Escalating U.S. Pressure on Venezuela: Impact on Global Oil Supply and Energy Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Escalating U.S. pressure on Venezuela—including the seizure of a sanctioned oil tanker and stricter enforcement of sanctions—could reduce Venezuela’s already limited crude exports and tighten medium-term global supply. While Venezuela’s production remains heavily constrained, the policy shift may introduce price volatility, benefit integrated majors and service companies, and pressure refiners dependent on heavy sour crude. The energy sector’s recent performance reflects cautious optimism in this environment.

The Trump administration has intensified pressure on Venezuela’s oil sector:

- Tanker seizure and stricter enforcement: U.S. forces seized a sanctioned oil tanker off Venezuela’s coast, and the administration announced a ban on sanctioned oil tankers entering and leaving Venezuela. Venezuela’s government characterized this as an “outrageous threat” aimed at seizing the country’s oil wealth [1][2].

- Economic impact in Venezuela: The move could choke off one of the few remaining revenue streams for Venezuela, which faces a new bout of hyperinflation pressure (local economists estimate annual inflation may exceed 400% by year-end). Continued seizures risk steep declines in import capacity and deeper recession [3].

- Corporate exposure: Chevron’s Venezuelan operations—roughly 150,000 barrels per day—generated about $2–4 billion in revenue in 2025, representing around 2% of company revenue. While material, this exposure is relatively small on an enterprise basis and is subject to changing policy [4].

- Production levels: Venezuela currently produces approximately 800,000 barrels per day, per Reuters, reflecting years of underinvestment and structural constraints (down from a historic peak above 3 million bpd) [3].

- OPEC status: Venezuela remains an OPEC member, though its output sits well below quota due to chronic operational and financial constraints. Policy shifts that further curtail exports would add to global supply adjustments rather than serve as a primary swing producer.

- Heavy crude reliance: Venezuela produces predominantly heavy sour crude that requires specific refinery configurations, primarily in the U.S. Gulf Coast and Asia. Limiting these flows could raise premiums for comparable grades and stress coker-intensive refineries.

