Impact Analysis of Crinetics Pharmaceuticals (CRNX) Clinical Data Release

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Current Stock Price:$46.73 (as of January 4, 2026 close) [0]

- Market Capitalization:$4.43 billion [0]

- 52-Week Range:$24.10 - $53.41 [0]

- Quarterly Performance:6-month gain +60.81%, 3-year gain +168.72% [0]

- Rating:Strong Buy (94.4% of analysts gave Buy rating) [0]

- Median Target Price:$82.00, representing a 75.5% upside from current stock price [0]

- Target Price Range:$36 - $143 [0]

- Current Ratio:15.12 (indicating strong liquidity) [0]

- Debt Risk:Low [0]

- Cash Position:As of Q3 2025, the company has sufficient cash to support operations and R&D investments [0]

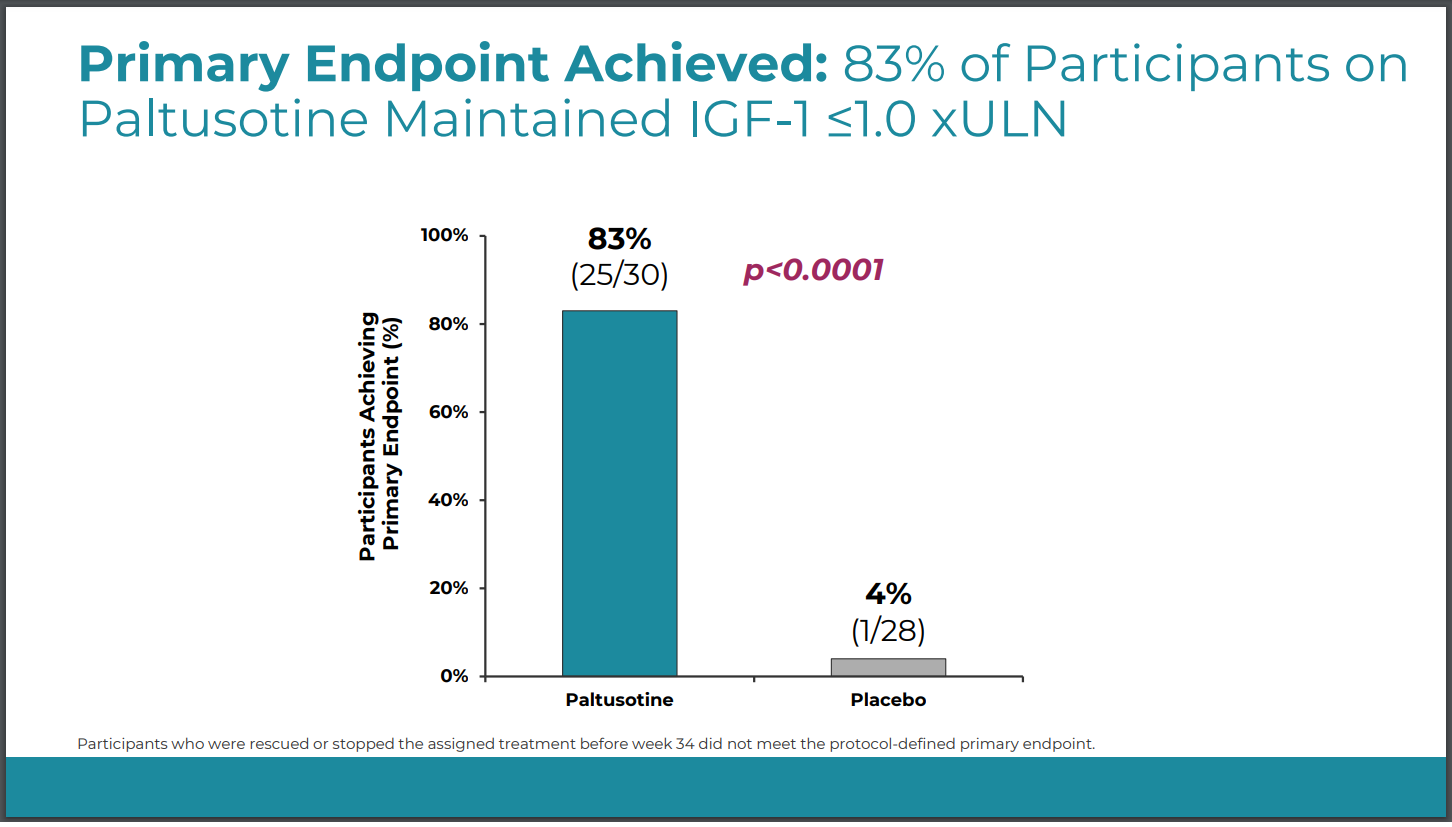

- First FDA-approvedonce-daily oral somatostatin receptor agonist for the treatment of adult acromegaly (approved in 2025) [1][2]

- Innovation Advantages:Compared to traditional injectable drugs (e.g., Octreotide, Lanreotide), PALSONIFY offers oral convenience, significantly improving patient compliance [1][2]

- Expanded Indications:CAREFNDR Phase 3 trial is ongoing for the treatment of Carcinoid Syndrome [1]

- Acromegaly Market:The global somatostatin analogs market is expected to reach $14.32 billion by 2032, with a CAGR of 8.04% [3]

- Carcinoid Syndrome:As a key treatment area for neuroendocrine tumors (NET), it accounts for the largest share of the somatostatin analogs market [3]

- Competitive Landscape:The current market is dominated by injectables (Novartis’ Sandostatin, Ipsen’s Somatuline), and oral formulations will create a new niche market [3]

- Achieved $14 million in license revenue in Q3 2025 [0]

- Investment banks like Piper Sandler expect PALSONIFY to achieve rapid commercial growth in 2026 [1]

- Analysts predict the product’s peak sales could reach hundreds of millions of dollars

- First-in-class Mechanism:The world’s firstoral small-molecule ACTH receptor antagonistto enter late-stage clinical development [1][4]

