In-depth Analysis of Sector Rotation Investment Logic in 2025 and Asset Allocation Strategy for 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

In 2025, major global markets generally rose but showed obvious structural differentiation [0]:

From the chart, we can see:

- A-share market performed brilliantly: ChiNext Index led major global markets with a 49.57% increase, while Shanghai Composite Index rose by 18.41%, its largest annual gain since 2020 [0]

- Hong Kong stock market rebounded strongly: Hang Seng Index rose by 27.77%, Hang Seng Tech Index by 23.45%, significantly outperforming most developed markets [0]

- US stocks rose steadily: S&P 500 increased by 15.70%, Nasdaq by 19.78%, Dow Jones by12.67% [0]

- Asia-Pacific markets led: South Korea’s KOSPI Index ranked first globally with an annual increase of75.63% [0]

###1.2 Significant Differentiation in A-share Industry Sectors

In2025,31 industries in the A-share market showed a pattern of ‘more gains than losses’, but the differentiation characteristics were extremely obvious [0]:

- Non-ferrous metals (+94.73%): Benefited from the surge in precious metal prices and rare earth export restrictions [0]

- Communications (+84.75%): Demand for AI computing power and satellite communications exploded [0]

- Electronics (+47.88%): Domestic substitution and independent chip control advanced [0]

- Food and beverage (-9.69%): Has fallen for five consecutive years [0]

- Coal (-5.27%): One of the only two declining industries [0]

###2.1 Film and Television Media Sector: Rise of IP Economy Led by “Ne Zha 2”

- Spring Festival档 record: The total box office of the 2025 Spring Festival档 reached 9.51 billion yuan, with 187 million moviegoers, both setting historical records, increasing by18.64% and14.72% year-on-year respectively [1]

- **Phenomenal success of “Ne Zha 2”:

- Box office reached15.446 billion yuan, becoming the first Chinese film history to break 10 billion yuan at the box office [1]

- Entered the top three of the global animated film box office list, the only Asian film in the top 20 of the global film history box office list [1]

- Nearly 1.8 million viewers gave a comprehensive score of 9.7 points, achieving a ‘double harvest’ of box office and word-of-mouth [1]

- Annual box office: China’s film box office reached51.755 billion yuan in2025, exceeding last year by more than9 billion yuan [1]

The success of “Ne Zha2” confirms the rise of IP power. Wanlian Securities pointed out that the strong IP effect and good reputation accumulated from the previous work made it have a wide audience before its release [1]. Chinese traditional IPs such as the “Ne Zha” series, “Detective Chinatown” series, and “The Battle at Lake Changjin” series have natural affinity and traffic advantages for audiences [1].

The Spring Festival档 has become a ‘blockbuster maker’ for domestic films. Among the 23 films in Chinese film history with box office exceeding 3 billion yuan, 12 are contributed by the Spring Festival档, accounting for more than half [1]. The box office output of the Spring Festival档, which lasts only7-8 days, accounts for12%-21% of the annual box office, with extremely high concentration [1].

- Among the19 stocks in the A-share film and television theater sector, Jiangsu幸福蓝海 Film & Television Investment Co., Ltd. and Hunan欢瑞世纪影视传媒 Co., Ltd. doubled their stock prices [1]

- Stocks such as Enlight Media (main investor and controller of “Ne Zha2”), China Film, and Wanda Film outperformed the Shanghai Composite Index [1]

Risks and opportunities coexist:

- Opportunities: Animated films have become a new highland for Chinese films, and2025 is the year with the highest box office for animated films in Chinese film history [1]

- Risks: The film and television industry is highly dependent on schedules and blockbusters, and the IP life cycle has uncertainty

###2.2 Commercial Aerospace Sector: Leap from “0 to1” to “1 to N”

- Launch次数: China completed87 space launches in2025, of which private commercial rocket companies executed23 [2]

- Orbital spacecraft: 324 spacecraft successfully entered orbit [2]

- Financing scale: The total domestic commercial aerospace financing in2025 reached9.764 billion yuan, more than twice that of2023 [2]

- Capacity planning: Hainan Satellite Super Factory has an annual capacity of1000 satellites, and the capacity will climb to900 satellites/year in2026, an increase of6 times compared to2025 (150 satellites/year) [2]