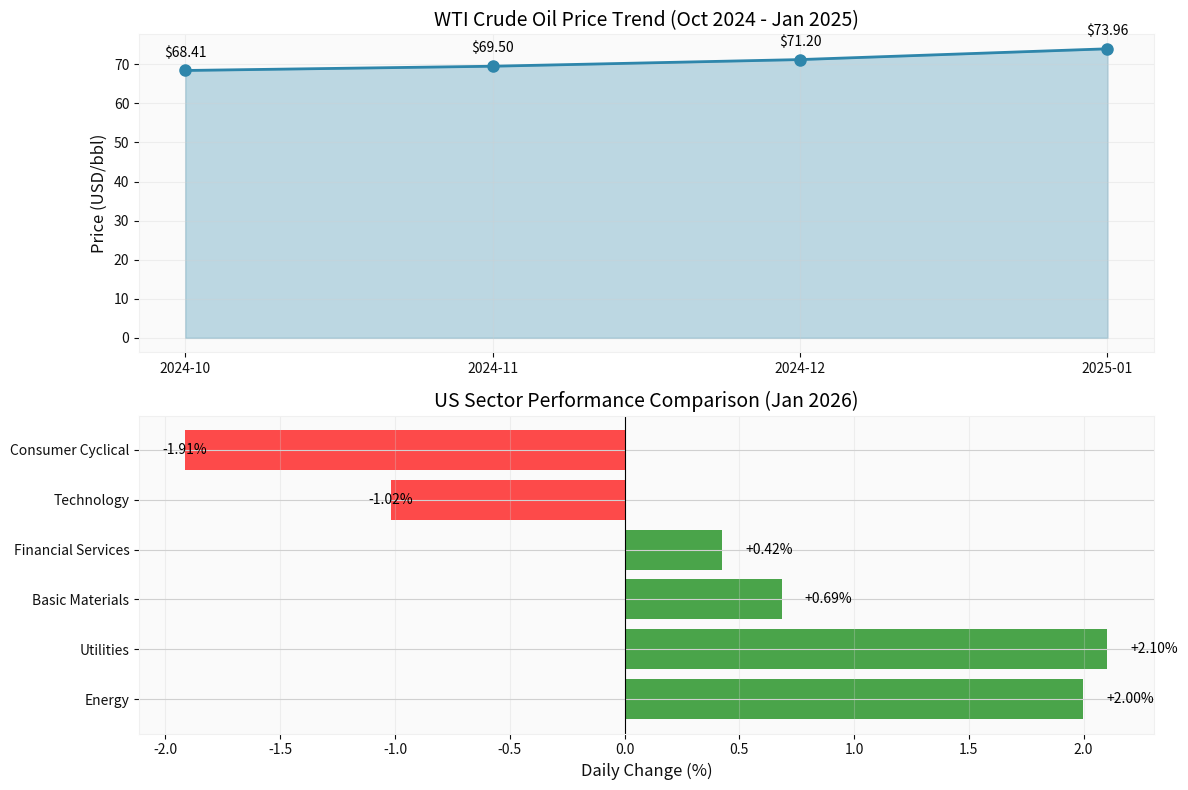

Chart: The top panel shows WTI crude prices rising from $68.41 in Oct 2024 to $73.96 in early Jan 2025 (8.11% over the period) [0]; the bottom panel shows Energy sector performance (+1.999%) among U.S. sectors on Jan 2026 [0].

| Scenario | Production Impact | Market Effect | Probability |

|---|---|---|---|

Status Quo (Limited Enforcement) |

Minimal change (150–200k bpd at risk) | Prices stable, EIA notes higher OPEC spare capacity | Medium |

Moderate Escalation |

150–300k bpd reduction | $2–5/bbl upside risk to Brent/WTI; tighter heavy sour discounts | Medium–High |

Severe Disruption |

400k+ bpd reduction | $5–10/bbl or greater upside; volatility spikes; heavy sour premiums widen | Low–Medium |

- Refining margins: U.S. Gulf Coast refineries configured for heavy sour crudes could face wider differentials for substitute grades, potentially squeezing margins if replacement costs rise.

- Asian buyers: China and India are key destinations for Venezuelan heavy crude; reduced supply may push them toward Canadian, Colombian, or Middle East heavies, reshaping trade flows and freight patterns.

- OPEC+ dynamics: Saudi Arabia and the UAE retain meaningful spare capacity and could offset disruptions, but coordinated response may depend on broader geopolitical considerations and price targets.

- Recent performance: Shares up roughly 14% over the past year [0].

- Metrics: P/E ~17.7x; ROE ~11.4%; solid operational cash flow [0].

- Exposure: Minimal direct Venezuela exposure; benefits from higher prices and widened heavy sour differentials.

- Drivers: Integrated model (upstream and downstream) provides insulation; free cash flow and shareholder returns remain key supports.

- Recent performance: Shares up roughly 6% over the past year [0]; analysts generally positive (consensus target ~$169) [0].

- Venezuela risk: Approximately 150,000 bpd Venezuelan production (~2% of revenue) is exposed to policy shifts. However, recent commentary suggests operations may persist under specific authorization regimes, and exposure is modest relative to the global portfolio [4].

- Offset: Diversified upstream portfolio and strong balance sheet can absorb volatility; higher benchmark prices support cash flow.

- Price upside: A sustained $5/bbl Brent price increase could support mid-single-digit earnings accretion for integrated majors (assuming volumes and costs stable).

- Risk premia: Companies with heavy crude exposure or Venezuelan assets may see modestly higher discount rates until policy clarity improves.

- Heavy sour specialists: Firms with assets in analogous basins (e.g., certain Canadian oil sands operators) may see improved pricing and netbacks if heavy sour differentials widen.

- U.S. shale: Indirect support via higher price decks; operators with disciplined capital frameworks benefit more than those expanding aggressively.

- Near-term catalysts: Increased activity and complexity (e.g., drilling in heavier or more remote fields) can support dayrates and utilization.

- Offshore exposure: Deepwater and international offshore services may gain as higher prices justify sanctioning longer-cycle projects.

- Mixed impact: Integrated refiners with flexible crude slates and coking capacity can adapt; those highly dependent on Venezuelan heavy sour may face cost pressures.

- Product crack spreads: Tightening heavy sour supply can lift margins for complex refineries capable of processing discounted alternatives.

- Price trend: WTI rose ~8% from October 2024 to early January 2025, reflecting a combination of macro factors, OPEC+ management, and geopolitical tensions (including Venezuela) [0].

- EIA spare capacity: The EIA’s revised OPEC capacity estimates indicate the system may have more buffer than previously assumed, which could dampen the price response to Venezuela-specific risks [5].

