Analysis of the Strong Performance of Jinwo Co., Ltd. (300984)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Event occurred on January 5, 2026 (UTC+8), Jinwo Co., Ltd. (300984) entered the strong stock pool, although the industrial sector as a whole fell slightly (-0.03547%) [0].

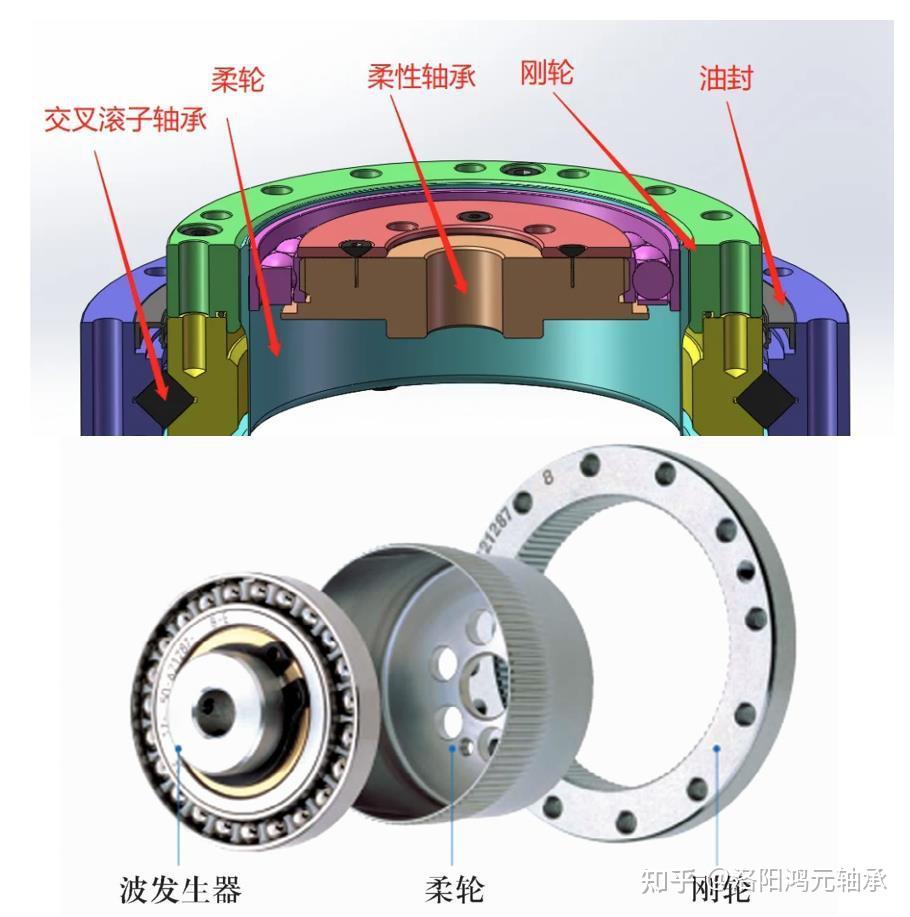

Analysts point out that the humanoid robot concept may be the driving factor. Jinwo Co., Ltd. mainly engages in bearing manufacturing [0], and bearings are key components of core parts such as robot joints. The rising industry attention to humanoid robots may drive up market expectations for the potential space of the company’s business.

Internal data shows that there have been obvious signs of capital inflow into this stock recently, and trading volume has increased [0]. If subsequent technical indicators (such as moving averages, RSI, etc.) continue to improve, it will further strengthen the short-term strong trend.

As a bearing industry enterprise, the company’s business layout has synergistic potential with the robot industry. It is necessary to pay attention to whether the company has business expansion or technical reserves related to humanoid robots, as well as the supporting role of the latest financial data (such as revenue growth, gross profit margin level, etc.) on the stock price.

The combination of the popularity of the humanoid robot concept and the company’s business attributes is the core logic for the stock to strengthen against the backdrop of overall sector weakness. This reflects the current market’s attention to niche areas of emerging industries and the linkage effect between individual stock fundamentals and concept catalysts.

- The rapid development of the humanoid robot market, if the company can seize the opportunity to expand related businesses, will provide new momentum for long-term growth [0].

- The strong performance driven by short-term capital inflows may attract more market attention.

- The popularity of the humanoid robot concept may fluctuate in the short term; if the company’s related businesses are not actually implemented, the stock price may lack sustained support.

- The overall performance of the industrial sector still has a certain impact on individual stocks, so we need to be alert to risks brought by sector fluctuations.

The strong performance of Jinwo Co., Ltd. (300984) is related to the current popularity of the humanoid robot concept, and the connection between its bearing business and the robot industry is the main logical support. Technical aspects show signs of short-term capital promotion; fundamentals need to be further verified with business expansion and financial data. The sustainability of future trends depends on the progress of the humanoid robot market and the implementation of the company’s related businesses. Investors should pay attention to company announcements and industry trends, and make decisions based on their own risk preferences.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.