Analysis of Market Competitive Position and Industry Impact of Zhongkuang Resources After Lithium Salt Capacity Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Product Flexibility: Main products are battery-grade lithium carbonate and battery-grade lithium hydroxide; the capacity of the two products can be flexibly adjusted according to market demand

- Technological Upgrade: Improved lithium recovery rate through technical transformation, effectively reducing production costs

- Raw Material Self-Sufficiency: The company has a 100% self-sufficiency rate in ore raw materials for lithium salt production, owning the Bikita mine in Zimbabwe and the Tanco mine in Canada [3]

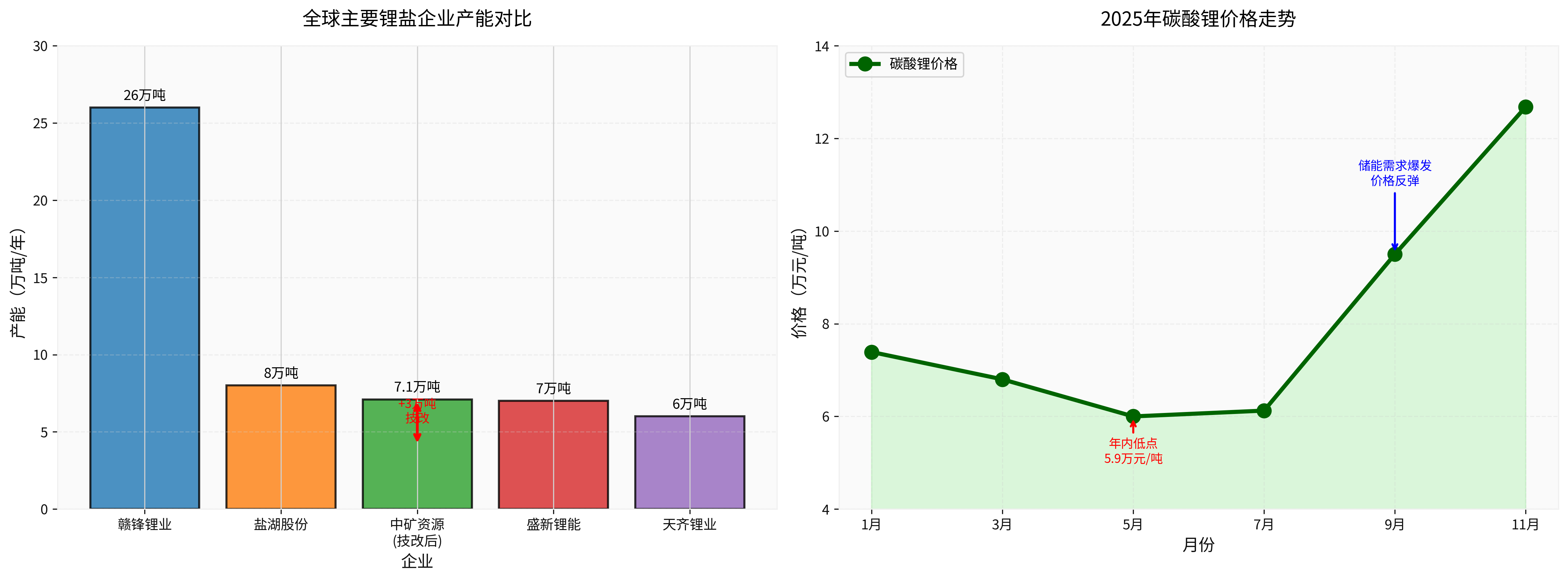

As can be seen from the chart, Zhongkuang Resources’ 71,000 tons/year capacity places it among global lithium salt enterprises as follows:

- First Tier: Ganfeng Lithium (260,000 tons/year) - Global absolute leader [4]

- Second Tier: Salt Lake Industry (80,000 tons/year),Zhongkuang Resources (71,000 tons/year), Shengxin Lithium Energy (70,000 tons/year), Tianqi Lithium (about 60,000 tons/year) [4,5]

- Among enterprises using the spodumene lithium extraction technology route, Zhongkuang Resources and Shengxin Lithium Energy are among the top