- Indication:Classic Congenital Adrenal Hyperplasia (Classic CAH) [1][4]

- Orphan Drug Designation:Granted orphan drug status by the U.S. FDA, enjoying market exclusivity and tax incentives [4]

- Significant Improvement in Biomarkers:Rapid, sustained, and statistically significant reduction in key CAH disease biomarkers, including androstenedione (A4) and 17-hydroxyprogesterone (17-OHP) [1][4]

- Clinical Benefits:Improvement in multiple clinical indicators such as reduced adrenal size and restored menstruation [4]

- Unique Dual Endpoints:The CALM-CAH Phase 3 trial is designed with unique endpoints to simultaneously evaluate normalization of adrenal androgen levels and reduction in glucocorticoid dosage [4]

- CAH Market Size:The global CAH treatment market is expected to reach $660 million by 2029, with a CAGR of 7.1% [5]

- Unmet Medical Needs:Current treatments mainly rely on steroid hormone replacement, which has significant long-term side effects; patients urgently need non-steroidal treatment options [5]

- Market Gap:There has been a lack of innovation in CAH treatment over the past few decades; Atumelnant is expected to be the first targeted therapy addressing the pathological mechanism of CAH [5]

- Phase 3 Initiation:The pivotal CALM-CAH Phase 3 trial completed first patient dosing on December 11, 2025 [4]

- Cohort 4 Data:Topline data from Phase 2 Cohort 4 will be announced soon [1]

-

PALSONIFY Commercialization Update:

- Initial market performance post-launch

- Prescription volume and insurance coverage progress

- Sales channel development status

-

Atumelnant Phase 2 Cohort 4 Data:

- Detailed data on biomarker improvement

- Dose-response relationship

- Safety data update

- Provide basis for Phase 3 trial design

- January 13, 2026:Participate in the 44th J.P. Morgan Healthcare Conference [1]

- February 26, 2026:Q4 FY2025 earnings release, expected EPS -$1.35 [0]

