Analysis of the Strong Performance of Feiwo Technology (301232)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Feiwo Technology (301232) recently entered the strong stock pool, and its strong performance is driven by multiple factors:

- Concept Catalyst: On December 31, 2025, the company invested in Xinsan Aerospace Technology, a 3D printing company, to lay out its commercial aerospace sector [1], benefiting from the capital market’s pursuit of the commercial aerospace concept [1][2].

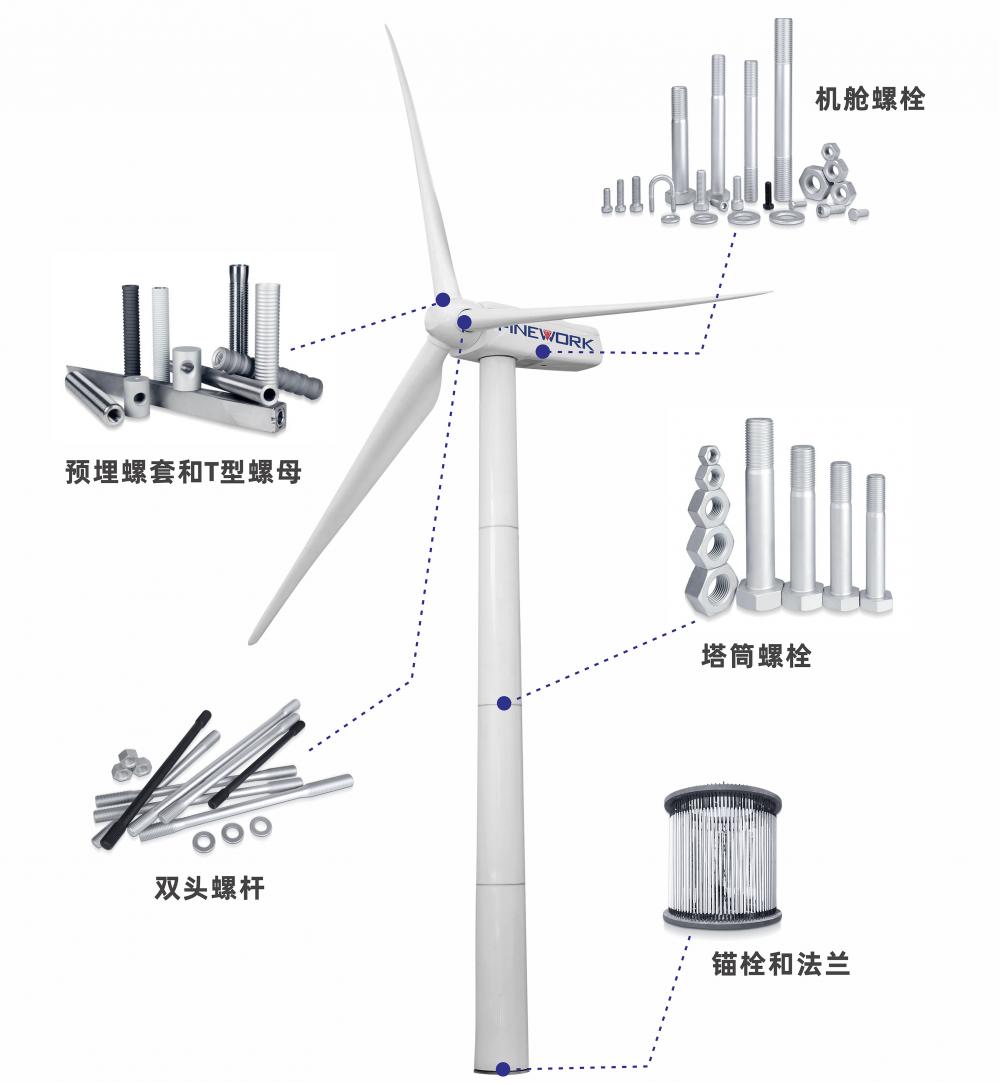

- Fundamental Support: As a high-strength fastener R&D and manufacturing enterprise, the company holds a 70% global market share in wind turbine blade embedded nuts, and the current recovery of the wind power industry supports its performance [1][3].

- Technical Performance: The stock price rose sharply from about 28 yuan in April 2025 to the current 168.37 yuan, reaching a high of 183.93 yuan on December 25, with a full-year gain of approximately 581.66% in 2025, ranking among the top ten in the A-share gain list [1][3].

- Business Expansion and Market Hotspot Resonance: The company is expanding from the wind power field to commercial aerospace, new energy vehicles and other tracks, aligning with the current market’s investment enthusiasm for high-end manufacturing and aerospace industries [1][3].

- Risk and Return Coexist: Although the stock price performance is strong, it should be noted that the current proportion of commercial aerospace business is less than 1%. If market expectations fail to materialize, it may trigger a stock price correction [1][2].

- Capital Flow Signal: On December 30, 2025, the company’s main capital had a net outflow of 185 million yuan, which may reflect the profit-taking sentiment of some investors [1].

- Risks: High stock price volatility; the company has issued multiple “abnormal fluctuation” announcements [1]; low proportion of commercial aerospace business, performance support remains to be seen [1][2].

- Opportunities: The recovery of the wind power industry continues to advance, and the company’s core business is expected to maintain growth; the layout of aerospace and new energy vehicles provides imagination space for long-term development [1][3].

The strong performance of Feiwo Technology (301232) is jointly driven by the commercial aerospace concept and the recovery of the wind power industry. Technically, the stock price has risen sharply; fundamentally, it relies on the market position of its core products. Investors need to pay attention to the risk of stock price volatility and the progress of new businesses, and make investment decisions comprehensively.

[1] Ginlix InfoFlow Analysis Database

[2] Commercial Aerospace Concept Market Analysis Report

[3] Wind Power Industry Recovery Research Report

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.