- Among integrated enterprises (own mines + lithium salt processing), Zhongkuang Resources is second only to Tianqi Lithium and Ganfeng Lithium

- Compared with the 41,000 tons capacity before the technical transformation, its market position has risen by one tier

According to the latest market data [0]:

- Current Stock Price: 78.55 yuan (closing on January 4, 2026)

- Market Capitalization: 56.673 billion yuan

- P/E Ratio: 136.42x (reflecting market expectations for high growth)

- Stock Price Performance: Up 121.27% in the past year, up 138.46% in the past 6 months

2025 first three quarters performance [5]:

- Revenue: 4.818 billion yuan, up 34.99% YoY

- Net profit attributable to parent company: 204 million yuan, down 62.58% YoY (mainly affected by the bottom of the lithium price cycle)

- Q3 gross margin: 23.24%, up 9.12 percentage points MoM (driven by lithium price recovery)

Zhongkuang Resources’ biggest competitive advantage lies in its 100% raw material self-sufficiency rate [3]:

- Bikita Mine in Zimbabwe: Acquired in 2022 with an investment of 180 million US dollars, owning 10.746 million tons of lithium ore (lithium grade 1.32%), equivalent to 350,400 tons of lithium carbonate equivalent (LCE) [3]

- Tanco Mine in Canada: Acquired in 2019 with an investment of 130 million US dollars, annual spodumene processing capacity of 180,000 tons/year [3]

- Upstream Total Capacity: Annual capacity of spodumene concentrate 300,000 tons + annual capacity of chemical-grade petalite concentrate 300,000 tons = 600,000 tons/year [3]

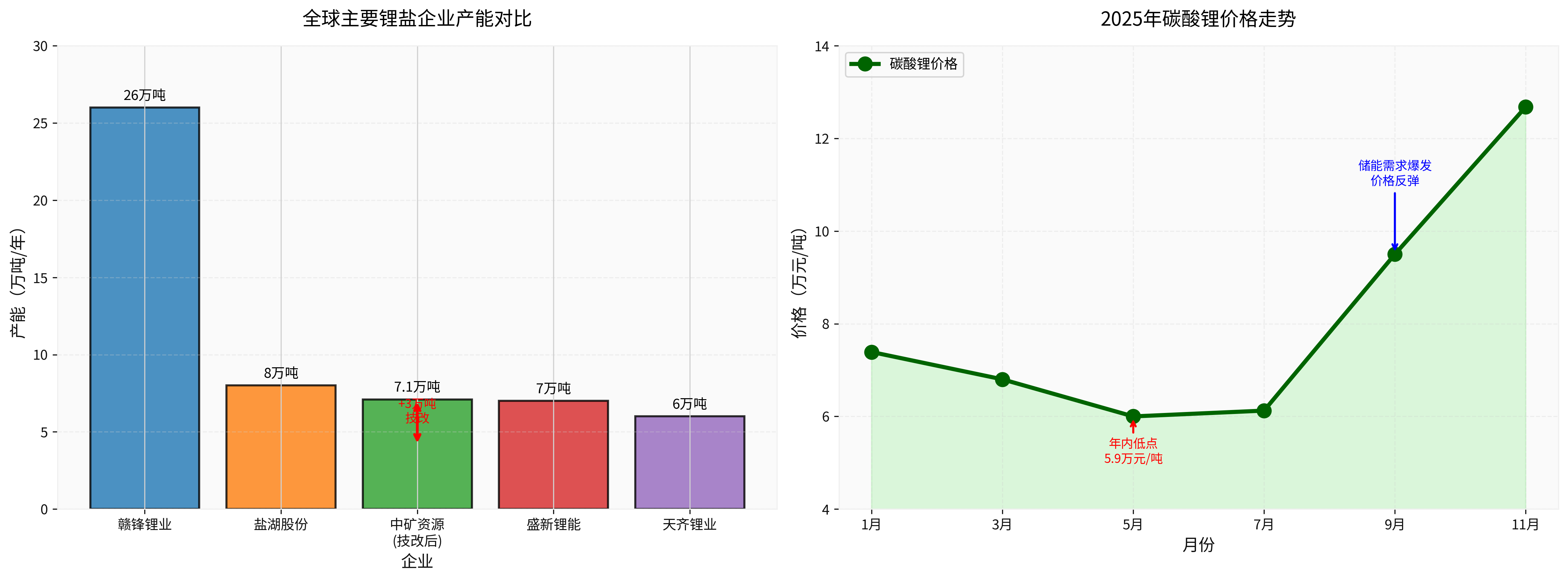

Zhongkuang Resources adopts a three-line layout of “Lithium + Cesium Rubidium + Copper Germanium” [3]:

