BAIC Blue Valley (600733) In-Depth Analysis: Sustainability of Growth Momentum and Profit Quality Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to BAIC Blue Valley’s 2025 performance data [1]:

- Annual Sales: 209,576 units, up 84.06% year-on-year

- December Sales: 35,205 units, up 114.56% year-on-year

- Annual Production: 206,284 units, up 127.17% year-on-year

- ArcFox brand’s annual sales exceeded 160,000 units, achieving double-digit growth for three consecutive years [2]

- Enjoyment brand’s December sales exceeded 10,000 units for the first time, setting a new monthly record for the brand [2]

According to Jinling API data [0]:

- Net Profit Margin: -29.30% (severe loss status)

- Operating Profit Margin: -35.55%

- Return on Equity (ROE): -153.23%

- Current Ratio: 0.69 (below the safety line of 1.0)

- Free Cash Flow: Approximately -4.127 billion yuan

- Price-to-Earnings Ratio (P/E): -7.61x (negative indicates loss)

Based on Python calculation analysis, if estimated at an average unit price of 180,000 yuan:

- Estimated Total Revenue: Approximately 37.7 billion yuan

- Estimated Net Loss: Approximately 11.1 billion yuan

- Per-Unit Loss: Approximately 52,700 yuan/unit

The “ArcFox + Enjoyment” dual-brand strategy is advancing in depth [2], forming differentiated positioning:

- ArcFox: Positioned in the mid-to-high-end market, it has achieved double-digit sales growth for three consecutive years and become the sales base

- Enjoyment: Jointly built with Huawei as a luxury flagship brand, its December sales exceeded 10,000 units, firmly ranking first in sales of luxury new energy sedans above 300,000 yuan

- ArcFox Alpha S (L3 version) officially obtained MIIT’s L3-level autonomous driving access permit and Beijing’s autonomous driving special license plate [3]

- In-depth cooperation with Huawei, mastering core intelligent driving technologies, including full experience coverage of high-speed NOA and urban NOA

According to online search information [4]:

- The 2025 new energy vehicle price war began to “brake”, no longer selling cars at a loss

- The industry returned from capital-driven disorderly expansion to a良性 cycle of commercial essence

- The speed of account recovery accelerated, and supply chain cash flow pressure improved

- New energy vehicle sales are expected to reach 15.5 million units in 2025, up about 20% year-on-year [1]

- The penetration rate of new energy vehicles has exceeded 50%, and the market has entered a new stage of high-quality development

According to online search information [5]:

- BAIC Blue Valley’s cumulative losses from 2021 to 2024 have exceeded 23 billion yuan

- The estimated net loss in 2025 is approximately 11.1 billion yuan, and the cumulative loss will exceed 34 billion yuan

- Severe cash flow consumption severely restricts the company’s continuous investment capacity

- The estimated per-unit loss is approximately 52,700 yuan, far exceeding the industry average

