Guggenheim's Neutral Rating Upgrade for PANW: Valuation & Strategic Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my analysis of recent market data, financial metrics, and sector developments, here is a comprehensive assessment of Guggenheim’s rating change and its implications for PANW’s valuation outlook.

Guggenheim’s upgrade from Sell to Neutral appears driven by improved valuation dynamics after significant multiple compression in 2025. PANW’s forward P/E ratio has contracted to

The most significant catalyst is the landmark

- Positions PANW as a premier security provider for AI and cloud workloads

- Addresses the critical need for AI infrastructure security (99% of organizations reported attacks on AI infrastructure in the past year)[3]

- Provides substantial recurring revenue visibility over multiple years

- Validates PANW’s platform approach in securing AI-from-development-to-deployment

PANW delivered only

Recent quarterly results demonstrate consistent execution:

- Q1 FY2026 EPS: $0.93 actual vs $0.93 estimate (in line) [0]

- Revenue: $2.47B, representing 15.3% year-over-year growth [0]

- Recent history of EPS beats (4.38% surprise in latest quarter) [0]

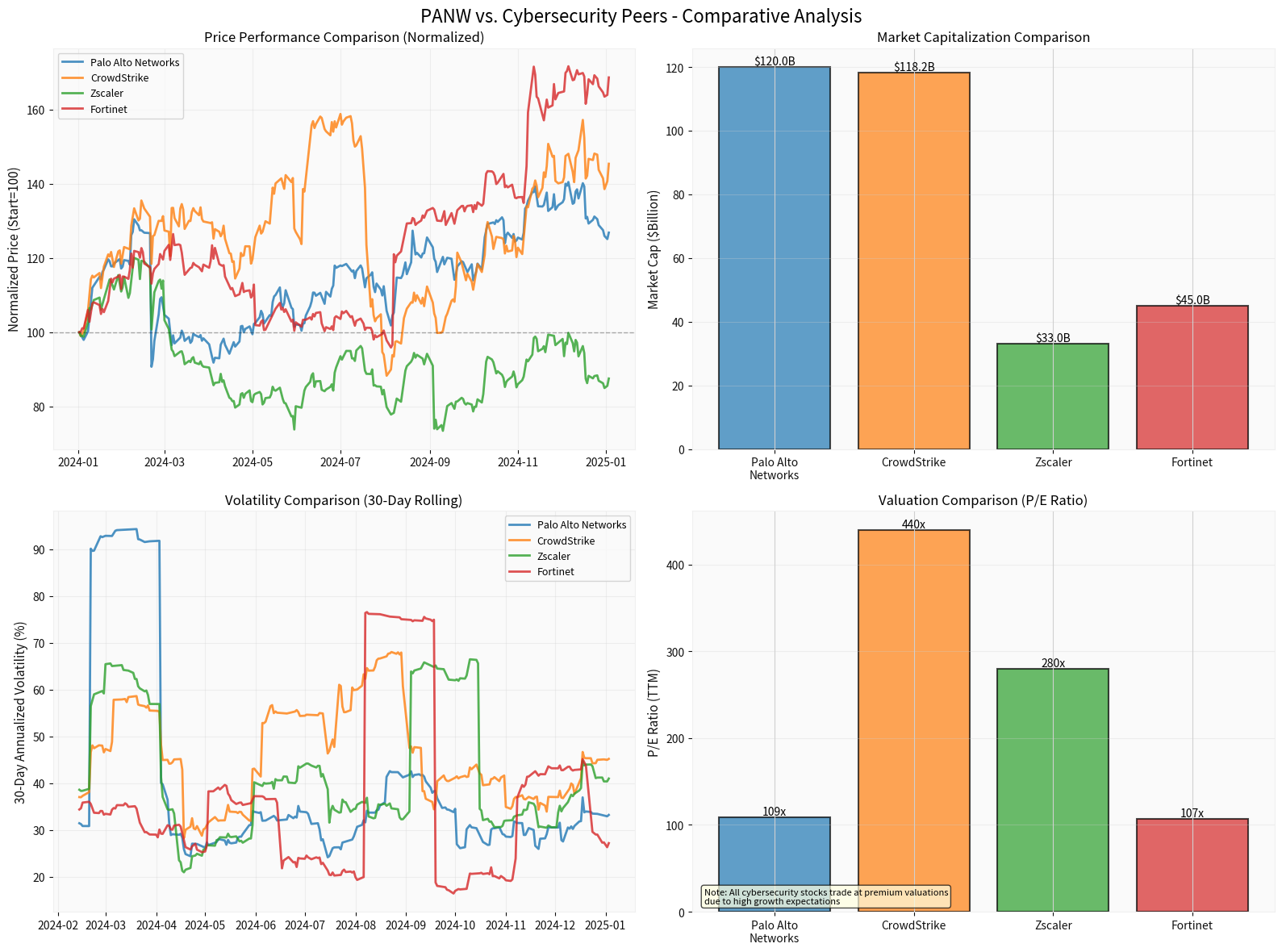

Chart: PANW stock performance showing 26.9% return since January 2024, with notable volatility around strategic announcements including the Google Cloud deal in December 2024.

| Metric | PANW Value | Context |

|---|---|---|

P/E Ratio (TTM) |

109.02x | Premium to S&P 500 |

Forward P/E |

~43.7x | Below 5-year average of 53x [1] |

P/S Ratio (TTM) |

12.55x | Rich but supported by growth |

Price Target |

$240.00 | 33.8% upside from current ~$179 [0] |

Market Cap |

$119.95B | Leader in cybersecurity [0] |

The intrinsic value analysis suggests significant caution:

- Conservative Fair Value: $17.76 (-90.1% vs current)

- Base Case Fair Value: $23.42 (-86.9% vs current)

- Optimistic Fair Value: $32.61 (-81.8% vs current) [0]

This substantial disconnect indicates the market is pricing in aggressive long-term growth expectations that may be difficult to achieve even under optimistic scenarios.

Chart: PANW versus major cybersecurity peers. PANW maintains the largest market capitalization at $120B, with valuation and volatility characteristics comparable to industry leaders.

- Scale Leadership: Largest market cap ($119.95B) among pure-play cybersecurity companies [0]

- Platform Moat: Comprehensive security platform versus point-solution competitors

- AI Security First-Mover: Google partnership secures leadership in emerging AI security market

