Saks Fifth Avenue: $1 Billion Financing Cannot Reverse Structural Dilemma

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and industry analysis, Saks Global Enterprises, the parent company of Saks Fifth Avenue, faces not only liquidity crisis but also deep-seated structural challenges. $1 billion financing may delay the bankruptcy time, but it is difficult to fundamentally solve the systemic risks faced by its business model.

Saks Global currently carries approximately

Notably, this is not Saks’ first debt restructuring.

As Saks’ parent company, Hudson’s Bay Company itself is also deeply mired in financial trouble. HBC has filed for bankruptcy protection in Canada, carrying

The retail industry is undergoing unprecedented structural adjustments:

-

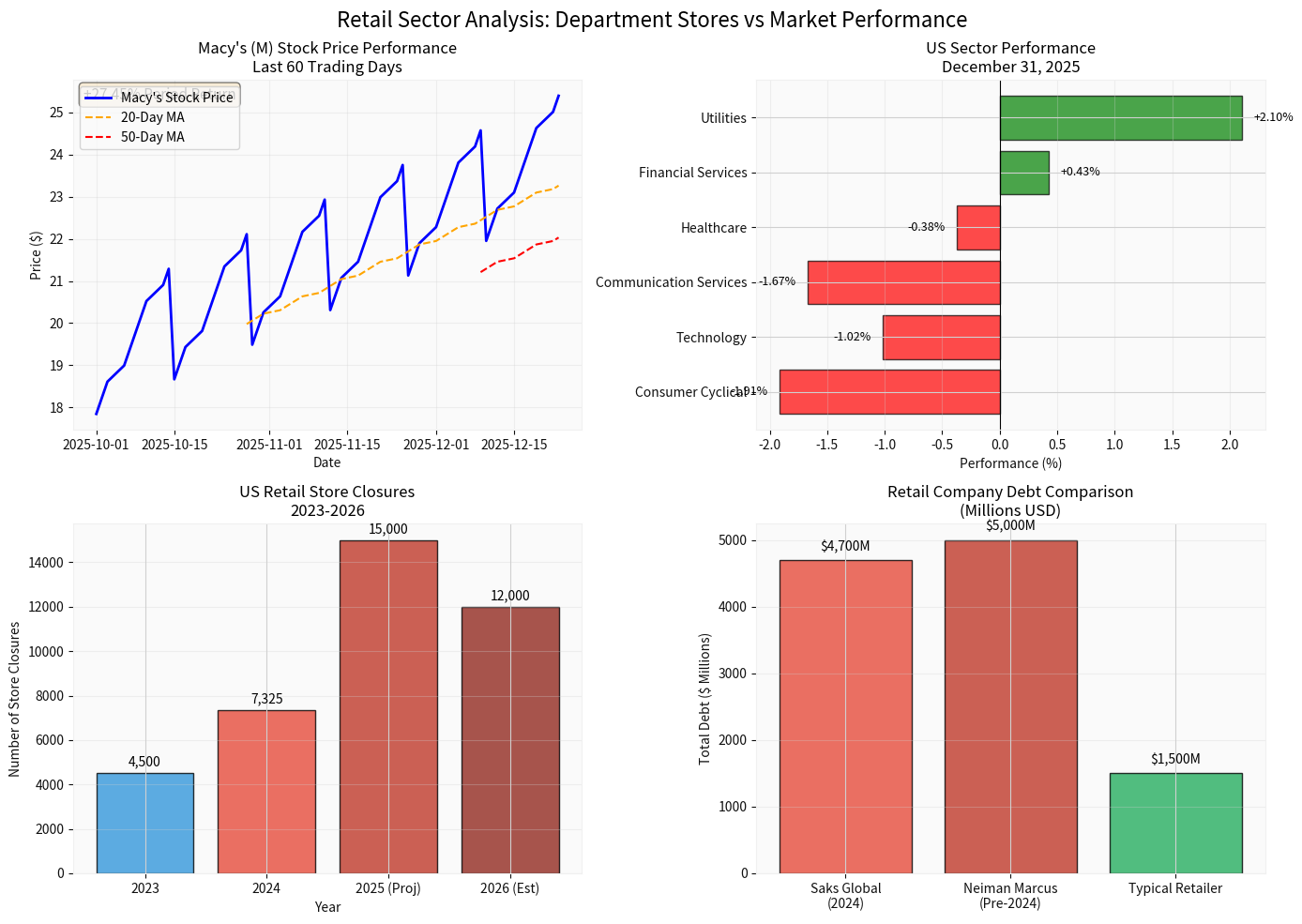

Store Closure Wave: Coresight Research predicts thatretailers will close up to 15,000 stores in 2025, more than twice the number in 2024 (7,325 stores) [7]. This is not a cyclical fluctuation but a permanent format transformation triggered by the continuous rise of e-commerce penetration rate.

-

Weak Sector Performance: TheConsumer Cyclical sector was the worst-performing sector (-1.91%) on December 31, 2025, significantly lagging behind the broader market (S&P 500 +2.00% in the same period) [0][8]. This reflects the capital market’s pessimistic expectations for traditional consumption models.

