Analysis of the Impact of Tesla's Lower-than-Expected Deliveries on Valuation and Growth Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

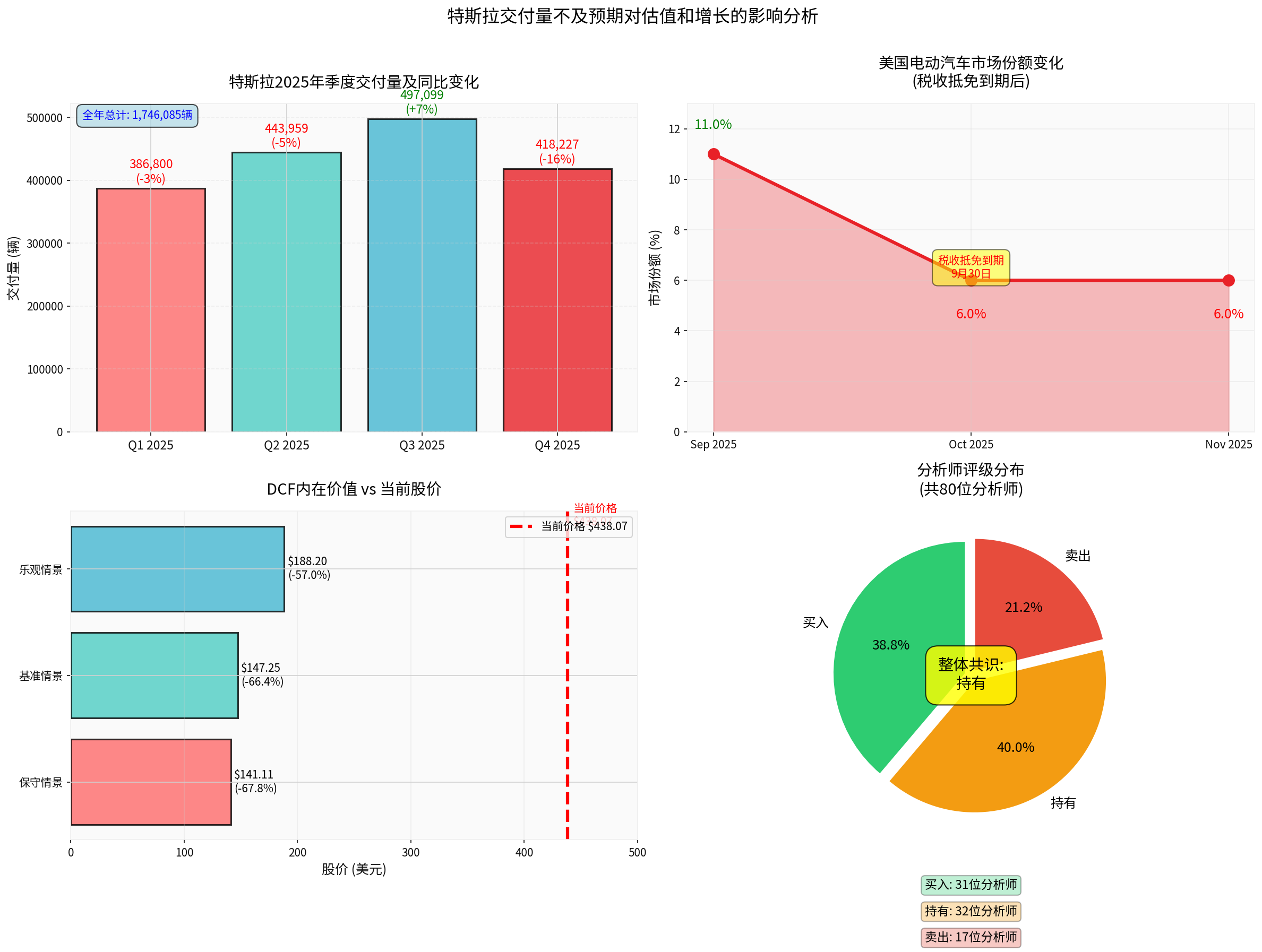

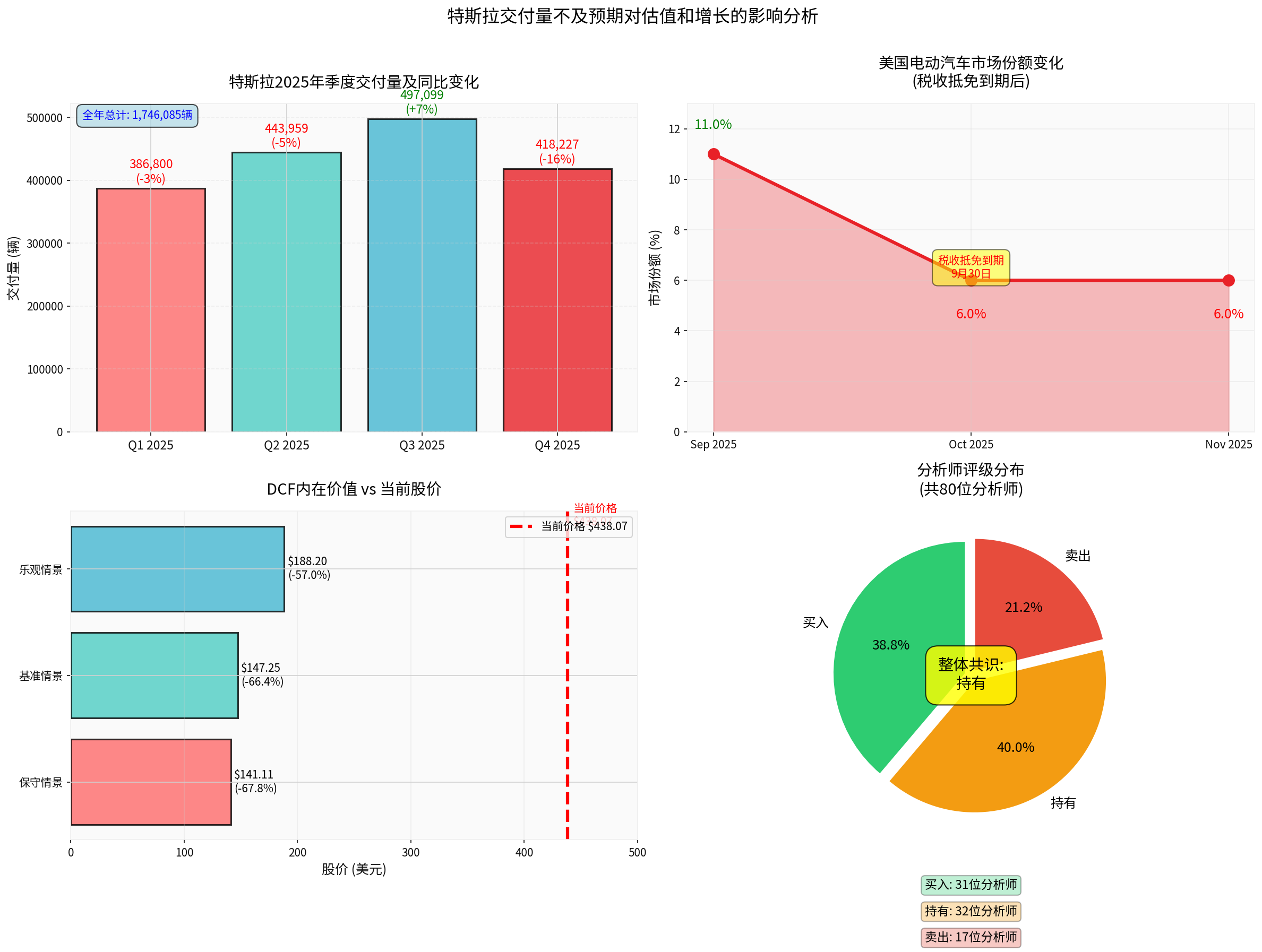