- Lithium Salt Business: Accounting for 40.01% (current core business with the highest growth elasticity)

- Cesium Rubidium Business: Accounting for 21.67% (high gross margin, stable operation)

- Other Businesses: Accounting for 38.22% (copper, germanium gallium, geological exploration services and trade, new growth points)

- Technical Transformation Efficiency: This 30,000-ton technical transformation project improves lithium recovery rate, reduces production costs, and enhances cost competitiveness [1,2]

- Cost Comparison:

- Salt lake lithium extraction cost: 30,000-40,000 yuan/ton (Salt Lake Industry) [6]

- Spodumene lithium extraction cost: 60,000-100,000 yuan/ton (industry average) [7]

- Zhongkuang Resources, through 100% raw material self-sufficiency and technical transformation upgrades, has a cost at a lower level among spodumene lithium extraction enterprises

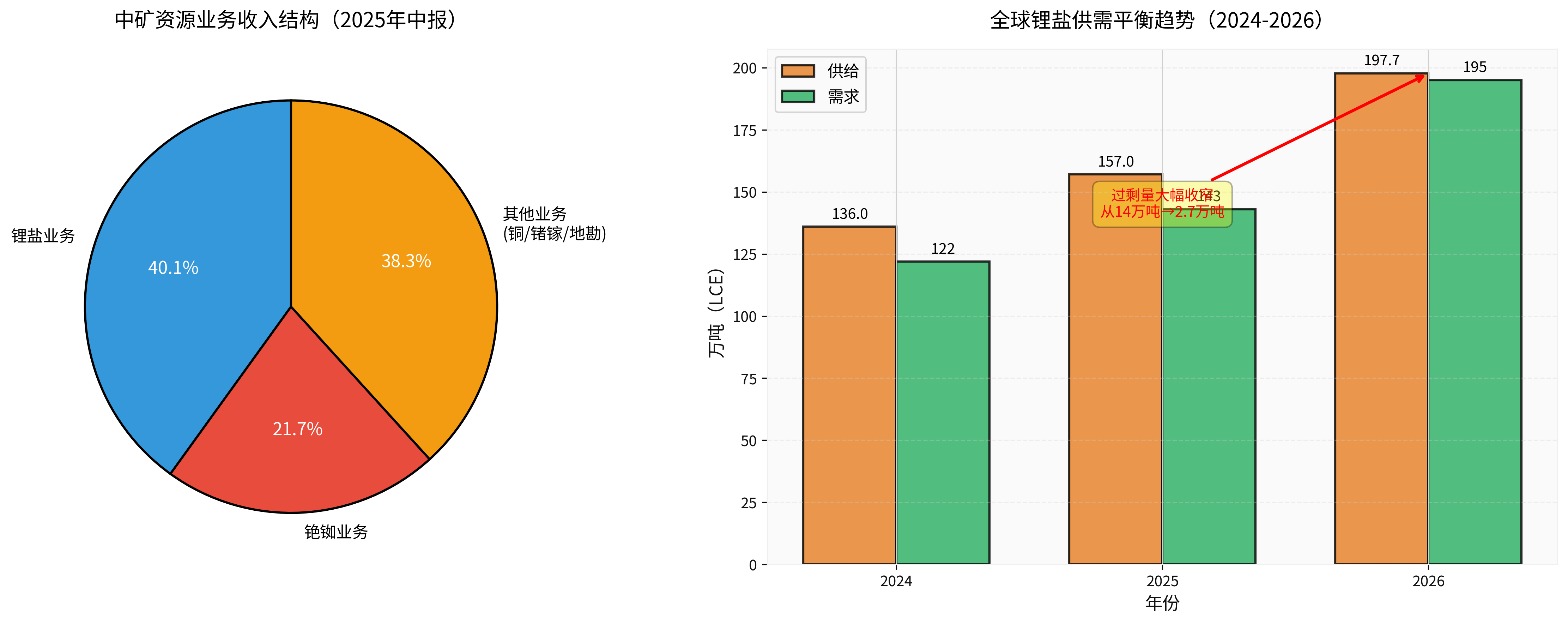

- Beginning of the year: 73,900 yuan/ton

- May low: 59,000 yuan/ton (a drop of 20.11%) [8]

- November high: 126,800 yuan/ton (a new high for the year) [8]

- Driving Factors: Explosive growth in energy storage demand, shutdown of Jianxiawo mine, fluctuations in global resource supply [8]

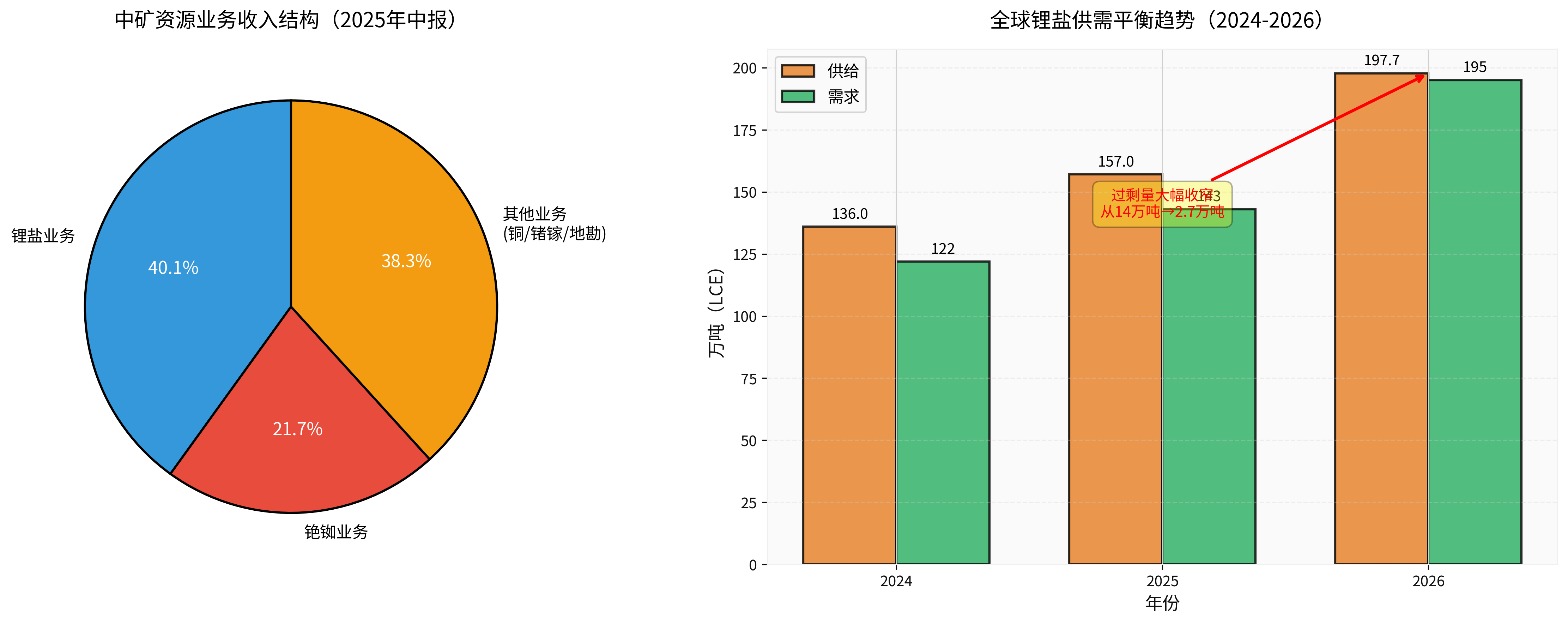

| Year | Supply (10k tons) | Demand (10k tons) | Surplus (10k tons) | Market Status |

|---|---|---|---|---|

| 2024 | 136 | 122 | 14 | Significant surplus |

| 2025 | 157 | 143 | 14 | Surplus narrowing |

| 2026 | 197.7 | 195 | 2.7 | Tight balance |

- 2025-2026: The global lithium market shifts from “significant surplus” to “tight balance”, with the surplus narrowing sharply from 140,000 tons to 27,000 tons [8,9]

