In-depth Analysis of the Impact of Xiaomi's Slowing Automotive Business on 1810.HK Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data analysis,

| Indicator | 2025 Actual | 2026 Target | Growth Rate Change |

|---|---|---|---|

| Annual Deliveries | ~410,000 units[1] | 550,000 units[2] | +34.1% |

| YoY Growth Rate Change | ~200% | 34.1% | -166 percentage points |

| November MoM Growth Rate | +October Growth | -4.94% [3] |

First MoM decline since July |

- Over-concentration Risk:YU7 accounts for 71% of Xiaomi’s automotive deliveries[4], with significant product concentration risk

- November Performance:YU7 delivered 33,729 units in a single month[3], but growth has shown signs of slowing

- Single Product Matrix:Currently relies mainly on two models, SU7 and YU7, lacking diversified product line support

- Q3 2025 marked the first quarterly profit for the automotive business, with net profit of RMB 700 million (approximately USD 98 million)[3]

- It took only 19 months from the launch of SU7 (April 2024) to break-even, faster than the industry average

- Extended-range SUVs will not be launched in the short term; delayed high-end modelsaffect the optimization of profit structure

- The RMB 200 billion R&D investment commitment[4] will continue to suppress overall profit margins over the next 5 years

Based on the latest data[0]:

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

| P/E (TTM) | 20.70x | Higher than traditional hardware manufacturers |

| P/B | 3.23x | Reflects market growth expectations |

| Market Capitalization | HK$1.04 trillion | Increasing contribution from automotive business |

| P/S | 2.04x | Relatively reasonable |

According to the DCF model[0]:

| Scenario | Fair Value | vs Current Price (HK$40.28) | Probability Weight |

|---|---|---|---|

Conservative |

HK$17.07 | -57.6% |

30% |

Base |

HK$20.98 | -47.9% |

50% |

Optimistic |

HK$42.64 | +5.9% |

20% |

- The current share price of HK$40.28 can only break even under the optimistic scenario

- Both base and conservative scenarios show significant downside risk

- WACC is 10.9%, a relatively conservative assumption reflecting the high-risk nature of the automotive business

Slowing Growth → Downgraded Growth Expectations → P/E Compression → Valuation Restructuring

