Analysis of Development Potential and Competitive Advantages of Wangfujing's Entry into the Duty-Free Market with a Registered Capital of 200 Million Yuan

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

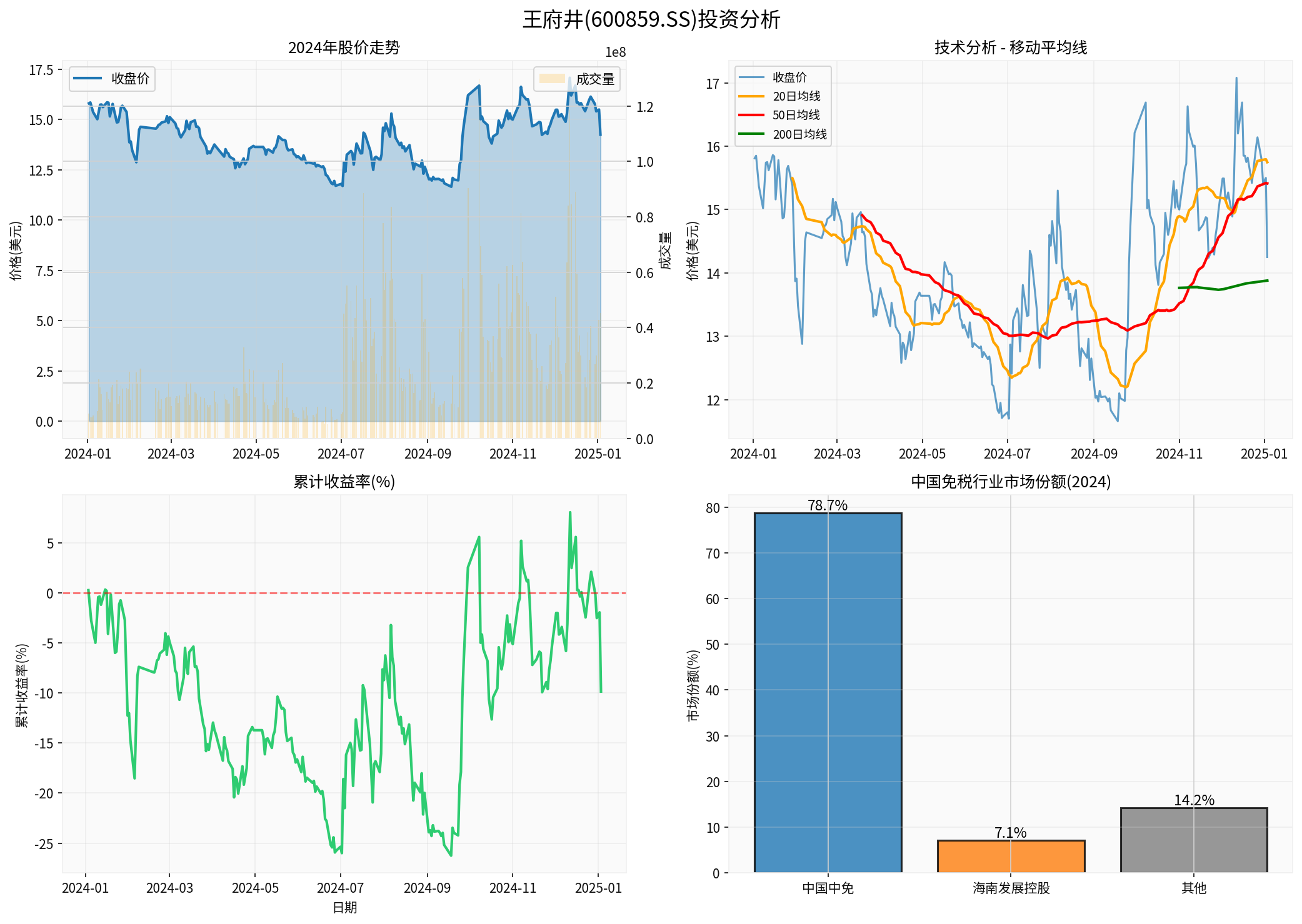

According to the latest data, Wangfujing Group (600859.SS) is a well-known department store retail enterprise in China with a current market value of approximately

Wangfujing’s recent financial performance is facing challenges [0]:

- Net Profit Margin: -0.33% (in loss)

- ROE (Return on Equity): -0.18%

- P/E Ratio: -505.48 times (due to loss)

- Current Ratio:1.65 (acceptable liquidity)

- P/B Ratio:0.89 (below book value)

In Q3 2025, the single-quarter EPS was 0.04 USD, lower than the expected 0.05 USD; revenue was 2.35 billion USD, which was less than the expected 2.62 billion USD [0].