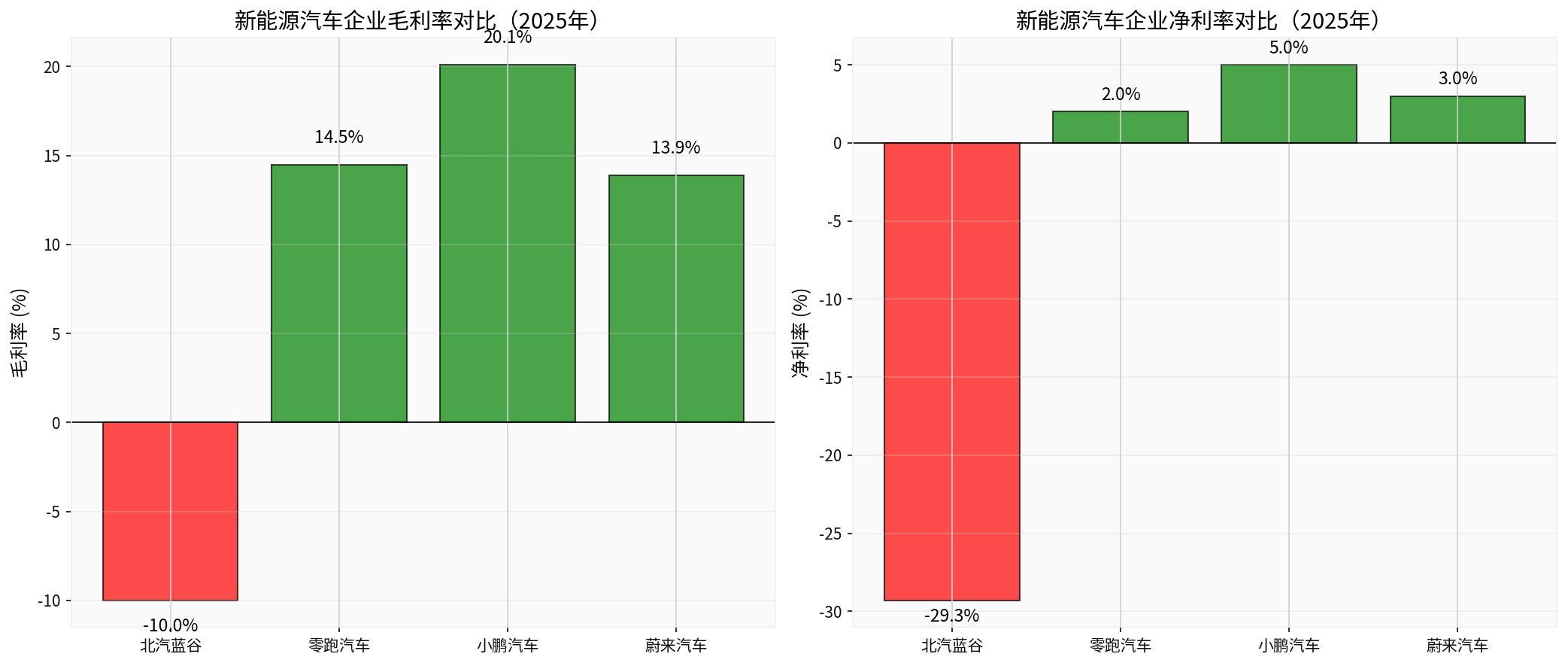

- Comparison with peers: Leapmotor’s gross margin is 14.5%, Xpeng Motors’ gross margin is 20.1%, NIO’s comprehensive gross margin is 13.9%, all have achieved or are close to profitability [4]

- BAIC Blue Valley’s gross margin may be negative, putting it at a clear disadvantage in the price war

- Current ratio of 0.69, far below the safety line of 1.0, with huge short-term debt repayment pressure

- Free cash flow continues to be negative, with an alarming rate of cash consumption

- Long-term losses may lead to financing difficulties

- L3-level autonomous driving R&D requires continuous huge investment

- Although the Enjoyment brand, in deep cooperation with Huawei, is positioned as high-end, large-scale profitability takes time

- It is difficult to balance technology investment and profitability improvement in a state of severe loss

The above chart shows that BAIC Blue Valley is significantly behind industry peers in terms of gross margin and net profit margin,处于 a severe loss state.

