Comprehensive Analysis of the Impact of OPEC+ Member States' Internal Turmoil on Global Oil Supply Patterns and Energy Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Recently, OPEC+ has faced unprecedented internal challenges, with political tensions among major member states continuing to escalate:

Despite facing multiple crises, OPEC+ still increased its oil production target by approximately 2.9 million barrels per day between April and December 2025, equivalent to nearly 3% of global oil demand [1]. However, entering the first quarter of 2026, OPEC+ adopted a more cautious strategy, suspending further supply increases to address the prospect of global oil oversupply [2,6].

According to the 2025 Energy Industry Review, OPEC+'s market leverage has been significantly limited. The organization has extended voluntary production cuts multiple times, but their effectiveness is limited by the following factors:

The latest data from OPEC shows that the global oil market will tend to balance in 2026, contrasting with the widely predicted oversupply situation [6]. OPEC and its allies need to produce an average of 43 million barrels of oil per day to balance supply and demand, a level roughly the same as production in December last year [6].

According to brokerage API data, energy investments showed significant divergence in 2025:

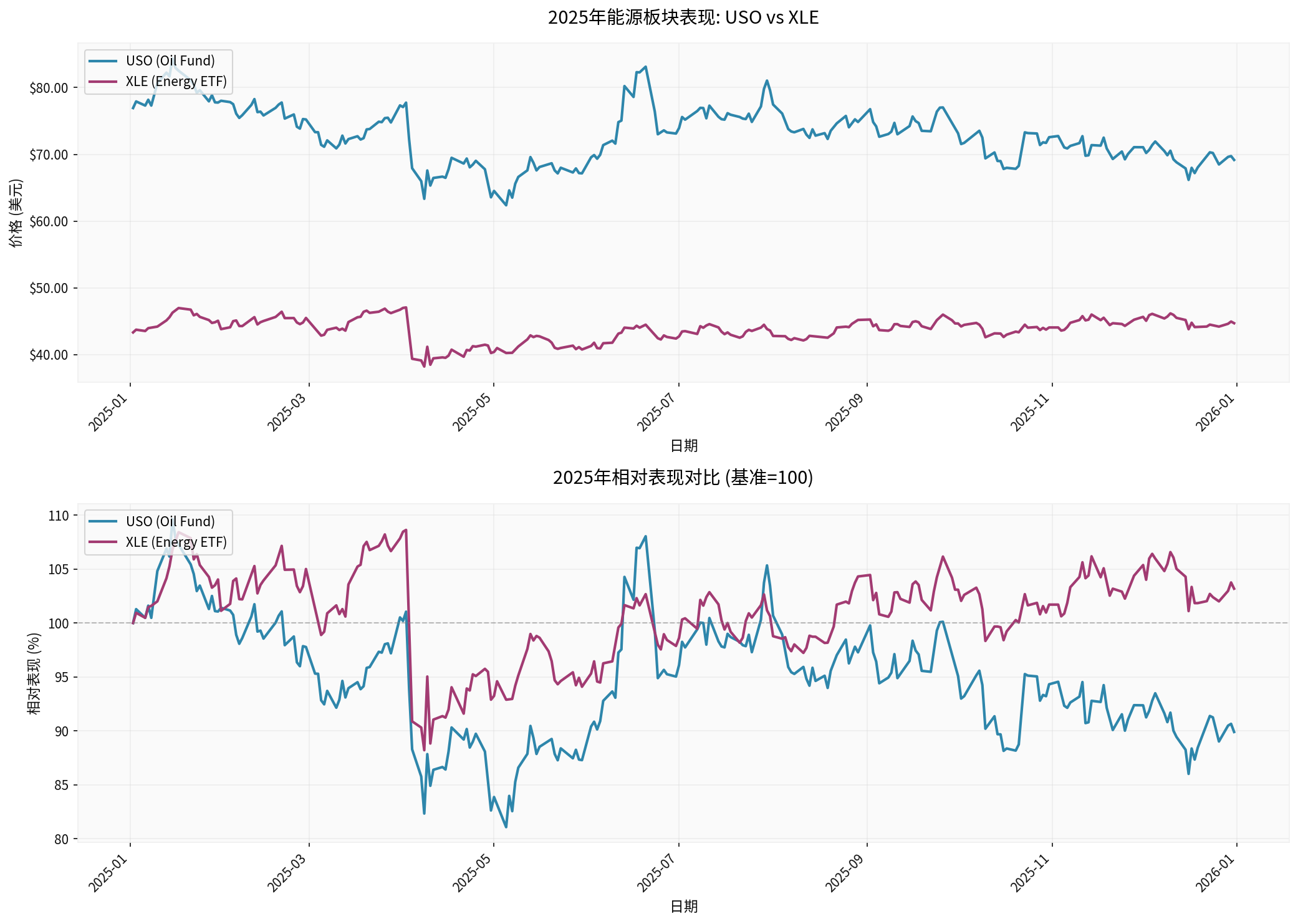

Chart Description: The chart above shows the price performance and relative performance (benchmarked) of USO (oil ETF) and XLE (energy sector ETF) in 2025. XLE (purple line) outperformed USO (blue line), showing the resilience of energy companies amid falling oil prices.