- 2026-2027:Data readouts from CAREFNDR Phase 3 (Carcinoid Syndrome) and CALM-CAH Phase 3 (CAH)

- Between October-December 2025the stock price rose from $41.50 to $46.55, an increase of 12.17% [0]

- Technical Aspect:The stock price is currently between the 20-day moving average ($47.96) and the 50-day moving average ($44.94), in a consolidation phase [0]

- Trading Volume:Average daily volume of 1.32 million shares, indicating good liquidity [0]

- October 1: Q3 earnings report showed $14 million in license revenue [0]

- November 20: Patient enrollment started for CAREFNDR Phase 3 trial [1]

- December 11: First patient dosed in CALM-CAH Phase 3 trial [4]

- Traditional DCF model shows negative value (base scenario -$2,166.37), which is a typical characteristic of clinical-stage biopharmaceutical companies[0]

- Reasons: High R&D investment, not yet profitable at scale, future revenue highly dependent on product commercial success

-

NPV Analysis Based on Peak Sales:

- PALSONIFY (Acromegaly): Expected peak sales of $300-500 million

- PALSONIFY (Carcinoid Syndrome): If approved, additional contribution of $200-300 million

- Atumelnant (CAH): Expected peak sales of $200-400 million

- Combined peak sales potential: $700 million - $1.2 billion

-

Risk-Adjusted Valuation:

- Conservative Scenario (40% success probability): $45-55/share

- Base Scenario (60% success probability): $70-85/share

- Optimistic Scenario (80% success probability): $100-130/share

-

Rationality Analysis of Analyst Target Prices:

- Median target price of $82 implies the market is optimistic about the success of both products [0]

- If PALSONIFY commercialization goes smoothly and Atumelnant Phase 3 data is positive, the target price can be achieved

-

Commercial Execution Risk (High Risk):

- PALSONIFY faces competition from injectables and needs to prove clinical advantages of oral formulation

- Market acceptance after Carcinoid Syndrome indication approval is uncertain

- Insurance coverage and patient reimbursement rates affect prescription volume

-

Clinical Development Risk (Medium-High Risk):

- Atumelnant Phase 3 trial may not replicate positive Phase 2 results

- If Cohort 4 data shows reduced efficacy or safety issues, it will affect Phase 3 design

-

Regulatory Risk (Medium Risk):

- FDA has strict requirements for safety and efficacy of new category drugs

- Approval of Carcinoid Syndrome indication may require additional confirmatory trials

-

Funding Demand Risk (Low Risk):

- The company currently has sufficient cash (current ratio of 15.12) [0]

- However, Phase 3 trials and commercialization will consume significant funds

- If clinical data is poor, it may affect subsequent financing capacity

-

Competition Risk (Medium Risk):

- Other biotech companies may develop competing products in the CAH field

- New oral long-acting formulations are being developed in the acromegaly field

- Trigger Conditions:Atumelnant Cohort 4 data shows sustained biomarker improvement, PALSONIFY commercialization exceeds expectations

- Stock Price Performance:Rises 30-50% to $60-70

- Key Drivers:Positive clinical data strengthens Phase 3 success probability

- Trigger Conditions:Data meets expectations, consistent with previous Phase 2 results, commercialization progresses steadily

- Stock Price Performance:Remains in the $45-55 range

- Key Drivers:Market waits for Phase 3 data, no major short-term catalysts

- Trigger Conditions:Cohort4 data shows reduced efficacy or safety issues, slow commercialization progress

- Stock Price Performance:Drops 20-30% to $33-38

- Key Drivers:Increased market concerns about Atumelnant’s success probability

-

Dual Product Drive:CRNX has two potential blockbuster products, diversifying the risk of single product failure

-

First-in-class Drug Advantages:

- PALSONIFY is the first oral somatostatin receptor agonist

- Atumelnant is the first ACTH receptor antagonist

- First-in-class drugs usually enjoy higher pricing power and longer market exclusivity

-

Market Expansion Potential:

- Oral convenience may expand the acromegaly treatment population (some patients currently untreated due to refusal of injections)

