Investment Impact Analysis of the "Solid Waste Comprehensive Management Action Plan" on Listed Companies in the Environmental Protection and Renewable Resources Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The State Council issued the “Solid Waste Comprehensive Management Action Plan” on December 27, 2025, which is a

The plan sets strategic goals for

- Annual comprehensive utilization of bulk solid waste reaching 4.5 billion tons

- Annual recycling volume of major renewable resources reaching 510 million tons

- By 2030, completing the governance of over 60% of historically accumulated solid waste storage sites nationwide

- Fully completing the environmental risk hazard rectification of red mud reservoirs and tailings ponds [2,5]

The Action Plan constructs a

- Industrial solid wastesource reduction: In principle, no approval will be given for the construction of mineral processing projects without self-built mines or supporting tailings utilization and disposal facilities [3,4]

- Urban solid wastecontrol: Promote classified treatment of construction waste and green construction

- Agricultural and forestry solid wastereduction: Strengthen scientific use and management of plastic film, and promote circular agricultural production models

- Key special rectification: Domestic waste landfills, construction waste, historically accumulated storage sites, phosphogypsum, etc. [5]

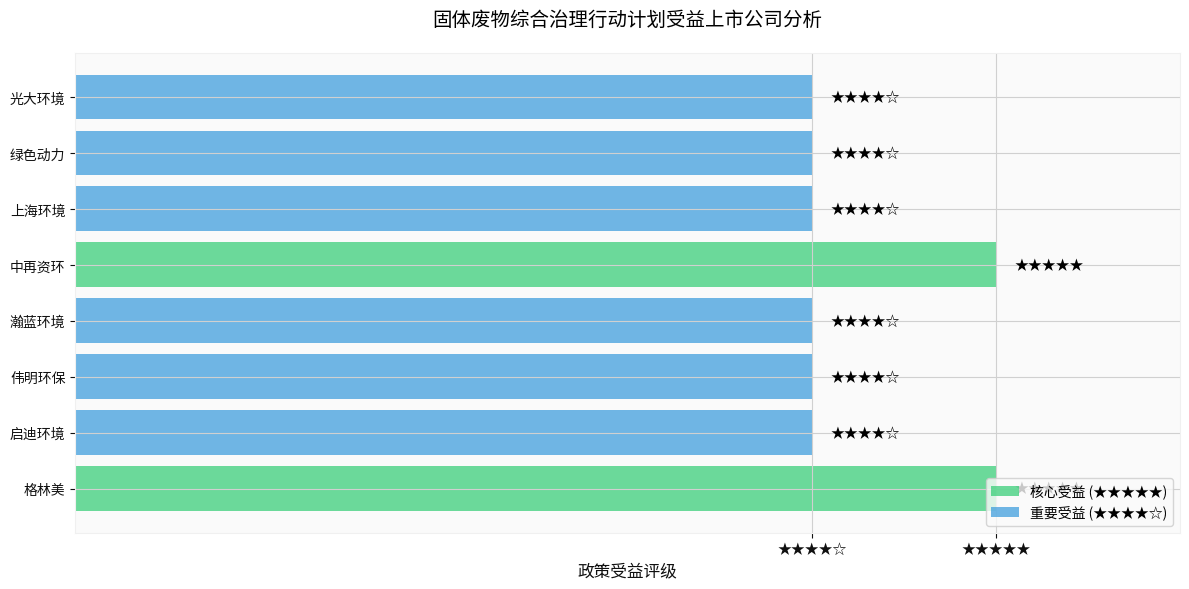

Based on policy orientation and business layout, we identify the following

| Company Name | Stock Code | Main Business | Beneficiary Logic |

|---|---|---|---|

GEM |

002340.SZ | Electronic waste recycling, battery material recycling | The policy clearly supports renewable resource recycling and utilization; as a leader in electronic waste recycling, the company directly benefits from the 510 million tons renewable resource recycling target [6] |

China National Resources Recycling |

600217.SH | Waste electrical and electronic product dismantling | Leading enterprise in waste electrical dismantling; benefits from the construction of renewable resource recycling system and “reverse invoicing” policy support [2] |

| Company Name | Stock Code | Main Business | Beneficiary Logic |

|---|---|---|---|

TUS Environment |

000826.SZ | Solid waste treatment, environmental remediation | Benefits from the special rectification of historically accumulated solid waste storage sites; current share price is 2.22 yuan, up 1.37% [7] |

Hanlan Environment |

600323.SH | Comprehensive solid waste treatment, water services | Integrated solid waste treatment enterprise with complete industrial chain; benefits from urban solid waste source control and construction waste special rectification |

Valiant Environmental |

603568.SH | Waste incineration power generation | Benefits from domestic waste landfill special rectification and improvement of waste treatment charging system |

Shanghai Environment |

601200.SH | Domestic waste treatment | Benefits from the special rectification of environmental pollution hazards at domestic waste landfills |

Green Power |

601330.SH | Waste incineration power generation | Benefits from the reform of waste treatment charging system and improvement of waste incineration treatment capacity |

Everbright Environment |

0257.HK | Comprehensive environmental services | Comprehensive environmental leader; benefits from the construction of solid waste comprehensive governance system in all aspects |

High Energy Environment |

603588.SH | Environmental remediation, solid waste treatment | Benefits from environmental risk investigation, assessment and rectification of historically accumulated solid waste storage sites |

According to industry research reports,

- Waste steel recycling: The recycling volume in 2024 was approximately 246 million tons, accounting for 63.33% of the total renewable resource recycling volume [9]

