Impact Analysis of Dolby Laboratories' Partnership with Douyin (Based on Verifiable Data)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the official announcement by both parties on January 5, 2026 [1]:

- Current coverage: iOS users can upload and watch Dolby Vision videos via the Douyin App, and use Douyin’s built-in editing tools or third-party tools that support Dolby Vision (e.g., CapCut) for content creation

- Future plans: Support for more device types will be rolled out gradually, with Android support coming soon

- Technical features: Dolby Vision optimizes the color, brightness, and contrast of each frame using dynamic metadata to achieve more realistic and rich image details

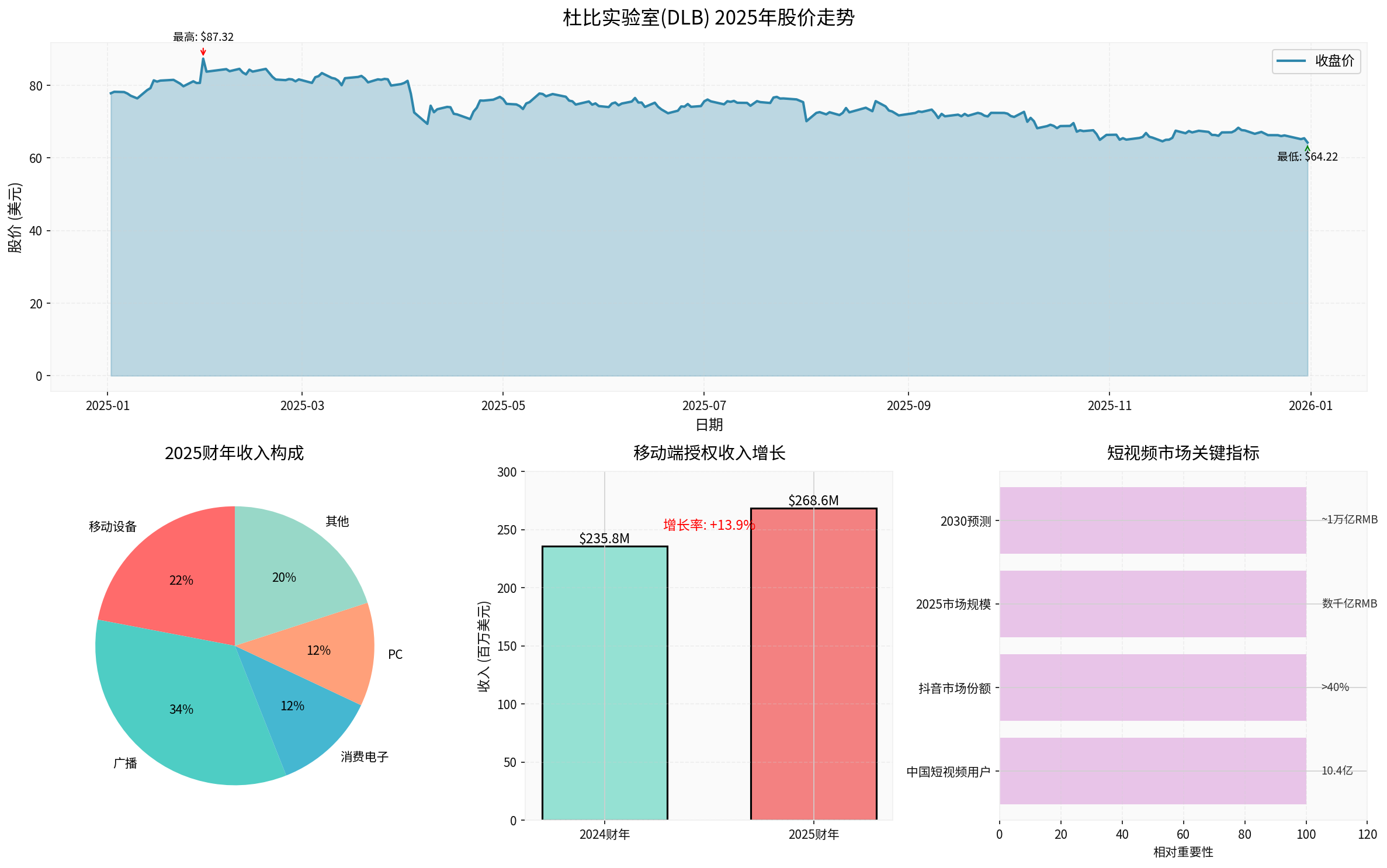

According to Dolby’s officially disclosed revenue structure for FY2025 (ending September 26, 2025) [0][4]:

- By segment (FY2025): Mobile revenue was approximately $268.6 million, accounting for about 22% of total licensing revenue (FY2024: ~$235.8 million, ~20% share), with a year-over-year growth of ~14%, ranking among the top in terms of growth rate among major segments

- By segment (Q4 FY2025, single quarter): Mobile revenue was approximately $50.63 million, accounting for ~18%

- Note: Mobile has become the second-largest segment in Dolby’s licensing business with rapid growth, but currently, the company’s mobile revenue still mainly comes from full-device licensing of end devices like smartphones and content service implementation; this partnership with Douyin is an expansion at the application/content distribution level, and its specific revenue contribution has not been separately disclosed in public financial reports