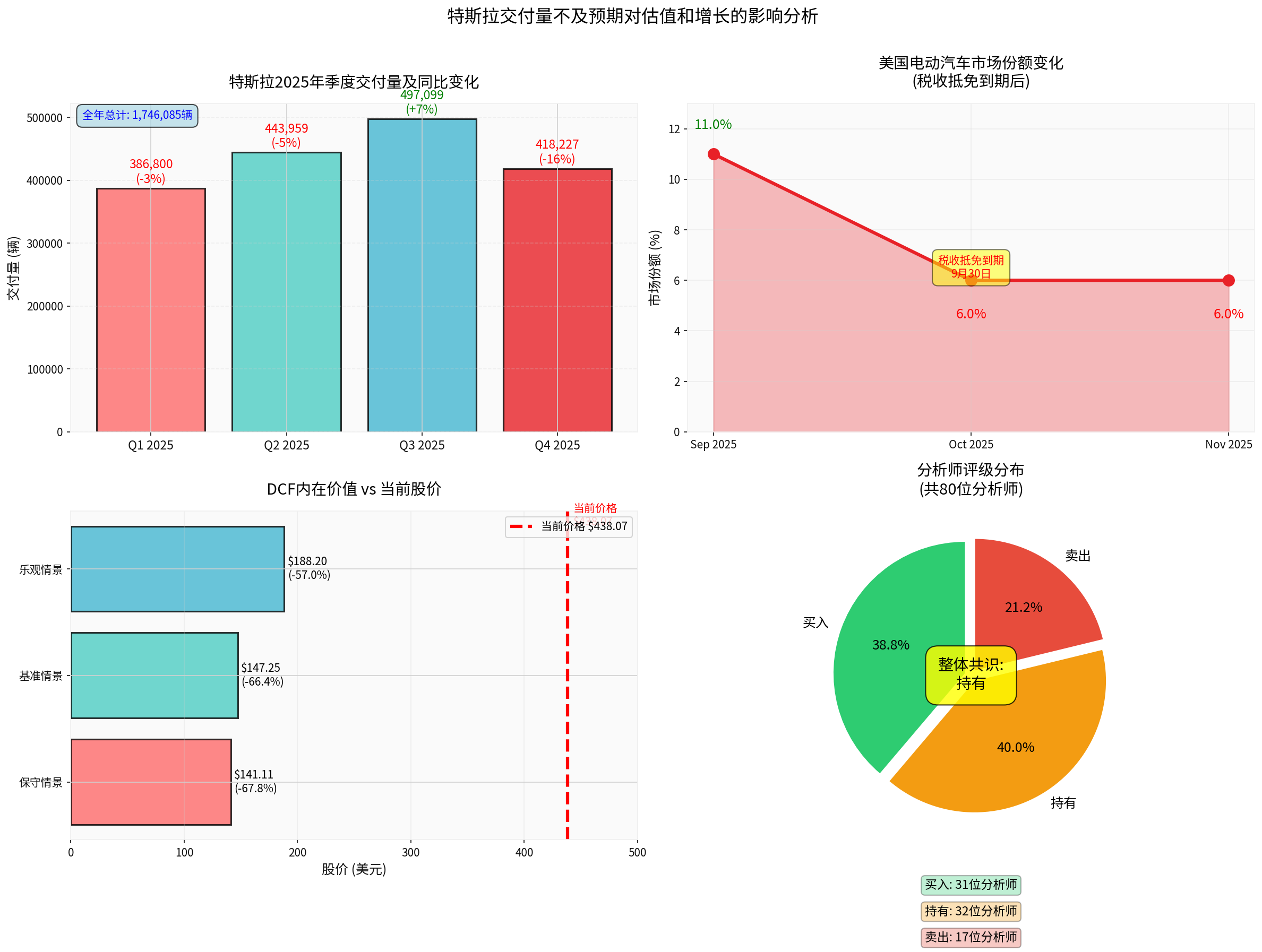

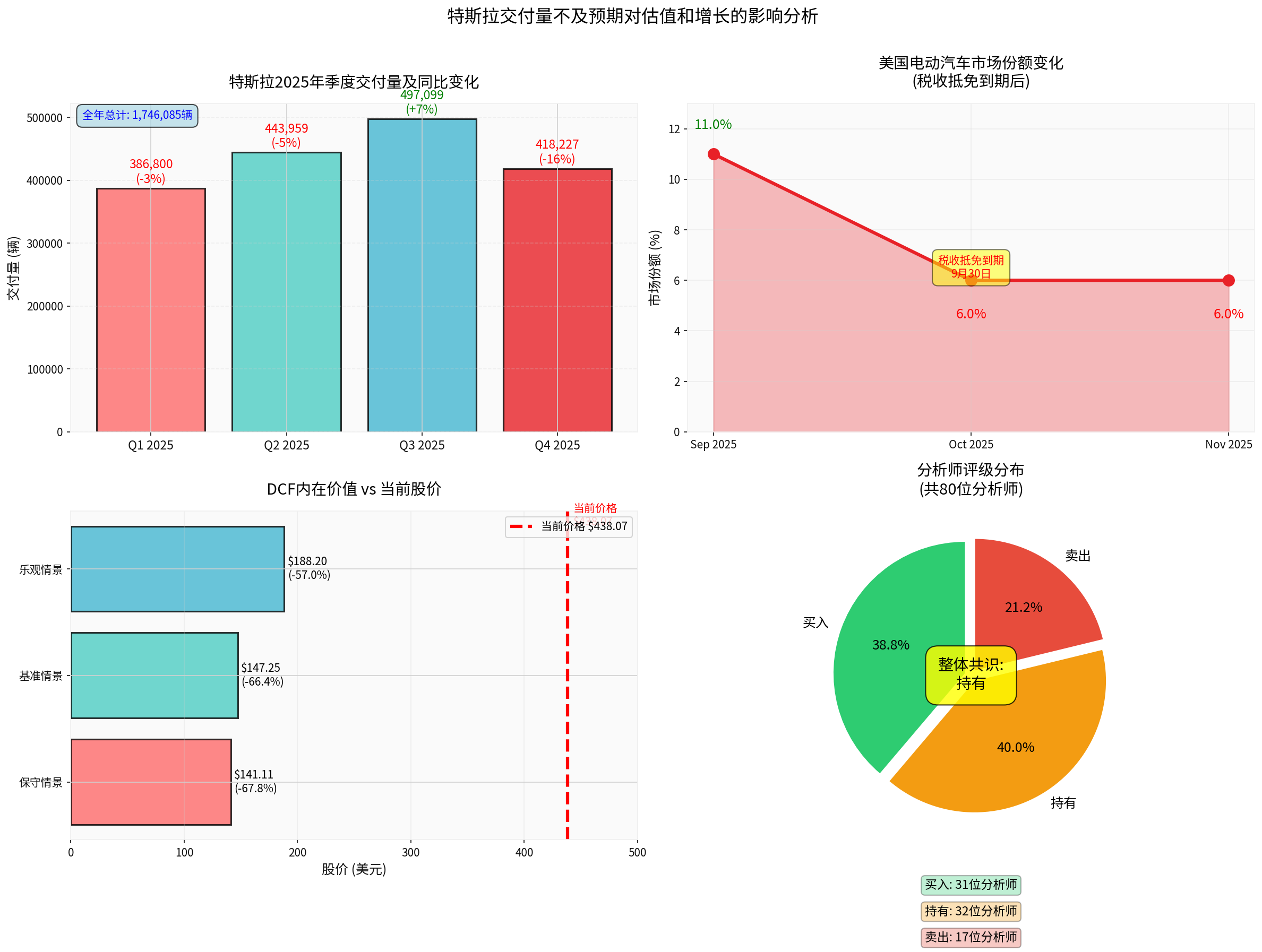

According to the latest data, Tesla’s 2025 deliveries showed significant volatility:

- Q1 2025: 386,800 units (-3% YoY)

- Q2 2025: 443,959 units (-5% YoY)

- Q3 2025: 497,099 units (+7% YoY) – Record quarter

- Q4 2025: 418,227 units (-16% YoY) – Significant decline

Q3’s record deliveries (497,000 units) were mainly driven by U.S. consumers rushing to purchase before the $7,500 federal electric vehicle tax credit expired on September 30 [1]. This directly led to:

- 16% QoQ decline: Demand was pre-overdrawn in Q3

- Sharp drop in market share: U.S. EV market share plummeted from over 11% in September to ~6% in October-November [2]

