Shengyi Technology's 4.5 Billion Yuan High-Performance Copper-Clad Laminate Project Investment Impact Assessment Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

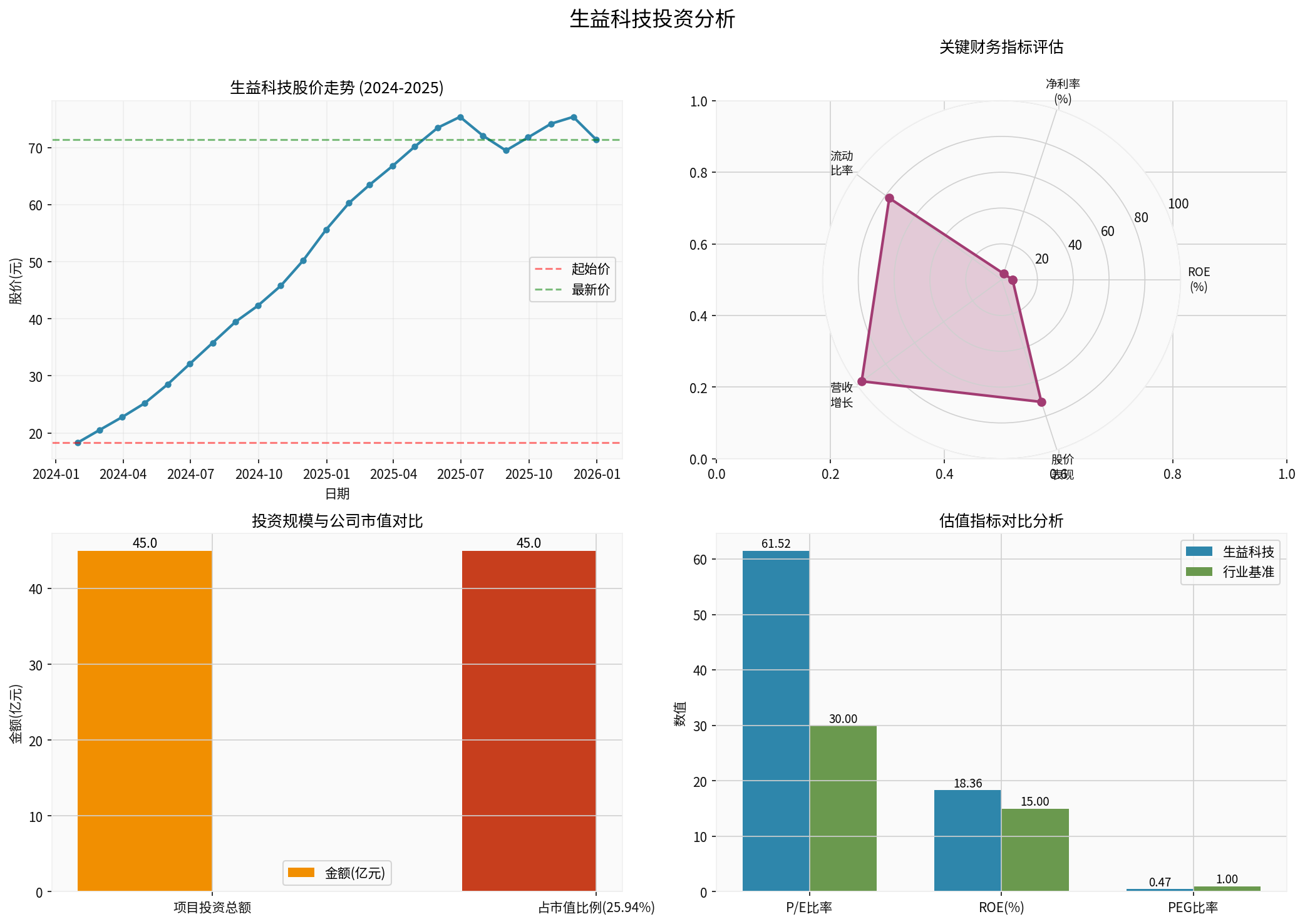

- Project Investment Amount: 4.5 billion yuan

- Company Market Capitalization: 17.346 billion yuan (current) [0]

- Investment Proportion: 25.94% of market capitalization, classified aslarge-scale investment(20-30% range) [0]

- Investment Nature: Capacity expansion + old plant land reserve integration project

- Current Ratio: 1.55 (good liquidity) [0]

- ROE: 18.36% (strong profitability) [0]

- Net Profit Margin: 10.70% (stable profitability) [0]

- Financial Attitude Classification: Neutral (balanced accounting policies) [0]

Scenario analysis based on industry data and company historical performance:

| Scenario | Assumptions | Annual Revenue Contribution | Growth Rate Contribution |

|---|---|---|---|

Conservative |

25% gross margin, 60% capacity utilization | ~40 billion yuan | +126% |

Neutral |

30% gross margin,70% capacity utilization | ~53.6 billion yuan | +169% |

Optimistic |

35% gross margin,85% capacity utilization | ~72 billion yuan | +227% |

Note: Current annualized revenue is approximately 31.72 billion yuan [0]

Under assumptions of 30% gross margin and12% net profit margin:

- Break-Even Annual Revenue: ~53.6 billion yuan

- Proportion of Current Revenue:168.9%

- Expected Time to Reach Full Capacity: Usually2-3 years

Key Conclusion: After the project successfully reaches full capacity, it is expected to bring more than double the revenue growth and significantly enhance the company’s market position.

