Impact of Semir Apparel's Trademark Dispute on A-share Apparel Consumption Sector and Risk Mitigation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on a comprehensive analysis of Semir Apparel and the A-share apparel consumption sector, I will systematically elaborate on the impact of trademark disputes and risk mitigation strategies from multiple dimensions.

According to public information, Semir Apparel (002563.SZ) had a trademark dispute with Henan Shaolin Intangible Asset Management Co., Ltd., a subsidiary of Shaolin Temple, in September 2020 [1]. Shaolin Asset Management has registered 666 trademarks covering 45 categories, including identifiers like “East, West, South, North Shaolin”. Shaolin Temple stated that registering trademarks is to protect the Shaolin brand, as its name has been misused to launch products like “Shaolin Secret Formula”.

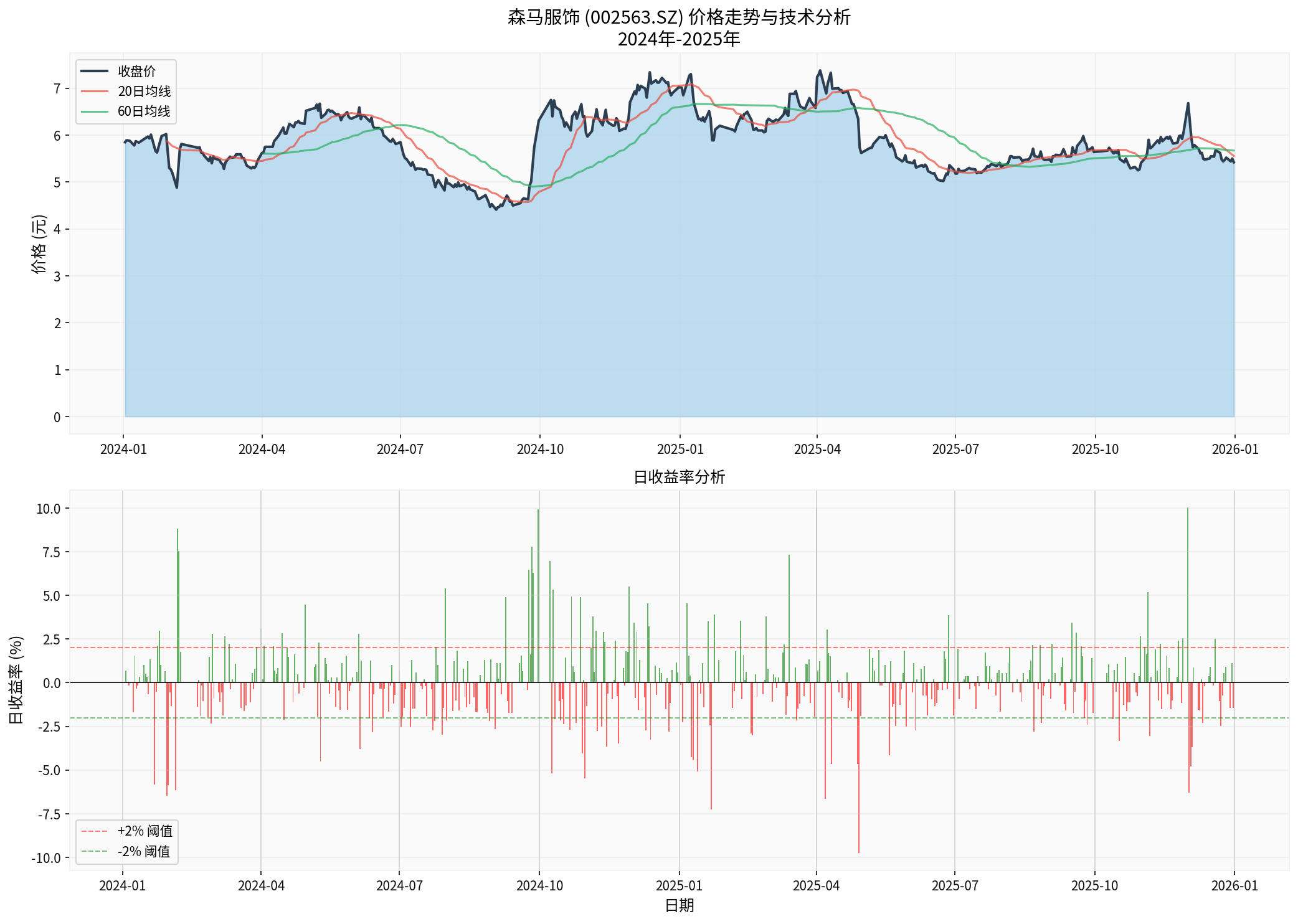

From the stock price performance, Semir Apparel fell by approximately 7.35% cumulatively during 2024-2025, with a volatility of 2.30% [0]. Although the trademark dispute occurred in 2020, the long-term impact of such intellectual property disputes on enterprises requires continuous attention.