- Reusable rockets: Reusable launch vehicles such as Zhuque-3 were launched into orbit, and the commercial aerospace market is promising [2]

- Cost reduction: With the maturity of reusable rocket technology, the launch cost is expected to further drop from20,000 yuan/kg to below10,000 yuan/kg [2]

- Beijing Economic and Technological Development Zone: Established a 10 billion yuan industrial fund, with a maximum reward of5 million yuan for commercial launches [2]

- Guangdong Province: Proposed a target of300 billion yuan in commercial aerospace industry scale by2026 [2]

- Shandong Province: Plans to build a production line with an annual output of100 500kg-class satellites [2]

- IPO acceleration: It is expected to add3-5 A-share commercial aerospace listed companies in2026 [2]

- Valuation increase: SpaceX’s valuation may reach800 billion US dollars, surpassing OpenAI to become the most valuable private company in the United States [2]

- Landspace: Completed listing counseling and plans to land on the Science and Technology Innovation Board in Q2 of2026, with a financing scale of about3-5 billion yuan [2]

From “single-point breakthrough” to “full-chain collaboration”, forming a virtuous cycle of “R&D-manufacturing-launch-application” [2]. Hainan Satellite Super Factory realized “launch upon delivery”, compressing the single satellite manufacturing cycle to28 days and reducing test costs by50% [2]

The commercial aerospace industry scale grows at an average annual rate of more than20%, and it is expected to reach7-10 trillion yuan by2030 [2]. 2026 will be an important inflection point for the development of China’s commercial aerospace, and it is expected to usher in explosive growth driven by four factors: policy, technology, market, and capital [2]

###2.3 Gold and Precious Metals Sector: Multi-dimensional Driving of a Historic Bull Market

- GLD Gold ETF: Rose from244.22 US dollars at the beginning of the year to396.31 US dollars at the end of the year, with an annual increase of62.28%, the highest single-year increase since1979 [0]

- COMEX Gold: The active contract had a maximum annual increase of66% [3]

- London Spot Gold: Rose by more than70% for the whole year, hitting a historical high50 times successively [3]

- Silver performed even better: COMEX silver active contract had a maximum annual increase of187%, London spot silver had a maximum increase of192% [3]

According to Securities Times and industry research, the gold market in2025 showed obvious five-stage characteristics [3]:

- Driving factor: Tariff disturbances and credit currency system risks highlight the safe-haven attribute of gold [3]

- Market performance: Gold prices climbed steadily

- Driving factor: The market digested and adjusted expectations for interest rate cuts [3]

- Driving factor: Powell’s speech at the Global Central Bank Annual Meeting indicated that the US labor market was weak, leading to an interest rate path of rate cuts [3]

- Market performance: Gold prices repeatedly broke historical highs

- Driving factor: Market profit-taking sentiment [3]

- Driving factor: The Fed cut interest rates for the third time in the year, superimposed on the poor performance of US macroeconomic data [3]

- Market performance: International gold prices broke through the shock range and continued to rise, once breaking through the 4500 US dollars/ounce mark

- In the first three quarters of2025, global central banks increased their gold holdings by241.7 tons, 172 tons, and219.9 tons respectively [3]

- The People’s Bank of China increased its gold holdings for13 consecutive months [3]

- The proportion of “central bank gold purchases” in gold investment demand rose from15% in Q1 of2022 to a high of54% in Q4 of2024 [4]

- The Fed entered a rate cut cycle in2025, and as an interest-free asset, the opportunity cost of holding gold decreased [3]

- The US dollar index plummeted by more than9% in2025, pushing up the price of gold denominated in US dollars [3]

- Geopolitical powers (China, Russia, India, etc.) and traditional neutral countries (Singapore, Saudi Arabia, Qatar, etc.) gradually increased their gold reserves [4]

- A2025 World Gold Council survey showed that76% of the central banks surveyed said that the proportion of gold reserves would continue to “rise moderately” in the next5 years [4]

Looking forward to2026, the foundation of the gold bull market remains solid [4]:

- Support logic: The core support logic of global stagflation, chaotic order, and US deficit monetization has not changed

- Risk factors: When the AI narrative becomes clear, the highlight moment of gold may fall; short-term corrections need to be vigilant

###2.4 Trendy Toy Consumption Sector: Explosion of Z-generation Emotional Consumption