- Return to natural demand: Deliveries fell back to a more “normal” level after subsidies expired

Beyond subsidy factors, Tesla faces:

- Intensified competition: Electric vehicle offensives from Chinese manufacturers (e.g., BYD) and U.S. traditional automakers

- Aging product line: Lack of major new model launches since Cybertruck

- Price pressure: The company introduced lower-priced “Standard Edition” Model 3 and Model Y in October-December 2025 to stimulate demand [2]

- Weak global markets: Growth slowed in markets other than China

Tesla’s current valuation is in an extreme state:

| Valuation Metric | Value | Industry Average | Assessment |

|---|---|---|---|

| Price-to-Earnings (P/E) | 268.35x | ~15-20x | Extremely overvalued |

| Price-to-Book (P/B) | 17.68x | ~2-3x | Severe premium |

| Price-to-Sales (P/S) | 14.75x | ~1-2x | Extremely expensive |

| EV/OCF | 89.26x | ~15-20x | Excessively high cash flow multiple |

Analysis using a three-scenario discounted cash flow model:

| Scenario | Intrinsic Value | Discount vs Current Price | Core Assumptions |

|---|---|---|---|

Conservative |

$141.11 | -67.8% | 0% revenue growth, 15.8% EBITDA margin |

Base |

$147.25 | -66.4% | 32.7% revenue growth,16.7% EBITDA margin |

Optimistic |

$188.20 | -57.0% | 35.7% revenue growth,17.5% EBITDA margin |

###2.3 Doubts About Sustainability of Valuation Multiples

Tesla’s high valuation is based on the following key assumptions:

- Success of Autopilot/Robotaxi: An unproven technology and business model

- Sustained ultra-high growth: Requires maintaining 30%+ revenue growth, which is extremely challenging in the current competitive environment

- Margin expansion: In reality, Tesla’s auto business gross margin is under pressure

###3.1 Current Analyst Rating Distribution

- Buy:31 (38.8%)

- Hold:32 (40.0%)

- Sell:17 (21.2%)

###3.2 Recent Rating Adjustments

- Truist Securities: Lowered target price from $444 to $439, citing lower-than-expected Q4 deliveries [3]

- Wedbush: Maintained “Underweight” rating with a target price of $600 (though target price is high, the rating is cautious)

- Morgan Stanley: Reaffirmed rating, emphasizing “Robotaxi” as a future catalyst but also noting delivery risks [3]

- William Blair: Reaffirmed “Market Perform” rating

###3.3 Deep Implications of Underweight Ratings

Underweight ratings from institutions like HSBC reflect:

- Recalibration of growth expectations: Shift from “unlimited growth” narrative to more realistic growth expectations

- Doubts about valuation rationality: Current multiples are hard to sustain amid profitability pressures

- Concerns about structural challenges: Intensified competition, subsidy withdrawal, and aging product cycles are not short-term issues

Does this represent a broader market sentiment shift?

- Sell rating ratio rose from historical lows to 21.2%

- Multiple institutions lowered target prices

- Stock reacted negatively (-2.59%) after Q4 delivery data was released [0]