- Financial Strength: $1.69B in free cash flow providing M&A and R&D flexibility [0]

Guggenheim’s

- Recognition of Improvement: Valuation is no longer egregiously expensive after 2025 compression

- Wait-and-See Approach: Needs proof points from the Google partnership execution

- Cautious on Macro: Technology sector facing headwinds (down -1.02% today) [0]

- Growth Sustainability Concerns: Maintaining 20%+ revenue growth may prove challenging at scale

- Catalyst-Driven: Google partnership announcements and initial customer wins could drive multiple expansion

- Earnings-Dependent: Must sustain or accelerate growth to justify current valuation

- Technical Range: Trading sideways with support at$180.53and resistance at$192.05[0]

- AI Security Theme: Positioned to benefit from secular growth in AI workloads requiring security

- Competitive Moat Strengthening: Platform approach and Google alliance create differentiation

- Valuation Risk: Current pricing requires flawless execution over extended period

Guggenheim’s upgrade appropriately reflects

The cybersecurity sector remains attractive long-term, and PANW’s leadership position is undeniable. However, investors should be aware that:

- Current pricing assumes aggressive growth scenarios

- The Google partnership is a positive catalyst but execution remains key

- Valuation remains stretched on traditional metrics despite multiple compression

- The market’s enthusiasm for AI-related investments may create volatility

The upgrade to Neutral acknowledges these factors are

[0] 金灵AI: PANW real-time quote, company overview, analyst consensus, financial statements, DCF valuation, technical analysis

[1] CNBC - “What spooked Palo Alto investors in 2025 could accelerate growth in 2026” (https://www.cnbc.com/2026/01/02/what-spooked-palo-alto-investors-in-2025-could-accelerate-growth-in-2026.html)

[2] Gotrade News - “Google Stock Up After $10 Billion Deal with Palo Alto” (https://www.heygotrade.com/en/news/google-stock-up-after-10-billion-deal-with-palo-alto)

[3] Cloud Computing News - “Google Cloud and Palo Alto Networks sign deal worth nearly $10 billion” (https://www.cloudcomputing-news.net/news/google-cloud-and-palo-alto-networks-sign-deal-worth-nearly-10-billion/)

[4] Seeking Alpha - “All J.P. Morgan’s top stock picks for 2026” (https://seekingalpha.com/news/4536103-all-jp-morgans-top-stock-picks-for-2026)

[5] TipRanks - “Best Cybersecurity Stocks | Top Cyber Companies” (https://www.tipranks.com/compare-stocks/cybersecurity)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.