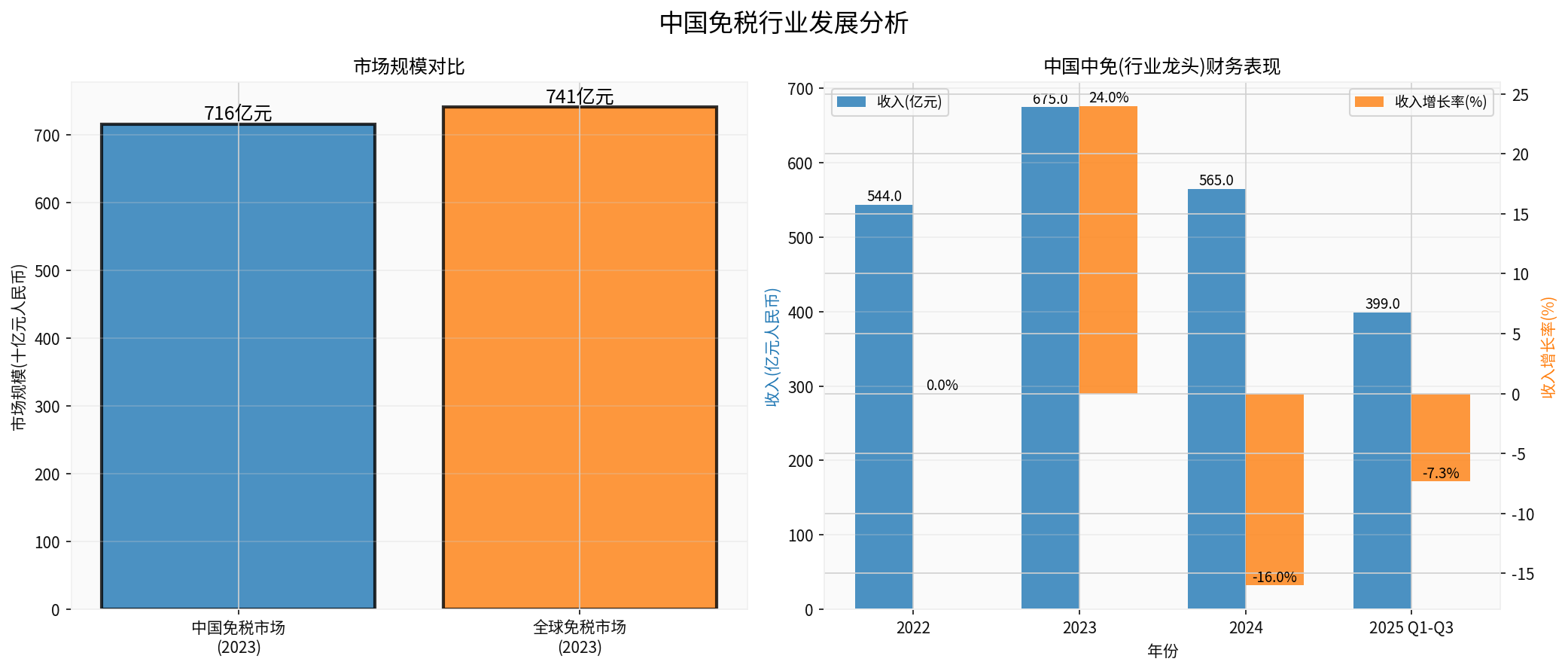

China’s duty-free market reached a size of approximately

- China Duty-Free Group:78.7% market share, absolute leading position

- Hainan Development Holdings:7.1% market share

- Other enterprises:14.2% share [1]

China Duty-Free Group currently has about 200 retail stores and is the largest duty-free chain operator in China [1].