- Market size: China’s IP trendy toy market expanded rapidly from350 million yuan in2021 to760 million yuan in2024, with an annual compound growth rate of more than30%, and it is expected to exceed1.1 billion yuan by2026 [5]

- Blind box category: The consumption proportion of blind box category is expected to increase from28.1% in2021 to38.5% in2026 [5]

- Capital market: Pop Mart’s market value doubled in2025, and the number of heavy-held funds soared from8 in Q2 of2023 to62 in Q3 of2024 [5]

- Generation Z contributed more than40% of the market share, and the consumption motivation of “pleasing oneself” drove the trendy toy track to rush [5]

- The average customer price of consumers aged30-45 is40% higher than that of Generation Z, and the trend of full-age coverage is obvious [5]

The success of trendy toys lies in:

- Emotional value: The consumption motivation of “pleasing oneself” fits the transformation of the new generation from “functional consumption” to “emotional value” and “interest expression” [5]

- Social attributes: Players establish emotional connections through interactive forms such as sharing, exchanging, and showing boxes, becoming social currency and status symbols [5]

- Addiction mechanism: The intermittent reinforcement mechanism of blind boxes (such as hidden models) produces emotional bonds [5]

- Traditional trendy toy blind boxes: Growth rate slowed to15% [5]

- Functional blind boxes: Education blind boxes and health blind boxes soared to40% [5]

- Segmented categories: Plush toys surged by1289% year-on-year in2024 due to IPs such as LABUBU [5]

- IP dependence risk: Trendy toys are directly linked to emotional consumption, and the volatility of emotions determines the uncertainty of the IP life cycle

- Premium threshold decline: The premium threshold that trendy toy players are willing to pay for head IPs has dropped from3-5 times to within1.5 times [5]

- Regulatory risks: Easily induce gambler psychology, leading to regulatory and ethical disputes

###3.1 Macro Background: Structural Bull Market Rather Than Universal Bull Market

The A-share market in2025 showed significant structural bull market characteristics, with concentrated profit-making effects and clear rotation [6]. The whole year mainly focused on

- Robot market in early year

- Big technology (chip) market in mid year

- Commercial aerospace market launched after National Day and continued until the end of the year

Different from the previous universal bull market, the market pays more attention to

###3.2 Common Characteristics of Sector Rotation

By analyzing the above four sectors, the following common driving factors can be found:

- Commercial aerospace: Local governments set up 10 billion-level industrial funds and clarify industrial scale targets [2]

- Film and television media: Spring Festival档 becomes the focus of cultural consumption supported by policies [1]

- Gold: Central banks systematically increase gold holdings under the background of de-dollarization [4]

- Trendy toys: Consumption upgrading policies support new consumption forms [5]

- Commercial aerospace: Technological breakthroughs such as reusable rockets and satellite super factories [2]

- Film and television media: Animation technology improved, and Chinese animation entered the top three in the world [1]

- Trendy toys: IP ecologicalization and digital operation model innovation [5]

- IPO expansion: Commercial aerospace enterprises accelerate listing [2]

- Institutional allocation: Institutional positions in trendy toys and gold sectors increased significantly [5]

- Derivatives enrichment: Gold futures, options and other tools are improved [4]

- Rise of Generation Z: Emotional consumption and interest consumption become new trends [5]

- Hedge demand: Geopolitical uncertainty pushes up gold demand [3][4]

- Cultural confidence: Chinese traditional IP and animated films rise [1]