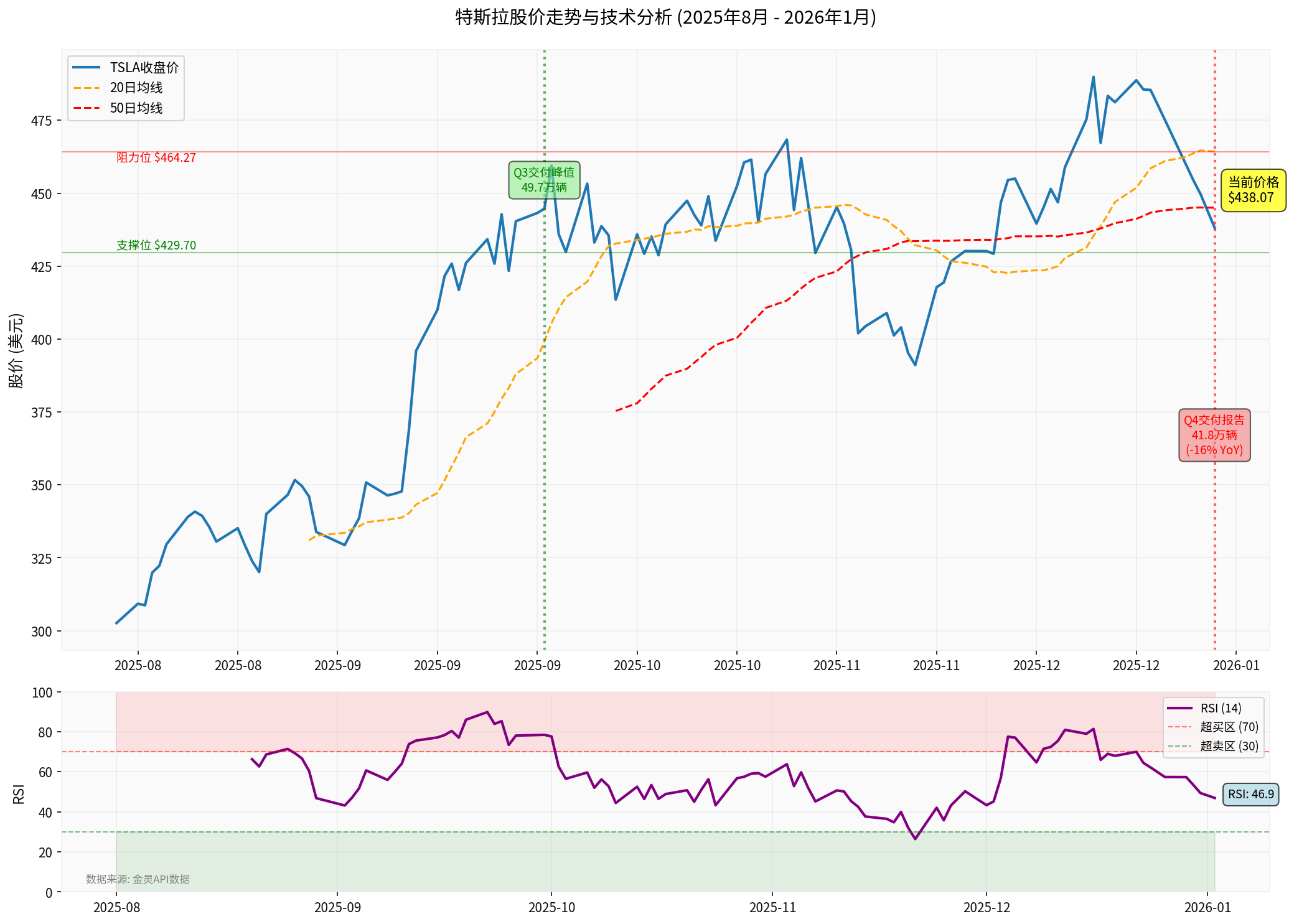

###4.1 Current Technical Status

- Trend: Sideways consolidation, no clear direction

- Support level: $429.70

- Resistance level: $464.27

- RSI: Near oversold territory, potential short-term rebound opportunity

- Moving averages: 20-day MA ($464.27) and 50-day MA ($445.01) form resistance

###4.2 Stock Performance Review in 2025

- YTD: +12.30% (mainly driven by AI and Autopilot narratives)

- vs S&P500: Tesla outperformed the broader market significantly, but this was mainly based on future expectations rather than current fundamentals

###5.1 Downgrade of 2025 Delivery Growth Expectations

Q4’s weak performance forced the market to reassess Tesla’s growth prospects:

| Indicator | Previous Expectation | Actual Performance | Gap |

|---|---|---|---|

| Q4 Deliveries | 422,850-455,000 units | 418,227 units | Missed expectation |

| YoY Growth | Expected positive | -16% | Significant decline |

| U.S. Market Share | Maintain high | 6% (vs peak of11%) | Nearly halved |

###5.2 Challenges to Mid-term Growth Prospects

Tesla faces the following structural constraints:

- Product cycle: Lack of new models means growth depends on incremental improvements to existing product lines and price wars