- New energy recycling: In 2024, the recycling volume of decommissioned wind and photovoltaic equipment surged by145.2% year-on-year, the recycling volume of scrapped motor vehicles increased by79.2% year-on-year, and the recycling volume of waste batteries increased by23.0% year-on-year[9]

- High-value utilization: Policies promote the shift from extensive recycling to high-quality and compliant development, accelerating the formation of a commercial closed loop for recycling businesses [10]

The Action Plan provides comprehensive policy guarantees [2]:

- Land guarantee: All regions arrange no less than1% of industrial landto support the construction of resource recycling facilities

- Fiscal and tax support: Implement tax incentives and “reverse invoicing” policies, promote green credit and bonds

- Charging system: Implement waste treatment charging system and explore differential charging

- Regulatory strengthening: Incorporate prominent ecological and environmental problems in the solid waste field into the central ecological and environmental protection inspection

-

Policy certainty: The Action Plan providesclear policy benefitsfor the environmental protection solid waste treatment and renewable resource recycling industries, with clear goals and strong guarantees, significantly enhancing industry certainty [1,2,10]

-

Cash flow improvement expectation: With the acceleration of national subsidies, promotion of debt resolution, and improvement of waste treatment charging system, thecash flow situation of environmental protection enterprises is expected to continue to improve, and dividend potential will increase [8]

-

Industry concentration improvement: Strict environmental supervision and subsidy adjustments will accelerate industry clearance, andleading enterprises with channel, capital, and technical advantageswill further increase their market share [8]

-

Technology innovation drive: Policies encourage the R&D and promotion of advanced technology and equipment, andimprovement of high-value utilization levelwill bring higher profitability [2,10]

- Thematic investment opportunitiesdriven by policy catalysis

- Focus on companies benefiting from special rectification (e.g., TUS Environment, High Energy Environment)

- Focus on pilot enterprises of renewable resource recycling system [8]

- Value revaluation of high-quality operating assets under cash flow improvement expectation

- Focus on solid waste treatment leaders with high dividends and high growth (e.g., Hanlan Environment, Valiant Environmental)

- Focus on leaders in high-growth segmented fields such as new energy recycling (e.g., GEM)

- Industry leaders benefiting from the circular economy trend

- Enterprises with core technical advantages and capable of high-value utilization

- High-quality environmental protection enterprises expected to expand overseas

- Policy implementation falling short of expectations: Some regions may have insufficient policy implementation efforts

- Delay in subsidy distribution: The problem of arrears in renewable energy subsidies still needs attention

- Raw material price fluctuations: Renewable resource recycling business is greatly affected by commodity price fluctuations

- Increased competition: The increased attractiveness of the industry may lead to more new entrants, worsening the competitive landscape

- Accounts receivable risk: The environmental protection industry has a relatively high proportion of accounts receivable (e.g., accounts receivable/market value of some enterprises exceeds 100%), and the progress of debt resolution affects performance release [6]

For a long time, the renewable resource industry has been trapped in the development dilemma of “small, scattered, chaotic” [10]. The Action Plan will promote the industry to shift from

- Establishing a scientific and reasonable price mechanism

- Guiding enterprises to increase R&D investment in technology

- Forming a sustainable business model

- Leveraging market forces to promote circular economy development

With the joint construction of ESG disclosure standards in the industry, Chinese environmental protection enterprises are gradually realizing the transformation from

The Action Plan emphasizes

The “Solid Waste Comprehensive Management Action Plan” provides

- Core Focus: Renewable resource recycling leaders such as GEM (002340.SZ) and China National Resources Recycling (600217.SH)

- Important Allocation: Leading solid waste treatment enterprises such as Hanlan Environment (600323.SH), TUS Environment (000826.SZ), and Valiant Environmental (603568.SH)

- Long-term Layout: High-quality environmental protection enterprises with core technical advantages, capable of high-value utilization, and expected to expand overseas

[0] Jinling API Data - Including real-time quotes of GEM (002340.SZ), TUS Environment (000826.SZ), and other market data

[1] People’s Daily - “State Council Issues ‘Solid Waste Comprehensive Management Action Plan’”

[2] People.cn - “State Council Issues ‘Solid Waste Comprehensive Management Action Plan’”

[3] Sina Finance - “Global ‘Black Swan’! CSRC’s Latest Release! China Assets Surge! Top Ten… Affecting the Market This Week”

[4] Securities Times - “Global ‘Black Swan’! CSRC’s Latest Release! China Assets Surge! Top Ten… Affecting the Market This Week”

[5] CCTV.com - “State Council Issues ‘Solid Waste Comprehensive Management Action Plan’”

[6] Qianzhan Industry Research Institute - “2021 China Solid Waste Treatment Industry Listed Companies Comprehensive Comparison”

[7] Debon Securities - “2024 Environmental Protection Sector Investment Strategy: Under the Expectation of Debt Resolution, Environmental Protection Enterprises Are Expected to Benefit Significantly”

[8] Soochow Securities - “Environmental Protection Industry Tracking Weekly: Ministry of Commerce Publishes Pilot Cities and Enterprises for Renewable Resource Recycling System, Debt Resolution Progresses Actively”

[9] China Report Hall - “2025 Renewable Resource Competition Analysis: From Scale Expansion to Pattern Reconstruction”

[10] Solid Waste Network - “Building a New Ecology of Circular Economy, Panoramic View of Renewable Resource Industry from Environmental Protection Perspective”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.