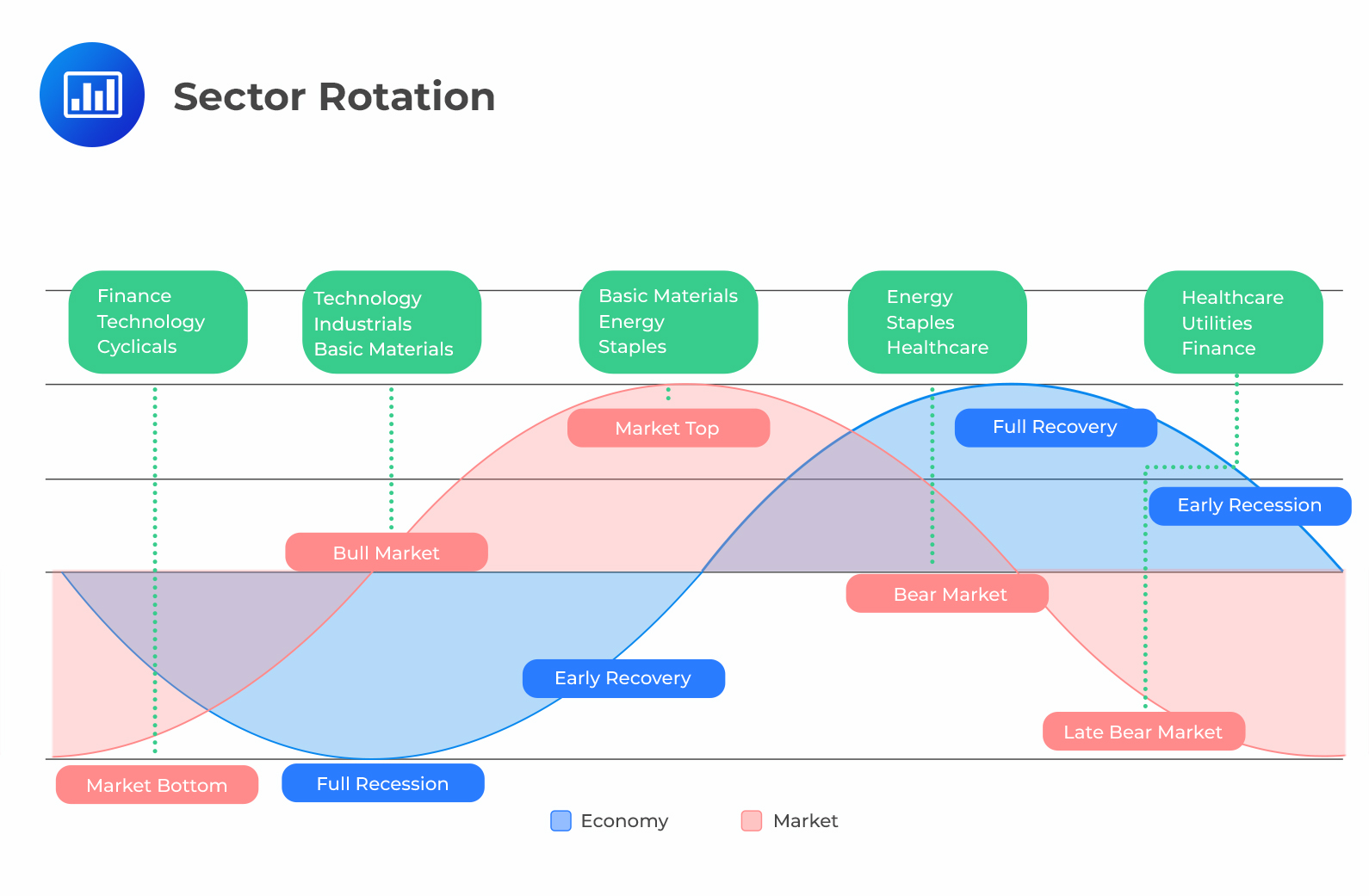

###3.3 Timing Law of Sector Rotation

According to market research, the industry rotation in2025 showed obvious Relative Rotation Graph characteristics, and industries generally moved clockwise on the graph [7]:

- Leading interval: Consumer, medical health, materials, financial and other sectors [7]

- Improvement interval: Energy, industry [7]

- Lagging interval: Telecommunications services, information technology [7]

- Weakening interval: Optional consumption, information technology momentum is weakening [7]

###4.1 Prediction of 2026 Market Mainline

According to research by institutions such as Guojin Securities, the new investment mainline in2026 has already been reflected [8]:

- Under the resonance of AI investment and global manufacturing recovery, the physical consumption of manufacturing links in various industrial chains is increasing

- The trading range of bulk commodities is lengthening

- China’s manufacturing advantages are gradually showing, and they are first reflected in the foreign exchange market [8]

- China’s equipment export chain with global comparative advantages and confirmed cycle bottom

- Domestic manufacturing bottom reversal varieties [8]

- Bottom stabilization and recovery of domestic demand consumption under policy dividends

- High-end and advanced manufacturing, artificial intelligence, new energy and renewable energy, emerging consumption and service consumption are expected to become the driving forces of China’s future economic growth [7]

###4.2 Four Sector Allocation Recommendations for2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.