Analysis of the Impact of Geopolitical Risks on Oil Prices and Energy Stock Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

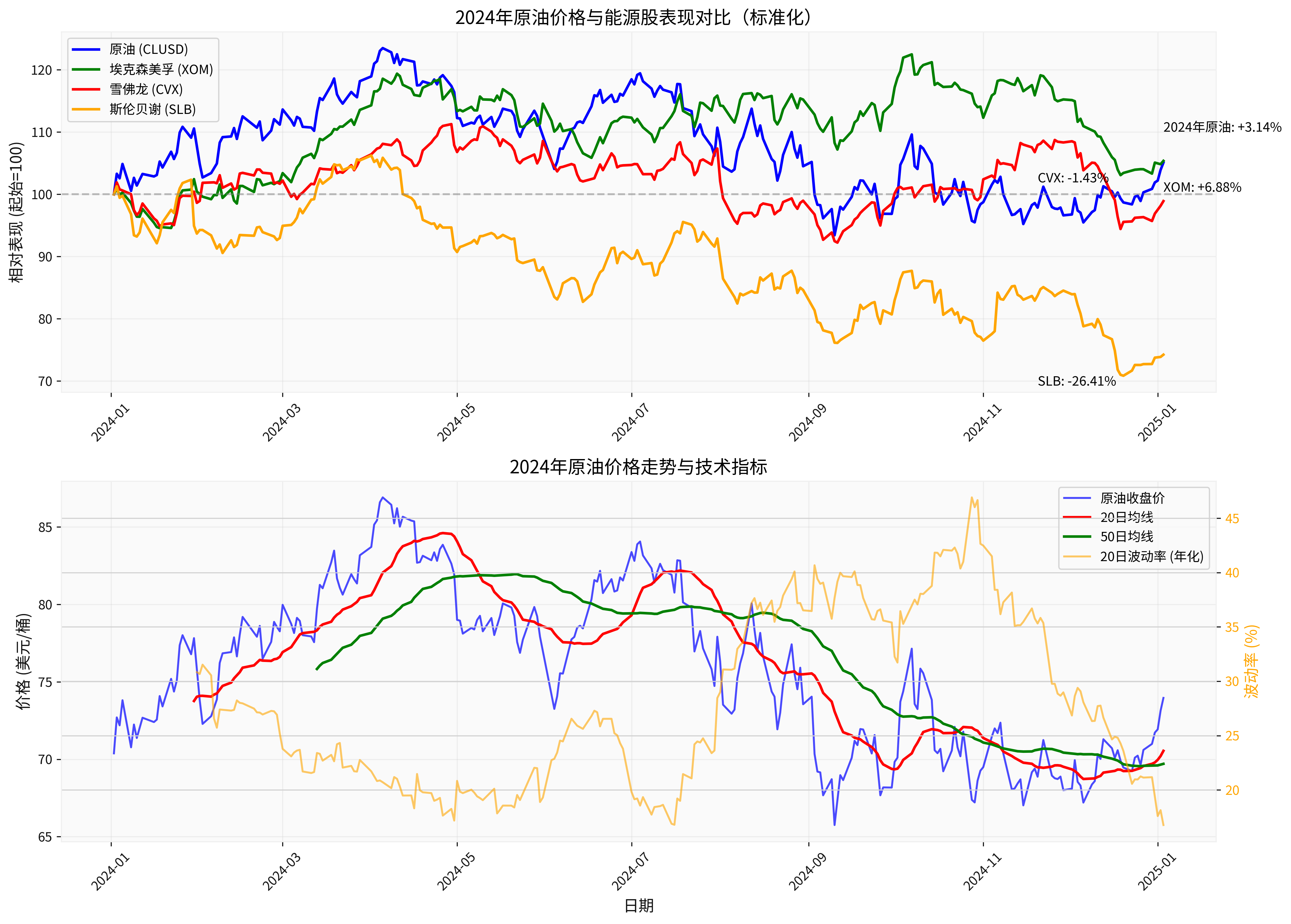

The crude oil market in 2024 showed a relatively stable trend but with significant volatility:

According to data, crude oil prices in 2024 opened at $71.71/barrel and closed at $73.96/barrel, rising

Chart shows: Crude oil prices (blue) are relatively stable, while energy stocks show significant divergence. The top chart is a normalized performance comparison (starting =100), and the bottom chart is a crude oil price trend and volatility analysis.

The energy sector showed significant divergence in 2024:

- ExxonMobil(XOM):+6.88%, outperforming crude oil prices[0]

- Chevron(CVX):-1.43%, basically flat[0]

- Schlumberger(SLB):-26.41%, oil service stocks suffered a heavy setback[0]

This divergence reflects the market’s differentiated expectations for different energy sub-sectors.

Venezuela has the

The recent U.S. capture of Venezuelan President Maduro has attracted market attention:

- Short-term impact: May generate an initial geopolitical risk premium, pushing up Brent crude and WTI crude prices[4]

- Long-term impact: Depends on Venezuela’s political landscape in the post-Maduro era. If the country stabilizes quickly and achieves democratization, foreign investment will flow in, risks will decrease, and supply may increase in a few years, which isnegative for oil prices[4]

According to Rystad Energy’s analysis, if Venezuela stabilizes quickly under a more democratic leadership (such as opposition figure María Corina Machado), international oil companies will lower their risk expectations, which may increase market supply in a few years[4].

