Investment Analysis and Sustainability Assessment of the Brain-Computer Interface (BCI) Concept

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The industry uses a classification similar to autonomous driving:

- L1: Real-time motion decoding

- L2: Real-time language decoding

- L3: Visual decoding

- L4: Emotion, memory, cognitive decoding [1]

- By 2025, 12 severely paralyzed patients have received implants and are actively using them

- Single electrode implantation time reduced from 17 seconds to 1.5 seconds, implantation depth突破50 mm

- Plans to launch “high-volume production” of BCI devices in 2026 and shift to “almost fully automated surgical procedures” [2][3]

- Completed the world’s first real-time Chinese language decoding, with speech rate reaching one-third of normal people’s level

- Successfully completed clinical trials of China’s first “three-full” (full implantation, full wireless, full functionality) BCI product

- Brain-controlled decoding rate reaches 5.2 bits per second, equivalent to international top levels

- Has completed 54 BCI human implantations, ranking first globally [1]

China has included BCI in the key priorities of the 15th Five-Year Plan, proposing to “explore diversified technical routes, typical application scenarios, feasible business models, and market supervision rules” to promote it as a new economic growth point [1][4].

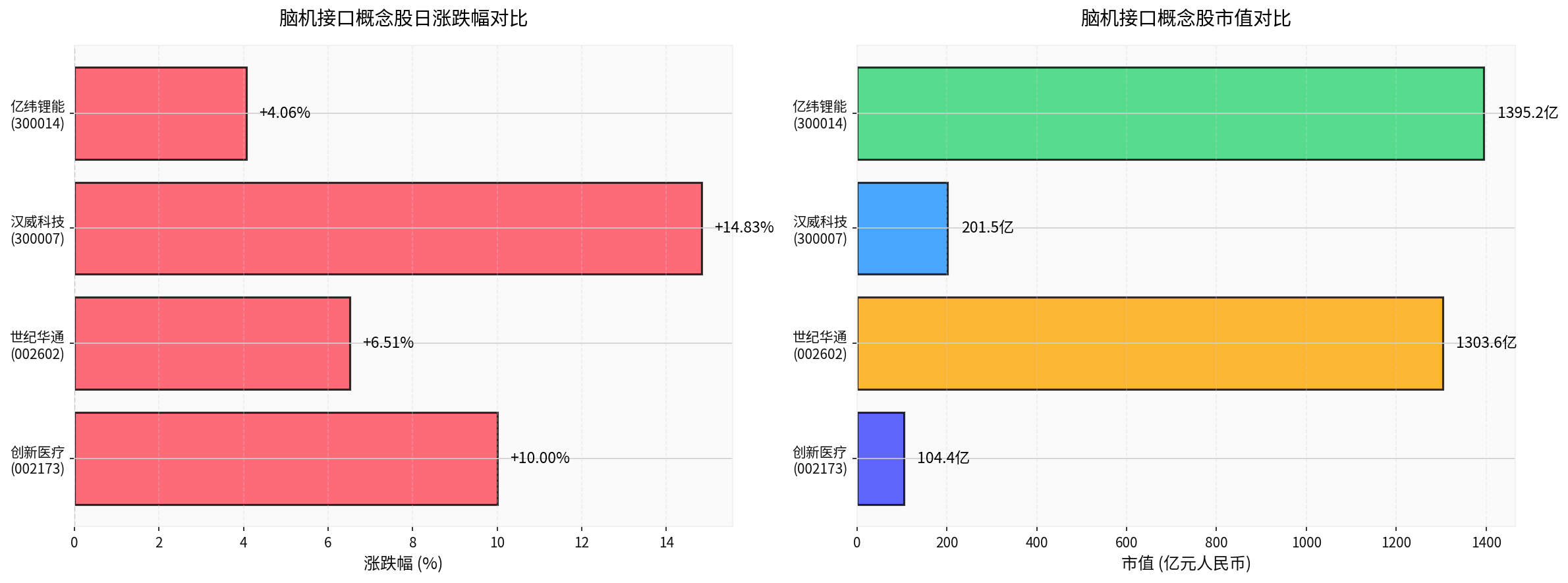

- Hanwei Technology (300007.SZ): Closed at 61.55 yuan, up 14.83% on the day, market capitalization 20.15 billion yuan, P/E ratio 246.20x

- Chuangxin Medical (002173.SZ): Closed at 23.66 yuan, daily limit up +10.00%, market capitalization 10.44 billion yuan, P/E ratio -169.00x (loss-making)

- Shiji Huatong (002602.SZ): Closed at 18.17 yuan, up 6.51%, market capitalization 130.36 billion yuan, P/E ratio 34.94x

- EVE Energy (300014.SZ): Closed at 68.43 yuan, up 4.06%, market capitalization 139.52 billion yuan, P/E ratio 40.49x

- Cumulative increase of +290.43%over the past six months [0], showing typical theme speculation characteristics

- The company is currently in a loss-making state (EPS: -0.14 yuan), with a negative P/E ratio [0]

- This deviation between fundamentals and stock price indicates that the market is more focused on concept speculation rather than actual performance

-

Accelerated Technical Breakthroughs

- Neuralink’s announcement of high-volume production in 2026 marks the industry’s transition from the laboratory phase to commercialization [2][3]

- Chinese enterprises have reached or even exceeded international levels in some areas, especially with more advantages in AI integration [1]