- 2026: Supply increases by 330,000 tons, demand increases by 380,000 tons, demand growth rate exceeds supply growth rate [8,9]

- Supply-demand Turning Point: A tight pattern may emerge after 2027 [8]

- Zhongkuang Resources’ new 30,000 tons capacity accounts for about 9% of the global supply increment (330,000 tons) in 2026, with a moderate impact

- Against the background of the global lithium salt market shifting to tight balance, the release of new capacity aligns with market demand growth

- Compared with the expansion plans of leading enterprises such as Ganfeng Lithium and Tianqi Lithium, Zhongkuang Resources’ expansion scale is relatively moderate

- Capacity Utilization Improvement: With the improvement of market supply and demand, Zhongkuang Resources’ lithium salt capacity utilization rate is expected to reach 80%/100% in 2026-2027, corresponding to sales volume of 56,800 tons/71,000 tons, an increase of +33%/+66% respectively compared to 2024 [3]

- Market Share Increase: From 41,000 tons to 71,000 tons, the market share among enterprises using the spodumene lithium extraction route increased significantly

- Industry Position Consolidation: Stand out among second-tier enterprises and approach the first tier

- The lithium industry is recovering from the bottom of the cycle, and enterprises with high-quality resources, cost advantages, and faster capacity expansion (such as Zhongkuang Resources) are expected to have more growth elasticity in the subsequent recovery [5]

- Zhongkuang Resources’ capacity expansion strategy reflects the industry trend of “steady expansion + integrated layout”, consistent with the direction of leading enterprises

-

Lithium Price Fluctuation Risk:

- Current lithium prices have rebounded from lows, but are still in cyclical fluctuations

- If lithium prices fall again, the company’s profitability will be directly affected

- Q3 gross margin of 23.24% is still lower than the industry high, and the sustainability of lithium price recovery needs to be observed [5]

-

Capacity Digestion Risk:

- The 30,000-ton technical transformation capacity has just been put into operation, and it takes time to ramp up to full production

- If downstream demand is lower than expected, the capacity utilization rate may be lower than expected

-

Competition Intensification Risk:

- Leading enterprises such as Ganfeng Lithium, Tianqi Lithium, and Salt Lake Industry are all expanding production

- Global lithium resource supply continues to be released, with a supply increment of 330,000 tons in 2026 [9]

-

Policy and Market Risks:

- Decline in new energy vehicle subsidies, adjustment of purchase tax policies

- Uncertainty in the growth of energy storage demand

- Policy risks in overseas markets (such as the US IRA Act, EU carbon tariffs, etc.)

- Tight Balance: The global lithium market will enter a tight balance state in 2026, and lithium prices are expected to remain relatively strong [8,9]

- Explosive Growth in Energy Storage: In 2025, energy storage demand for lithium carbonate reached 345,000 tons, and is expected to exceed 500,000 tons in 2026 (a 10-fold increase compared to 50,000 tons in 2021) [8]

- Price Expectation: Multiple securities firms predict that the central lithium price in 2026 will be higher than in 2025 [8]

- Capacity Release: After the full release of the 71,000-ton capacity, sales volume is expected to increase from about 43,000 tons in 2024 to 71,000 tons in 2027 [3]

- Performance Elasticity: In the upward cycle of lithium prices, enterprises with cost advantages and capacity expansion will fully benefit [5]

- Business Diversification: The cesium rubidium business provides stable cash flow, and the copper and germanium gallium businesses are expected to become new growth points [3]

- Resource Barrier: 100% raw material self-sufficiency constitutes a core competitive barrier, showing value in the industry downturn