- Users and traffic: Douyin accounts for a significant share of user time in China (~50.8%) [2]; as of 2024, China’s short video users are approximately 1.04 billion, with a usage rate of ~93.8% [2]; partnering with Douyin helps Dolby Vision reach creators and audiences more widely

- Technical benchmark status: Dolby Vision is widely regarded as one of the industry’s image quality benchmarks; the partnership can provide the platform with a more consistent and predictable creation and viewing experience [1]

- Potential impact: The short-term direct impact on DLB’s revenue and profits is limited, mostly reflected in brand and ecosystem extension; in the medium to long term, if more devices and platforms follow suit, it may expand the upper limit of mobile licensing revenue, but it takes time to implement and scale

- Current market capitalization is approximately $6.09 billion [0]; FY2025 licensing revenue is about $1.248 billion, of which mobile accounts for ~$268.6 million [0][4]

- Profitability and financial health: Net profit margin is ~18.90%, operating profit margin ~20.34%, with abundant cash and low debt risk [0]

- Market expectations: The next earnings date is February 4, 2026 (Q1 FY2026) [0]; given that the partnership is in the phase of iOS launch and Android support pending, the quantifiable contribution of this collaboration to short-term performance is limited, mostly reflecting ecosystem and long-term layout

- Image quality standard: Dolby Vision’s dynamic metadata approach adapts display on different screens, allowing creators to focus more on storytelling and color expression rather than output adaptation [1]

- Creator toolchain: Integration with Douyin’s built-in tools and third-party tools like CapCut can lower the threshold for producing and distributing high-quality HDR content, pushing UGC toward more professional production standards

- Competitive impact: If Dolby Vision becomes a priority/recommended creation standard on leading short video platforms, it may accelerate competition and upgrades among platforms for HDR capabilities

- Upstream chips and devices: Dolby Vision has been implemented on many high-end smartphones, displays, and content platforms; if this partnership expands device coverage, it may further promote terminal manufacturers and chip vendors to adapt and select technologies like HDR10+ and Dolby Vision

- Downstream content ecosystem: Support from more platforms helps form a unified HDR content production and delivery chain, improving consistent experience across platforms/devices

- Competing technologies: Technologies like HDR10+/HLG have a wide foundation in cost and ecosystem; Dolby Vision needs to consolidate premium pricing and ecological barriers through platform/terminal partnerships and content depth

- Douyin’s globalization: Douyin’s overseas version has different content strategies and device ecosystems in various markets; whether the partnership can be replicated globally depends on subsequent product and commercialization progress on the platform side

- Actual impact on user behavior: Whether higher image quality standards and tool thresholds can significantly increase user duration, retention, and willingness to pay depends on content supply and operational guidance, which requires time to observe

- Device fragmentation: Dolby Vision requires collaborative support from terminals and content links; popularization of mid-to-low-end devices still takes time, which may affect the scale of content consumption

- Content production threshold: The HDR production process still has learning and computing power costs for some creators; platforms need to continuously provide tool and operational support

- Regional and compliance issues: In some markets, content compliance and copyright management have higher requirements for distribution review of HD/UGC content, which may affect the pace of technology implementation

- Short-term (6–12 months): Direct financial pull for DLB is limited; more focused on ecosystem and brand building. Douyin’s iOS launch is the first phase, and Android support and more device coverage are key observation points

- Medium-term (1–3 years): If the partnership expands to more regions/platforms and builds content depth, mobile licensing revenue is expected to benefit continuously, but it depends on terminal coverage and content creation willingness

- Long-term: If Dolby Vision can establish a positive cycle of “benchmark experience—content supply—platform distribution—terminal support” in the mobile short video field, it will enhance its technical voice and bargaining power in the mobile segment, and promote the upgrading of the industry’s overall HDR capabilities

[0] Gilin API Data (Company Overview, Financial Analysis, Stock Price & Technical Analysis, Real-Time Quotes)

[1] PChome News - Dolby and Douyin Partner: Now You Can Create and Share Videos Using Dolby Vision

https://article.pchome.net/content-2192420.html

[2] Qianzhan Industry Research Institute - 2025 China Short Video Industry Panoramic Map (Including Market Status, Competitive Landscape, and Scale Forecast)

https://www.qianzhan.com/analyst/detail/220/250430-b72455dd.html

[3] Shuoyuan Consulting - 2025 China Short Video Industry Market Insight Report

https://www.fxbaogao.com/detail/5069230

[4] Yahoo Finance / Dolby IR - Dolby Laboratories Reports Fourth Quarter and Fiscal Year 2025 Financial Results

https://finance.yahoo.com/news/dolby-laboratories-reports-fourth-quarter-211500083.html

- Top left: DLB’s full-year 2025 stock price trend (closing price with filled shadow); data covers January 1 to December 31, 2025 [0]

- Top right: FY2025 licensing revenue composition by segment (Broadcast/Mobile/Consumer Electronics/PC/Other); mobile accounts for 22% [0][4]

- Middle bottom: FY2024 vs FY2025 mobile licensing revenue comparison (~$235.8M → ~$268.6M, YoY growth ~+14%) [0][4]

- Bottom right: Key indicators of China’s short video market (user scale, Douyin market share, 2025 and 2030 market size forecasts); user and share data from [2], size forecasts from [3]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.