│ │ │

↓ ↓ ↓

34% vs 200% Valuation Logic Shift From Growth Stock to Value Stock

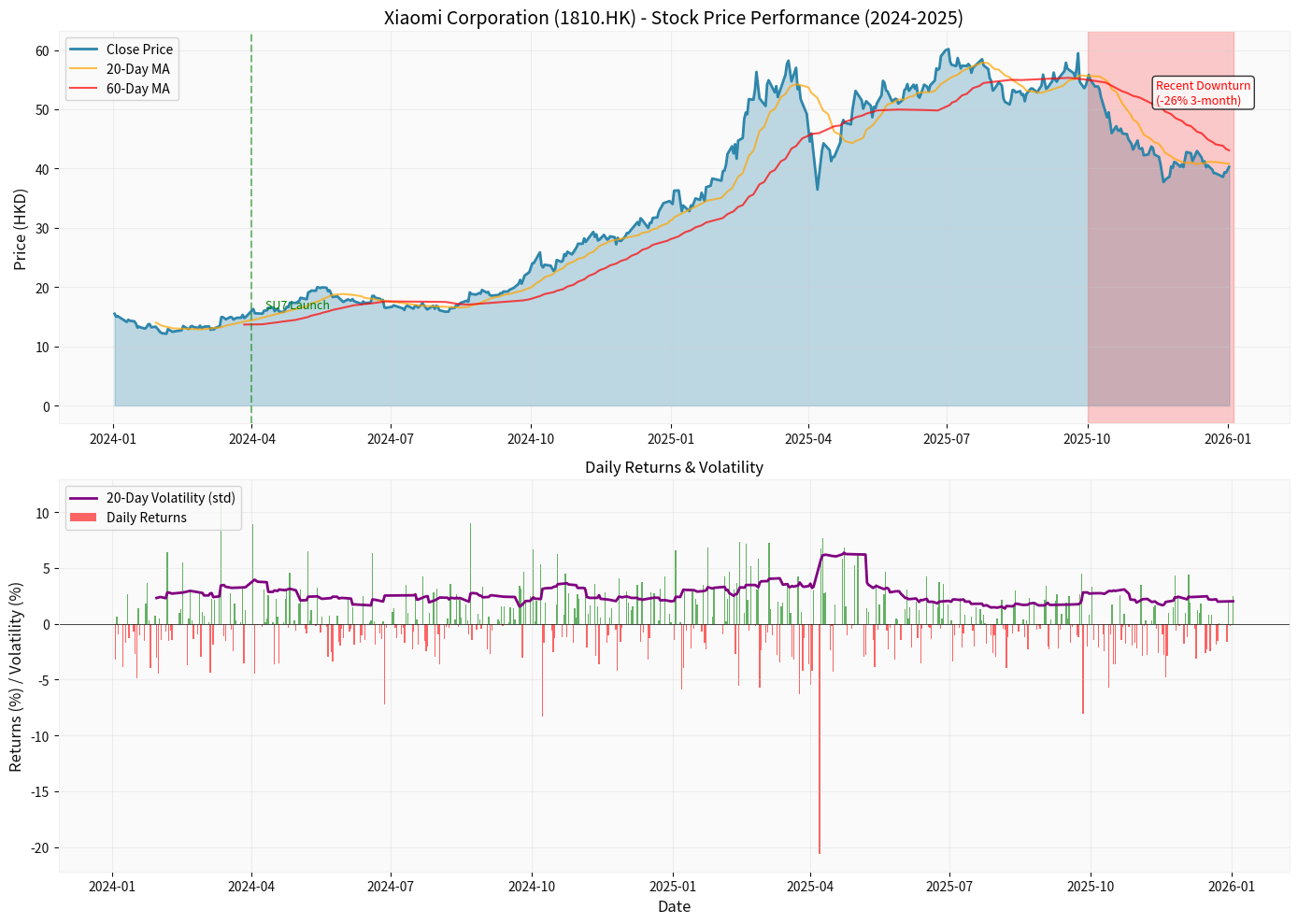

- Cumulative decline of 25.20% during this period[0]

- Retracement from high (HK$54.70) to low (HK$36.62) reached 33%

Chart Description: The chart above shows the share price performance of Xiaomi Group (1810.HK) from January 2024 to January 2026. The blue line is the closing price, the orange line is the 20-day moving average, and the red line is the 60-day moving average. The chart marks the SU7 launch event (April 2024) and the recent downward trend. From early 2024 to October, the share price soared from HK$12 to over HK$60, then continued to correct, falling back to around HK$40 in early 2026. The bar chart below shows daily returns, and the purple line shows 20-day volatility, indicating a recent increase in market volatility.

According to technical analysis[0]:

- Trend Status:Sideways consolidation (SIDEWAYS), no clear direction

- Key Levels:Support at HK$39.64, resistance at HK$40.92

- KDJ Indicator:K:46.8, D:30.0, J:80.5 — shows signs of short-term oversold

- Beta Value:0.96 (relative to Hang Seng Index), close to market average level

- Turnover Rate:Current trading volume is 61.20M, lower than the average of 177.69M[0], indicatingstrong market wait-and-see sentiment

- Volatility:Annualized volatility of 44.86%[0], still at a high level, reflecting uncertainty

- Sector Performance:The technology sector fell by 1.02% on December 31, 2025[0], and the consumer cyclical sector led the decline with 1.91%[0]

- BYD Reference:2025 sales of 4.6 million units, YoY growth of only 7.7% (target was revised down)[5]

- Subsidy Reduction:China is gradually cutting electric vehicle sales incentives, putting growth pressure on the industry[5]

- Intense Competition:A large number of new models are entering the market, and price wars continue

- Ecosystem Synergy: Deep integration of mobile phones, AIoT, and automobiles

- Brand Effect: High recognition among young user groups

- Technical Reserve: Leading 30,000rpm high-speed motor technology[6]

- Lack of manufacturing experience, long production capacity ramp-up period

- Temporary abandonment of extended-range technology route, limited product line expansion

- Internationalization process lags behind competitors like BYD

- Production Capacity Constraints:Order backlog after YU7 launch; delivery bottleneck is due to capacity rather than demand

- Product Cycle:Q3 2025 achieved quarterly profit, proving the business model is feasible