Figure: Semir Apparel (002563.SZ) 2024-2025 Price Trend and Technical Analysis. Data shows the stock price exhibited a volatile downward trend during this period, with large fluctuations in daily returns.

Trademark disputes often trigger market doubts about enterprises’ brand management capabilities, leading to short-term stock price fluctuations. Case examples:

- Jianhe International(formerly Biostime) was exposed for its “fake foreign milk powder” identity in 2013 and fined 163 million yuan, severely damaging brand trust [2]

- Tongrentanghad to issue repeated “solemn statements” to distance itself from non-compliant enterprises due to repeated OEM chaos, eroding the brand value of this century-old brand [3]

- Huangshi Groupfell into a trust crisis due to a “word game” trademark dispute, where product ingredients differed from宣传 [3]

As of December 19, 2025, the PE-TTM (excluding negative values) of SW Textile and Apparel sector was 20.32x, at the 76.86% percentile of the past five years’ valuation level [1]. Intellectual property disputes like trademark conflicts increase investors’ uncertainty, leading to sector valuation discounts.

The domestic sportswear market in 2025 showed characteristics of “differentiation and沉淀”, with most domestic brands trapped in the predicament of “having market share but no premium” [1]. Trademark disputes further weaken brand premium capabilities, making it difficult for enterprises to break through homogeneous competition.

Trademark disputes often expose internal control flaws:

- Financial analysis of Semir Apparel shows it adopts “aggressive” accounting policies, with low depreciation/capital expenditure ratios, and the upside potential of reported earnings may be limited [0]

- Jianhe International’s sales expenses reached 5.57 billion yuan in 2024, with a sales expense ratio of 42.7%, but high marketing spending failed to avoid brand disputes [2]

Chaos in intellectual property management reflects governance system loopholes:

- Tongrentang’s subsidiary used trademarks without authorization to carry out franchise activities, exposing the group’s ineffective control [3]

- Habor Pharmaceutical was involved in 5 trademark infringement cases in the past 3 years, along with 5 administrative penalties [3]

Continuous brand disputes lead to:

- Increased Risk Premium: Investors demand higher returns to compensate for brand risks

- Moat Erosion: Trademarks are core brand assets, and disputes weaken competitive advantages

- Lower ESG Scores: Intellectual property compliance is an important indicator in the Governance (G) dimension

- Reference Shaolin Temple’s practice of registering 666 trademarks covering 45 categories [1]

- Conduct defensive layout for core brands in Class 25 (apparel) and related categories

- Register similar trademarks to prevent “free-riding” behaviors

- With the acceleration of apparel industry’s overseas expansion, international registration via the Madrid Agreement is necessary

- Pay attention to differences in trademark legal systems in target markets

- Establish an overseas trademark monitoring mechanism

According to Article 57 of the Trademark Law, trademark infringement behaviors include [4]:

- Using identical/ similar trademarks on the same kind of goods

- Selling infringing goods

- Forging/ unauthorized manufacturing of trademark identifiers

- Intentionally providing convenience for infringement

Enterprises should establish:

- Trademark search mechanism before new product launch

- Trademark compliance review for suppliers/OEMs

- Three-level review system for marketing materials

Case warnings [3]:

- “Huangshi Buffalo” is only a trademark, not indicating the product is pure buffalo milk

- “Buffalo Formula” uses consumers’ impression of “formula” as high-quality to create宣传 gimmicks

- Violates the right to know stipulated in the Consumer Rights Protection Law

- Clarify the use boundary between core trademarks and sub-brands

- Only use for group direct operations or highly controlled core product lines

- Avoid implicit endorsement by subsidiaries through equity关联 [3]

- Conduct comprehensive due diligence on partners and refuse to cooperate with non-compliant operations [3]

- Clearly stipulate trademark use norms and liability for breach in contracts

- Regularly audit partners’ trademark use情况

- Abandon the “easy money” model of collecting authorization fees solely relying on brands [3]

