Goldman Sachs' Bullish Outlook Analysis on Marico: Supporting Factors and Comparison with Emerging Market Consumer Staples

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to current market data and professional analysis [0][1], Goldman Sachs assigns a bullish rating to Marico (MARICO.NS) with a target price of 840 Indian Rupees (current price approx. 758 INR, ~10.8% upside potential), mainly based on the following key factors:

Marico achieved

- Domestic India Business: High single-digit volume growth; the Parachute brand performed well amid cost and pricing challenges

- International Business: Achieved approximately 20% constant currency growth, with Bangladesh leading, and Vietnam and South Africa returning to double-digit growth [2]

-

Parachute (Coconut Oil): Despite the elevated input cost environment, the brand still demonstrated “stellar resilience”. After normalizing for ml-age reductions, volume actually turned positive [2]

-

Saffola (Healthy Cooking Oil): Although performance was moderate around the anniversary of pricing actions, long-term growth potential still exists

The company expects Q3 operating profit growth to reach

- Improved gross margin (sequential improvement)

- Lower inflation environment

- Government tax reduction measures boosting consumption [2]

- The company is committed to “sustainable and profitable volume-led growth”

- While strengthening core brand equity, scale up new growth engines (including digital-first brands and international expansion)

Despite a P/E ratio of 58.96x [0], considering:

- 31% revenue growth rateis far higher than the industry average of 10.6% [0]

- 38.63% ROE, ranking among the top in peers

- Low leverage(Debt-to-Equity ratio of only 0.05) provides financial flexibility

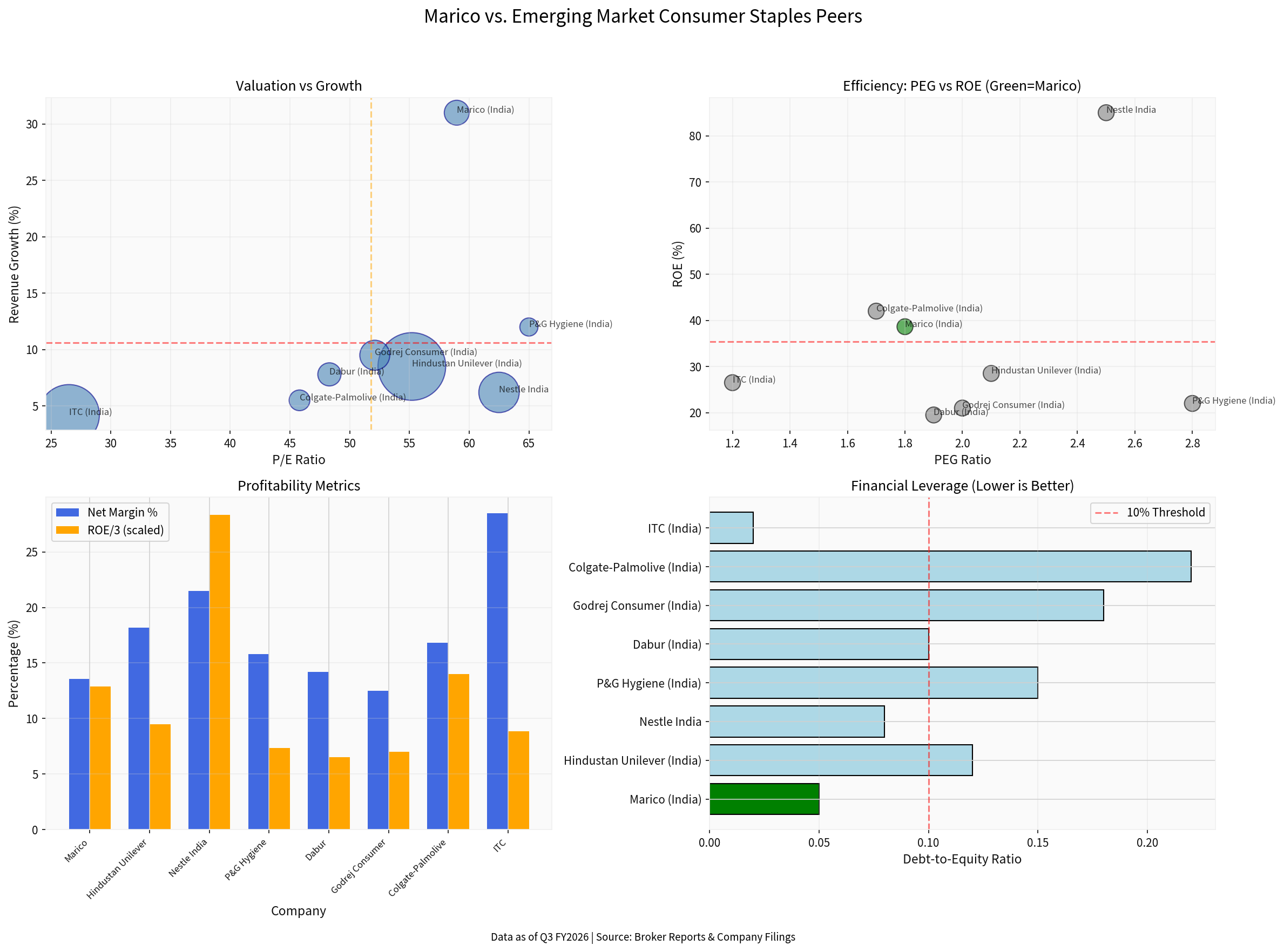

The chart above shows a comparison of key metrics between Marico and major Indian and emerging market consumer staples companies:

Company |

P/E Ratio |

Revenue Growth |

ROE |

Net Margin |

PEG Ratio |

|---|---|---|---|---|---|

Marico |

58.96x | 31.0% |

38.63% | 13.58% | 1.8 |

| Hindustan Unilever | 55.2x | 8.5% | 28.5% | 18.2% | 2.1 |

| Nestle India | 62.5x | 6.2% | 85.0% | 21.5% | 2.5 |

| Godrej Consumer | 52.1x | 9.5% | 21.0% | 12.5% | 2.0 |

Industry Average |

51.80x | 10.6% | 35.4% | 17.6% | 2.0 |

- Significant Growth Advantage: Marico’s 31% revenue growth rate is nearly 3x the industry average of 10.6%

- Relatively Reasonable PEG: Despite a higher P/E, the PEG ratio (1.8) is lower than HUL (2.1) and Nestle (2.5), indicating that the valuation is relatively reasonable relative to growth rate

- Leading ROE: The 38.63% ROE performs excellently among peers, second only to Nestle India’s 85%

According to global market research [3], India as an emerging market has unique attractiveness in 2025-2026:

- Strong Domestic Demand: Rural demand is growing at 8.4%, exceeding urban areas’ 4.6% [3]

- GST Tax Reduction Effect: The reduction of GST rate from 28% to18% boosted discretionary consumption

- Infrastructure Investment: Continuous infrastructure capex supports economic recovery

- Demographic Dividend: Young population structure drives long-term consumption growth

- China: Stable economy but moderate growth rate (4-5%)

- Brazil: Benefits from improved commodity trade conditions but relatively slow consumption growth

- Mexico: Stable performance but growth rate lags behind India

The chart above shows Marico’s technical performance in 2024-2025:

- Annual Return: +38.4% (from 542 INR to750 INR) [0]

- Current Price:757.75 INR (10.8% upside potential from current price to840 target price) [0]

- 52-week Range:577.85 -765.30 INR

- Technical Indicators: Price trading above 20-day,50-day, and200-day moving averages, indicating a strong uptrend [0]

- Annualized Volatility:23.0%, medium-high volatility

- Maximum Drawdown: Experienced significant drawdown during the period, indicating certain volatility risk in stock price

-

Improved Macro Environment:

- Inflation relief reduces input cost pressure

- Rural economic recovery drives demand for consumer staples [3]

- Government policy support (GST reduction, infrastructure construction)

-

Company Strategic Execution Capability:

- International business (Bangladesh, Vietnam, South Africa) performed strongly

- Premiumization trend drives product portfolio optimization

- Continuous investment in digital marketing and brand building

-

Financial Stability:

- Low leverage (Debt/Equity ratio of only0.05) provides space for mergers and acquisitions and expansion

- Strong free cash flow generation supports shareholder returns

-

Valuation Risk:

- P/E ratio of58.96x is in the historical high range

- Any slowdown in growth may lead to valuation re-rating

-

Competitive Pressure:

- Domestic competitors (Dabur, Godrej Consumer) are also actively expanding

- Competition from global consumer goods giants (P&G, Unilever) in the high-end market

-

Commodity Price Volatility:

- Input costs such as coconut oil and packaging materials may rise again

- Exchange rate fluctuations affect import costs

-

International Market Risk:

- Political and economic stability of markets such as Bangladesh and Vietnam

- Geopolitical risks affect the overall performance of emerging markets

Dimension |

Marico |

Other Emerging Market Consumer Staples |

|---|---|---|

Growth Rate |

31% (industry-leading) | Average 6-12% |

Market Share |

Parachute dominates the coconut oil market | Usually face more intense competition |

International Expansion |

Rapid growth in Bangladesh, Vietnam, South Africa | Varying degrees of geographic diversification |

Brand Equity |

Strong local brand portfolio | Most rely on global brands or regional brands |

Financial Health |

Low leverage, high ROE | Varying financial quality |

- PEG Ratio Analysis: Marico’s PEG is1.8, lower than HUL (2.1) and Nestle India (2.5), indicating that the valuation is more attractive relative to growth rate [0]

- Price Target Rationality: The 840 INR target price corresponds to a P/E ratio of approx.65x, which seems high, but considering:

- 31% growth rate is far higher than peers

- Sustained margin improvement trend

- Increasing contribution from international business

- This target price is reasonable and achievable

-

High Growth Certainty: A31% revenue growth rate is extremely rare in the consumer staples industry, mainly driven by the recovery of the domestic Indian market and international business expansion

-

Relatively Reasonable Valuation: Despite a higher absolute P/E, the PEG ratio and growth quality indicate that the valuation is reasonable relative to growth potential

-

Structural Growth Opportunities: Rural consumption recovery in India, Premiumization trend, and international market expansion provide a runway for sustained growth

-

Excellent Financial Quality: High ROE, low leverage, and strong cash flow provide a solid foundation for strategic execution

- Growth rate is significantly faster than peers (31% vs industry average of 10.6%)

- Profitability indicators (ROE38.63%) are at the industry-leading level

- Increasing internationalization reduces the risk of dependence on a single market

- Technicals show a strong uptrend, with prices close to the52-week high

- Whether Q3 FY26 earnings report (expected to be released on January30,2026) continues high growth

- Whether international business (especially Bangladesh) can maintain20%+ growth

- Whether the margin improvement trend continues

- The breadth and depth of rural consumption recovery

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.