Chart shows: (Top left) Macy’s stock price has rebounded recently but is far below historical highs; (Top right) Consumer Cyclical sector ranks last among all sectors; (Bottom left) Number of retail store closures surges; (Bottom right) Saks Global’s debt level is far higher than that of typical retailers [0]

-

Consumption Downgrade Trend: PwC’s 2025 “Holiday Outlook” survey shows that shoppers expect seasonal spending todecrease by 5% year-on-year[9]. Gen Z group even expects holiday consumption to decrease by 23% [10].

-

Credit Pressure Emerges: Although the credit card default rate remains relatively stable at about 3%, the average credit card debt has reached$6,523 per person, with an average APR exceeding 20% [11][12]. The default rate of low-income consumers is rising [13], which will further weaken discretionary spending.

-

Weak Luxury Consumption: China’s economic slowdown (especially the ongoing real estate crisis) has dealt a major blow to global luxury demand [14]. In contrast, the stock prices of luxury groups like LVMH are under pressure, while the stock prices of companies targeting Chinese consumers like Treasury Wine Estates have fallen to their lowest levels in more than a decade [15].

-

AI-driven Shopping Revolution: One of the three major trends in the retail industry in 2026 is the rise of AI agents.Only 27% of brands say they have fully connected and scalable digital capabilities[16]. Traditional department stores like Saks have insufficient investment in digital transformation and are difficult to compete with e-commerce giants like Amazon and Alibaba.

-

Rise of Social E-commerce: Social platforms are blurring the line between shopping and entertainment [16]. Young consumers discover and buy products through platforms like TikTok and Instagram, bypassing the physical channels of traditional department stores.

Assuming Saks can obtain $1 billion in financing, this amount accounts for only about 21% of its

-

Interest Payment Pressure: Calculated based on the current high-interest rate environment (corporate bond rates generally exceed 8%), $1 billion in financing will generateabout $80 million in annual interest expenses. Considering that the company is already unable to pay the $100 million interest on existing debt [3], new financing will only exacerbate rather than alleviate the financial burden.

-

Deterioration of Asset Quality: The value of core assets such as Bergdorf Goodman (the company is considering selling its minority stake [3]) and Beverly Hills properties continues to shrink against the backdrop of retail industry decline, limiting financing capacity.

The

-

Physical Store Network: Saks Fifth Avenue has dozens of large flagship stores in North America, each with extremely high rent, labor, and inventory costs. In contrast, the e-commerce model significantly reduces unit fulfillment costs through centralized warehousing and automation.

-

Inventory Turnover Efficiency: The inventory turnover rate of high-end department stores is generally lower than that of professional e-commerce and brand direct channels, leading to capital occupation and depreciation losses.

-

Disadvantage in Customer Experience: Young consumers prefer personalized recommendations and seamless online-offline integrated shopping experiences, while traditional department stores have seriously insufficient digital capabilities [16].

Saks Global attempts to build the “world’s largest multi-brand luxury retailer” by merging high-end brands such as Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman [17], but this strategy has fundamental flaws:

-

Brand Homogenization: These brands have high overlap in product categories, customer groups, and geographic locations, resulting in limited synergies from the merger.

-

Shrinking Customer Base: Truly high-net-worth customers (the top 10% of earners account for 49.2% of consumption [18]) are increasingly buying luxury goods through brand direct sales, personal shopping consultants, and other channels, bypassing department store intermediaries.

-

Competitive Disadvantage: Compared with competitors like Nordstrom and Bloomingdale’s, Saks has not established obvious advantages in digitalization and omnichannel capabilities.

The decline of traditional department stores did not start today. Over the past two decades, former giants such as Sears, J.C. Penney, and Barneys have gone bankrupt or been acquired one after another.

-

Irreversible Business Model: E-commerce penetration rate has risen from less than 1% in 2000 to about 20%+ in 2025 and is still growing. This trend will not be reversed by short-term financing.

-

Abandonment by Capital Market: As can be seen from the Macy’s case, although its stock price has rebounded 27.45% to $22.75 in the past 60 days [0], this is mainly based on expectations of restructuring and asset sales, not fundamental improvement. The market value is only $6.05 billion [0], reflecting the market’s pessimism about the long-term prospects of this format.

Based on the above analysis, Saks Global’s application for

-

Debt Write-down: Bankruptcy proceedings will allow the company to restructure its debt, significantly writing down the $4.7 billion debt to a sustainable level.

-

Store Closures: It is expected to close a large number of low-profit stores and retain a few core flagship stores.

-

Business Spin-off: The Saks.com e-commerce business may be spun off and sold (similar to the 2021 SPAC listing attempt), while the physical business may be acquired by private equity or real estate investment trusts.

Even after completing bankruptcy restructuring, Saks still faces huge challenges in long-term survival as an independent entity:

-

Niche Market Positioning: The most likely outcome is to become an ultra-high-end boutique in a few core cities (such as New York and Beverly Hills), rather than a national chain.

-

Ownership Change: It is highly likely to be acquired by private equity or family offices, exit the listed company system, and operate in a non-public manner.