-

Expansion of Application Scenarios

- Medical field(currently accounting for 58.4%): Helping paralyzed, ALS, and blind patients restore functions [5]

- Entertainment field: Mind games, virtual reality interaction [1]

- Communication field: Brain-controlled communication, smart home control [5]

-

China-US Tech Competition

- BCI is “the only field in China-US cutting-edge competition without a generation gap” [1]

- Has dual military and civilian use characteristics, with significant strategic significance [1]

-

Market Space Expectations

- The global BCI market is expected to reach 2.94 billion US dollars by 2025 [5]

- In the long term, with technological maturity and application expansion, the market space is huge

- Technology has indeed made substantial breakthroughs, not pure concept speculation

- Clear policy support, included in national strategic planning

- Industrialization path gradually clear, expanding from medical rigid demand to consumer fields

- Most A-share listed companies are not core BCI technology companies

- Long commercialization cycle, difficult to contribute substantial performance in the short term

- Generally high valuation levels, Hanwei Technology’s P/E ratio is 246x [0]

- Regulatory and ethical risks are not yet clear

- News of Neuralink’s high-volume production in 2026 will continue to catalyze [2][3]

- Chinese enterprises are expected to continue announcing clinical progress

- Policy details may be gradually implemented

- Leading stocks like Chuangxin Medical have risen too much in the short term (+290%) [0], with correction pressure

- Obvious theme speculation characteristics; easy to retreat once there is no new catalyst

- Impact of overall A-share market fluctuations

- Industrialization enters a critical period; multiple companies plan to conduct formal registered clinical trials [1]

- Medical application scenarios have strong rigid demand and high willingness to pay

- Integration of AI large models and BCI will generate new application scenarios

- Whether Neuralink’s automated surgical procedures in 2026 can be successfully implemented [3]

- Whether Chinese enterprises can obtain medical device registration certificates

- Safety and effectiveness data from larger-scale clinical trials

- BCI is a technological revolution at the level of “next-generation computing platform”

- Clear technical path, progressing step by step from L1 to L4 [1]

- China has competitiveness in clinical resources, cost advantages, and data acquisition [1]

- Combination with AI will produce exponential effects

This is not a short-term hot spot but a strategic track similar to the Internet and smartphones. However, it should be noted that most companies currently hyped in A-shares may only be “concept stocks” rather than “core assets”.

- Wait for correction opportunities after the first round of speculation cools down

- Focus on targets with real business layouts and sound financials

- Control positions, treat it as a satellite allocation rather than core holdings

- Distinguish between “core assets” and “concept speculation”

- Focus on key links in the industrial chain: upstream materials, midstream equipment manufacturing, downstream applications

- Build positions in batches, avoid chasing highs

- Long-term verification of human implantation safety is needed

- Technical paths may change

- Gaps with international advanced levels exist

- Long medical device registration approval cycle

- Uncertainty in medical insurance payment willingness and quota

- Mass production capacity to be verified

- High valuation levels, with correction pressure

- May remain低迷 for a long time after theme speculation retreats

- Impact of overall A-share market environment

- Most concept stocks have low relevance to BCI business

- Some companies are in loss-making state [0]

- Need to be alert to companies with pure concept speculation

To evaluate BCI investment targets, consider the following dimensions:

- Technical Strength: Whether it has core patents and technical teams

- Business Proportion: Proportion of BCI-related business revenue

- Financial Health: Profitability, cash flow, R&D investment

- Partners: Cooperation with scientific research institutions, hospitals, and international enterprises

- Industrialization Progress: Clinical trial phase, registration application progress

The BCI track has long-term investment value, and technological breakthroughs and industrialization processes will continue to catalyze. However, the current speculation on A-share concept stocks is at a high level, with increasing short-term correction risks.

- Long-term: Track value is confirmed, worthy of strategic attention

- Medium-term: Focus on high-quality targets with real business layouts

- Short-term: Participate cautiously, avoid chasing highs, wait for correction opportunities

Investing in the BCI track requires patience and risk tolerance. It is recommended to adopt a strategy of batch layout and long-term holding rather than short-term speculation. At the same time, carefully identify genuine and fake BCI companies to avoid falling into the trap of pure concept speculation.

[0] Gilin API Data - Stock prices, market capitalization, financial indicators, and historical transaction data

[1] Yahoo Finance - “China’s BCI Technology is Unique, Surpassing the US, Using Mind to Play Games ‘Speak’ Chinese, AI Integration is Better” (https://hk.finance.yahoo.com/news/中國腦機接口技術獨到-趕超美國-用意念打機-說-漢語-195300332.html)

[2] Business Insider - “Elon Musk says Neuralink will ramp up production of brain-chip implants in 2026” (https://www.businessinsider.com/neuralink-elon-musk-expanding-production-brain-chips-automated-procedure-2026-1)

[3] Reuters - “Neuralink plans ‘high-volume’ brain implant production by 2026, Musk says” (https://www.reuters.com/business/healthcare-pharmaceuticals/musk-says-neuralink-start-high-volume-production-interface-devices-by-2026-2026-01-01/)

[4] Huafu Securities Research Report - “BCI Technology Development and 14th Five-Year/15th Five-Year Plan Prospects” (Research report image, October 23, 2025)

[5] Industry Market Analysis - “Global BCI Market Size Forecast and Application Field Distribution” (Market analysis chart, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.