japan raised interest rates to 0.75% in December 2025, and meeting minutes show that many members believe the real interest rate is still at a low level, with room for further hikes [2][3].

- Data Support: From October to December 2025, USD/JPY rose from 147.80 to 156.85 (+6.12%) with a daily volatility of 0.46%, indicating that despite the rate hike, the yen remained weak, reflecting market expectations for further hike pace and the persistent US-Japan interest rate differential [0].

- Policy Signal: The minutes show some members believe policy should be adjusted at a “every few months” pace; the market expects the next hike may be in 6 months, with a terminal rate around 1.25% [2].

- Market Reaction: The yen strengthened briefly after the hike but remained weak overall, indicating the market is cautious about the sustainability of the hike cycle.

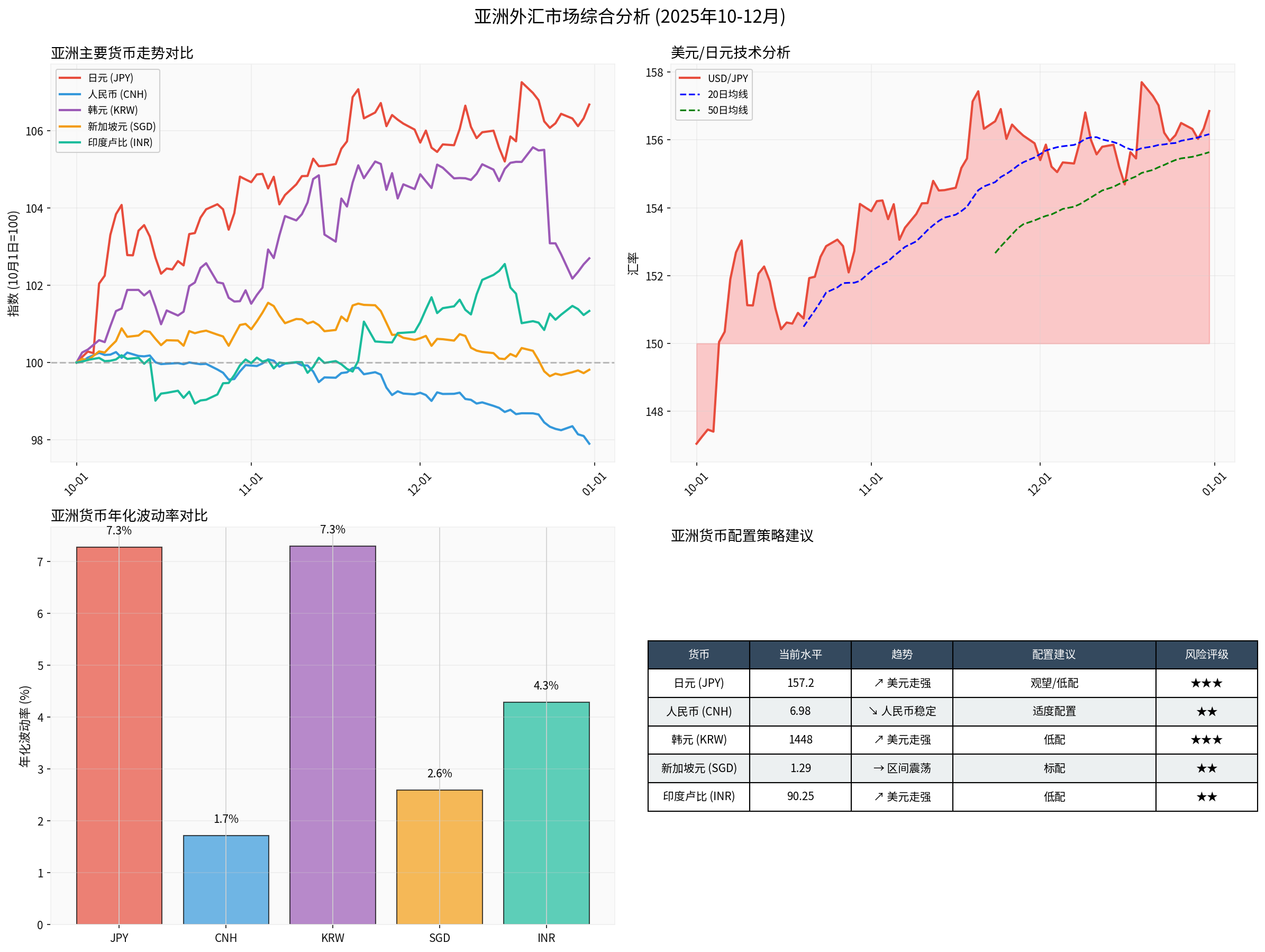

According to real-time data and historical performance, Asian currencies show obvious divergence:

- Weakest Currencies: The Japanese yen (JPY) depreciated 6.67% against the USD from October to December, with current USD/JPY around 157.21 [0][3]. The South Korean won (KRW) depreciated 2.69% against the USD over the same period, with current USD/KRW around 1448.16; the Bank of Korea governor once said the won’s depreciation was “seriously misaligned”, but data shows it remained relatively stable compared to other Asian currencies from October to December 2025 [0].