- If approved, Atumelnant will create a new CAH treatment market

-

Pipeline Depth:The company has over 10 disclosed R&D projects, providing potential for long-term growth [1]

- 2026:PALSONIFY sales reach $50-100 million, Atumelnant Phase3 ongoing

- 2027:PALSONIFY peak sales of $200-300 million, Atumelnant receives FDA approval

- 2028:Dual product commercialization, total revenue reaches $500-800 million

- Valuation Target:Based on multiple method (3-4x revenue), market capitalization reaches $15-24 billion, stock price $160-250

- Investors who can tolerate high volatility of clinical-stage biopharmaceutical companies

- Long-term investors with an investment horizon of over 12 months

- Investors with in-depth knowledge of innovative drugs and rare disease fields

- **Aggressive Portfolio:**3-5% position

- **Balanced Portfolio:**1-2% position

- Conservative Portfolio:Not recommended (or only as a small satellite position)

- Weekly:PALSONIFY prescription volume data (available via IQVIA and other channels)

- Monthly:Enrollment progress of CAREFNDR and CALM-CAH trials

- Quarterly:Cash burn rate and funding runway

- Key Events:Phase3 data readout schedule (expected in 2027)

##7. Conclusion

- If Cohort4 data is positive, the stock price is expected to break through $50 and move towards the median analyst target price of $82

- If data meets expectations, the stock price will remain in the $45-55 range

- If data falls short of expectations, the stock price will correct sharply

- Success Scenario:Both products are approved for marketing, CRNX will become a leader in the endocrine rare disease field, with market capitalization expected to exceed $10 billion

- Partial Success Scenario:PALSONIFY commercialization goes smoothly and Atumelnant Phase3 data is positive, market capitalization reaches $6-8 billion

- Failure Risk:Failure of either product will significantly reduce the company’s valuation, but the other product can still support part of the value

— References —

[0] Jinling API Data (Crinetics Pharmaceuticals company overview, financial data, market data)

[1] GlobeNewswire - “Crinetics Pharmaceuticals to Provide PALSONIFY Business Update and Announce Topline Results from Fourth Cohort of Phase 2 Trial of Atumelnant” (https://www.globenewswire.com/news-release/2026/01/04/3212404/0/en/Crinetics-Pharmaceuticals-to-Provide-PALSONIFY-Business-Update-and-Announce-Topline-Results-from-Fourth-Cohort-of-Phase-2-Trial-of-Atumelnant-in-Congenital-Adrenal-Hyperplasia.html)

[2] Nature - “2025 FDA approvals” - Paltusotine (Palsonify) FDA approval listing (https://www.nature.com/articles/d41573-026-00001-z)

[3] GlobeNewswire - “Somatostatin Analogs Market Size to Reach USD 14.32 Billion by 2032” (https://www.globenewswire.com/news-release/2025/11/17/3189167/0/en/Somatostatin-Analogs-Market-Size-to-Reach-USD-14-32-Billion-by-2032-as-Advanced-Treatments-Accelerate-Global-Adoption-SNS-Insider.html)

[4] GlobeNewswire - “Crinetics Announces First Patient Dosed in Pivotal Adult Trial of Atumelnant in Congenital Adrenal Hyperplasia (CAH)” (https://www.globenewswire.com/news-release/2025/12/11/3204301/0/en/Crinetics-Announces-First-Patient-Dosed-in-Pivotal-Adult-Trial-of-Atumelnant-in-Congenital-Adrenal-Hyperplasia-CAH.html)

[5] The Business Research Company - “Global Congenital Adrenal Hyperplasia Market Report 2025” - Market size and growth projections (https://www.thebusinessresearchcompany.com/infographimages/250306_GMR_Congenital_Adrenal_Hyperplasia_Market.webp)

[6] CARES Foundation - “VOICE OF THE PATIENT REPORT” - Unmet medical needs in CAH treatment (https://caresfoundation.org/wp-content/uploads/2025/05/CARES-CAH-Voice-of-the-Patient-Report-2025.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.