###3. Assessment of Industry Competitiveness Enhancement

- Company Status: One of the leading enterprises in China’s CCL industry

- Product Positioning: High-performance CCL (for high-end applications like high-frequency/high-speed, AI servers,5G communications)

- Competitive Advantages:

- Deep technical accumulation

- Leading production capacity scale

- High-quality customer resources

According to industry research, the CCL market has strong demand in the following areas:

- AI Servers/HPC: Explosive growth in demand for high-performance computing [2]

- 5G Communications: Continuous base station construction

- New Energy Vehicles: Increased demand for power electronics

- High-end PCB: Rising demand for high-frequency/high-speed materials

Market Opportunity: Demand for AI servers and high-performance PCBs is becoming the core driver of high-end PCBs, and related industry chain companies have performed strongly [2].

###4. Valuation and Investment Return Analysis

| Indicator | Shengyi Technology | Industry Benchmark | Evaluation |

|---|---|---|---|

| P/E Ratio | 61.52x | 30x | High |

| ROE | 18.36% | 15% | Excellent |

| PEG | 0.47 | 1.0 | Undervalued |

PEG Analysis: Based on an annualized growth rate of215.28%, the PEG ratio is0.47, significantly below 1, indicating that although the absolute valuation is high, the valuation is reasonable or even low relative to growth [0].

- Stock Price Performance: Up215.28% in the past year, up130.35% in6 months [0]

- Market Expectations: The AI industry chain remains prosperous, and the company as a core material supplier is expected to continue to benefit

- Long-term Value: After the project reaches full capacity, EPS and revenue scale are expected to increase significantly

###5. Risk Factor Identification

- Capacity Absorption Risk:

- Large project investment scale, need to consider the risk of market demand falling short of expectations

- Intensified industry competition may lead to price pressure

- Capital Chain Pressure:

-4.5 billion yuan investment accounts for a high proportion of total market capitalization (25.94%)- Need to pay attention to the company’s cash flow status and financing arrangements

- Technology Iteration Risk:

- High-performance CCL technology updates quickly

- Need continuous R&D investment to maintain technological leadership

- Macroeconomic Risks:

- Global economic fluctuations affect demand in the electronics industry

- Geopolitical factors affect the supply chain

- Current ratio of1.55, good short-term debt-paying ability [0]

- Old plant land reserve can provide partial funding support

- As an industry leader, it has scale and technological advantages

###6. Comprehensive Assessment Conclusion

- Large Performance Growth Potential: After reaching full capacity, the project is expected to bring more than double revenue growth and significantly enhance the company’s scale and market position

- Consolidation of Industry Position: Expansion of high-performance CCL capacity can capture high-end market demand such as AI servers and5G communications, enhancing core competitiveness

- Relatively Reasonable Valuation: PEG of0.47 indicates undervaluation relative to growth, with investment value [0]

- Outstanding Strategic Significance: Adopting a “package solution” to promote old plant land reserve and optimize asset structure

- Large Investment Scale:4.5 billion yuan accounts for25.94% of market capitalization, requiring high capital chain and project management capabilities

- Existence of Uncertainties: Long project construction and full capacity period (usually 2-3 years), with risks of changes in market demand

- High Absolute Valuation Level: P/E ratio of61.52x is relatively high in absolute terms, requiring high growth to digest the valuation [0]

###7. Investment Recommendations

- AI industry chain remains prosperous, strong demand for CCL

- Company has prominent industry position and deep technical accumulation

- PEG indicates reasonable valuation relative to growth

- Healthy financial status, ROE of18.36% [0]

- Closely track project construction and capacity release progress

- Pay attention to changes in market demand and industry competition pattern

- Monitor changes in the company’s cash flow and balance sheet

- Observe the sustainability of downstream demand such as AI servers and5G

[0] Gilin API Data

[2] Yahoo Finance - Taiwan Optoelectronics and Zhen Ding Reach Strategic Alliance to Deepen Material R&D and Smart Manufacturing Development (https://hk.finance.yahoo.com/news/台光電與臻鼎達成戰略結盟-深化材料研發及智慧製造発展-104430603.html)

[2] Yahoo Finance - A-Shares Surge with Volume, Computing Power Industry Chain Follows Suit (https://hk.finance.yahoo.com/news/a股放量大漲-工業富聯奔漲停-算力產業鏈跟進噴發-055432509.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.