Analysis of the Impact of Escalating Geopolitical Conflicts on Global Markets and Investors' Asset Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Recent global geopolitical tensions have escalated significantly:

- North Korea’s Missile Launch: On January 2, 2026, North Korea launched a ballistic missile. The South Korean government strongly condemned this and heightened its defense posture [1]

- US Military Action Against Venezuela: The US-led military strike against Venezuela has attracted widespread international attention. These actions reflect the complexity and uncertainty of the current international geopolitical landscape [1]

These events occurred against the backdrop of US attacks on Islamic State targets in Nigeria, exacerbating global investors’ concerns about geopolitical risks and driving up market safe-haven sentiment [2].

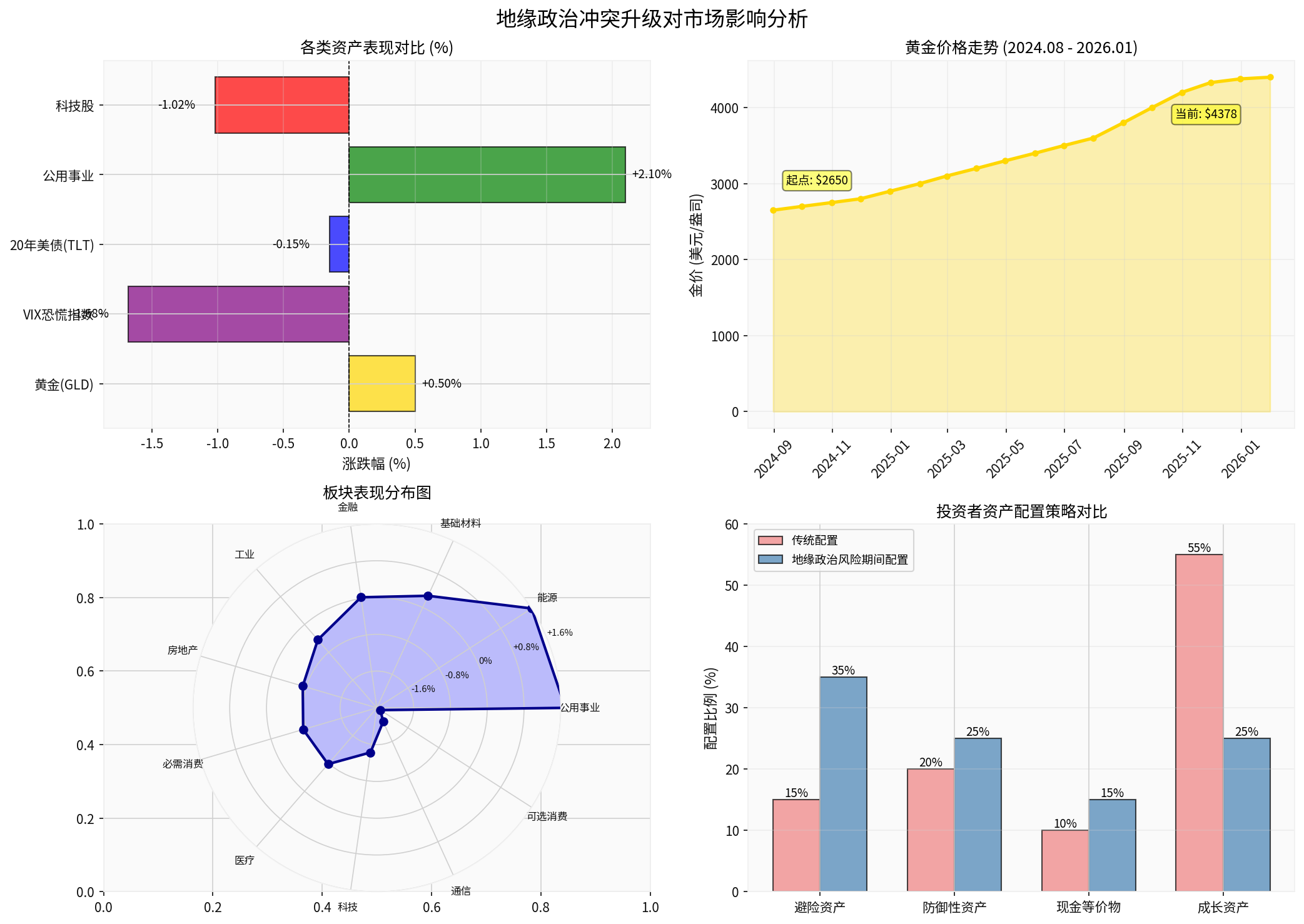

The current market shows obvious characteristics of “shift from risk to defense”:

- Gold (GLD): Closed at $398.28, up 0.50%, continuing its strong rally in 2025 (cumulative increase of about 70% for the year) [0][2]

- Silver: Also performed strongly with more significant gains, partly driven by expectations of possible US import tariffs on refined metals [4]

