Goldman Sachs Bullish on Madison Square Garden Entertainment (MSGE): Core Drivers and Analysis of Venue Entertainment Industry Resilience

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

When discussing Goldman Sachs’ bullish thesis on MSGE, combining cross-verifiable analyst views and company data (Finviz, company overview, etc.), the following core drivers can be extracted:

- Unique Location and Scarcity of Flagship Assets

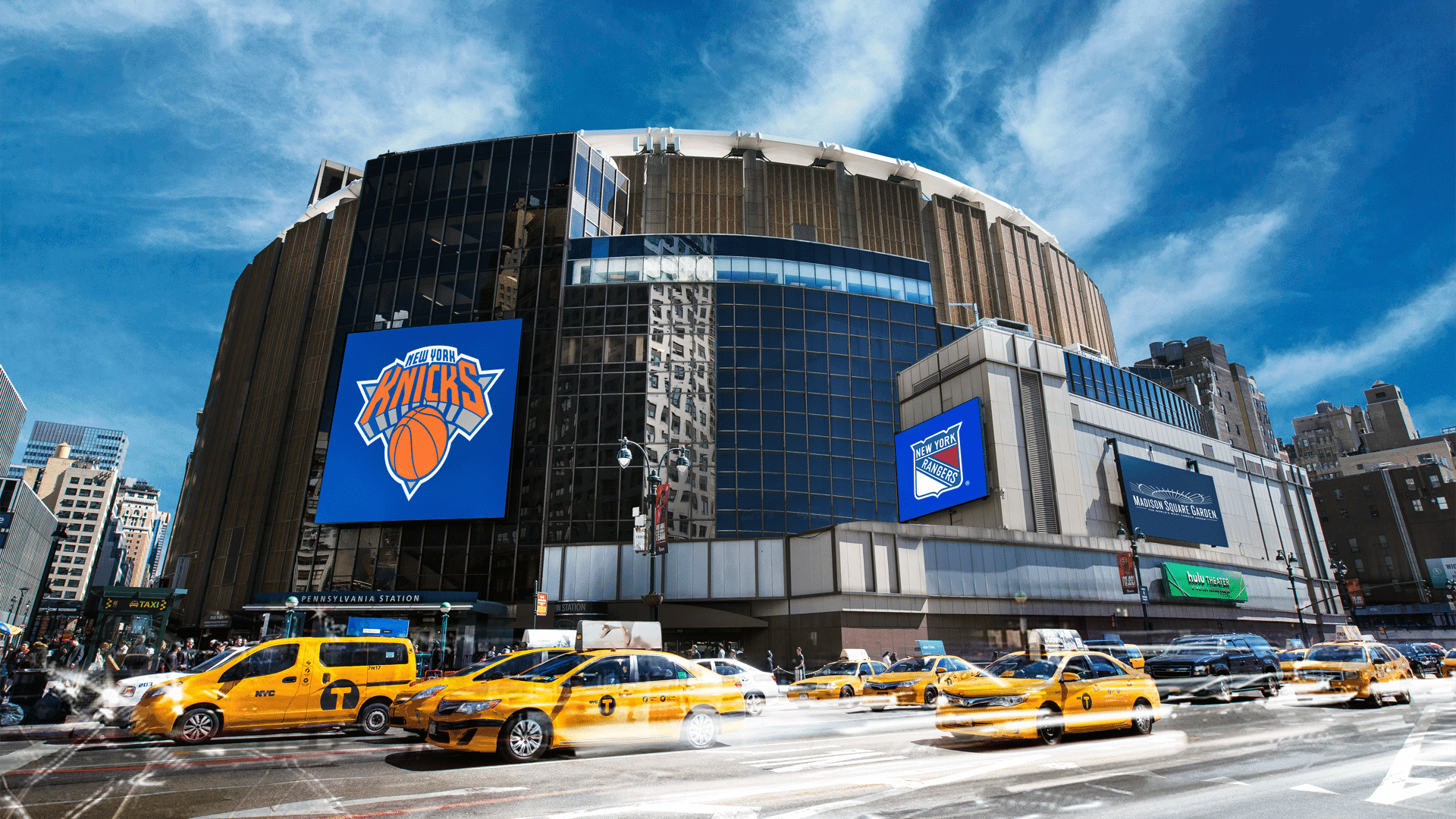

- High foot traffic and premium space from core New York location: MSGE owns and operates flagship venues like Madison Square Garden (MSG) in Manhattan, New York, which brings sustained high foot traffic and brand premium space [0][1]. Finviz pages have also repeatedly mentioned the synergy between MSGE’s assets and New York’s urban entertainment ecosystem, seen as one of the foundations supporting its valuation [2].

- Diversified and Exclusive Content Portfolio

- Diversified revenue structure: Segment data disclosed by the company shows that entertainment-related revenue (including performances, ticketing and venue licensing, on-site catering and merchandise, etc.) is the main source. Among them, ticketing and venue licensing fees and entertainment revenue contributed approximately 54.4% and 35.5% of revenue in Q1 FY2026 ($131.31M / $85.85M) [0]. This diversification helps stabilize cash flow amid volatility.

