Horizon Capital Increase & Three AI Chip Companies Comparison

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

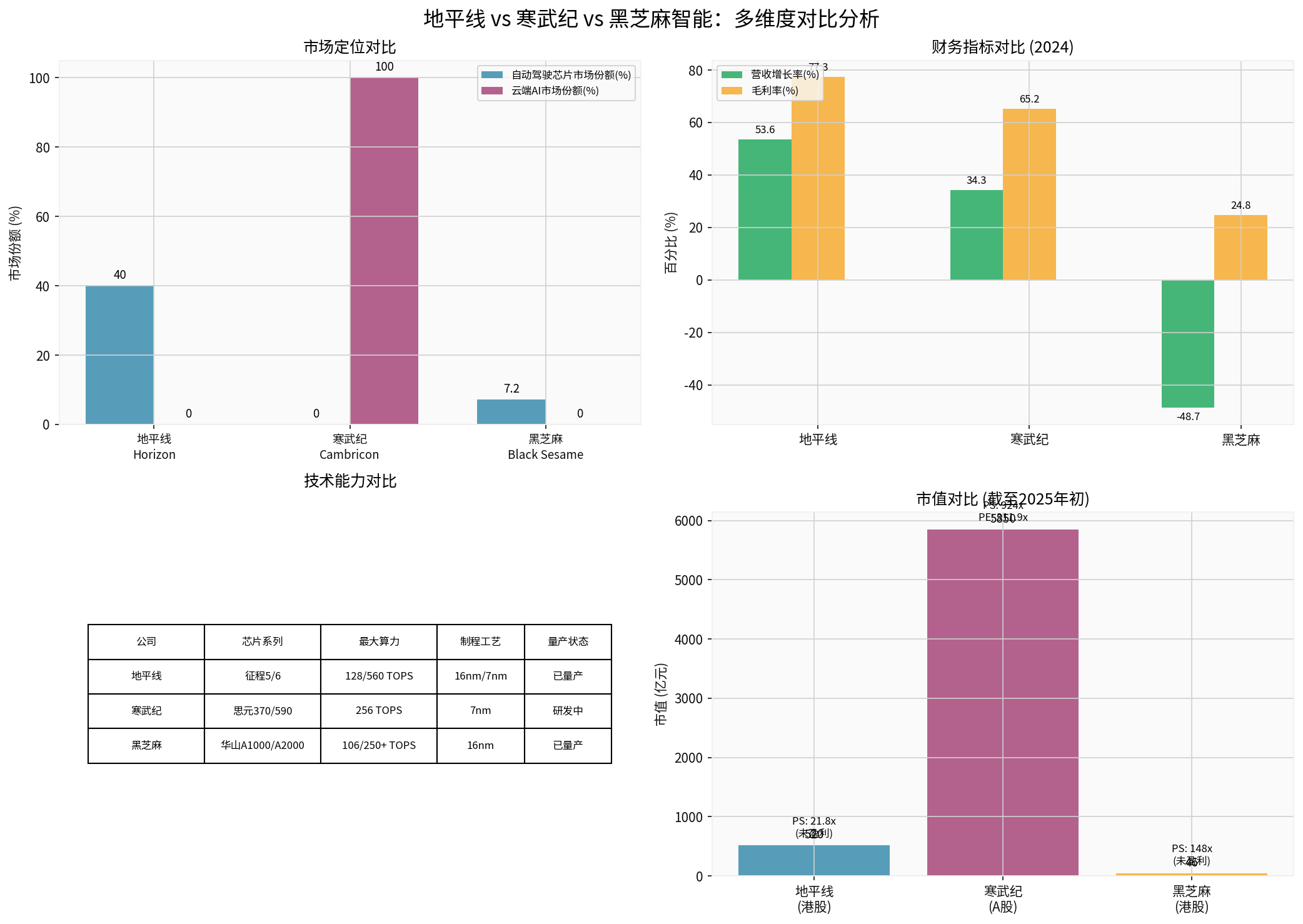

I will analyze the deep meaning behind Horizon’s capital increase and compare the three AI chip companies from three dimensions: strategic layout, competitive advantages, and valuation logic.