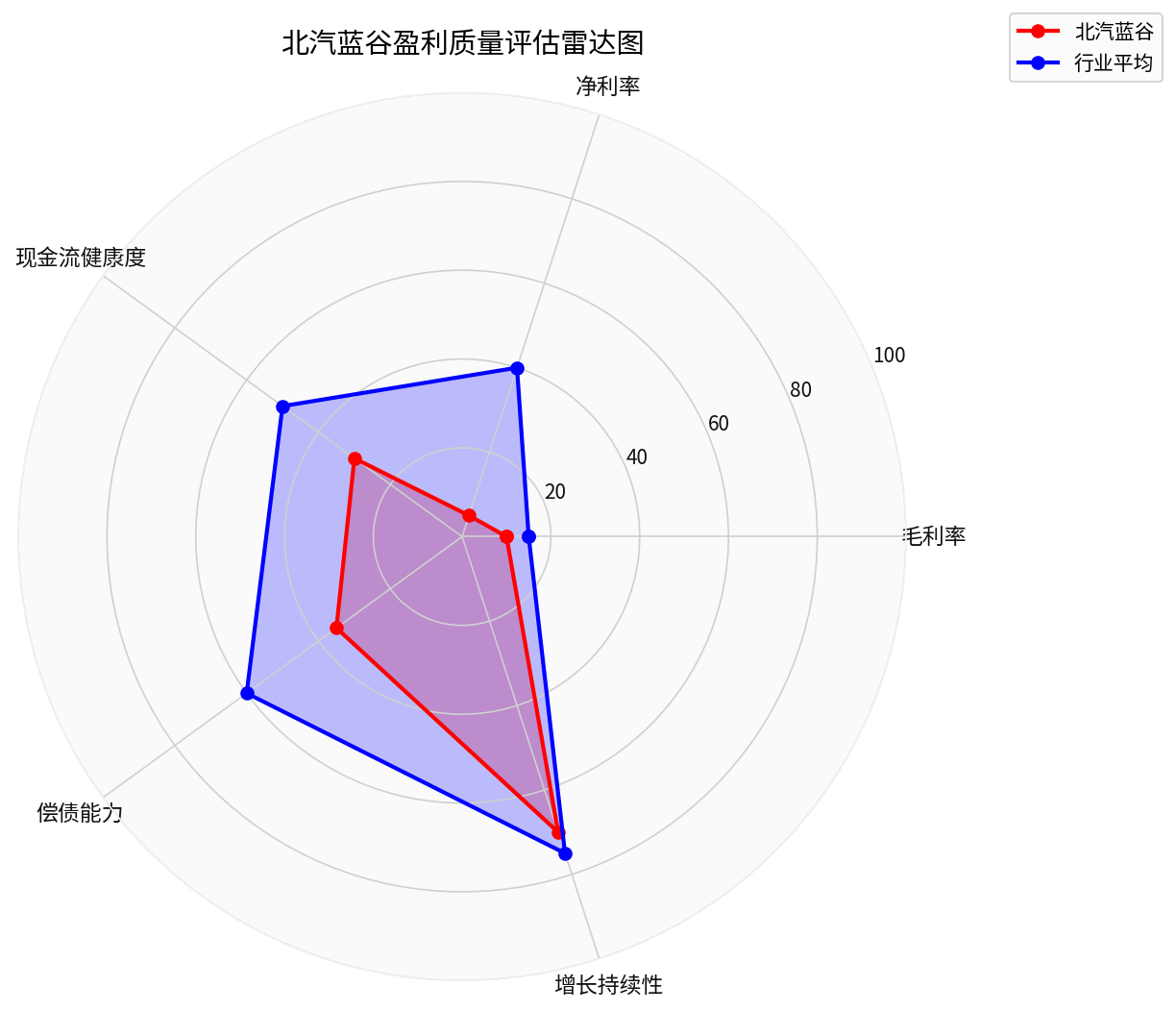

The radar chart shows that BAIC Blue Valley is severely insufficient in gross margin, net profit margin, cash flow health and solvency, and only performs well in growth sustainability.

| Indicator | BAIC Blue Valley | Industry Benchmark | Assessment |

|---|---|---|---|

Gross Margin |

Approximately -10% [Estimated] | 15%-20% | ❌ Extremely Poor |

Net Profit Margin |

-29.30% | 5%-10% | ❌ Severe Loss |

Cash Flow Health |

-4.127 billion yuan | Positive | ❌ Extremely Poor |

Solvency |

Current Ratio 0.69 | >1.5 | ❌ High Risk |

Growth Sustainability |

84% Sales Growth | 20%-30% | ⚠️ Volume Without Profit |

- ✅ Dual-brand strategy and Huawei cooperation bring growth momentum

- ✅ L3 autonomous driving technical advantages form differentiated competitiveness

- ⚠️ However, the growth model of “volume without profit” is unsustainable

- ❌ If gross margin cannot be significantly improved within 12-18 months, a cash flow crisis may erupt

- ❌ Cumulative losses exceed 34 billion yuan, and the deterioration of financing environment will severely restrict development

- ⚠️ Although the price war “brake” is beneficial, it still takes time for BAIC Blue Valley’s gross margin to turn positive

- Depends on whether the Enjoyment brand can achieve large-scale profitability

- Depends on whether the ArcFox brand can increase gross margin to more than 10%

- Depends on whether L3 autonomous driving can be commercialized and monetized

- Per-unit loss of 52,700 yuan: This is a typical model of “the more you sell, the more you lose”

- Gross margin may be negative: Indicates serious problems in cost control or pricing strategy

- Cash flow crisis: Free cash flow of -4.127 billion yuan, with an alarming rate of cash consumption

- High debt repayment risk: Current ratio of 0.69, with huge short-term debt repayment pressure

- Leapmotor: Gross margin of 14.5%, has achieved quarterly profitability [4]

- Xpeng Motors: Gross margin of 20.1%, breaking 20% for the first time [4]

- NIO: Comprehensive gross margin of 13.9% [4]

- BAIC Blue Valley: Severe loss, far behind the industry

- ⚠️ Cautious Wait-and-See: Although sales growth is impressive, profit quality is extremely poor

- ❌ Not Recommended for Long-Term Holding: Unless a clear path to gross margin improvement is seen

- 📊 Focus on Key Indicators:

- Whether gross margin turns positive (Target: >10%)

- Whether per-unit loss narrows (Target: Loss <10,000 yuan/unit)

- Whether free cash flow improves

- Whether the Enjoyment brand can contribute positive cash flow

- Emergency Stop Loss:尽快 turn gross margin positive and stop the “lose money on every unit sold” model

- Cost Optimization: Reduce costs through scale effect and supply chain optimization

- Product Upgrade: Rely on Huawei’s technology to enhance product premium capacity

- Cash Flow Management: Strictly control capital expenditure and prioritize ensuring cash flow safety

- Cash flow断裂 risk: If cash flow cannot be improved in 2026, it may face a capital chain断裂

- Deterioration of financing environment: Sustained losses may lead to financing difficulties and increased costs

- Price war restart: Although the industry price war has temporarily “braked”, BAIC Blue Valley will be in a passive position if it restarts

- Failure to balance technology investment and profitability: It is difficult to support high-investment projects such as L3 autonomous driving in a loss state

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.