According to online searches and industry data, China’s duty-free industry is facing multiple challenges [1]:

- Weak consumer demand: After the pandemic, consumers’ demand for high-value foreign goods (luxury goods, alcohol, cosmetics) has declined

- Rise of local brands: Consumers are increasingly inclined to choose domestic brands, squeezing the duty-free goods market

- Slowdown in industry growth:

- China Duty-Free Group’s revenue fell by 16%year-on-year to 56.5 billion RMB in 2024

- Net profit plummeted 36%to 4.32 billion RMB

- Revenue decreased by7.34% to39.9 billion RMB in the first three quarters of2025

- China Duty-Free Group’s revenue fell by

- Hainan Free Trade Port officially established: Hainan officially became a free trade zone on December18,2025, injecting new momentum into duty-free shopping [1]

- Opening up of foreign investment access: China has reopened the duty-free industry to foreign operators, which was basically closed to foreign investment since 2019 [1]

- Adjustment of import tariffs: China will implement temporary import tariffs lower than the most-favored-nation tariff rate on 935 items of goods starting from January1,2026 [2]

- Duty-free resources at airports and railway hubs are basically saturated

- Strict industry supervision and high license barriers

Although the industry is under short-term pressure, the long-term potential of China’s duty-free market is still considerable:

- China is one of the largest duty-free markets in the world (71.6 billion RMB scale)[1]

- With the deepening of Hainan Free Trade Port policy, the market is expected to usher in new growth points

- The scale of the domestic middle class is expanding, and the trend of consumption upgrading remains unchanged

- Accelerated construction of Hainan Free Trade Port provides institutional dividends for the duty-free industry

- Beijing may introduce supporting policies to support the development of local enterprises

- Scarcity of duty-free licenses: Wangfujing’s acquisition of a license means a policy access advantage

####3.

Wangfujing as an established department store retail enterprise, has:

- Brand awareness: The “Wangfujing” brand has strong influence in North China

- Supply chain management: Decades of retail operation experience

- Channel resources: Offline store network and customer resources

- Talent reserve: Retail management team

####1.

| Comparison Dimension | Wangfujing | China Duty-Free Group | Evaluation |

|---|---|---|---|

| Market Position | New Entrant | 78.7% Market Share | Significant Disadvantage |

| Store Scale | 0 Stores (Starting from Scratch) | About 200 Stores | Huge Gap |

| Procurement Cost | No Scale Advantage | Huge Procurement Scale | Cost Disadvantage |

| Operation Experience | No Duty-Free Experience | Decades of Experience | Long Learning Curve |

| Airport Resources | Need to Compete from Zero | Three Major Airport Hubs | Channel Disadvantage |

####2.

- Registered capital is only 200 million yuan, which is obviously insufficient compared to the investment scale required by the duty-free industry

- China Duty-Free Group’s 2024 revenue was56.5 billion yuan; Wangfujing’s 200 million yuan registered capital is only 0.35%of China Duty-Free Group’s revenue

- Need a lot of capital investment in store construction, commodity procurement, and channel expansion

####3.

- Currently in the trough period of China’s duty-free industry; the industry leader China Duty-Free Group has both revenue and profit declines

- Consumer preferences have shifted to domestic brands, weakening demand for imported duty-free goods

- International tourism has not fully recovered after the pandemic, leading to insufficient passenger flow at airport duty-free shops

####4.

- Main business is in loss (net profit margin -0.33%)

- It is difficult to provide sufficient cash flow support for new businesses in the short term

- Weak stock price performance limits equity financing capacity

-

Scarcity of License

- The number of duty-free licenses is limited; Wangfujing’s acquisition of a license means policy barrier protection

- May become an important holder of scarce license resources in the future

-

Regional Brand Advantage

- Has high brand awareness in Beijing and North China

- Can use existing store network to expand duty-free business

-

Retail Operation Experience

- More than 60 years of retail industry experience

- Mature membership system and customer resources

-

State-Owned Background

- As a state-owned enterprise under Beijing Municipality, it may obtain more policy support

