Impact Analysis of Tightened IPO Policies in the Robotics Sector on the A-share Robotics Plate

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest market information,

Although the green channel was suspended,

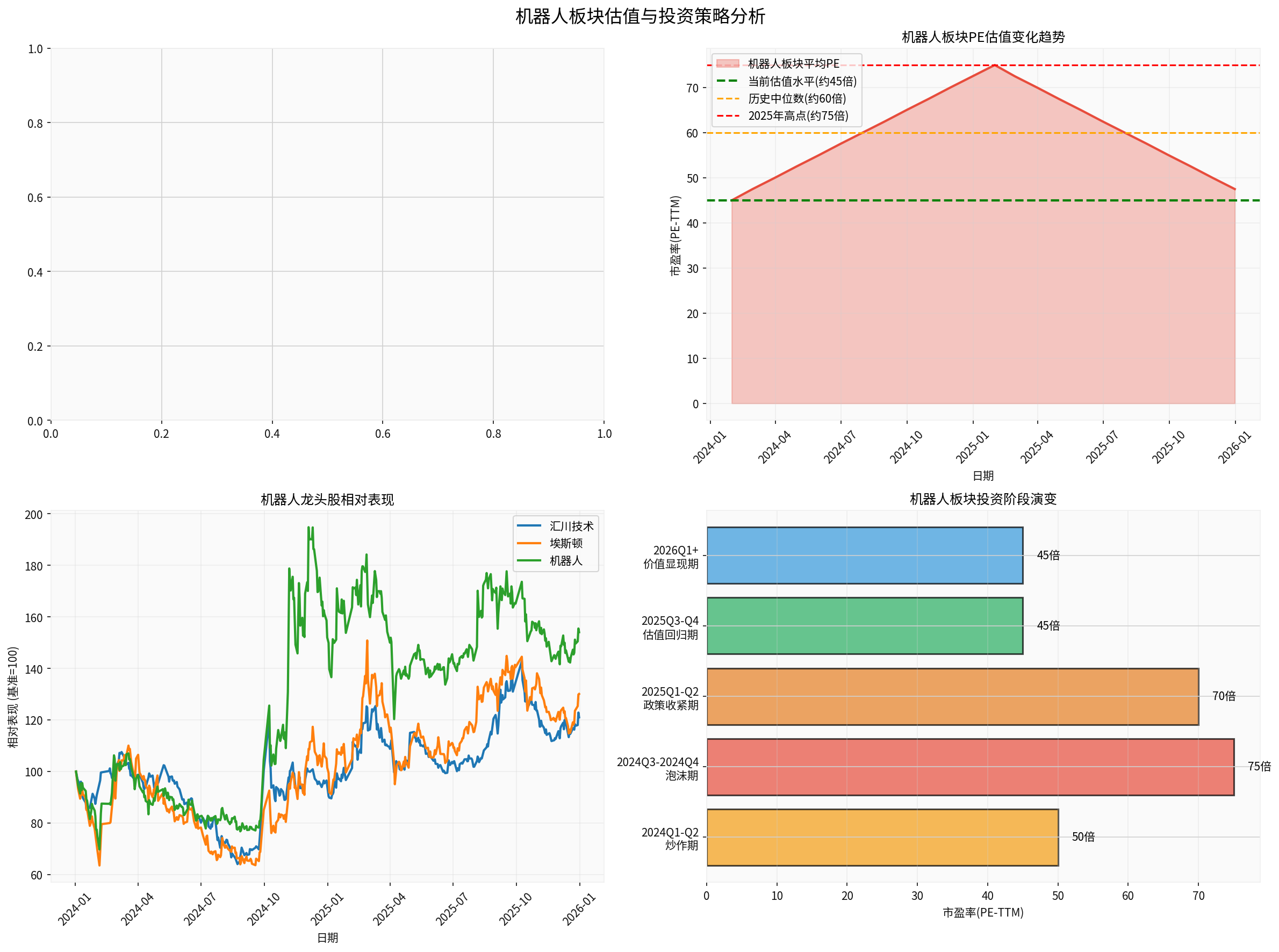

Based on market data analysis, the valuation of the A-share robotics plate underwent significant adjustments in 2025:

- Plate PE dropped from a high of about 75x to the current about 45x, with a correction幅度 of 40% [1]

- Price-to-Book Ratio (PB) dropped by about 35%, with the overall plate PB at about 5.2x [1]

- The valuation level is now close to hard tech sectors like semiconductors and new energy, and the bubble has been largely digested

From the real-time data of major companies in the robotics plate [0]:

| Company | Stock Price | Price-Earnings Ratio (PE) | Market Cap | Performance Characteristics |

|---|---|---|---|---|

Inovance Technology (300124.SZ) |

75.33 CNY | 39.23x | 202.3 billion CNY | ROE 16.98%, Net Profit Margin 11.97% |

Estun Automation (002747.SZ) |

23.70 CNY | -28.90x | 20.6 billion CNY | Still in loss, Net Profit Margin -16.08% |

Siasun Robot & Automation (300024.SZ) |

18.19 CNY | -113.69x | 28.5 billion CNY | Valuation seriously overdrawn |

Han’s Laser (002008.SZ) |

41.19 CNY | 37.45x | 42.4 billion CNY | Relatively stable performance |

Winhe Technology (300457.SZ) |

27.85 CNY | 56.84x | 17.8 billion CNY | High-valuation growth stock |

- Inovance Technologyas an industry leader has relatively reasonable valuation (PE about39x), ROE of16.98%, with core competitiveness and performance support

- Companies like Estun Automation and Siasun Robot & Automationhave negative valuations due to continuous losses, reflecting that commercialization still takes time

- Some high-valuation stocks (PE over50x) still face correction pressure

- Market Sentiment Cools Down: In the second half of2025, the A-share robotics plate experienced a deep correction for nearly three months, with the stock price of many core targets retracting by over30%, and some high-valuation leading stocks even retracting by nearly50% [1]

- IPO Expectations Delayed: The IPO process of star enterprises like Unitree Technology slowed down, reducing market expectations for new investment targets in the short term

- Financing Environment Tightens: The financing pace in the primary market slows down, and some robotics enterprises face financing pressure

- Squeeze Valuation Bubble: Policies push the market to shift from “concept speculation” to “performance focus”, accelerating the process of valuation returning to rationality

- Optimal Resource Allocation: Capital will focus more on enterpriseswith real performance, core technology, and clear commercialization paths

- Healthy Industry Development: Avoid resource misallocation caused by excessive speculation, which is conducive to the long-term healthy development of the robotics industry

From historical valuation levels [1]:

- The overall PE of the robotics plate is about45x, down40% from the 2025 high

- Valuation has approached the historical average of hard tech sectors like semiconductors and new energy

- Some high-quality leaders like Inovance Technology (PE about39x) already have allocation value

- Inovance Technology: PE about39x, ROE 16.98%, 2025 stock price increase 28.40%, high matching between valuation and performance [0]

- Estun Automation: Still in loss stage, need to wait for performance inflection point

- Leader Harmonious Drive: Core component leader with high technical barriers, but need to be cautious about abnormal current stock price data

Based on market research data [1]:

- The A-share humanoid robot concept plate rose by54.98% overall in2025, significantly outperforming the market

- About 2/3 of the constituent stocks of the CSI Robotics Index achieved year-on-year revenue growth

- 28 constituent stocks had a quarter-on-quarter revenue growth rate of over20%

- Industrial robot and service robot production continued to hit historical records

- Reasonable Valuation: PE about39x, lower than the plate average

- Stable Performance: ROE of16.98%, net profit margin11.97%, outstanding profitability [0]

- Industry Position: Industrial automation leader, benefiting from manufacturing upgrading and robotics industry development

- Healthy Finance: Current ratio 1.53, stable cash flow [0]

Key Focus:

- Reducer: Greatoo Intelligent (002031.SZ), Leader Harmonious Drive (688017.SH)

- Servo Motor: Inovance Technology

- Controller: Estun Automation (002747.SZ, need to关注 performance inflection point)