- Market competition: Especially fierce in China, where BYD overtook Tesla as the world’s largest EV manufacturer in 2025 [4]

- Margin pressure: Price war and rising costs may erode profitability

- Regulatory risk: Regulatory scrutiny of autonomous driving and AI is intensifying globally

###5.3 Reassessment of Long-Term Growth Story

Tesla’s long-term value proposition mainly relies on:

- FSD (Full Self-Driving) and Robotaxi: An unproven technology and business model with uncertain commercialization timelines

- Energy storage business: Growing rapidly but still small relative to the auto business

- Humanoid robots: An early-stage exploratory project that will take years to contribute revenue

###6.1 Key Risk Factors

- Valuation risk: Current prices have already priced in optimistic growth expectations for the next several years; any execution deviation will lead to a sharp stock correction

- Sustained delivery misses: Q4 may be the start of a trend rather than a one-time event

- Intensified competition: Especially from Chinese manufacturers

- Margin pressure: Price wars and rising costs may worsen profitability

- Key person risk: Elon Musk’s distractions from multiple businesses

- Regulatory risk: Autonomous driving and AI technologies face stricter regulatory scrutiny

###6.2 Key Observation Indicators

Investors should closely monitor:

| Indicator | Observation Point | Trigger Signal |

|---|---|---|

Q1 2026 Deliveries |

Whether growth can resume | Below 400,000 units is negative |

Gross Margin |

Trend of auto business gross margin | Sustained below18% is a warning |

FSD Progress |

Robotaxi commercialization progress | Any delay is negative |

New Products |

Model 2 or new Model Y | No new models in2026 is negative |

China Market Share |

Whether it can stop falling and recover | Continued loss of share is severely negative |

###6.3 Potential Positive Catalysts

Despite challenges, the following factors may drive a stock rebound:

- Robotaxi breakthrough: Any commercial progress may reignite the growth story

- New model launch: Model2 or updated existing models

- Overexpected growth of energy storage business: This business is growing rapidly

- Recovery of overall market risk appetite: A rebound in growth stocks as a whole may drive Tesla

###7.1 Core Conclusions

- Delivery miss is structural: Q4’s decline was not just due to tax credit expiration but also reflected deeper challenges like intensified competition and aging product cycles

- Extreme valuation: Current stock price is 57-68% higher than DCF intrinsic value; even the optimistic scenario cannot support it

- Cautious analyst sentiment: Underweight ratings from institutions like HSBC reflect the market’s reassessment of Tesla’s growth sustainability

- Technical sideways: Stock is consolidating in the $430-$465 range with no clear direction

###7.2 Is This a Broader Market Sentiment Shift?

- From “unconditionally believing in Tesla’s growth story” to “demanding clearer execution evidence”

- From “paying any price for future tech vision” to “focusing on current fundamentals and profitability”

- From “Tesla will win” to “more balanced risk-reward assessment”

###7.3 Investment Recommendation Framework

| Investor Type | Recommendation | Reason |

|---|---|---|

Long-term value investors |

Avoid or reduce positions | Extreme valuation, rising risk of fundamental deterioration |

Growth investors |

Cautious wait | Need clearer evidence of delivery recovery and Robotaxi progress |

Short-term traders |

Range trading | Look for rebound opportunities near $430 support level, but set strict stop-loss |

Low-risk tolerance investors |

Avoid | High volatility, high fundamental uncertainty |

[0] Jinling API Data – Tesla real-time quotes, financial data, technical analysis and valuation models

[1] Yahoo Finance – “Tesla Warning Investors About What’s to Come?” (https://finance.yahoo.com/news/tesla-warning-investors-come-153104223.html)

[2] StockTitan – “Tesla Deliveries by Quarter 2020 to2025: Complete Tables” (https://www.stocktitan.net/articles/tesla-q4-2025-deliveries-quarterly-history-analysis)

[3] Investing.com – “Analyst Stock Ratings” (https://cn.investing.com/news/analyst-ratings)

[4] Benzinga – “Weekend Round-Up: Tesla Loses EV Crown, BYD’s Overseas Sales Surge” (https://www.benzinga.com/markets/tech/26/01/49681748)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.