- Establish a product quality traceability system

- Implement the same quality standards for OEM products as direct-sale products

- Use big data technology to monitor e-commerce platforms and social media

- Pay attention to competitors’ trademark applications and use情况

- Establish a reward system for reporting infringement clues

Take different measures according to the severity of infringement:

- Administrative Complaint: Report to market supervision departments for large-scale counterfeiting and sales

- Civil Litigation: For infringement behaviors causing actual economic losses

- Criminal Report: For serious and large-scale counterfeit trademark behaviors

According to the Trademark Law, punitive damages can be applied for malicious infringement with serious circumstances [4]:

- Obtain full-store sales data to prove infringement scale

- Prove the continuous infringement behavior of the defendant

- Claim punitive damages to increase the cost of violation

- Set up a full-time intellectual property management department

- Equip with professional teams such as trademark agents and legal personnel

- Establish a cross-departmental intellectual property coordination mechanism

- Formulate internal systems like the “Trademark Management Measures”

- Establish a full-life-cycle management process for trademarks

- Conduct regular intellectual property training

- Establish a trademark management information system

- Use AI technology for trademark risk early warning

- Realize real-time update and sharing of trademark data

As a leading enterprise in the industry, Semir Apparel has participated in the formulation of multiple industry standards [4], and should play a leading role in the field of intellectual property protection.

- Jointly boycott enterprises with repeated infringements

- Share information and evidence of infringement behaviors

- Promote the establishment of a credit file system

- Propose to increase the standard of statutory compensation

- Simplify intellectual property rights protection procedures

- Strengthen the responsibility of e-commerce platforms

- Check the number and layout of enterprises’ trademark registrations

- Pay attention to whether there are major intellectual property disputes

- Evaluate the sustainability of enterprises’ brand moats

For example, Jianhe International’s sales expense ratio is as high as 42.7% [2]. If high marketing spending is accompanied by brand disputes, attention should be paid to sustainability risks.

- Avoid companies with frequent related transaction violations

- Pay attention to information disclosure transparency

- Attach importance to the governance dimension in ESG scores

The textile and apparel industry is expected to benefit from the following in 2026:

- The Central Economic Work Conference emphasizes “domestic demand-led”, boosting consumer confidence [1]

- The cumulative year-on-year growth rate of apparel retail sales from January to October 2025 was 3.5% [1]

- Substantial subsidies for terminal consumption from the policy side

However, industry differentiation will continue, and enterprises with the following characteristics will stand out:

- Technological Innovation: Such as Anta Group’s launch of “Fluorine-free Anta Membrane Technology” and “Six-Degree Core Warmth Technology” [1]

- Cultural Empowerment: Such as Li-Ning’s integration of traditional cultural elements with modern design [1]

- Green and Low-Carbon: Li-Ning launched the first fully degradable professional sports shoe in China [1]

The trademark dispute case of Semir Apparel warns us that in the increasingly competitive apparel consumption market, intellectual property has become the core asset and competitive barrier of enterprises. Enterprises must build a comprehensive trademark protection system, and establish a systematic risk prevention and control mechanism from strategic layout, compliance use, authorization management, monitoring and rights protection to internal governance.

For investors, intellectual property management level should be included in the enterprise evaluation framework, and attention should be paid to the valuation discount and investment risk caused by brand disputes. The future competition in the apparel industry will focus on the three dimensions of “technology, fashion and green”, and the ability of intellectual property protection will become a key factor determining whether enterprises can survive the cycle.

— References —

[0] Jinling API Data - Semir Apparel Stock Real-time Quotes, Financial Analysis, Historical Price Data

[1] Sina Finance - “Sports Goods Concept Stocks Rise Collectively, Industry Accelerates Recovery?” (https://finance.sina.com.cn/stock/relnews/hk/2025-12-15/doc-inhawpkf4072061.shtml)

[2] East Money - “Biostime Unsaleable + Swisse Brand in Dispute, Jianhe International Suffers First Loss in 15 Years of Listing” (https://finance.eastmoney.com/a/202507313472810044.html)

[3] 21 Finance - “Antarctic Krill Oil Fraud Storm: Tongrentang’s OEM Model Again in Trust Crisis” (https://www.21jingji.com/article/20251216/herald/54e17f98436b0bf3f1657740565255bf.html)

[4] Deheng Law Firm - “Intellectual Property Protection in Garment Design Industry: Protection Paths and Rights Protection Pain Points Analysis” (https://www.deheheng.com/content/34526.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.