The registered capital of Horizon’s Shanghai subsidiary increased from 4 billion yuan to 6 billion yuan, a 50% increase. This significant capital increase occurred after the company’s listing on the Hong Kong Stock Exchange (stock code: 09660.HK), reflecting the following strategic intentions:

- Journey 6 Series Mass Production Preparation: Support the mass production of J6P chips (560 TOPS computing power). Under 1/2 sparse network, the equivalent computing power of this chip reaches 560 TOPS, surpassing NVIDIA Orin X’s 254 TOPS [1]

- Process Technology Breakthrough: Moving from 16nm to 7nm process, forming a echelon competition with Huawei MDC610 (400 TOPS) and NVIDIA Thor-Super (2000 TOPS) [1]

- Continuous Increase in R&D Investment: 2024 R&D expenditure reached 3.156 billion yuan, accounting for 132.4% of revenue, far exceeding the industry average [2]

- Market Share Breakthrough: Over 40% market share in China’s ADAS market, ranking second among independent third-party suppliers [2]

- Ecosystem Partner Expansion: The Journey 6 series is expected to be installed in more than 100 mid-to-high-end intelligent driving models, establishing in-depth cooperation with BYD, Chery, SAIC Group, Volkswagen Group, etc. [3]

- Cumulative Shipment Target: Plan to achieve cumulative shipments exceeding 10 million units in 2025, becoming the first autonomous driving chip company in China to reach this milestone [2]

- “Journey 6 Chip + Tian Gong Kai Wu Toolchain + Ta Ge Middleware” Technical Moat: Energy efficiency ratio reaches 5.6 TOPS/W, meeting full-stack needs from low-level to high-level intelligent driving [2]

- Horizon SuperDrive Solution: Expected to achieve large-scale mass production in Q3 2025, promoting transformation from a chip supplier to a full-stack solution provider [2]

- Growth of Authorization and Service Business: In 2024, this business revenue reached 1.647 billion yuan, a year-on-year increase of 70.9%, accounting for 69.1%, becoming the core engine driving revenue growth [2]

- Response to International Giants: NVIDIA Drive Orin-X installed 1.554 million units (32.6% market share), Tesla FSD chips 1.0131 million units (26.8% market share), together accounting for nearly 60% [3]

- Localization Advantage: Horizon, relying on localized services and technology ecosystem, forms a “twin stars” pattern with NVIDIA in the Chinese market [4]

- Geopolitical Factors: U.S. restrictions on advanced process chips accelerate domestic chip replacement, and Horizon’s capital increase is also an active response to this trend

- Focus Area: 100% focus on automotive intelligent driving, non-automotive business revenue accounts for only 3% [2]

- Product Coverage: From Journey 2 (4 TOPS) to Journey6P (560 TOPS), achieving full-scenario coverage from L2 to L4 [1]

- Mass Production Scale: 2024 product delivery volume reached 2.9 million units, cumulative 7.7 million units [2]

- Core Products: Si Yuan 290/370 series for cloud training; Si Yuan590 is under development with maximum computing power of 256 TOPS [5]

- Process Advantage: Adopts 7nm process; Si Yuan370 is Cambricon’s first AI chip using chiplet technology [5]

- Financial Performance: 2024 revenue 633 million yuan, net profit margin 33.53%, gross margin 65.2% [0]

- Valuation Level: Market capitalization 585 billion yuan, P/E ratio 311.9x, P/S ratio 924x [0]

- Product Series: Huashan series high-computing SoC (autonomous driving) and Wudang series cross-domain SoC (cockpit and driving integration) [6]

- Shipment Scale: By the end of 2023, Huashan series chips had a total shipment of over 152,000 units, accounting for 7.2% of China’s high-computing SoC market [6]

- Financial Pressure: H1 2024 revenue 31 million yuan, down 48.7% YoY; gross margin dropped from 50.0% to 24.8% [7]

| Dimension | Horizon | Cambricon | Black Sesame Intelligence |

|---|---|---|---|

Flagship Chip |

Journey6P (560 TOPS) | Si Yuan370 (256 TOPS) | Huashan A2000 (250+ TOPS) |

Process Technology |

16nm/7nm | 7nm | 16nm |

Mass Production Status |

Mass-produced (2.9 million units) | In R&D | Mass-produced (152,000 units) |

Core Technology |

BPU Architecture (4th iteration) | Chiplet Technology | Self-developed ISP and NPU |

- Horizon Journey6P’s 560 TOPS computing power is actually far higher than the combined computing power of 4 Orin chips (limited by in-vehicle Ethernet bandwidth, the computing power of 4 Orin chips is only 1.2x that of a single Orin, about 300 TOPS) [1]

- Cambricon has first-mover advantage in cloud training market, but faces fierce competition from Huawei Ascend, Hygon Information, etc. [5]

- Black Sesame Intelligence’s Wudang series is the first domestic cockpit-driving integrated chip, but the mass production progress after the 2024 A2000 launch still needs to be observed [6]