- Exclusive content assets: MSGE differentiates itself from competitors through flagship venues, brands, and related content IP. Finviz’s analyst news summaries have repeatedly emphasized the support of its content and asset uniqueness for valuation [2].

- Relative Resilience to Consumer Spending

- Discretionary priority of experiential consumption: Multiple research and news sources indicate that even in a high-inflation environment, consumers tend to prioritize spending on live experiences such as concerts and major events. For example, Live Nation management referred to live entertainment as a “post-pandemic consumption priority” in a recent quarterly conference call [4]. McKinsey’s consumer research also shows that while willingness to spend on many categories has declined, spending on experiential categories remains resilient [6]. This structural preference benefits venue assets.

- Quantifiable demand and pricing potential: Gametime’s 2025 industry report shows that about 40-50% of audiences in some tours travel across states or long distances, while online ticketing channels and secondary markets are active (e.g., a global event received over 1.5 million ticket applications within 24 hours), indicating strong demand and that dynamic pricing can increase per-customer revenue [3][5].

Note: There are inconsistent records in public channels regarding the specific time and amount of “Goldman Sachs raising the target price to $60” (Finviz also records that Goldman Sachs lowered MSGE’s target price to $36 in April 2025) [2]. Therefore, the above only extracts the sources of the “bullish thesis” that can be cross-verified in public information, and does not involve unconfirmed details of the “$60 increase”.

- Stock Price and Performance Resilience (Broker API Data)

- Stock price performance: MSGE’s stock price has risen significantly since 2024 (2024-01-02 to 2025-12-31 period: ~+71.24% range gain, ~+53.98% 1-year gain) [0].

- Seasonality of revenue and earnings: SEC data shows the company has obvious seasonality, with Q2 being the peak season (Q2 FY2025 revenue $407.42M, EPS $1.56), while Q1 FY2026 revenue was $158.26M [0]. This pattern reflects the direct impact of concentrated schedules of major events/tours on quarterly performance.

- Industry-Level Evidence and References

- Live Nation as a macro sample: Industry information shows that Live Nation’s sponsorship revenue grew by over 20% YoY in 2023 and is expected to maintain high growth in 2024-2025; its venue upgrades and expansion aim to increase per capita consumption [4]. This indicates that venue sponsorship and monetization are still accelerating.

- Sustainability on the demand side: Gametime’s report points out that demand for live events such as concerts and sports events will be strong in 2025, with over half of the audience in some performances traveling long distances (e.g., about 51% of the audience for Chris Brown’s performance traveled more than 250 miles), and the online ticketing and secondary market volume is considerable (the 2024 secondary ticket market value is about $6.58 billion), reflecting sustained demand and price elasticity [3][5].

- Macroeconomic consumption background: McKinsey’s research points out that US consumers tend to “trade down” in some discretionary consumption categories, but their willingness to spend on experiential consumption is relatively more resilient [6].

- MSGE’s Financial Fundamentals (Based on Company Overview Data)

- Valuation and earnings: The current TTM P/E is about 76.54x, indicating high expectations for future growth and improvement; meanwhile, the TTM operating margin is 13.07%, reflecting the profitability of the core business [0].

- Liquidity: The current ratio is about 0.96, and overall liquidity is at a reasonable level [0].

Based on verifiable data and public sources:

- Goldman Sachs’ related bullish thesis (from sources like Finviz) mainly revolves around the scarcity of core New York locations and flagship assets, diversified and exclusive content portfolio, and the relative resilience of live experiential consumption, providing valuation support for MSGE [2].

- From industry and company data, the venue entertainment business has shown certain resilience amid changes in consumer spending: Live Nation’s sponsorship growth and venue investment [4], strong and cross-regional demand reflected by Gametime [3][5], and McKinsey’s observation of experiential consumption resilience [6] all support this judgment.

- MSGE itself has performed well in stock price and revenue between 2024-2025, showing seasonal characteristics; the current high valuation level and operating margin mean the market has expectations for its continuous improvement and growth, but at the same time, attention needs to be paid to the potential impact of seasonal fluctuations and macro environment on foot traffic and pricing [0].

[0] Jinling API Data (MSGE Company Overview, Real-Time Quotes, Historical Prices)

[1] MSGE Official Website (Venue and Business Information)

[2] Finviz - MSGE Analysis Page (Analyst Ratings, Historical Target Price Adjustments, etc.)

[3] Gametime - “2025 Instant Replay” Report (Cross-City Travel Ratio, Online Ticketing and Secondary Market Data)

[4] ad-hoc-news.de - Live Nation Related Analysis (Sponsorship Revenue >20% YoY, Venue and Investment)

[5] Market Growth Reports - Ticketing Market and Sports Ticket Market Data (Online Ticketing Structure, Secondary Market Size, Sports Ticket Market Value)

[6] McKinsey - “The State of the US Consumer” (2025 Consumer Spending and Trends)

[7] MSGE Company Overview (Segment Revenue and Financial Ratios)

[8] Finviz - 2025 Analyst Ratings and Price Target Adjustments

[9] CNBC - MSGE and Sports Asset Valuation Related Information

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.