- Technical Accumulation: Improve technical level and cost control capabilities through technical transformation upgrades

- Global Layout: Mineral resource layout in Zimbabwe, Canada and other places provides long-term guarantee

After Zhongkuang Resources expanded its lithium salt capacity to 71,000 tons/year:

- Capacity Scale: Entered the top five global lithium salt enterprises, ranking among the top three in spodumene lithium extraction enterprises

- Competitive Advantage: 100% raw material self-sufficiency is in a leading position in the industry, with significant cost advantages

- Business Model: “Lithium + Cesium Rubidium + Copper Germanium” diversified layout, with better risk resistance than single lithium salt enterprises

- Growth Potential: There is a large room for improvement in capacity utilization and sales volume (capacity utilization rate can reach 100% in 2027)

Zhongkuang Resources’ capacity expansion:

- Comply with Industry Trend: Against the background of the global lithium market shifting from surplus to tight balance, new capacity matches demand growth

- Relatively Moderate Impact: The 30,000-ton increment accounts for about 9% of the global supply increment in 2026, which will not exacerbate surplus

- Optimize Supply Quality: Improve recovery rate and reduce costs through technical transformation upgrades, promoting high-quality development of the industry

- Strengthen Industry Concentration: Capacity expansion of enterprises with resource and technical advantages accelerates the survival of the fittest in the industry

- Focus on lithium price trends and the progress of technical transformation capacity ramp-up

- Q1-Q2 2026 performance is expected to benefit from lithium price recovery and capacity release

- Benefit from the tight balance of the global lithium market, lithium prices remain relatively strong

- Full release of 71,000-ton capacity, simultaneous increase in sales volume and profit margin

- Diversified business structure provides performance support

- Resource self-sufficiency advantage and diversified layout build long-term competitive barriers

- Energy storage demand continues to grow, lithium demand is long-term positive

- Expected to move from the second tier to the first tier

[0] Jinling API Data - Zhongkuang Resources (002738.SZ) Market Data and Financial Analysis

[1] The Beijing News - Zhongkuang Resources: 30,000 tons/year high-purity lithium salt technical transformation project ignited trial operation (https://www.bjnews.com.cn/detail/1767515804129866.html)

[2] Sina Finance - Zhongkuang Resources 30,000 tons/year high-purity lithium salt technical transformation project ignited trial operation (https://finance.sina.com.cn/jjxw/2026-01-04/doc-inhfctqq7481733.shtml)

[3] Dongxing Securities - Zhongkuang Resources (002738.SZ): In-depth Report on “Lithium + Cesium Rubidium + Copper Germanium” Three-line Layout (https://pdf.dfcfw.com/pdf/H3_AP202509091740756090_1.pdf?1757437744000.pdf)

[4] Fortune - Top 10 Leading Enterprises in Energy Metals, Who Has the Hardest Resource Barrier? (https://caifuhao.eastmoney.com/news/20260102135122829549200)

[5] Zhihu Column - Tracking Invisible Leaders in Lithium Salt, Spodumene Route: Zhongkuang Resources, Yahua Group, Shengxin Lithium Energy (https://zhuanlan.zhihu.com/p/1985004418391900507)

[6] Zhiyan Consulting - Salt Lake Lithium Extraction Industry Market Size, Industrial Chain Panorama and Market Competition Pattern Analysis Report (https://finance.sina.com.cn/stock/relnews/cn/2025-12-10/doc-inhahnvh1981360.shtml)

[7] 21st Century Economic Report - Double! Is the Super Lithium Cycle Coming Again? (https://www.21jingji.com/article/20251225/herald/9472291cce468aa5f7108d69b6d7e5cc.html)

[8] QQ News - Phased Opportunities Arrive, Have You Bought Lithium? A-share 2026 Investment Strategy (https://news.qq.com/rain/a/20260102A03BBH00)

[9] Yide Futures - Lithium Carbonate: Energy Storage Breakthrough, Supply and Demand May Be Restructured Research Report (https://pic-test-gjmetal-1324067834.cos.ap-shanghai.myqcloud.com/newsv2/629263f1e15a416d802cd54632960c5c20251226174357.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.