This chart shows the performance comparison of various assets during geopolitical events, gold price trends, sector distribution, and recommended asset allocation strategies

The current market shows significant sector rotation characteristics:

- Outstanding Performance of Defensive Assets: Traditional defensive sectors such as utilities, energy, and basic materials led the gains

- Growth Tech Stocks Under Pressure: High-growth sectors such as technology and communications adjusted

- Safe-Haven Role of Dollar Assets: Although the dollar index weakened slightly, dollar assets still played an important safe-haven role [2]

- Central Bank Gold Buying Spree: Global central banks bought a total of 254 tons of gold in 2025, with net purchases of 53 tons in October alone. The Polish Central Bank (83 tons), Kazakhstan Central Bank (41 tons), and Azerbaijan (38 tons) were among the top [2]

- De-Dollarization Trend: The Central Bank of Brazil restarted its gold purchase plan after 4 years, buying a total of 31 tons from September to October, which was interpreted by the market as an important measure to reduce dependence on the dollar [2]

- Geopolitical Risks: Ongoing conflicts in the Middle East, the stalemate in the Russia-Ukraine war, and US “reciprocal tariff” policies have triggered global trade frictions [2]

- Goldman Sachs: Raised its 2026 gold target price to $4900/ounce, saying “we are more optimistic about gold than ever before” [3]

- JPMorgan Private Bank: More optimistic, expecting gold prices to reach $5200-$5300/ounce by the end of 2026 [3]

- HSBC: Target price of $5000/ounce, believing that geopolitical risks and economic uncertainty will support gold prices until the first half of 2026 [3]

- UBS: Expects to see $4700 in the first quarter of 2026 [3]

- Citigroup: Adopts a cautious attitude, believing that if geopolitical tensions ease, gold prices may fall back to $3000/ounce. Citigroup pointed out five warning indicators: the proportion of gold to GDP hit a 55-year high, the proportion to household wealth hit a historical high, the proportion to foreign exchange hit a 30-year high, the ratio to broad money approached a historical high, and miners’ profits hit a 50-year high [3]

- Dow Jones Industrial Average: 48,382.40 points (+0.57%)

- S&P 500 Index: 6,858.48 points (-0.29%)

- Nasdaq Composite Index: 23,235.63 points (-1.05%)

- Russell 2000 Small-Cap Index: 2,508.22 points (+0.66%)

- Leading Sectors: Utilities (+2.10%), Energy (+2.00%), Basic Materials (+0.68%)

- Lagging Sectors: Consumer Discretionary (-1.91%), Communication Services (-1.67%), Technology (-1.02%) [0]

Based on the current market environment of escalating geopolitical risks, the following are asset allocation recommendations for investors with different risk preferences:

| Asset Class | Recommended Allocation Ratio | Specific Products |

|---|---|---|

Safe-Haven Assets |

45-55% | Gold ETF (GLD), Physical Gold, Silver |

Defensive Assets |

25-30% | Utilities Sector ETF, Consumer Staples, Healthcare |

Treasuries/High-Grade Bonds |

15-20% | 20-Year US Treasury ETF (TLT), Investment-Grade Corporate Bonds |

Cash Equivalents |

5-10% | Money Market Funds, Short-Term Treasuries |

- Focus on allocating gold and related precious metals to fully utilize their safe-haven properties

- Increase allocation to defensive sectors such as utilities and consumer staples

- Maintain a high proportion of liquid assets to cope with market fluctuations

- Reduce exposure to cyclical and growth assets

| Asset Class | Recommended Allocation Ratio | Specific Products |

|---|---|---|

Safe-Haven Assets |

25-35% | Gold, Silver, Yen and other traditional safe-haven assets |

Defensive Assets |

30-35% | Utilities, Energy, Financials and other defensive sectors |

Growth Assets |

20-25% | Tech Leaders, Consumption Upgrade Themes |

Cash/Bonds |

10-15% | Investment-Grade Bonds, Money Market Funds |

- Maintain moderate gold allocation to hedge against geopolitical risks

- Allocate to defensive sectors while focusing on beneficiary sectors like energy

- Select tech leaders with core competitiveness and deploy on dips

- Adjust positions dynamically and respond flexibly to market changes

| Asset Class | Recommended Allocation Ratio | Specific Products |

|---|---|---|

Safe-Haven Assets |

15-25% | Gold, Volatility Products (VIX-related) |

Defensive Assets |

25-30% | Utilities, Healthcare, Consumer Staples |

Growth Assets |

35-45% | Technology, New Energy, AI and other high-growth sectors |

Cash/Derivatives |

5-10% | Option Strategies, Futures Hedging |

- Allocate moderately to gold as insurance, but avoid over-hedging

- Focus on trading opportunities brought by geopolitical events

- Use derivatives for hedging and yield enhancement

- Focus on deploying core assets with long-term growth potential

- Federal Reserve’s Interest Rate Cut Cycle: Expected to continue cutting rates in 2026, reducing borrowing costs and benefiting non-interest-bearing assets like gold [2]