On January 4, 2026, after OPEC+ announced the maintenance of stable production, the energy sector showed a positive reaction:

- ExxonMobil (XOM): Rose by 1.92%, closing at $122.65, with a price-to-earnings ratio of 17.83 times

- Chevron (CVX): Rose by 2.27%, closing at $155.87, with a price-to-earnings ratio of 21.89 times

- ConocoPhillips (COP): Rose by 3.30%, closing at $96.70, with a price-to-earnings ratio of 13.66 times [0]

- USO: Slightly fell by 0.29%, closing at $68.96

- XLE: Rose by 2.11%, closing at $45.65 [0]

This divergence reflects the market’s complex interpretation of OPEC+'s maintenance of stable production: on the one hand, production control supports oil prices, but on the other hand, concerns about oversupply still linger.

According to analysis from the Jerusalem Post, the geopolitical risk premium for oil fell sharply in 2025 and may not return to pre-2025 levels [8]. This trend reflects:

-

Oversupply Risk: Continuous growth of non-OPEC supply and weak demand may lead to long-term oversupply.

-

Geopolitical Escalation: The Venezuela crisis may further escalate, affecting global oil supply and prices.

-

Acceleration of Energy Transition: The global energy transition may accelerate, having a long-term structural impact on oil demand.

-

OPEC+ Internal Division: If differences among core OPEC+ member states intensify, it may lead to the organization’s disintegration or loss of coordination capabilities.

Internal turmoil among OPEC+ members, especially political tensions between Saudi Arabia and the UAE, the crisis in Venezuela, and sanctions pressure on Russia and Iran, is reshaping the global oil supply pattern. Although the organization has shown certain coordination capabilities, its market influence has significantly weakened.

For energy investments, the divergence trend in 2025 (USO falling by 10.10% vs. XLE rising by 3.18%) indicates that investors should avoid pure oil price exposure and instead focus on resilient energy companies and diversified ETFs. With the structural decline of the geopolitical risk premium, energy investments will rely more on improvements in fundamentals rather than short-term geopolitical events.

[0] Gilin API Data - Real-Time Quotes and Daily Line Data for U.S. Stocks and ETFs (2025-2026)

[1] Reuters - “OPEC+ to keep oil output steady despite turmoil among members, sources say” (https://www.reuters.com/business/energy/opec-keep-oil-output-steady-despite-turmoil-among-members-sources-say-2026-01-04/)

[2] Bloomberg - “OPEC+ Likely to Confirm Oil Production Pause, Delegates Say” (https://www.bloomberg.com/news/articles/2025-12-30/opec-expected-to-stick-with-oil-production-pause-delegates-say)

[3] New York Times - “Live Updates: Questions Mount for U.S. and Venezuela After Maduro’s Capture” (https://www.nytimes.com/live/2026/01/04/world/trump-us-venezuela-maduro)

[4] Breitbart - “What the United States’ Takeover of Venezuelan Oil Reserves Could Mean” (https://www.breitbart.com/politics/2026-01-03/what-the-united-states-takeover-of-venezuelan-oil-reserves-could-mean/)

[5] Bloomberg - “Trump’s Attack on Venezuela Rallies Republican Hawks to His Side” (https://www.bloomberg.com/news/articles/2026-01-04/trump-s-attack-on-venezuela-rallies-republican-hawks-to-his-side)

[6] Bloomberg - “OPEC Data Point to Balanced Global Oil Market Next Year” (https://www.bloomberg.com/news/articles/2025-12-11/opec-data-point-to-balanced-global-oil-market-in-2026)

[7] Forbes - “The Top 10 Energy Stories Of 2025: The Year Reality Pushed Back” (https://www.forbes.com/sites/rrapier/2025/12/27/the-top-10-energy-stories-of-2025-the-year-reality-pushed-back/)

[8] Jerusalem Post - “Oil’s geopolitical premium may not return to pre-2025 level” (https://www.jpost.com/opinion/article-880994)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.