- Has advantages in cooperation with local governments

-

Zero Duty-Free Operation Experience

- Starting from scratch, lack of experience in duty-free product procurement, pricing, and inventory management

- Need time to accumulate industry know-how

-

Insufficient Capital Scale

- The 200 million yuan registered capital does not match the investment needs of the industry

- Difficult to compete on price with giants like China Duty-Free Group

-

Supply Chain Disadvantages

- No international brand procurement channels and bargaining power

- Difficult to obtain competitive procurement prices

-

Channel Disadvantages

- No airport duty-free store resources

- Lack of cooperative relationships with travel retail channels

-

Industry Timing

- Entering a market where the peak period has passed against the trend

- Need to go through the test of the industry adjustment period

-

Differentiated Positioning

- Avoid direct competition with China Duty-Free Group at airport hubs

- Focus on duty-free stores in downtown Beijing and online duty-free business

- Explore the “duty-free + department store” integration model

-

Step-by-Step

- Initially focus on high-frequency categories such as cosmetics and perfumes

- Use the existing membership system to carry out online duty-free bookings

- Expand scale after accumulating experience

-

Seek Cooperation

- Cooperate with international duty-free groups to introduce operation experience

- Cooperate with tourism enterprises to expand customer sources

- Consider introducing strategic investors

⚠️

- Policy Risk

- Fast changes in duty-free industry policies

- Accelerated license issuance may intensify competition

- Operational Risk

- Operational difficulties due to insufficient industry experience

- Tight capital chain, difficult to sustain investment

- Market Risk

- Sustained weak consumption

- Accelerated substitution effect of domestic brands

- Competitive Risk

- Price wars with giants like China Duty-Free Group

- Entry of foreign duty-free enterprises

- Financial Risk

- Difficult to make profits in the short term, dragging down overall performance

- Affecting the company’s cash flow and financial health

| Evaluation Dimension | Score (1-10) | Explanation |

|---|---|---|

| Market Potential | 6 | Large market but slow growth |

| Competitive Advantage | 4 | License advantage but insufficient experience and capital |

| Timing Selection | 3 | Entering during industry trough |

| Capital Strength | 3 | 200 million yuan registered capital is obviously insufficient |

| Policy Support | 7 | Scarce license + Hainan Free Trade Port dividend |

Comprehensive Score |

4.6 |

Cautiously Negative |

Wangfujing’s entry into the duty-free market

- Obtained a scarce duty-free license, protected by policy thresholds

- Provides a new direction for the transformation of traditional department store business

- Can share the dividends of China’s duty-free market in the long run

- The 200 million yuan registered capital is obviously insufficient to form effective competitiveness

- Lack of duty-free operation experience and supply chain resources

- Poor entry timing (industry adjustment period)

- Main business is in loss, difficult to provide cash flow support

- Whether the registered capital is increased

- Store opening status and operation data

- Cooperation progress with international brands

- Policy support intensity and supporting measures

[0] Gilin API Data - Wangfujing Group (600859.SS) Company Overview, Stock Price, Financial Data, Technical Analysis

[1] Yahoo Finance Hong Kong - “Bidding Infighting Drives Away Sunrider Duty-Free Shop; China Duty-Free Wins Shanghai Airport Duty-Free Shop” (Reported in December 2025)

https://hk.finance.yahoo.com/news/競投內鬥擊退日上免稅行-中免拿下上海機場免稅店-035337451.html

[2] Wall Street Journal Chinese Edition - “China to Implement Temporary Import Tariffs Lower Than MFN Rates on 935 Items Starting January 1, 2026” [2]

https://cn.wsj.com/articles/china-to-lower-import-tariffs-on-hundreds-of-products-from-2026-xinhua-reports-28c211dc

[3] Sina Finance - “Wangfujing Establishes New Duty-Free Product Operation Company” (January4,2026)

https://finance.sina.com.cn/roll/2026-01-04/doc-inhfcphr2902155.shtml

[4] Eastmoney.com - “Wangfujing Establishes New Duty-Free Product Operation Company with Registered Capital of 200 Million Yuan” (January4,2026)

https://finance.eastmoney.com/a/202601043607872241.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.