- Continuous Central Bank Gold Buying: 43% of surveyed central banks plan to increase gold holdings in the next 12 months, and 75% of institutions believe the dollar’s share in global reserves will decline [2]

- Resilience of China’s Economy: The RMB has strengthened sharply beyond the “7” mark, showing the sound fundamentals of emerging market economies [2]

- Geopolitical Uncertainty: If tensions escalate further, it may trigger larger-scale market volatility

- US Policy Uncertainty: Rising domestic policy uncertainty in the US weakens dollar credibility [2]

- Inflation Pressure: If inflation rebounds, it may restrict the central bank’s easing space

- Escalation of Geopolitical Risks: If the situation on the Korean Peninsula or in Venezuela deteriorates further, it may trigger systemic risks

- Gold Valuation Risk: Current gold prices are at historical highs, with technical correction pressure

- Market Liquidity Risk: Light trading volume during holidays may amplify price fluctuations [4]

- Dollar Strength Risk: If safe-haven funds flow back to the dollar significantly, it will pressure gold and non-dollar assets

- Maintain a defensive stance and moderately increase gold allocation

- Follow geopolitical event developments and adjust positions flexibly

- Avoid chasing safe-haven assets that have risen sharply

- Use market fluctuations to deploy high-quality assets on dips

- Maintain balanced allocation and do not bet on a single direction

- Follow Federal Reserve policy trends and inflation data

- Select industries and companies that benefit from geopolitical situations

- Keep a certain cash reserve to wait for better entry opportunities

- Adhere to long-term investment philosophy and do not deviate from long-term goals due to short-term fluctuations

- Increase the proportion of gold in strategic asset allocation (recommended 5-10%)

- Focus on investment opportunities brought by de-dollarization trends

- Deploy core assets that benefit from global supply chain restructuring

Investors should closely monitor the following key indicators:

- VIX Fear Index: Monitor changes in market panic sentiment

- Gold Price Trend: Observe the intensity of safe-haven demand

- Dollar Index: Track changes in dollar strength

- Geopolitical News: Obtain event developments in a timely manner

- Central Bank Policy Trends: Follow monetary policy adjustments of major central banks

- Capital Flow Data: Monitor cross-border capital flow trends

The current escalation of geopolitical conflicts has had a significant impact on global market risk preferences, with investors shifting from risk assets to safe-haven and defensive assets. As a traditional safe-haven asset, gold has hit a historical high driven by central bank gold buying spree and geopolitical risks, but it also faces valuation risks due to high prices.

- Increase Safe-Haven Asset Allocation: Raise the allocation ratio of precious metals like gold to a strategic level (5-10%)

- Strengthen Defensive Sectors: Increase the weight of defensive sectors such as utilities and consumer staples

- Maintain Moderate Liquidity: Hold sufficient cash to cope with market fluctuations and seize opportunities

- Avoid Overreaction: Do not completely change long-term investment strategies due to short-term geopolitical events

- Adjust Positions Dynamically: Adjust flexibly according to market changes to maintain portfolio elasticity

Although geopolitical risks加剧 market volatility in the short term, they also provide long-term investors with opportunities to deploy high-quality assets on dips. The key is to maintain investment discipline while controlling risks and seize investment opportunities contained in uncertainty.

[0] Jinling API Data (Real-time market data, gold prices, VIX index, sector performance, treasury yields)

[1] The Washington Post - “South Korea says North Korea has launched a ballistic missile into the sea” (January 2, 2026)

https://www.washingtonpost.com/world/2026/01/03/south-north-korea-missile/550aa480-e8ff-11f0-ae3e-837f914c795b_story.html

[2] Yahoo Finance Hong Kong - “〈US Stock Morning Session〉 Profit-Taking at Year-End, Major Indices Open Lower” (December 29, 2025)

https://hk.finance.yahoo.com/news/美股早盤-年底獲利了結出籠-主要指數開低-144333792.html

[3] Yahoo Finance Hong Kong - “Can Gold Prices Above 4500 Still Be Chased? World Gold Council: 43% of Central Banks Say They Will Continue to Buy Next Year” (December 25, 2025)

https://hk.finance.yahoo.com/news/金價漲破4500還能追嗎-世界黃金協有-43-央行表示明年接著買-104006317.html

[4] Yahoo Finance Hong Kong - “2026 Gold Price Trend: Some Major Banks Are Bullish, Some Experts Say It’s Extremely Expensive”

https://hk.finance.yahoo.com/news/2026金價走勢-有大行大力唱好-有高人稱貴到咋舌-075548825.html

[5] Yahoo Finance Hong Kong - “Continuing Last Year’s Fierce Rally, Gold and Silver Remain Soaring at the Start of 2026” (January 3, 2026)

https://hk.finance.yahoo.com/news/延續去年猛烈漲勢-黃金白銀2026年開局仍在飆高-053015703.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.