- Authorization Model: Through IP licensing and technical service output, the gross margin of authorization and service business reached 92% in 2024 [2]

- Ecosystem Cooperation: Over 50 ecosystem partners launched pre-mass production products based on Journey6E/M [1]

- Deep Customer Binding: Accounts for 79.44% share in Li Auto Pro version, but also shows certain customer dependence [8]

- Revenue Structure: Q3 2024 revenue 173 million USD, mainly from cloud training chips and edge computing products [0]

- Market Position: Leading position in domestic cloud AI chip market, but faces “winner takes all” market pattern [9]

- Cooperation Model: Cooperates with leading customers like Geely, BYD, Dongfeng, FAW, but does not disclose specific fixed-model quantities [7]

- Challenges: Gross margin dropped sharply by 25.2 percentage points to 24.8%, reflecting fierce price competition and insufficient scale effect [7]

| Company | Market Cap (100 million yuan) | P/S Ratio | P/E Ratio | Profit Status |

|---|---|---|---|---|

| Horizon | 520 | 21.8x | N/A | Loss |

| Cambricon | 5,850 | 924x | 311.9x | Profit |

| Black Sesame Intelligence | 46 | 148x | N/A | Loss |

- High Growth Expectation: 2024 revenue growth 53.6%, three-year CAGR 72.19% [2]

- Market Space: China’s ADAS market is expected to increase from 1.9747 million units (penetration rate 8.62%) in 2024 to 5-6 million units (penetration rate 30%) in 2025 [2]

- Technology Premium: 77.3% gross margin (exceeding NVIDIA’s 60-70%) reflects high proportion of soft revenue and large-scale mass production capability [2]

- Valuation Rationality: P/S 21.8x is relatively reasonable compared to high growth and leading market share

- Mystery of High PE: 311.9x PE reflects market’s optimistic expectation for its long-term profitability [0]

- Excessively High PS: 924x PS far exceeds Horizon, mainly due to:

- A-share liquidity premium (2024 stock price increase 356.62%) [0]

- Cloud AI chip market dominated by NVIDIA (82.5% global share), huge domestic replacement space [3]

- Presence of competitors like Huawei Ascend, Hygon Information limits its pricing power [5]

- Valuation Risk: 2024 free cash flow -1.984 billion yuan, facing capital pressure [0]

- Market Cap Shrinkage: From nearly 30 billion yuan in private equity financing to 15 billion HKD (about 13.5 billion yuan) [5]

- PS148x Still High: Considering 48.7% revenue decline and sharp gross margin drop, valuation support is insufficient [7]

- Stagnant Growth: Revenue decline, gross margin drop, and difficulty in customer development reflect its “difficult to expand customers” dilemma [7]

- Horizon: Journey6 mass production is imminent, leading market share, high growth certainty

- Cambricon: Benefits from AI computing power demand growth, but overvaluation needs performance digestion

- Black Sesame Intelligence: Faces performance pressure and intensified competition, need to observe A2000 mass production progress

- Horizon: Integrated software and hardware ecosystem completed, expected to become “China’s Mobileye”

- Cambricon: Fierce competition in cloud AI chip market, need to break through encirclement by Huawei, Hygon, etc.

- Black Sesame Intelligence: If cockpit-driving integration trend is established, there is reversal possibility, but risk is high

- First echelon: NVIDIA (32.6% market share), Tesla (26.8%)

- Domestic leading: Horizon (8.0% market share), Huawei (9.6% market share) [3]

- Catch-up: Black Sesame Intelligence, Xuchip Technology, etc.

- Horizon: Journey6 series mass production progress and customer expansion

- Cambricon: Si Yuan590 R&D progress and market share increase

- Black Sesame Intelligence: A2000 mass production progress and gross margin recovery

[0] 金灵API数据 - 寒武纪(688256.SS)公司概况、财务分析、股价数据

[1] 地平线征程J6系列芯片深度分析 - 佐思汽研

[2] 地平线2024年报分析 - 芝能汽车/新浪财经

[3] 2024自动驾驶芯片年终盘点 - Supplyframe四方维

[4] 中国AI算力芯片独角兽分析 - 雪球

[5] 国产AI算力芯片全景图 - 民生证券

[6] 黑芝麻智能华山芯片技术分析 - 公司官网

[7] 黑芝麻智能半年报分析 - DoNews

[8] 剖析2024年中国市场智驾芯片市场 - 新浪财经

[9] 黑芝麻智能有望打破高通对CDC芯片的垄断 - 国泰君安国际

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.