OPEC+ decided to

- OPEC+ focuses more on long-term market sharerather than short-term price support

- Supply surplusconcerns outweigh geopolitical risk premiums

According to web search data,

Key supply dynamics:

- Strong growth in non-OPEC production: Strong non-OPEC production from the U.S., Brazil, Guyana, and Argentina exceeds unbalanced global demand[2]

- OPEC+ strategy shift: OPEC+ has changed its long-standing price defense policy and instead increased production to regain market share[2]

- Market expectations: The oil market is expected to remain insupply surplus until 2026, and analysts expect prices to stay in the $50-$70 range[2]

The geopolitical “fear premium” in 2024 and early 2025 has

Geopolitical events affect oil prices through the following mechanisms:

- Concerns about supply disruption: Venezuela’s turmoil threatens its 800,000-900,000 barrels/day oil supply

- Transport route risks: Impact of U.S. blockade of Venezuelan oil tankers

- Market sentiment fluctuations: Investors’ risk-averse reactions to uncertainty

However, the impact of geopolitical risks is limited by the following factors:

- Sufficient global supply: Growth in non-OPEC production offsets potential supply disruptions

- Strategic petroleum reserves: Countries have buffers to cope with supply shocks

- Slow demand growth: Uncertainty about the global economic outlook suppresses demand

As analysts pointed out, “Uncertainty about how Trump will implement the blockade of sanctioned tankers

Based on financial analysis:

- Free cash flow: 30.7 billion USD[0]

- Financial attitude: Neutral to conservative[0]

- Debt risk: Medium to low[0]

- 2024 performance: +6.88%, outperforming crude oil prices[0]

- Free cash flow: 15 billion USD[0]

- Financial attitude: Conservative, high depreciation/capital expenditure ratio[0]

- Debt risk: Medium to low[0]

- 2024 performance: -1.43%, relatively flat[0]

- Dividend advantage: Integrated oil companies usually offermore than 5%dividend yield[7], providing stable cash flow during geopolitical uncertainty

- Cost advantage: Integrated business model provides natural hedging

- Valuation protection: Lower valuation multiples provide downside protection

Schlumberger(SLB) fell

- Sensitivity to drilling activities

- Direct impact of supply-demand imbalance

- More cyclical and volatile

- Only suitable for investors with strong risk tolerance

- Requires precise market timing

- More attractive in a clear upward trend of oil prices

Investment strategies for geopolitical uncertainty:

- Diversified allocation: Do not over-concentrate on a single energy sub-sector

- Dividend reinvestment: Accumulate shares through compound interest during volatility

- Long-term perspective: Geopolitical events are usually short-term shocks, and long-term value depends on fundamentals

- Focus on free cash flow: Choose companies with strong cash flow, such as XOM’s 30.7 billion USD free cash flow[0]

Analysts predict that crude oil prices will fluctuate in the

- Upside risks: Supply disruptions in Venezuela or Russia

- Downside pressure: Persistent supply surplus and weak demand growth

- Range trading: Lack of clear trend opportunities

Investors should pay attention to the following key indicators:

- Venezuela’s political progress: Whether it stabilizes quickly and attracts foreign investment

- OPEC+ production policy: Whether to continue maintaining stable production

- U.S. production data: Growth rate of shale oil production

- Global inventory levels: Inventory changes in places like China[2]

- Demand growth data: Especially demand from China and India

- Focus on integrated oil giants(XOM, CVX)

- Enjoy stable dividend income

- Avoid high volatility of oil service companies

- Wait for better entry opportunities

- Focus on high-quality oil service companies that are mispriced

- More attractive in a clear upward trend of oil prices

Geopolitical events such as Venezuela’s turmoil will indeed have a short-term impact on oil prices, but against the backdrop of

- The geopolitical risk premium has faded significantly, with crude oil prices rising only 3.14% in 2024 and volatility of 28.60%[0]

- Global supply surplus is expected to persist until 2026, and prices may remain in the $50-$70 range[2]

- Energy stocks show divergence: Integrated oil companies are relatively stable, while oil service companies have fallen sharply[0]

- Investment strategy should focus on defense: Choose integrated oil giants with strong cash flow and stable dividends

- Venezuela may increase supply rather than reduce it in the long run, depending on the degree of political stability[4]

When making investment decisions, it is recommended to

[0] Gilin API Data (Crude oil price CLUSD, XOM, CVX, SLB stock prices and financial data)

[1] Reuters via Yahoo Finance - “OPEC+ to keep oil output steady despite turmoil among members, Maduro capture” (https://ca.finance.yahoo.com/news/opec-keep-oil-output-steady-093638969.html)

[2] Bloomberg - “Oil Posts Deepest Annual Loss Since 2020 on Surplus…” (https://www.bloomberg.com/news/articles/2025-12-30/latest-oil-market-news-and-analysis-for-dec-31)

[3] Forbes - “Energy Outlook 2026: Too Much Oil, Not Enough Electricity” (https://www.forbes.com/sites/rrapier/2026/01/01/energy-outlook-2026-the-year-of-the-glut-and-the-crunch/)

[4] Yahoo Finance UK - “Impact of Maduro’s capture on oil market likely to depend on the country’s political situation” (https://uk.finance.yahoo.com/news/impact-of-maduros-capture-on-oil-market-likely-to-depend-on-the-countrys-political-situation-going-forward-173333002.html)

[5] Reuters via Yahoo Finance - “Oil prices climb as US blocks Venezuelan tankers” (https://ca.finance.yahoo.com/news/oil-prices-climb-us-blocks-203018201.html)

[6] Yahoo Finance - “OPEC+ Reaffirms Output Pause as Eight Producers Cite…” (https://finance.yahoo.com/news/opec-reaffirms-output-pause-eight-122858329.html)

[7] Yahoo Finance - “Seeking Income Into 2026? 3 High-Yield Stocks to Buy Now” (https://finance.yahoo.com/news/seeking-income-2026-3-high-145800662.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.