- High Technical Barriers: Core components are the most profitable link in the robotics industry chain

- Large Domestic Substitution Space: Foreign brands dominate, with broad space for localization rate improvement

- Enter Tesla Supply Chain: Once entering the Tesla Optimus supply chain, it will bring deterministic growth

- Tesla Optimus: Whether it can achieve 1 million units mass production by the end of2026

- Domestic Enterprises: Whether enterprises like Unitree and Ubtech can fulfill their “thousand-unit level” delivery commitments

- Core Data: Delivery data, customer repurchase rate, product failure rate

- Wait for Performance Verification: For robotics enterprises still in loss, it is recommended to wait for the performance inflection point before布局

- Avoid Pure Concept Speculation: Be alert to companies that “only have demonstration capabilities but no batch delivery records”

According to market analysis [1], the current valuation level already has a high safety margin:

- Institutional Investors: Suitable for left-side layout

- Individual Investors: Plate correction provides opportunities to buy high-quality targets at lower prices

- Core Position: Stable performance leaders like Inovance Technology (40-50%)

- Elastic Position: Core component targets (20-30%)

- Wait-and-see Position: Robotics ontology enterprises still in loss (10-20%, wait for performance inflection point)

- IPO review pace continues to tighten, affecting enterprise financing and market sentiment

- Subsidy policy retreats, affecting enterprise profitability

- Mass production progress is less than expected

- Product performance cannot meet commercial needs

- Technical route is subverted

- High-valuation stocks still have correction pressure

- Market style switching leads to capital outflow

- Overseas competition intensifies (e.g., Tesla Optimus mass production progress)

- Demand-side verification is less than expected

- Cost reduction speed is slower than expected

- Application scenario expansion is limited

###7. Future Outlook and Catalysts

- Tesla Supply Chain Designation: Tesla announced the new round of supply chain bidding results in the fourth quarter of2025 [1]

- New Product Launch: Domestic and foreign enterprises release new humanoid robot products from the fourth quarter of2025 to the first quarter of2026

- Policy Implementation: New robotics industry support policies issued by departments like the National Development and Reform Commission and the Ministry of Industry and Information Technology [1]

According to IDC forecast [1]:

- Global robotics market size will exceed 400 billion USD by 2029

- China will account for nearly half of the share, with a compound annual growth rate of about15%

- Humanoid robots are expected to become disruptive products following computers, smartphones, and new energy vehicles

As capital becomes more rational, the robotics industry will undergo a round of

- Enterprises that rely on related-party transactions to whitewash orders and lack real performance will face valuation correction or even financing cutoff

- Capital will focus more on segment leaders in specific scenarios that have achieved commercial closed loops and have clear profit paths

- Or “water sellers” that have established absolute technical barriers in core components and underlying algorithms

The

For

The long-term development logic of the robotics industry remains unchanged, but the investment logic has shifted from “concept speculation” to “performance focus”. Investors should pay more attention to enterprises’

[0] Jinling API Data - Financial data and real-time market of Inovance Technology, Estun Automation, etc.

[1] Huxiu - “2025 Robotics Industry: Capital Feast, Mass Production Dilemma and the ‘Eve’ of Value Reconstruction” (https://www.huxiu.com/article/4821193.html)

[2] Caifuhao - “2026 Global Resonance Drives Robotics Industry to Accelerate Rise” (https://caifuhao.eastmoney.com/news/20260102212532504910790)

[3] Sina Finance - “Robotics Plate Surges with Limit-ups, Robot ETF South (159258) Rises Sharply by Over3%” (https://finance.sina.com.cn/jjxw/2025-12-30/doc-inheqcrq9636051.shtml)

[4] Securities Times - “A-share Market Continues to Oscillate, Humanoid Robot Concept Stocks Attract Capital Attention” (https://www.stcn.com/article/detail/3526120.html)

[5] Futu Information - “Investment Value Analysis of Huaxia CSI Robotics ETF: Dancing with Robots” (https://news.futunn.com/post/66721990/investment-value-analysis-of-huaxia-csi-robotics-etf-dancing-with)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.