- 2026 Target:550,000 units still mean 34.1% growth, with an absolute increase of 140,000 units

| Risk Dimension | Specific Performance | Severity |

|---|---|---|

| Product Concentration | YU7 accounts for 71% | ⚠️ High Risk |

| Technical Route | Extended-range SUV delayed | ⚠️ Medium Risk |

| Profit Quality | Q3 profit of RMB700 million, but full-year loss is still possible | ⚠️ Medium Risk |

| Increasing Competition | Industry price wars continue | ⚠️ High Risk |

Core information from Lei Jun’s first New Year live broadcast on January 3, 2026[4]:

- YU7 Teardown:Technical transparency to address “assembled car” doubts

- Confirmation of No Extended-range SUV Launch:Manage market expectations and avoid resource dispersion

- RMB200 Billion R&D Investment Commitment:Strengthen long-term investment narrative

- 550,000 Unit Target:Provide reasonable growth guidance and reduce overheated market expectations

| Scenario | Trigger Conditions | Target Price | Probability | Operation Suggestion |

|---|---|---|---|---|

Optimistic |

2026 target exceeded expectations, new products successful | HK$42-45 | 20% | Hold/Increase Position |

Base |

550,000 unit target achieved, automotive business break-even | HK$35-40 | 50% | Wait and See/Reduce Position |

Pessimistic |

Sales below expectations, price wars intensify | HK$25-30 | 30% | Avoid Risk |

- Monthly Deliveries:Need continuous tracking; MoM positive growth is a key signal

- Gross Margin Trend:Can automotive business gross margin turn positive and continue to improve?

- New Product Timeline:Specific launch time of extended-range SUV

- Industry Policies:Rhythm of subsidy reduction and alternative policies

- Capacity Utilization:YU7 production capacity ramp-up progress

- ⚠️ Over-reliance on Single Model: YU7 accounts for too high a proportion; any product problem will amplify the impact

- ⚠️ Valuation Premium Compression: If growth continues to be below 50%, the 20.70x P/E will be difficult to maintain

- ⚠️ R&D Investment Pressure: RMB 200 billion R&D expenditure will significantly drag down overall profitability

- ⚠️ Deteriorating Industry Competition: Price wars may continue until 2026

- ✅ Ecosystem synergy effects gradually emerge

- ✅ International market expansion (Europe, Southeast Asia)

- ✅ AI technology integration brings new valuation premium

- Short-term (1-3 months):Share price willfluctuate in the range of HK$38-42, waiting for confirmation of Q1 2026 delivery data

- Mid-term (6-12 months):If the 550,000 unit target is successfully achieved, the share price is expected to回升 toHK$45; if it continues to fall short of expectations, it may drop toHK$30

- Long-term (2-3 years):Whether the automotive business can achievestable profitabilityis the key to valuation restructuring; if successful, it will support long-term value

- Has caused significant negative impact: 26.76% decline in 3 months; valuation has shifted from “growth premium” to “value revaluation”

- DCF base scenario shows 33% downside potential: Current share price of HK$40.28 is higher than fair value of HK$26.90

- P/E compression risk: If growth continues to be below 50%, the 20.70x P/E will be difficult to maintain

- More accurate judgment: Entering a “structural shift period” rather than a “growth bottleneck”

- The target growth rate of 34.1% is still healthy, but need to accept the paradigm shift from “explosive growth” to “sustainable growth”

- Key Turning Point:New product launches in Q2-Q3 2026 and continuous improvement in profitability are signals to break the bottleneck

[0] Gilin API Data - Xiaomi Group (1810.HK) real-time quotes, company overview, financial analysis, technical analysis, DCF valuation data

[1] Automotive World - “Xiaomi reportedly planning three new models, one EREV” (2025-12-23)

[2] Bloomberg via Automotive News - “Xiaomi, after breakout year, sets EV sales target of 550,000 for 2026” (2026-01-04)

[3] Automotive World - “Xiaomi delivered 46,249 vehicles during November… Q3 2025 with CN¥700m profits” (2025-12-23)

[4] Web Search Results - “Lei Jun’s 4-hour live broadcast on January 3, 2026; YU7 accounts for 71% of deliveries; RMB200 billion R&D investment; no short-term launch of extended-range SUV”

[5] Yahoo Finance - “BYD sold 4.6 million units in 2025, achieving revised annual target” (Bloomberg, 2026-01-04)

[6] Automotive World - “IDTechEx examines rise of high-speed EV motor designs” (2025-12-23)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.