-

Cooperation with E-commerce Giants: It may consider cooperating with platforms like Amazon to become their offline experience stores, but this will seriously damage its high-end brand image.

$1 billion financing

-

Excessive Debt Scale: $1 billion is a drop in the bucket compared to the total debt of $4.7 billion, and new financing will bring higher interest burdens.

-

Irreversible Industry Trends: Continuous rise of e-commerce penetration rate, accelerated wave of physical store closures, and structural changes in consumer behavior—these macro trends will not be changed by short-term financing.

-

Fundamental Flaws in Business Model: The physical department store model with high fixed costs lacks competitiveness in the digital age, and Saks’ digital capabilities are far behind platforms like Amazon.

-

Lack of Parent Company Support: HBC itself has filed for bankruptcy protection and is unable to provide support.

-

Persistent Consumption Downgrade: Macroeconomic pressure, credit tightening, and weak luxury consumption—these factors will continue to suppress Saks’ core customer groups.

The golden age of traditional department stores has ended, and Saks Fifth Avenue is just one of the latest victims of this historic transformation.

— References

[0] Gilin API Data - Market Indices, Sector Performance, Macy’s Stock Price Data

[1] Business of Fashion - “Saks Mulls Bankruptcy Year After Raising Billions for Turnaround” (https://www.businessoffashion.com/news/retail/saks-mulls-bankruptcy-year-after-raising-billions-for-turnaround/)

[2] New York Post - “Saks Fifth Avenue parent mulls Chapter 11 bankruptcy as it seeks emergency funds: report” (https://nypost.com/2025/12/22/business/saks-fifth-avenue-parent-mulls-chapter-11-bankruptcy-report/)

[3] CNBC - “Saks Group reportedly preparing to file bankruptcy after missing debt payment” (https://www.cnbc.com/2026/01/01/saks-group-reportedly-preparing-to-file-bankruptcy-after-missing-debt-payment.html)

[4] Bloomberg - “Saks Mulls Bankruptcy After Raising Billions for Turnaround” (https://www.bloomberg.com/news/articles/2025-12-22/saks-mulls-bankruptcy-year-after-raising-billions-for-turnaround)

[5] Yahoo Finance Canada - “Hudson’s Bay Company nearly $1B in debt, with court…” (https://ca.finance.yahoo.com/news/hudsons-bay-company-nearly-1b-150739506.html)

[6] Bloomberg - “North America’s Oldest Firm Meets Its End and Liquidates” (https://www.bloomberg.com/news/articles/2025-04-25/hudson-s-bay-company-north-america-s-oldest-firm-meets-its-end-and-liquidates)

[7] Forbes - “Retail Layoffs Surge As Retailers Adjust To Mounting…” (https://www.forbes.com/sites/pamdanziger/2025/03/07/retail-layoffs-surge-as-retailers-adjust-to-mounting-economic-and-profitability-pressures/)

[8] Gilin API Data - Sector Performance Data (2025-12-31)

[9] Forbes - “How Retailers And E-Commerce Sellers Can Manage The…” (https://www.forbes.com/councils/forbesbusinesscouncil/2025/12/15/how-retailers-and-e-commerce-sellers-can-manage-the-final-holiday-rush/)

[10] Forbes - “Gen-Z Is Redefining Luxury: How Leaders Can Rethink…” (https://www.forbes.com/councils/forbesbusinesscouncil/2025/12/15/gen-z-is-redefining-luxury-how-leaders-can-rethink-premium-offers/)

[11] Forbes - “How Does Your Debt Compare? U.S. Average Credit Card…” (https://www.forbes.com/advisor/credit-cards/average-credit-card-debt/)

[12] Forbes - “Holiday Spending Looks Strong—But Credit Data Tells A…” (https://www.forbes.com/sites/pamkaur/2025/12/19/holiday-spending-looks-strong-but-credit-data-tells-a-different-story/)

[13] Yahoo Finance - “Gen Z, lower-income consumers seeing rise in credit…” (https://finance.yahoo.com/video/gen-z-lower-income-consumers-225000743.html)

[14] Forbes - “China’s Chaotic 2026 Makes This The Worst Job In…” (https://www.forbes.com/sites/williampesek/2025/12/30/chinas-chaotic-2026-makes-this-the-worst-job-in-economics/)

[15] Bloomberg - “Treasury Wine Shares Sink After Flagging US, China…” (https://www.bloomberg.com/news/articles/2025-12-16/treasury-wine-unveils-overhaul-to-tackle-slowdown-in-china-us)

[16] Forbes - “3 Major Trends That Will Reshape Retail In 2026” (https://www.forbes.com/sites/catherineerdly/2025/12/22/3-major-retail-trends-that-will-reshape-retail-in-2026/)

[17] Yahoo Finance - “After 158 years, Saks Fifth Avenue may file bankruptcy” (https://finance.yahoo.com/news/158-years-saks-fifth-avenue-184044010.html)

[18] Forbes - “Luxury Buyers Are Still Spending; Here’s How To Reach…” (https://www.forbes.com/councils/forbesbusinesscouncil/2025/12/08/luxury-buyers-are-still-spending-heres-how-to-reach-them/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.