- Demand backdrop: Global growth outlook and seasonal patterns will modulate the impact; any synchronized slowdown alongside supply curtailments could mute price gains.

| Subsector | Short-Term (1–3 months) | Medium-Term (3–12 months) | Risk Factors |

|---|---|---|---|

Integrated Majors |

Support from price uplift and sector sentiment | EPS upside if prices sustain higher levels; share gains from buybacks/dividends | Policy volatility, demand softening |

E&P – Heavy Sour |

Netback improvement on wider differentials | Capital allocation discipline critical; cost control | Access to alternative heavy blends |

Refiners |

Mixed: complex plants gain; simple plants lose | Margin dispersion increases by crude slate | Crack spread volatility, feedstock substitution |

Services |

Stabilization as activity holds | International and offshore upside | Efficiency pressures, capital discipline |

- U.S. policy execution: Scope and duration of tanker seizures and enforcement mechanisms.

- License regime: Specific authorizations (e.g., for Chevron or other U.S. firms) and their renewal.

- OPEC+ response: Will Saudi Arabia/UAE adjust output to offset lost Venezuelan barrels?

- Demand indicators: Global growth data, particularly from major consumers (China, U.S., Europe).

- Inventories: OECD commercial crude and product stocks for signs of tightening.

| Scenario | Integrated Majors | E&P | Refiners | Services |

|---|---|---|---|---|

Diplomatic Resolution |

Modest gains as risk premia recede | Neutral to positive | Selective gains | Steady |

Contained Escalation (most likely) |

Stronger earnings; buyback support | Netback expansion; discipline rewarded | Mixed by complexity | Uptick in utilization |

Severe Disruption |

Price tail supports but volatility rises | Outperformance if hedged | Margins compress for simple refineries | Dayrate upside for offshore |

- Quality bias: Favor companies with strong balance sheets, low decline rates, and visible returns.

- Flexibility matters: Refiners and integrated players with crude slate flexibility and trading capabilities can adapt to changing grades.

- Geographic diversification: Reduce single-country or single-basin concentration to manage policy risk.

The intensification of U.S. pressure on Venezuela introduces tangible but manageable risks to global oil supply. While Venezuela’s production is already depressed relative to its historical capacity, further curtailments could tighten heavy sour markets, create modest price upside, and widen certain differentials. For investors, integrated majors such as Exxon Mobil and Chevron—with Chevron carrying modest Venezuelan exposure (~150,000 bpd) and Exxon largely unexposed—remain the primary beneficiaries through improved cash flow and shareholder returns potential. E&P companies with heavy sour assets and complex refiners may see differentiated outcomes based on feedstock flexibility and cost structures. Services could see a gradual lift if activity remains robust.

Market participants should monitor policy implementation details, OPEC+ responses, and demand indicators closely. The current energy sector performance (+1.999%) and oil’s recent uptick (WTI +8.11% since Oct 2024) reflect cautious optimism in a context where supply discipline and geopolitical risks coexist with greater-than-appreciated spare capacity [0][5]. Prudent positioning in quality names with defensive characteristics and disciplined capital allocation appears warranted as the situation evolves.

[0] 金灵API数据 (stock prices, company overviews, sector performance, market indices, oil prices)

[1] NPR - “What’s Trump’s Venezuela endgame?” (https://www.npr.org/2025/12/17/nx-s1-5647780/whats-trumps-venezuela-endgame)

[2] USA Today - “Why is Trump threatening Venezuela? What to know after tanker seized” (https://www.usatoday.com/story/news/world/2025/12/11/why-trump-is-threatening-venezuela-tanker/87718581007/)

[3] Bloomberg - “US Seizure of Venezuela Oil Tanker Risks Amping Up Economic Pain” (https://www.bloomberg.com/news/articles/2025-12-12/us-seizure-of-venezuela-oil-tanker-risks-amping-up-economic-pain)

[4] Forbes - “Chevron Stock Up 6%. Why Venezuelan Oil May Not Make CVX a Buy” (https://www.forbes.com/sites/petercohan/2026/01/04/chevron-stock-up-6-why-venezuelan-oil-may-not-make--cvx-a-buy/)

[5] Yahoo Finance - “The EIA Thinks OPEC Can Pump More Than Anyone …” (https://finance.yahoo.com/news/eia-thinks-opec-pump-more-113000757.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.