- Relatively Stable Currencies: The Chinese yuan (CNH) appreciated 2.10% against the USD from October to December, with current USDCNH around 6.98, indicating that the People’s Bank of China’s exchange rate stabilization measures have played a role in the current phase [0]. The Singapore dollar (SGD) was almost flat over the same period, with current USDSGD around 1.29, reflecting the stability of its policy framework [0].

- Middle-performing Currencies: The Indian rupee (INR) depreciated 1.33% against the USD from October to December, with current USDINR around 90.25, reflecting some capital outflow pressure but it remains relatively controllable [0].

The chart clearly shows: From October to December 2025, the yen depreciated the most, the yuan performed the strongest, and the won, Singapore dollar, and Indian rupee were in the middle, reflecting differences in central bank policies and economic fundamentals across countries.

Based on current data and market environment, the following tiered allocation strategy is recommended:

- Chinese Yuan (CNH): Moderate allocation. The People’s Bank of China has high policy flexibility; data shows the yuan was stable against the USD from October to December 2025 [0], and China’s economic growth target is relatively steady [4].

- Singapore Dollar (SGD): Standard allocation. As a regional financial center currency, its volatility is relatively low and policy transparency is high; data shows its exchange rate was stable from October to December 2025 [0].

- Japanese Yen (JPY): Cautious low allocation. Despite existing hike expectations, data shows the yen remains weak [0][3]; future trends depend highly on the Bank of Japan’s policy pace and the Fed’s rate cut expectation gap.

- South Korean Won (KRW): Low allocation. Geopolitical risks and verbal intervention by the Bank of Korea form short-term support, but data shows it still faces some depreciation pressure against the USD [0].

- Indian Rupee (INR): Low allocation. Falling oil prices theoretically benefit India’s trade terms, but data shows it still faces depreciation pressure against the USD [0]; close attention should be paid to foreign capital flows.

- Drivers Continue: Venezuela-related actions remain unchanged; oil prices oscillate at low levels; Bank of Japan raises rates moderately.

- Market Impact: Asian currencies maintain current divergence pattern; yuan and Singapore dollar remain relatively stable; yen and won continue to face pressure.

- Strategy Response: Maintain the above allocation recommendations; moderately increase the proportion of yuan and Singapore dollar.

- Drivers Strengthen: Geopolitical risks escalate; oil prices rebound above $65; Bank of Japan accelerates hike pace.

- Market Impact: Yen rebounds阶段性; emerging market currencies (KRW, INR) face pressure.

- Strategy Response:适当 increase yen allocation to neutral; reduce the proportion of high-beta currencies.

- Drivers Ease: Geopolitical risks ease; oil prices fall further; Bank of Japan maintains current policy.

- Market Impact: Asian currencies generally strengthen against the USD; carry trade restarts.

- Strategy Response: Increase the proportion of high-yield currencies (e.g., INR); reduce USD hedging.

-

Key Monitoring Indicators:

- USD/JPY 158 level (potential BOJ intervention level) [3]

- U.S. non-farm data and inflation trends (affect Fed rate cut expectations)

- China PMI and real estate data (affect yuan trends)

- Oil price突破 $65 (affect Indian rupee)

-

Execution Discipline:

- Single currency weight does not exceed 40%

- Maintain at least 20% cash or liquid assets

- Monthly rebalancing to avoid excessive concentration risk

-

Hedging Tools:

- Use USD/JPY options to hedge yen risk

- Consider NDIRS (Non-Deliverable Interest Rate Swaps) to manage yuan and won exposure

[0] Jinling API Data - Contains real-time quotes, historical prices, technical indicators and statistical indicators

[1] Yahoo Finance Hong Kong - “Energy After Hours: Oil Prices Oscillate in Low Range Before OPEC+ Meeting; Start of 2026 Sees Decline” (https://hk.finance.yahoo.com/news/能源盤後-opec-會議前-油價在低檔區間震盪-2026年開局走低-221651474.html)

[2] Yahoo Finance Hong Kong - “0.75% is Just the Start: Bank of Japan Minutes Reveal Real Interest Rate Still Low, Room for Further Hikes” (https://hk.finance.yahoo.com/news/0-75-只是起點-日銀會議紀錄透露-實質利率仍偏低-025207819.html)

[3] Yahoo Finance Hong Kong - “Weak Yen Pushes Up Import Costs; Leaders of Two Major Japanese Business Groups Urge Government to Act” (https://hk.finance.yahoo.com/news/日元疲弱推升進口成本-日本兩大商團領袖促政府出手-035109322.html)

[4] Yahoo Finance Hong Kong - “Weekly Market Review: Fed Internal Divisions; Xi Jinping Praises China’s Achievements” (https://hk.finance.yahoo.com/news/周市場回顧-聯儲會內部分歧-�¿�近平盛贊中國成就-解放軍圍台演習-052455765.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.